Bitcoin (BTC) has largely stayed above $80,000

since March 11, indicating that the bulls are not waiting for a

deeper correction to buy. However, the failure to propel the price

above $86,000 shows that the bears have not given up and continue

to sell on rallies.

CoinShares’ weekly report shows that cryptocurrency

exchange-traded products (ETPs) witnessed $1.7

billion in outflows last week. That takes the total five-week

outflows to $6.4 billion. Additionally, the streak of outflows has

reached 17 days, marking the longest negative streak since

CoinShares records began in 2015.

Daily cryptocurrency market performance. Source:

Coin360

It’s not all gloom and doom for the long-term investors.

CryptoQuant contributor ShayanBTC said that investors who purchased

Bitcoin between three and six months ago are

showing an

accumulation pattern. Historically, similar behavior has

“played a crucial role in forming market bottoms and igniting new

uptrends.”

Will buyers succeed in catapulting Bitcoin above the overhead

resistance levels? How are the altcoins placed? Let’s analyze the

charts to find out.

S&P 500 Index price analysis

The S&P 500 Index (SPX) is in a strong corrective phase. The

fall to 5,504 on March 13 sent the relative strength index (RSI)

into the oversold territory, signaling a possible relief rally in

the near term.

SPX daily chart. Source: Cointelegraph/TradingView

The bears will try to halt the recovery in the 5,670 to 5,773

resistance zone. If they succeed, it will signal that the sentiment

remains negative and traders are selling on rallies. That heightens

the risk of a fall to 5,400. The bulls are expected to defend the

5,400 level with all their might because a drop below it may sink

the index to 5,100.

On the upside, a break and close above the 20-day exponential

moving average (5,780) will signal strength. The index may then

climb to the 50-day simple moving average (5,938).

US Dollar Index price analysis

The weak rebound off the 103.37 support in the US Dollar Index

(DXY) suggests that the bears have kept up the pressure.

DXY daily chart. Source: Cointelegraph/TradingView

Sellers are trying to sink the index below 103.37. If they can

pull it off, the decline could extend to 102 and thereafter to

101.

Conversely, if the price turns up from the current level and

breaks above 104, it will signal that buyers are trying to make a

comeback. The index could rise to the 20-day EMA (105), which is

likely to attract sellers. If buyers do not cede much ground to the

bears, the prospects of a break above the 20-day EMA increase. The

index could then rally to the 50-day SMA (107).

Bitcoin price analysis

Bitcoin has been trying to form a higher low in the near term,

building strength to cross above the 200-day SMA ($84,112).

BTC/USDT daily chart. Source:

Cointelegraph/TradingView

The positive divergence on the RSI suggests that the bearish

momentum is weakening. If buyers drive the price above the 20-day

EMA ($85,808), the BTC/USDT pair could rise to the 50-day SMA

($92,621).

Contrary to this assumption, if the price turns down sharply

from the 200-day SMA, it will indicate that the bears are trying to

flip the level into resistance. The pair may slide to $80,000 and

next to $76,606.

Ether price analysis

Ether (ETH) has been trading between $1,963

and $1,821, signaling a lack of aggressive buying at current

levels.

ETH/USDT daily chart. Source:

Cointelegraph/TradingView

If the price dips below the $1,821 to $1,754 support zone, it

will indicate the resumption of the downtrend. The ETH/USDT pair

may then nosedive to the next significant support at $1,550.

This negative view will be invalidated in the near term if the

price turns up and breaks above the 20-day EMA ($2,107). The pair

could ascend to the 50-day SMA ($2,514), where the bears are likely

to sell aggressively. However, if the bulls pierce the 50-day SMA

resistance, the pair may rally to $2,857.

XRP price analysis

XRP (XRP) turned down from the

50-day SMA ($2.51) on March 15, indicating that the bears are

active at higher levels.

XRP/USDT daily chart. Source:

Cointelegraph/TradingView

The 20-day EMA ($2.34) has flattened out, and the RSI is near

the midpoint, indicating a balance between supply and demand. The

XRP/USDT pair could remain stuck between the 50-day SMA and $2 for

some time.

If the price turns up from the current level and breaks above

the 50-day SMA, it will clear the path for a potential rally to $3.

Instead, a break and close below $2 will complete a

head-and-shoulders pattern. The pair may then tumble to $1.28.

BNB price analysis

BNB (BNB) turned up from the

20-day EMA ($598) and rose above the 50-day SMA ($620), indicating

that the correction may be ending.

BNB/USDT daily chart. Source:

Cointelegraph/TradingView

The 20-day EMA has started to turn up, and the RSI has risen

into positive territory, indicating a slight advantage to the

bulls. If the price sustains above the 50-day SMA, the BNB/USDT

pair could rally to $686 and eventually to $745.

The 20-day EMA is the critical support to watch out for on the

downside. A break and close below the 20-day EMA will signal that

the bears have seized control. The pair may then descend to the

strong support at $500.

Solana price analysis

Solana (SOL) turned down from the

20-day EMA ($139) on March 16, signaling that bears are

aggressively defending the level.

SOL/USDT daily chart. Source:

Cointelegraph/TradingView

The SOL/USDT pair could drop to $120 and then to $110, where

buyers are expected to step in. If the price rebounds off the

support zone, the bulls will again try to drive the SOL/USDT pair

above the 20-day EMA. If they manage to do that, the pair could

climb to $180.

This positive view will be invalidated in the near term if the

price continues lower and breaks below the support zone. That may

start a downward move to $100 and subsequently to $80.

Related: Ethereum onchain data suggests $2K ETH price is

out of reach for now

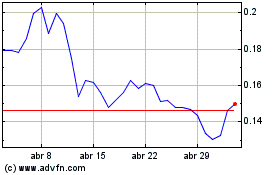

Dogecoin price analysis

Dogecoin (DOGE) has been gradually rising

toward the 20-day EMA ($0.19), which is an important near-term

resistance to watch out for.

DOGE/USDT daily chart. Source:

Cointelegraph/TradingView

If the price turns down sharply from the 20-day EMA, it suggests

that bears are selling on every minor rally. That heightens the

risk of a break below the $0.14 support. If that happens, the

DOGE/USDT pair could plunge to $0.10.

Contrarily, a break and close above the 20-day EMA indicates

that the selling pressure is reducing. The pair could rise to the

50-day SMA ($0.23) and later to $0.29. A break and close above

$0.29 suggests that buyers are back in the driver’s seat.

Cardano price analysis

Cardano (ADA) has been trading below the

20-day EMA ($0.76) since March 8, but the bears have failed to sink

the pair to the uptrend line. This suggests that selling dries up

at lower levels.

ADA/USDT daily chart. Source:

Cointelegraph/TradingView

Buyers will have to drive the price above the moving averages to

start a sustained recovery. The ADA/USDT pair could climb to $1.02,

where the bears may again mount a strong defense.

Contrary to this assumption, if the price turns down from the

moving averages, it will suggest that bears remain in control. That

increases the likelihood of a drop below the uptrend line. If that

happens, the pair may plummet to $0.50.

Pi price analysis

Pi (PI) has been gradually sliding toward the $1.23 support,

which is likely to attract buying from the bulls.

PI/USDT daily chart. Source:

Cointelegraph/TradingView

If the price rebounds off $1.23 with strength, the PI/USDT pair

could attempt a move back toward $1.80. Sellers are expected to

pose a strong challenge at $1.80, but if the bulls prevail, the

pair could rally to $2 and thereafter to $2.35.

Contrarily, if the price turns down from $1.80, it will signal a

range formation. The pair may swing between $1.23 and $1.80 for a

while. Sellers will strengthen their position on a break below

$1.23. The pair may then collapse to the 78.6% retracement level of

$0.72.

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Price analysis 3/17: SPX, DXY, BTC,

ETH, XRP, BNB, SOL, DOGE, ADA, PI

The post

Price analysis 3/17: SPX, DXY, BTC, ETH, XRP, BNB,

SOL, DOGE, ADA, PI appeared first on

CoinTelegraph.

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Dogecoin (COIN:DOGEUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025