'Very possible' Bitcoin consolidates for 8 months again: 10x Research

15 Março 2025 - 3:35AM

Cointelegraph

10x Research’s head crypto researcher isn’t ruling out Bitcoin

repeating its 2024 price action, where it spent much of the year

consolidating after hitting all-time highs early on.

“Very possible,” Markus Thielen told Cointelegraph when asked

what the chances of Bitcoin (BTC) repeating a similar market

movement to 2024, where it reached an all-time high of $73,679 in

March before entering a consolidation phase, swinging within a

range of around $20,000 up until Donald Trump was elected as US

president in November.

Bitcoin’s current chart signals “market indecision”

Thielen said he had this thought even two months ago, around the

time Bitcoin hit its current all-time high of

$109,000 on the day of Trump’s inauguration.

He explained in his most

recent market report on March 15 that Bitcoin’s current chart

resembles a “High and Tight Flag,” which, despite typically being a

bullish continuation pattern, shows signs of weakness.

Bitcoin’s price chart is forming a High, Tight Flag Pattern.

Source:

10x Research

“Two flags instead of a single, precise formation weakens this

setup,” Thielen said.

“As a result, the pattern currently suggests market indecision

rather than a straightforward bullish consolidation,” he added.

Meanwhile, he also pointed out that the spot Bitcoin

exchange-traded fund (ETF) market shows no signs of a “buy-the-dip”

mentality.

“Little incentive” to take advantage of Bitcoin’s recent price

dip

“This aligns with our view that most ETF flows came from

arbitrage-driven hedge funds. Given the persistently low funding

rates, there’s little incentive or willingness to deploy additional

capital despite the recent price correction,” Thielen said.

Since the beginning of March, when Bitcoin fell below $90,000,

spot Bitcoin ETFs in the US have recorded total outflows of around

$1.66 billion, according to Farside

data.

Bitcoin is trading at $84,290 at the time of publication,

according to CoinMarketCap.

This represents a 23% decline from its $109,000 January all-time

high.

Bitcoin is down 12.86% over the past month. Source:

CoinMarketCap

Thielen is unsure if Bitcoin’s uptrend will resume in the short

term. ”Therefore, it may be prudent to close short positions at

this stage, although there remains little evidence to support a

strong price recovery,” Thielen said.

Related:

Bitcoin panic selling costs new investors $100M in 6

weeks — Research

Ever since Bitcoin fell below $80,000 on Feb. 28 — the first

time since November — amid growing macroeconomic uncertainty over

US President Donald Trump’s proposed tariffs, several crypto

analysts have been predicting further downfall for the asset.

On March 10, BitMEX co-founder and Maelstrom

chief investment officer Arthur Hayes said “it looks like

Bitcoin will retest $78,000.” “If it fails, $75,000 is next in the

crosshairs,” he added.

Meanwhile, Iliya Kalchev, dispatch analyst at digital asset

investment platform Nexo, told Cointelegraph on

March 11 that the low $70,000 range could “provide a foundation

for a more sustainable recovery.”

Magazine: Crypto fans are obsessed with longevity and

biohacking: Here’s why

...

Continue reading 'Very possible' Bitcoin

consolidates for 8 months again: 10x Research

The post

'Very possible' Bitcoin consolidates for 8 months

again: 10x Research appeared first on

CoinTelegraph.

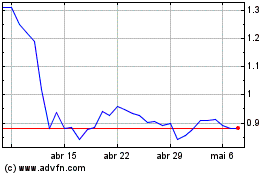

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025