Coeur Completes Acquisition of SilverCrest

14 Fevereiro 2025 - 10:37AM

Business Wire

Coeur Mining, Inc. (“Coeur”) (NYSE: CDE) is pleased to announce

the completion of its acquisition of SilverCrest Metals Inc.

(“SilverCrest”) by Coeur (the “Transaction”) pursuant to the

definitive agreement (the “Agreement”) previously announced in the

joint news release of Coeur and SilverCrest dated October 4,

2024.

Under the terms of the Agreement, Coeur acquired all of the

issued and outstanding common shares of SilverCrest, with

SilverCrest shareholders receiving 1.6022 Coeur common shares for

each SilverCrest common share. Coeur issued 239,331,799 shares in

the Transaction.

Coeur plans to share additional information about the expected

benefits of the Transaction, including 2025 production and cost

guidance, when it releases its fourth quarter and full-year 2024

operational and financial results, which is planned for Wednesday,

February 19, 2025 after the New York Stock Exchange closes for

trading.

BMO Capital Markets acted as financial advisor to Coeur. Goldman

Sachs & Co. LLC also acted as a financial advisor to Coeur.

Goodmans LLP and Gibson, Dunn & Crutcher LLP acted as Coeur’s

legal advisors.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing

precious metals producer with five wholly-owned operations: the Las

Chispas silver-gold mine in Sonora, Mexico, the Palmarejo

gold-silver complex in Chihuahua, Mexico, the Rochester silver-gold

mine in Nevada, the Kensington gold mine in Alaska and the Wharf

gold mine in South Dakota. In addition, Coeur wholly-owns the

Silvertip polymetallic critical minerals exploration project in

British Columbia.

Cautionary Statements

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding the acquisition and integration of

SilverCrest. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause

Coeur’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Such factors include, among others, the risk that

anticipated production, cost and expense levels are not attained,

the risks and hazards inherent in the mining business (including

risks inherent in developing and expanding large-scale mining

projects, environmental hazards, industrial accidents, weather or

geologically-related conditions), changes in the market prices of

gold and silver and a sustained lower price or higher treatment and

refining charge environment, the uncertainties inherent in Coeur’s

production, exploration and development activities, including risks

relating to permitting and regulatory delays (including the impact

of government shutdowns) and mining law changes, ground conditions,

grade and recovery variability, any future labor disputes or work

stoppages (involving the Company and its subsidiaries or third

parties), the risk of adverse outcomes in litigation, the

uncertainties inherent in the estimation of mineral reserves and

resources, impacts from Coeur’s future acquisition of new mining

properties or businesses, risks associated with the continued

integration of the recent acquisition of SilverCrest, the loss of

access or insolvency of any third-party refiner or smelter to whom

Coeur markets its production, materials and equipment availability,

inflationary pressures, continued access to financing sources, the

effects of environmental and other governmental regulations and

government shut-downs, the risks inherent in the ownership or

operation of or investment in mining properties or businesses in

foreign countries, Coeur’s ability to raise additional financing

necessary to conduct its business, make payments or refinance its

debt, as well as other uncertainties and risk factors set out in

filings made from time to time with the United States Securities

and Exchange Commission, and the Canadian securities regulators,

including, without limitation, Coeur’s most recent report on Form

10-K. Actual results, developments and timetables could vary

significantly from the estimates presented. Readers are cautioned

not to put undue reliance on forward-looking statements. Coeur

disclaims any intent or obligation to update publicly such

forward-looking statements, whether as a result of new information,

future events or otherwise. Additionally, Coeur undertakes no

obligation to comment on analyses, expectations or statements made

by third parties in respect of Coeur, its financial or operating

results or its securities. This does not constitute an offer of any

securities for sale.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213256643/en/

Coeur Mining, Inc. 200 S. Wacker Drive, Suite 2100 Chicago,

Illinois 60606 Attention: Jeff Wilhoit, Senior Director, Investor

Relations Phone: (312) 489-5800 www.coeur.com

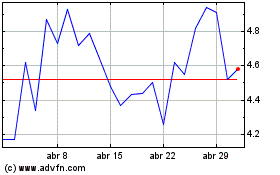

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

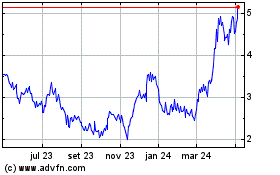

Coeur Mining (NYSE:CDE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025