UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

United States

Steel Corporation

|

(Name of Registrant as Specified In Its Charter)

|

| |

ANCORA CATALYST INSTITUTIONAL, LP

ANCORA BELLATOR FUND, LP

ANCORA CATALYST, LP

ANCORA MERLIN INSTITUTIONAL, LP

ANCORA MERLIN, LP

ANCORA ALTERNATIVES LLC

ANCORA HOLDINGS GROUP, LLC

FREDRICK D. DISANTO

JAMIE BOYCHUK

ROBERT P. FISHER, JR.

DR. JAMES K. HAYES

ALAN KESTENBAUM

ROGER K. NEWPORT

SHELLEY Y. SIMMS

PETER T. THOMAS

DAVID J. URBAN

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Ancora Catalyst Institutional,

LP, together with the other participants named herein (collectively, “Ancora”), intend to file a preliminary proxy

statement and accompanying universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit

votes for the election of Ancora’s slate of director nominees at the 2025 annual meeting of stockholders (the “Annual Meeting”)

of United States Steel Corporation, a Delaware corporation (the “Company”).

Item 1: On February 19,

2025, Ancora hosted a conference call featuring James Chadwick, President of Ancora Alternatives LLC, and Alan Kestenbaum, a director

nominee of Ancora, to discuss its investment in the Company. A written transcript of the interview is included below. Additionally, Ancora

distributed an investor presentation to the attendees of the conference call, which is attached hereto as Exhibit 99.1 and incorporated

herein by reference.

Transcript:

Ashley Areopagita (00:31):

Good morning and

welcome to Ancora’s Conference call regarding an alternative U.S. solution for U.S. Steel. Please note that this call and accompanying

material are not intended to represent a recommendation or investment advice of any kind. Such content is not provided in a fiduciary

capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation

of any kind. All content has been provided for informational purposes only, and as such should not be construed as legal or investment

advice and/or a legal opinion. On today's call, you'll hear from Jim Chadwick, president of Ancora Alternatives, and Alan Kestenbaum,

former CEO of Stelco and proposed CEO for U.S. Steel. As a reminder, Ancora announced on January 27th that it has nominated a majority

slate of director candidates for election to U.S. Steel's board at the 2025 Annual Meeting of Stockholders. Ancora stated on that date

that U.S. Steel should abandon the blocked sale to Nippon and collect the merger agreements’ $565 million breakup fee. Ancora also

noted that its slate, including Mr. Kestenbaum, are ready to lead a multi-billion dollar capital investment program to revitalize the

company following the failed transaction with Nippon. I'll turn the call over to Jim and Alan, who will introduce themselves, run through

a short presentation, and then open up a Q&A session. Jim, onto you.

Jim Chadwick (01:54):

Okay, thank you.

Good morning. I'm Jim Chadwick. I'm a partner and I'm the president of Ancora Alternatives. Ancora is an Ohio based investment firm with

approximately 10 billion of assets under management today. I joined the firm about 10 years ago after starting my career in activism,

originally with Relational Investors. Relational was one of the real pioneers in shareholder activism. Ancora’s Alternatives Group

is consistently ranked as one of the world's top activist investors. In recent years, we've had several value enhancing engagements in

the industrial and logistics space. Most recently, including our efforts at Berry Global culminated in a merger with Amcor, which was

announced in Q4 of last year. Also, last year we engaged in a proxy contest with Norfolk Southern, which resulted in significant changes

on the board and ultimately led to significant changes to senior management and the company's been performing and on its way, we believe,

to a very successful turnaround. Also, we obtained board representation and defended the merger that effectively created RB Global, which

has actually been one of our most successful investments. I look forward to talking to you guys today about our latest campaign and how

we feel that we can maximize value for shareholders. And this would be, of course, at U.S. Steel. Before we go there, I'll hand it over

to Alan.

Alan Kestenbaum (03:10):

Good morning, everyone.

I've spent decades in the steel industry and have experience with turnarounds, strategy, operations, M&A, labor and stakeholder relations.

I was previously and most recently CEO of Stelco, which I bought out of bankruptcy from U.S. Steel in 2017. I implemented a turnaround

plan, took the company public, and ultimately engineered a value maximizing sale that closed in December 2024. The hallmark of my career

has been turning U.S. Steel’s failures into success stories for investors. I also previously founded and led two successful businesses.

Globe Specialty Metals, that I founded, eventually running 27 smelters, numerous mines in coal and courts, and eventually selling that

in 2016 through a merger to a competitor. And Marco International, which is a trading company that I founded. Let me now hand it back

to Jim to get our presentation started on slide three.

Jim Chadwick (04:08):

Great, thanks, Alan.

So, just quickly, I wanna show the disclaimer slides here before we get started on the slides. So, what we'll cover today for today's

agenda is effectively our critique of the present at U.S. Steel, our concerns about the future of the company under current leadership,

and our plans here for setting things right and providing a U.S. solution for U.S. Steel. The big reason we submitted our 220 demand letter

yesterday is that we feel that Burritt and the board are continuing to drag shareholders down a dead end road. You can see here on the

slide some of the headlines that are recent that talk about the realities of the situation, and the realities being that this merger with

Nippon Steel is dead, $55 is not gonna happen. Yet, despite these recent events, Burritt has known about this really from the start, even

back in August, 2023

Jim Chadwick (05:06):

Then Senator JD

Vance sent a letter before this deal was even announced that if they were to pursue a sale to a foreign corporation, that they would receive

stiff resistance from Washington, D.C. Others like JD and some of his colleagues. Obviously, once this went public, that was immediately

the same type of outcome from President Biden or then President Biden and candidate Trump. So despite the fact that the company knew or

Burritt knew that this was going to be a very difficult situation, one that was very unlikely to ever close, they continued to forge down

a road and make one bad decision after the next, the first of which obviously is a deal that was DOA from the start. The second of which

was a lack of succession planning, and the third of which was a catastrophic contingency plan, which we'll discuss here shortly. You know,

Burritt has made comments that the company doesn't have money to reinvest in its flat role business. You know, we obviously believe that

the $565 million break of fee would go far to begin revamping the Gary Works and Mon Valley facilities.

Jim Chadwick (06:09):

I think this, this

slide, the results speak for themselves. Obviously, management and the board have failed at running this business. If you look here at

this performance here, this relative TSR on this page and these operating metrics, these are during really his Burritt’s tenure

as CEO leading up to the point of announcing strategic alternatives. But since he began here, he's at a negative 227% TSR on a relative

basis. And his performance metrics, I mean, revenue growth, negative 32%, negative 53% adjusted EBITDA growth, terrible free cash flow

growth, obviously, and then CapEx positive. But in this case, that equates to actually overruns in costs, which have been at least over

$600 million to date.

Jim Chadwick (06:58):

So the future under,

under Dave Burritt, we believe is bleak. You know, threats of plant closures and job cuts may have been tactics during the approval process

to get regulatory approval. But look, we think ultimately shareholders should hold Burritt to his words. The union certainly seems to,

you know, when he says he's gonna close Mon Valley and close Gary Works and, and lay off union workers, I think we have to take him literally

that that is the plan. Obviously it's a plan that, that it is, it's sort of the hallmark of the time that Burritt’s run the company,

which is one of lack of innovation and poor operating efficiencies. These threats that he's made exacerbated a very – which is already

a bad relationship with the union – is now gonna be much worse. You have to ask yourself, how can Burritt ever successfully renegotiate

the labor contract that comes up in 2026?

Jim Chadwick (07:48):

Look I know publicly and

in this deck and probably throughout this Q&A we've beaten up Burritt a lot, obviously, and you know, I just want to say I don't,

you know, obviously he's not bad at everything. Because clearly he's shown that he's very good at trading U.S. Steel stock. So he has

been one of the most consistent guys making money and trading shares in the company today. But look, we believe there's an alternative

path, you know, we'll discuss that after we provide some additional info on the risk of the status quo. And I do, there's a note here

on the bottom of this slide, I want Alan to cover as when we cover, come up into his slides, but that has to do with the iron ore mines

that relate to these plants that they're talking about closing, and what would happen to the value of those very valuable mines.

Jim Chadwick (08:32):

So here we are today,

why the board can't be trusted to save U.S. Steel, obviously, with the opposition that's being faced from President Trump. You know, we

know that this deal has no chance to be resurrected. Yet leadership at U.S. Steel continues to throw good money after bad and pursue costly

litigation. You know, we believe that U.S. Steel doesn't need a deal or doesn't need investment, it needs good management and obviously

our solution here and our sports slate and our CEO candidate is one that we think is that solution to turnaround U.S. Steel as a standalone

public company. So I'm gonna turn it over to Alan to cover the next section here on the presentation.

Alan Kestenbaum (09:15):

Thank you, Jim, and

it's really great seeing a lot of you again. You know, having had a number of you as my investors in Globe, and then most recently in

Stelco, well, with very successful operations, really great to be here again and address you. I think one of the things that that stand

out to me the most when we talk about, you know, how this company is headed into a very, very bad place. It's just looking at the continued

unreliable projections. I think one of the hallmarks of a public company is transparency, accessibility, and honesty with shareholders

and analysts. And I think you can see over time, this has just not been the case. So this is one of the first things I would restore just

by looking at what's gone on.

Think about this.

In December 2023, they filed a proxy. It's December 2023. You have a lot of visibility on what's coming the following year, in December

of prior to a year, they estimated 17.7 billion of revenues. They hit 15.6, they estimated adjusted EBITDA 2.4. They, they got only halfway

there to 1.2 down by 50%. They estimated EBITDA of margin of 13.4, something they rarely have hit in their history, even in the best of

times, and they hit 7.4%. And to me, the most egregious thing, and just so you know how these things work, when you look at CapEx, CapEx

is something that you start discussing a whole year before to get to December, a month before the beginning of the year and estimate 1.5

billion and actually hit 2.3. It's just nothing short than egregious and perhaps worse. Management's projections that they have put out

and I'll add the analysts as well, really ignore some incredibly significant assumptions that are not being included.

Alan Kestenbaum (11:06):

Number one, the CapEx

is, you can see in the later years starting 2026 shows continued underinvestment once the big river plant is finished being built. Well,

you can't on one hand say that you're gonna underinvest and then continue to perform as if the operations are not gonna continue to deteriorate.

In fact, having been at these plants, these, these facilities are in disrepair. As Jim said, when Dave says, Hey, there's no future unless

Nippon comes in, we're gonna have to close these down. That may be his view and certainly what they've been doing. That's not my view.

When it comes to Big River, if you look at their performance since they've started several years ago and since they took over the plant

compared to any other competitor, Steel Dynamics, Nucor, others, BlueScope, they're not even close in operations.

Alan Kestenbaum (11:57):

This company is completely

not run the right way, and that is something that has to change. Then the other parts that are in the forecast, USSC and Tubular, neither

of these have much of a future. USSC – that's the facility in Europe – starting next year they're gonna be facing crippling

carbon tax. They have no plan to deal with it. That plant is gonna end up closing down probably in the next couple of years as they get

buried under these carbon taxes. Tubular is a business with, if you go back 15 years, has lost money pretty much every year other than

a couple of years post covid with a lucky bounce. Can't, we can't live with lucky bounces. And finally, just basic things. They're talking

about doubling the size of Big River, no working capital increase, which of course, impacts cash.

Alan Kestenbaum (12:48):

Management's projections

are unrealistic and I might add the analyst projections are unrealistic as well. Having been involved in diligence in this company, I

can tell you that when I did the work I projected in 2024, based on the work that I did, that the company would only hit, would not even

hit 16 billion in revenue. Well, you can see the company in 2023, estimated 17.7, the analysts estimated 16.7. I can tell you we estimated

something like around 15.8, and it actually only hit 15.6. This is a very, very significant drop, but not a surprise because again, the

facilities are underinvested in. As you go forward, same story. The work that we've done shows continued deterioration in the operational

capability of the legacy plants. The company's forecasting 18.2, the street consensus is 16.4. We believe it's closer to 14.5.

Alan Kestenbaum (13:47):

Same with 2026, 17.9,

14.9. EBITDA is the same story. I'm not gonna repeat the narrative, but you can see on the slide here I believe that based on the work

that we have done both due diligence with my team, that this company will hit maximum a billion dollars of EBITDA in 2025 and 2026. And

you know, this is not much of a surprise. Again, it's continued deterioration in the legacy plants, and I'd be surprised I wouldn't be

surprised to see continued poor performance at the Big River level as well. So, a billion dollars EBITDA is what we believe is the company

continues on its current path. And then CapEx, I mentioned before, how egregious it is and perhaps worse to sit in December and say 1.5

and actually hit 2.3. Well, similarly, the company's projecting 800 million and less. I've

tried to be a little bit a, you know, a little bit generous here and say a billion. I actually think it's more once we get in there, I

think we're probably looking at another couple of hundred million each in 2025 and 2026 to restore these plants that Burritt says he's

going to close.

Jim Chadwick (15:05):

So, look, we believe

that the board's lack of clarity and the lack of deal resolution here is distorting the valuation of the company. As you can see here

on the slide, historically, U.S. Steel is traded at a meaningful discount to its peers. When we applied today with Alan is, you know,

what he just mentioned on the prior slides, which was a realistic EBITDA assumption for 2025 being the stock's currently trading at 11.2

times EBITDA, which is a 43% premium to the peer group, A peer group that is traded at over a 40% discount to prior to the strategic alternatives

review. So this is definitely representative in our opinion of the froth that exists in the stock today.

Alan Kestenbaum (15:48):

I wanna walk through

what my solution is to turn this around. And first of all, just in the interest of credibility, I know a lot of you know me already, but

those of you who don't I bought Stelco in 2017 from U.S. Steel at the time. The company had terrible morale within the entire workforce.

Horrible relations with the union and a plant that had been really underinvested in for many years through their ownership. Well the company

probably had the highest cost and the lowest performance in North America when I took over in 2017. But you can see, and first I'll talk

about the share price you know, a lot of shareholders here and share price is important. It's something that I focus on because I've always

owned about 20% of the companies that I run, both in Globe and Stelco. We had 498% TSR over my tenure. And you can compare that to any

other steel producer. You know we killed everyone by a long shot. And U.S. Steel only had 124%, including this froth connected to the

recent deal.

Alan Kestenbaum (16:59):

This wasn't only

done on the share price, this was also done on performance. You can see here, every single year we beat U.S. Steel by a long shot both

in terms in EBITDA margin. That's what this this graph is here. EBITDA margin every single year we beat U.S. Steel. And you can say, well,

U.S. Steel has other businesses, so therefore we display this not only on the rolling business not only on U.S. Steel's whole business,

but also on the rolling business itself. So when they're out there projecting these enormous margins it's not gonna happen the way things

are going. In fact, it's gonna get even worse. I wanna highlight two things here. You know, a lot of people are talking about tariffs

being baked into their stock. Well, guess what? In 2018, Stelco achieved 25% EBITDA margin despite receiving the headwinds from tariffs.

Alan Kestenbaum (17:49):

They were directed

at Canada and U.S. Steel that had the benefit of it only had 13 and 12%. So when we get crazy about the tariffs and say, wow, this is

gonna create a new panacea. It will, it's gonna be very, very helpful for the industry if you know how to manage it. I managed the company

that was the victim of tariffs and doubled their EBITDA margin. You can see after our major investments that we made in including the

Coke battery and the Blast Furnaces. Look at our margins. We beat every company. We had 50% margins in ‘21, 34 and ‘22. You

can see 17 and ‘21 in ‘24 compared to U.S. Steel. Most of the time, single digits if not losses. This is the type of this

is the difference between a management team that knows how to run the business on an operational level as well.

Alan Kestenbaum (18:41):

So the realistic path to

making U.S. Steel first of all identify and implement asset optimization and reformation and invest properly. We don't need other people's

money. We have the cash. I've never raised a dollar in debt at Stelco. I never issued a share. In fact, we ended up taking close to 40%

of the shares off the market with share buybacks. U.S. Steel, based on my analysis, does not need to be sold. It also does not need any

investment from anybody. We’re gonna dramatically reduce the SG&A and get decision making. Someone calls U.S. Steel today for

an order can may take a month to get a call back At Stelco, it took an hour. We're gonna implement that. We're gonna have fast decision

making, a lean and mean corporate staff. We're going to upgrade the Blast furnaces the way we did at Stelco.

Alan Kestenbaum (19:31):

And we're gonna

bring Big River to industry standards. And most importantly, there is no chance there's a union contract that comes due next year. Usually

a year before you start the union contract, you start sitting down to negotiate. There is no shot that a man and a company that publicly

called Dave McCall, basically a mob boss or a thug, has any shot at reaching an agreement with this union. My relationship with the union

is deep and long and deeply respected, and I'm sure that we'll be able to get a good contract for the Labor Union and for the company.

And it's to reinvigorate the middlemen except that is actually worthy of working at such an iconic company like U.S. Steel and help them

make me make U.S. Steel Great again.

Jim Chadwick (20:20):

Thanks, Alan. These

are the six steps that are representative obviously of what Alan did at Stelco translated to this opportunity at U.S. Steel. We're obviously

doing our part here to drive change and see to it the shareholders have a choice here to make and options going forward here soon enough.

The one thing we do wanna respond before we go into the Q&A is we've had some questions from people that consistently made these comments

that the company should terminate the merger and collect and collect the significant termination fee. You know, what gives us confidence

on that being a viable strategy? Look we've, we've obviously hired our own attorneys and have done a significant amount of work and the

counsel that we've received is that is clearly something that can happen here. I do want to just gonna read here from something that we

had received on this specifically, but the merger agreement permits termination by either party, if any government entity enacted legal

restraint, which is final and not appealable.

Jim Chadwick (21:19):

So obviously, former

President Biden's order and Trump reaffirming it, that is obviously a legal government entity enacting legal restraint that cannot be

appealed. If U.S. Steel were to halt its baseless legal actions here, we think it can exercise its right to terminate the merger. U.S.

Steel was never required under the merger agreement to sue for review of the D.C. Circuit case. The merger agreement only applies to best

reasonable efforts to do all things necessary, proper or advisable under the applicable laws to consummate the merger. It's not necessary,

proper or advisable to waste money challenging an unappealable executive order in order to restart the CFIUS process. So that is why we

are highly confident when we make these comments that the board can terminate and collect why we believe that is in fact true. The question

I think shareholders need to ask itself is why is the board not do it? And obviously we think David Burritt has 72 million reasons why

he hasn't to date. With that, we'll move to the question and answer section of the presentation.

Ashley Areopagita (22:26):

Thanks, Alan and Jim. We'll

now transition to the Q&A portion of today's call. If you have a question, please continue to submit them in the box, in the bottom

right hand corner of your screen and it will be added to the queue. All questions will be anonymous to encourage participation. Now for

our first question, how can you say that you have a better alternative when we don't even know the terms of Nippon's investment yet?

Alan Kestenbaum (22:54):

Look first of all,

the company doesn't actually need an investment. The company has its own cash flow and its own ability to turn around these businesses,

invest in this business. If there is investment needed and capital needs to be raised, we have a lot of experience in raising capital.

Nippon can absolutely stand in line with anybody else and present their potential investment, and it'll be weighed against other alternatives.

But Nippon is not the only one in the world with money. They bring nothing in terms of technology that's a complete non-truth. They talk

about EAF, they don't even have an EAF plant that's operating like Big River. So their money will be weighed against other people's money.

And if it doesn't come with heavy types of conditions around the governance and things like that it'll be weighed and considered.

Jim Chadwick (23:46):

I also add to that, Alan,

I would say that, you know, in addition to the foreign investment itself, capital coming from Nippon doesn't solve the management problem

at U.S. Steel. So this is not a change of control investment. This is a minority investment with the same management team that has failed

to deliver value that has underperformed that is not in the best interest of shareholders in our opinion.

Ashley Areopagita (24:11):

Next question. U.S. Steel

is much larger and a more complex business than Stelco. Alan, why are you so confident in your ability to run U.S. Steel?

Alan Kestenbaum (24:21):

That's true. It is

larger than Stelco, but I have a lot of confidence in this because I ran Globe, for instance, that had 27 plants, had a larger footprint,

different business slightly, but more or less the same. And mining smelting and all the various operations Stelco had two plants, a finishing

plant and a blast furnace plant. And really it's a modular type business. There are two things that go into this. It's the modularity

of the business and repeating that modular approach on each of the operations at U.S. Steel, and then implementing sensible commercial

strategies, having toured the plants, the commercial strategy is an easy fix. It's upside down. It focuses more on trying to get awards

from customers than profitability. And anyone who's followed my changes I made at Stelco would know that those same type of changes could

be made at U.S. Steel and implemented and turned this company around rather quickly.

Ashley Areopagita (25:20):

Thank you. Next

question for Jim, with the limited ownership Ancora has, how do you plan to win a proxy fight at U.S. Steel?

Jim Chadwick (25:31):

Look, we expect

to continue to add to that position here as this campaign goes on. You know I mentioned the overvaluation of the shares, the froth that

we see in the shares today, and obviously we think as this resolution plays out around reality sinking in around the merger that we'll

be adding to the position here going into a vote date. But ultimately, look, there's only one real choice here in our minds in terms of

management and what Alan brings to the table is so much greater that we're highly confident we'll end up winning.

Ashley Areopagita (26:03):

We've gotten quite a few

questions around Mon Valley and Gary Works. Can you discuss how you would invest in those plants and how would you keep them open and

save jobs that could be lost without new capital investment?

Alan Kestenbaum (26:19):

Yes. So I spent

a lot of time at those plants. And I'm not gonna go into, you know, very specifics. I'll stay high level, but let me answer it like this.

Mon Valley, as you know, U.S. Steel had planned to invest in that plant a number of years ago, fixing a very, very old antiquated hot

strip mill. They abandoned that plant and the workers in favor of putting the money into Big River, which as, as you can see, has really

not worked out that well so far. That plant has the capability and Gary, of being the lowest cost steel plant in the entire North America,

the lowest cost steel plant. I just need to do the kind of things I did at Stelco. The difference at Mon Valley is it does need a new

hot strip mill. But other than that, it's about brain power on the commercial side, it's about proper strategy. It's about investing in

smart blast furnaces like I did at Stelco. Think about it like this. Stelco became the lowest cost deal producer in North America, and

it was buying iron ore from U.S. Steel. Now think of the same type of performance at the plant level that Stelco had at both of those

plants and deduct the profit because it gets consolidated through earnings of the profit that U.S. Steel was making on that iron ore contract.

If you assume that they were making $20 a ton, well, that's $30 a ton of production cost reduction just on the integration of the iron

ore. And if you assume similar operations, what we did at Stelco, which is basically three things, it's the Blast Furnace. It was Coke

over there. It's not necessary at U.S. Steel. There's some fix up to do, but it has the Coke ovens and then the hot strip mill. You do

that, these plants are the lowest cost plants in North America.

Jim Chadwick (28:09):

Yeah. And just to

add to that, Alan, I mean, look, I've said it a couple times, but you know, the company has a significant breakup here $565 million that

it can receive from Nippon here and determine as this transaction is terminated, that money immediately would go a long ways to starting

this revamp that Alan just described.

Ashley Areopagita (28:33):

Next question directed

at Alan. Alan, you said Big River is run improperly. Could you expand on that? What did you mean?

Alan Kestenbaum (28:41):

I think if you just

look at the metrics, the biggest one is yield loss. So yield loss is last year hit 20%. The numbers that they're putting out there going

forward shows that yield loss is at 12%. Think about it as a double whammy. When you're doing that badly, of course it's easy to put projections

out there. Very difficult to achieve that projection, especially since the whole business model is to move the higher value added products

where the yield losses are larger. So 20% is way below industry standards. And that is a very, very key point because it hits both the

top line and the bottom line. It hits the top line because, and that's one of the reasons why the revenues have missed so much, is because

you're essentially producing 20% less steel for sale than you project and then on the bottom line because it increases your cost of product,

your cost of goods sold. So the first thing to do there is to focus on bringing proper people to run the plan to achieve better yields.

And secondly, again, the sales plan that U.S. Steel has for Big River, trying to make it into a super sophisticated plant may not be the

best plan. Having said that, we'll get in there. I'm not promising to do better than industry standard like I have done in all the other

plants I've run. I've always done better than industry standard. My goal would be to get just to industry standard on Big River.

Ashley Areopagita (30:13):

Also related to Big

River, given all of the interest in Big River, would you sell Big River and use the proceeds to reinvest in the rest of the business and/or

return capital to shareholders?

Alan Kestenbaum (30:24):

Look, returning

capital to shareholders has always been, you know, a key mantra for me. First of all, I've always owned large percentages of the business,

and so I've been completely aligned with shareholders. And you can see that from the TSR that I showed you before. You know, nearly 500%

TSR through the through, and it wasn't just the sales price. It, when we sold the company, we were paying for the last three years an

11% dividend. We bought back, we started with 95 million shares. We ended up with 55 million shares. I bought back almost half the shares

and did not incur any type of debt. And we did it purely out of cash flow. So that's what we do. You know, we look to return money to

shareholders now. You know, you asked me if we're gonna sell Big River, not sell Big River, you know, right now I'm focused on getting

in there, operating the company and getting it operationally positioned to be able to return cash to shareholders. And that, as you know,

comes through many different ways, you know, dividends, share price appreciation, and if there are asset divestitures that makes sense,

you know, we'll look at it at that time. But shareholder value is the key performance indicator for me. And the other thing that's very

important to me is my relationship with the workers. And this is another area that I need to fix. I experienced this at Stelco, and the

amount of disrespect that was thrown at the union is very similar to the disrespect that's been thrown to the union here. The amount of

bloat at the corporate level is similar to what I've seen over here. We're going to skinny this down dramatically. We're gonna dramatically

improve worker relations. You can call anybody in the city of Hamilton or anybody in any of the plants at Globe and ask them, you know,

what were the best years of their career?

Alan Kestenbaum (32:14):

And you're gonna

get the same answer from both of them. I intend to do the same thing at U.S. Steel. This is an iconic American company. It deserves better,

it deserves to be run in a proper way and not run for the benefit of the CEO or other people looking to take a quick cash and in a reckless

way. It deserves to be run as a business and to restore itself to its former greatness. And for me, at a stage of my career this is something

I would really love to do because this would be a crowning glory for me to take this company over the next, you know, five to 10 years

and restore it to greatness and show a shareholder value eventually substantially higher than what is even on the table today.

Ashley Areopagita (33:00):

If Nippon is going to make

a big capital infusion into the company, what can your slate or proposal do to compete? How will you fund the gap?

Alan Kestenbaum (33:09):

I don't understand the

question.

Ashley Areopagita (33:12):

I think it's moreso asking

how will you raise required capital for any upgrades and investments in the company?

Alan Kestenbaum (33:19):

There's no shortage

of capital for good businesses and good ideas. And as I said before, if Nippon Steel wants to make a proposal, we'll look at it. I have

good business relations with Nippon Steel. In fact, the entire steel industry doors are open to me everywhere. I don't think that we would

want to have an investor in there with all kinds of governance rights and taking product away and diluting the earnings for the company.

However, if Nippon, like any investor wants to come in, and if we need the capital, which I'm not convinced we do, but if we needed the

capital, Nippon is invited to the table like anybody else, but we're certainly not gonna make a bad deal with Nippon. Like, the companies

has kind of at least thrown out the idea to help them save the breakup fee that's not on the table.

Ashley Areopagita (34:05):

Labor relations and human

resources has deteriorated drastically over the last 15 years and non-existent undercurrent leadership. How could or would you turn that

around and make workers proud of their company again?

Alan Kestenbaum (34:17):

I'll just give you

some anecdotes from my prior experiences and, you know, allow me two or three minutes to answer the question. When I bought Globe, it

had union facilities and I eventually went and acquired a ferrosilicon plant in Alabama. And when I bought that plant in Alabama the hedge

fund that was trying to sell it to me started bragging to me how they cut the union wages down by 40 cents an hour. And I looked at them,

I said, that's like $3 and 20 cents a day. It's like dinner for these people, for a family. Like, it must be some better way to cut costs.

So I bought the company, and the day that I bought it Icalled the plant manager and I said, I want you to restore those wages back to

where they were.

And he said, I'm

not doing it. And if you can fire me. I said, okay, you're fired. Got rid of him. Raise the wages. Two weeks later, Leo Gerard, the former

president of the U.S Steelworkers Union, called me and said, I wanna have breakfast with you. I met him in Washington. He said, I've never

seen anyone raise wages in between contract periods. Like, why? And I told him the story that began a relationship that's now almost 15

years old of tremendous respect. I recently chaired the Leo Gerard chair at the University of Toronto. That was put up in his honor. And

then the work I did in Canada, you can just Google it. The workers were treated really like garbage under the U.S. Steel Administration.

Alan Kestenbaum (35:42):

I’d improved

that dramatically. I took 2000 grievances from the day I got there that were sitting, waiting in a file from the union, and I brought

it down to zero and kept it zero to the day I left the company. And it wasn't hard, it's just about attention. Every steel worker union

rep had my phone number and if there was a problem. They called me. And there never were problems because I had management teams that

ran this. Dave McCall is a prince of a man. He's a man that has given his life. He could've done anything. He's a brilliant guy, could've

done anything. He chose to give his life to the workers and to the union. I've got a really good relationship with him. Got a lot of mutual

respect. And I'm sure that when I get into this chair here, you're gonna see a dramatic turnaround in the Union forces attitude towards

their bosses. What I encountered at Stelco was there were two workforces. There was a workforce that was the union workforce, and there

was a workforce that were the salaried people. And they asked me when I got in there, can you put our flag back up? And I did. These are

the kind of little things, little maneuvers that create a positive environment. To me it’s about restoring jobs, investing in the

plant, using my brain and my experience to make the company great and so that these people have solid jobs that they can rely on for generations.

Ashley Areopagita (37:02):

This next question is directed

toward Jim. Why does Ancora feel the need to change out so much of the board?

Jim Chadwick (37:11):

Look, I think, you

know, when, when you're in a control contest, especially one that has to do with the CEO, you know, typically the situation's one where

you're not settling for a CEO replacement. But ultimately, this board has made a bunch of bad decisions. I mean, they've supported all

these actions. They supported this transaction that was doomed to fail. They've, you know, been party to, what we see as this egregious

kind of golden parachute that they've been chasing and continue to chase. They're part of that number, that $196 million number we referenced

from the merger proxy. The board is in that, and obviously we think it's clouded their judgment, and they've left Dave Burritt in place

for far too long. And so, you know, ultimately we think for the company to do the right thing for shareholders, it's gonna take significant

change on the board. And as such, you know, that we think that appropriately we nominated a majority slate.

Ashley Areopagita (38:05):

What do you see as the

company's potential value?

Jim Chadwick (38:12):

I'm gonna leave

that to Alan, but I think, you know, obviously your answer is a long term answer. And, and as part of a turnaround, we're not talking

about M&A or anything like that. But Alan, if you wanna jump in.

Alan Kestenbaum (38:22):

Yeah, I'm not gonna throw

a share price number at you, but I will tell you, I believe that this company's EBITDA margin should be similar to Stelco. And then you

can run the numbers from there.

Jim Chadwick (38:33):

As we move forward

in the campaign and provide more information on our plan and details of what we think we can do here, I think we'll provide some more

of that information. I think right now it's premature.

Ashley Areopagita (38:46):

Jim, have you heard

any feedback from other shareholders?

Jim Chadwick (38:51):

Yeah the feedback

that we've heard directly from people that have reached out to us has been very positive. I mean, so look, I think people are, those that

are looking to become long-term or are long- term shareholders of the company are very excited about the prospect of a guy like Alan Kestenbaum

at the helm of U.S. Steel. I mean, the outcome here could be significant. And so overwhelmingly positive. I mean, obviously there's been

some public commentary out of some of the ARB investors, but, you know, I don't have any problem with them either. I like folks at Pentwater.

I mean, they have their own views. And, I think once they've accepted the fact that this transaction is over, I think Pentwater, if they

wanna remain a long-term shareholder, will actually be very supportive of somebody like Alan versus versus Dave Burritt.

Ashley Areopagita (39:38):

This next question

is regarding the model. You're saying consensus estimates for revenue and EBITDA for 2025 and 2026 are too high. What do you think are

the biggest gaps between your expectations and the sell side?

Alan Kestenbaum (39:53):

There are three

areas. One is they have not accounted for continued deterioration of the operating plants that have not been invested in. So that's one

big number. So you have to reduce the quantities that are being produced at the NFR plant. That's the flat roll business. And you also

need to raise the cost because of less fixed cost absorption. The second thing the estimates to improve operations at the Big River are

completely unfounded and based on no historical precedent especially considering the company's dismal performance to date. And the third

area involves cash, which directly impacts share price. The company and the most analysts have estimated the company's gonna be at zero

net debt. That's not true. If you add in the additional CapEx and you add in the lower EBITDA performance, and you add in the working

capital, you end up with a cash difference of over $2 billion, which is at least $8 a share.

Ashley Areopagita (40:58):

Okay. We've had quite

a few questions come in about Cleveland-Cliffs. There appears to be some skepticism about your motivation because of the perceived relationship

with Cleveland-Cliffs. Can you comment on that, please?

Jim Chadwick (41:12):

Sure. Alan, maybe you Yeah,

I was gonna say, maybe start first with your route and we'll talk from the course side.

Alan Kestenbaum (41:18):

Yeah. There's no connection

to this with Cleveland-Cliffs. Plain and simple.

Jim Chadwick (41:23):

Yeah, no, look,

we obviously know Cleveland-Cliffs. I mean, we're here in Cleveland, but you know, it just, this strategy and this plan, I think we've

been very clear is about a turnaround of the business under Alan. It's not about a sale.

Ashley Areopagita (41:40):

Okay. And then our

final question for today. What's the next step here?

Jim Chadwick (41:47):

I think the next

step for us here obviously is we'll go through this campaign. I mean, campaigns take time, and we're still in the early days of it, but

as we move forward here, you know, we're prepared to go all the way. And that's something we've done, obviously with Norfolk Southern

and others. Obviously, you know, running proxy fights is time consuming and expensive and we take it very seriously. But this is an asset

that's worth it, and we're very, very excited about the slate. I mean, we really haven't spoken much about the board slate, but our slate

is outstanding. And, you know, we're excited to see these people work together and work with Alan here for success that will ultimately

benefit all the shareholders of the company.

Alan Kestenbaum (42:29):

And I, wanna address

also the in terms of the board you know, the question came is, sounds like it's the second time this has come up. Like, why change the

board? So I've worked with public company boards. I've been on company boards, and I've led two company boards. It's very, very important

to get a board that's growing in the same direction in order to make the company work. And I think what you've seen from this board has

been numerous mistakes supporting a strategy that is a failed strategy. You also see a board that enabled Burritt to write this completely

unhinged letter calling Biden corrupt calling the union leader a thug. Like, I don't know, a board that spends that time on approving

public releases like that. I, it's not the kind of board that I'd like to work with. I can work with anyone, but I can tell you if I need

to, I would change that board over time. And that board is simply like you need to clean up shop. And that shop needs to be cleaned, starting

with the board, starting with senior management and down through the SG&A. The people that don't need to be cleaned up are the hard

workers. Those are the best assets this company has.

Ashley Areopagita (43:43):

Okay. Thank you both.

That ends the Q&A portion of today's call. Thank you all for joining us. If you have any further questions or wish to get in touch

with us directly, please visit, MakeUSSteelGreatAgain.com. A replay of today's event will be posted on our website and emailed to attendees

in the coming days.

Jim Chadwick (44:00):

Thank you.

***

Item 2: Also on February

19, 2025, Ancora published certain material on X.com, which is attached hereto in Exhibit 99.1 and incorporated herein by reference.

Item 3: Also on February

19, 2025, Ancora published an email to subscribers of www.MakeUSSteelGreatAgain.com, which is attached hereto in Exhibit 99.1 and

incorporated herein by reference.

Item 4: Also on February

19, 2025, Ancora published certain materials on www.MakeUSSteelGreatAgain.com, which are attached hereto in Exhibit 99.1 and incorporated

herein by reference.

CERTAIN INFORMATION CONCERNING

THE PARTICIPANTS

Ancora Catalyst Institutional,

LP (“Ancora Catalyst Institutional”), together with the other participants named herein, intend to file a preliminary proxy

statement and accompanying universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit

votes for the election of Ancora Catalyst Institutional’s slate of highly-qualified director nominees at the 2025 annual meeting

of stockholders of United States Steel Corporation, a Delaware corporation (the “Company”).

ANCORA CATALYST INSTITUTIONAL

STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A PROXY CARD, AS THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB

SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT

CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the

anticipated proxy solicitation are expected to be Ancora Catalyst Institutional, Ancora Bellator Fund, LP (“Ancora Bellator”),

Ancora Catalyst, LP (“Ancora Catalyst”), Ancora Merlin Institutional, LP (“Ancora Merlin Institutional”), Ancora

Merlin, LP (“Ancora Merlin”), Ancora Alternatives LLC, (“Ancora Alternatives”), Ancora Holdings Group, LLC (“Ancora

Holdings”), Fredrick D. DiSanto, Jamie Boychuk, Robert P. Fisher, Jr., Dr. James K. Hayes, Alan Kestenbaum, Roger K. Newport, Shelley

Y. Simms, Peter T. Thomas, and David J. Urban.

As of the date hereof,

Ancora Catalyst Institutional directly beneficially owns 121,589 shares of common stock, par value $1.00 per share (the “Common

Stock”), of the Company, 100 shares of which are held in record name. As of the date hereof, Ancora Bellator directly beneficially

owns 62,384 shares of Common Stock. As of the date hereof, Ancora Catalyst directly beneficially owns 12,831 shares of Common Stock. As

of the date hereof, Ancora Merlin Institutional directly beneficially owns 123,075 shares of Common Stock. As of the date hereof, Ancora

Merlin directly beneficially owns 11,165 shares of Common Stock. As the investment advisor and general partner to each of Ancora Catalyst

Institutional, Ancora Bellator, Ancora Catalyst, Ancora Merlin Institutional, Ancora Merlin and certain separately managed accounts (the

“Ancora Alternatives SMAs”), Ancora Alternatives may be deemed to beneficially own the 121,589 shares of Common Stock beneficially

owned directly by Ancora Catalyst Institutional, 12,831 shares of Common Stock beneficially owned directly by Ancora Catalyst, 62,384

shares of Common Stock beneficially owned directly by Ancora Bellator, 123,075 shares of Common Stock beneficially owned directly by Ancora

Merlin Institutional, 11,165 shares of Common Stock beneficially owned directly by Ancora Merlin and 137,453 shares of Common Stock held

in the Ancora Alternatives SMAs. As the sole member of Ancora Alternatives, Ancora Holdings may be deemed to beneficially own the 121,589

shares of Common Stock beneficially owned directly by Ancora Catalyst Institutional, 12,831 shares of Common Stock owned directly by Ancora

Catalyst, 62,384 shares of Common Stock beneficially owned directly by Ancora Bellator, 123,075 shares of Common Stock beneficially owned

directly by Ancora Merlin Institutional, 11,165 shares of Common Stock beneficially owned directly by Ancora Merlin, and 137,453 shares

of Common Stock held in the Ancora Alternatives SMAs. As the Chairman and Chief Executive Officer of Ancora Holdings, Mr. DiSanto may

be deemed to beneficially own the 121,589 shares of Common Stock beneficially owned directly by Ancora Catalyst Institutional, 12,831

shares of Common Stock owned directly by Ancora Catalyst, 62,384 shares of Common Stock beneficially owned directly by Ancora Bellator,

123,075 shares of Common Stock beneficially owned directly by Ancora Merlin Institutional, 11,165 shares of Common Stock beneficially

owned directly by Ancora Merlin, and 137,453 shares of Common Stock held in the Ancora Alternatives SMAs. As of the date hereof, Messrs.

Boychuk, Fisher, Kestenbaum, Newport, Thomas, and Urban, Dr. Hayes and Ms. Simms do not beneficially own any shares of Common Stock.

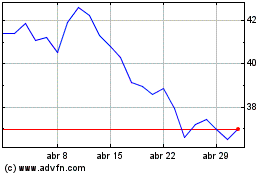

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

US Steel (NYSE:X)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025