Bitcoin bull market in peril as US recession and tariff worries loom

14 Março 2025 - 2:30PM

Cointelegraph

In the first three months of his presidency, Donald Trump has

ignited trade tensions by announcing tariffs on Canada, Mexico, and

China and the result has been unexpected turmoil in US and global

markets.

The fallout from the tariffs has been relatively swift, and the

impact has been felt across the crypto market. As of March 8, the

US president had backed away from some plans to impose tariffs on

certain Mexican and Canadian goods—another twist in the

rollercoaster of US trade policy that continues to shake

markets.

Singapore crypto trading firm QCP Capital said in a

note. “This week’s

crypto markets have been nothing short of a roller coaster. With

macro conditions in flux, crypto remains tightly linked to

equities, with price action reflecting broader economic

shifts.”

The wild swings underscore the volatility ahead for

cryptocurrencies—often seen as high-risk assets—as the Trump

administration tests the limits of economic and foreign policy and

serves as a cautionary tale as uncertainty pervades

markets.

In a post on X, former US Treasury Secretary Lawrence Summers

said that

[…] tariff policy has already taken $2 trillion off the value of

the US stock market,” and Summers suggested that these measures

were “ill-conceived” and that they would undermine US

competitiveness.

“No wonder Wall Street’s fear gauge is up by

one-third.”

Volatility index (VIX) price action. Source: Yahoo!

Finance.

While tariffs and Trump’s market-moving policy announcements may

create a sense of impending doom, their impact on the future of the

crypto sector remains in question. If a trade war weakens the US

dollar through inflation, Bitcoin could actually benefit, says

Eugene Epstein, head of trading and structured products at

Moneycorp. Investors fleeing depreciating fiat currencies may turn

to crypto, and if tariff-hit nations devalue their currencies in

response, Bitcoin could serve as a vehicle for capital flight.

Unlike traditional markets, Bitcoin trades 24/7 and reacts

instantly to macroeconomic shifts, making it highly vulnerable to

risk-off sentiment. “Sentiment-wise, the primary drivers of crypto

will continue to be the status of a federal crypto reserve as well

as overall risk sentiment. If US equities continue falling it is

hard to envision a strong crypto market, at least in the near

term,” Epstein said.

Many in the crypto community expected Trump’s return to the

White House to send Bitcoin

soaring, and initially, it did—rising from $69,374 on Election

Day to a record $108,786 by Inauguration Day. But since then, BTC

has tumbled, dropping below $80,000 by late February and again in

March. The price weakness comes despite the administration’s

pro-crypto stance, including plans for a strategic crypto reserve

and market-structure reforms.

Cumulative flows into Bitcoin Spot ETFs reached record highs

following Trump’s victory, with investors pouring over $10 billion

into these instruments in the aftermath of the election, according

to data by Farside Investors. However, growing

concerns over a potential tariff war seem to have taken a toll on

market sentiment and, by extension, on cryptocurrencies.

Since early February, Bitcoin ETFs have seen significant

outflows as uncertainty looms over the broader economic landscape.

At the same time, safe haven assets like gold, have actually

responded

positively amid the tariff war.

Spot Bitcoin ETF flows. Source: Farside Investors.

This isn’t the first time President Trump has wielded tariff

threats as a bargaining chip and some traders believe the market

will adjust to focus on fundamentals over the blunt use of tariffs

as a way to force policy changes among US allies.

That’s why some traders in the industry choose to not base their

strategies solely on tariffs. For Bob Walden, head of Trading at

Abra, tariffs are “just a headline” that influences short-term

investor sentiment but doesn’t alter the market’s fundamental

conditions.

“To me, tariffs are a red herring. It is something

Trump uses as a bargaining chip, and I do not think they mean

anything to crypto. They initially caused a drawdown—tariffs caught

a market that was long at the top and over-leveraged looking for an

exciting move—but that was a correlation, not the

causation.”

Related: 3 reasons why Bitcoin sells off on

Trump tariff news

Walden points to Trump’s fiscal austerity program as the real

driver of crypto markets.

“That is what everyone’s looking at in the TradFi

space. Tariffs are just another piece in the fiscal austerity trade

that’s happening across global markets—that is actually what’s

influencing crypto a lot more, as fiscal austerity means less cash

out there to deploy.”

This article is for

general information purposes and is not intended to be and should

not be taken as legal or investment advice. The views, thoughts,

and opinions expressed here are the author’s alone and do not

necessarily reflect or represent the views and opinions of

Cointelegraph.

...

Continue reading Bitcoin bull market in peril as US

recession and tariff worries loom

The post

Bitcoin bull market in peril as US recession and

tariff worries loom appeared first on

CoinTelegraph.

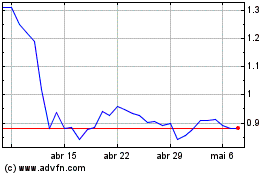

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025