Ancora and Proposed CEO Alan Kestenbaum to

Hold Investor Call and Q&A Session Tomorrow, February 19th, at

10:00 a.m. Eastern – Register at

https://bit.ly/AncoraXInvestorWebinar

Pursuant to Section 220 of Delaware Law,

Ancora has Submitted a Books and Records Request Related to Issues

That Include U.S. Steel’s Futile, Wasteful Efforts to Revive the

Dead Sale to Nippon

Ancora Holdings Group, LLC (collectively with its affiliates,

“Ancora” or “we”), a shareholder of United States Steel Corporation

(NYSE: X) (“U.S. Steel” or the “Company”), today announced it will

host a live investor conference call entitled, “A U.S. Solution for

U.S. Steel.” The call will be hosted by James Chadwick, President

of Ancora Alternatives LLC, and Alan Kestenbaum, CEO candidate and

the architect of the legendary turnaround of Stelco Holdings Inc.

(formerly TSX: STLC), who will provide analysis and take questions.

The call takes place tomorrow, February 19th, at 10:00 a.m.

Eastern. Register and join at

https://bit.ly/AncoraXInvestorWebinar.

As a reminder, Ancora recently nominated nine highly qualified,

independent candidates for election to U.S. Steel’s Board of

Directors (the “Board”) at the 2025 Annual Meeting of Stockholders

(the “Annual Meeting”). In connection with its campaign, the firm

has independently submitted a books and records request letter to

U.S. Steel’s Board, pursuant to Section 220 of the Delaware General

Corporation Law. The letter seeks to help Ancora achieve the

following:

- Investigate whether U.S. Steel’s Board and management breached

their fiduciary duties by, among other things, wasting corporate

resources and carrying out a potentially disloyal pursuit of the

seemingly dead transaction with Nippon Steel Corporation.

- Investigate potential wrongdoing with respect to insider

trading on the part of insiders, including CEO David Burritt,

around the time in which U.S. Steel was assessing transaction

options in 2023. Ancora has never before seen an executive put in

place a 10b5-1 plan, with trigger prices in the neighborhood of

subsequently submitted bids, during what appears to have been a

fluid review of strategic options.

- Investigate whether the Board is violating its duty of loyalty

by taking actions to improperly entrench itself ahead of the Annual

Meeting.

- Assess whether to take action in response to the results of the

investigation, including potential litigation against U.S. Steel

and Mr. Burritt, amongst others.

- Enhance communication with other shareholders regarding

relevant matters, so that other shareholders may effectively

address any mismanagement, improper conduct or breach of fiduciary

duties.

A copy of the letter can be found at

www.MakeUSSteelGreatAgain.com.

About Ancora

Founded in 2003, Ancora Holdings Group, LLC offers integrated

investment advisory, wealth management, retirement plan services

and insurance solutions to individuals and institutions across the

United States. The firm is a long-term supporter of union labor and

has a history of working with union groups and public pension plans

to deliver long-term value. Ancora’s comprehensive service offering

is complemented by a dedicated team that has the breadth of

expertise and operational structure of a global institution, with

the responsiveness and flexibility of a boutique firm. Ancora

Alternatives is the alternative asset management division of Ancora

Holdings Group, investing across three primary strategies:

activism, multi-strategy and commodities. For more information

about Ancora Alternatives, please visit

https://www.ancoraalts.com/.

CERTAIN INFORMATION CONCERNING THE

PARTICIPANTS

Ancora Catalyst Institutional, LP (“Ancora Catalyst

Institutional”), together with the other participants named herein,

intend to file a preliminary proxy statement and accompanying

universal proxy card with the Securities and Exchange Commission

(“SEC”) to be used to solicit votes for the election of Ancora

Catalyst Institutional’s slate of highly-qualified director

nominees at the 2025 annual meeting of stockholders of United

States Steel Corporation, a Delaware corporation (the

“Company”).

ANCORA CATALYST INSTITUTIONAL STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY

MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL

BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT

HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY

SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT

CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE

DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the anticipated proxy solicitation are

expected to be Ancora Catalyst Institutional, Ancora Bellator Fund,

LP (“Ancora Bellator”), Ancora Catalyst, LP (“Ancora Catalyst”),

Ancora Merlin Institutional, LP (“Ancora Merlin Institutional”),

Ancora Merlin, LP (“Ancora Merlin”), Ancora Alternatives LLC,

(“Ancora Alternatives”), Ancora Holdings Group, LLC (“Ancora

Holdings”), Fredrick D. DiSanto, Jamie Boychuk, Robert P. Fisher,

Jr., Dr. James K. Hayes, Alan Kestenbaum, Roger K. Newport, Shelley

Y. Simms, Peter T. Thomas, and David J. Urban.

As of the date hereof, Ancora Catalyst Institutional directly

beneficially owns 121,589 shares of common stock, par value $1.00

per share (the “Common Stock”), of the Company, 100 shares of which

are held in record name. As of the date hereof, Ancora Bellator

directly beneficially owns 62,384 shares of Common Stock. As of the

date hereof, Ancora Catalyst directly beneficially owns 12,831

shares of Common Stock. As of the date hereof, Ancora Merlin

Institutional directly beneficially owns 123,075 shares of Common

Stock. As of the date hereof, Ancora Merlin directly beneficially

owns 11,165 shares of Common Stock. As the investment advisor and

general partner to each of Ancora Catalyst Institutional, Ancora

Bellator, Ancora Catalyst, Ancora Merlin Institutional, Ancora

Merlin and certain separately managed accounts (the “Ancora

Alternatives SMAs”), Ancora Alternatives may be deemed to

beneficially own the 121,589 shares of Common Stock beneficially

owned directly by Ancora Catalyst Institutional, 12,831 shares of

Common Stock beneficially owned directly by Ancora Catalyst, 62,384

shares of Common Stock beneficially owned directly by Ancora

Bellator, 123,075 shares of Common Stock beneficially owned

directly by Ancora Merlin Institutional, 11,165 shares of Common

Stock beneficially owned directly by Ancora Merlin and 137,453

shares of Common Stock held in the Ancora Alternatives SMAs. As the

sole member of Ancora Alternatives, Ancora Holdings may be deemed

to beneficially own the 121,589 shares of Common Stock beneficially

owned directly by Ancora Catalyst Institutional, 12,831 shares of

Common Stock owned directly by Ancora Catalyst, 62,384 shares of

Common Stock beneficially owned directly by Ancora Bellator,

123,075 shares of Common Stock beneficially owned directly by

Ancora Merlin Institutional, 11,165 shares of Common Stock

beneficially owned directly by Ancora Merlin, and 137,453 shares of

Common Stock held in the Ancora Alternatives SMAs. As the Chairman

and Chief Executive Officer of Ancora Holdings, Mr. DiSanto may be

deemed to beneficially own the 121,589 shares of Common Stock

beneficially owned directly by Ancora Catalyst Institutional,

12,831 shares of Common Stock owned directly by Ancora Catalyst,

62,384 shares of Common Stock beneficially owned directly by Ancora

Bellator, 123,075 shares of Common Stock beneficially owned

directly by Ancora Merlin Institutional, 11,165 shares of Common

Stock beneficially owned directly by Ancora Merlin, and 137,453

shares of Common Stock held in the Ancora Alternatives SMAs. As of

the date hereof, Messrs. Boychuk, Fisher, Kestenbaum, Newport,

Thomas, and Urban, Dr. Hayes and Ms. Simms do not beneficially own

any shares of Common Stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218690331/en/

Longacre Square Partners LLC Greg Marose / Ashley Areopagita,

646-386-0091 gmarose@longacresquare.com /

aareopagita@longacresquare.com

Saratoga Proxy Consulting LLC John Ferguson / Joseph Mills,

212-257-1311 info@saratogaproxy.com

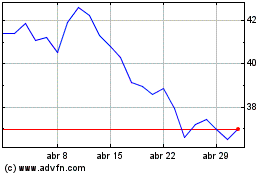

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025