By Amrith Ramkumar

Eric Perkins believes Tesla Inc. shares have climbed too

quickly, to heights the company's earnings can't sustain. He's

still not selling.

A 44-year-old living outside San Diego, Mr. Perkins says he

normally would sell to lock in a profit when a stock quadruples in

four months. But after missing past Tesla rallies, he is determined

to hold onto his shares, which now make up about half of his

roughly $1 million portfolio.

"I don't see anything stopping the momentum, at least until

earnings are announced," said Mr. Perkins, who drives a Tesla Model

X. The electric auto maker reports second-quarter earnings on

Wednesday. Shares hit a record of $1,546 this past Wednesday,

giving Tesla a market value of $287 billion -- higher than that of

titans like Intel Corp. and Home Depot Inc.

Tesla is one of a handful of stocks whose recent surge continues

to power the broader market higher. These companies like tech

stalwart Amazon.com Inc. and vaccine maker Moderna Inc. have lifted

the Nasdaq Composite to fresh records recently and helped push the

S&P 500 up 44% from a multiyear low hit in March.

Momentum stocks are popular among investors who buy shares

because they are rising and sell stocks that are falling, with

little regard for economic or market fundamentals.

Some momentum stocks, like Tesla, have yet to record a full-year

profit, but their future potential and recent stock performance

have still attracted hordes of buyers in recent weeks. Many of

these investments are mainstays for individuals using apps like

Robinhood. They have increased their trading activity lately,

buying all sorts of things that worry professionals, including

shares of companies on the brink of bankruptcy.

The swings are a concern for analysts who worry that the gains

could reverse suddenly, sending major indexes into a tailspin and

even destabilizing the economy because of how many investors hold

the stocks. If it records a fourth consecutive quarterly profit

Wednesday, Tesla could earn inclusion into the S&P 500, making

it even more widely owned through funds tied to the index and

increasing the company's sway over financial markets.

Retired hedge-fund manager David Rocker worries that big gains

in shares of unprofitable companies represent market manipulation

and excesses in the financial system even more extreme than the

late 1990s dot-com bubble. Mr. Rocker was known for short selling

-- wagering on falling stock prices by borrowing shares, selling

them, then aiming to repurchase at lower prices. He argues that

government and central-bank stimulus is contributing to the

phenomenon, adding to a mountain of debt that will eventually hurt

the economy.

"This is going to end in tears and do enormous damage," he

said.

Short sellers of Tesla and other so-called momentum stocks have

suffered losses lately, forcing them to buy shares at higher prices

to close out weakening positions, a trend known as a "short

squeeze" that can add further fuel to rallies.

Investors this week will be monitoring a flurry of earnings

results from companies tied to momentum and popular among retail

traders including Tesla and Microsoft Corp.

"People want to pile into what's working today," said Michael

Lippert, who manages the Baron Capital Opportunity Fund that counts

both companies as large holdings.

Amateurs aren't the only ones chasing returns in momentum

stocks. Quant funds and other strategies that trade factors such as

momentum and volatility have grown in popularity in recent years.

Some of these funds along with individual investors are often quick

to buy stocks that are doing well, then can sell just as fast when

trading conditions shift.

This was illustrated on Monday, when stocks erased gains after

California said it would roll back its reopening amid a surge in

coronavirus cases. Tesla rose as much as 16% before closing lower,

while the Nasdaq ended the day down 2.1% after advancing nearly 2%

earlier in the session.

Despite the jarring moves, many remain confident in momentum

stocks because many of the companies are perceived as beneficiaries

of trends like remote work that are being accelerated by the

pandemic. About 74% of fund managers surveyed in a recent Bank of

America monthly poll said owning tech stocks was the most crowded

trade in the market, the highest percentage of any trade going back

to 2013.

"We are in a market that is incredibly bifurcated between the

winners and losers," said Holly Framsted, head of U.S. Factor ETFs

at BlackRock Inc.'s iShares division.

Mark Castro, a 34-year-old nurse from the Philippines, shares a

roughly $10,000 portfolio with his wife concentrated in Netflix

Inc. and vaccine companies Moderna and Inovio Pharmaceuticals Inc.

He tries to capture short-term gains in stocks based on their

trading patterns, so he buys and sells often, particularly when

activity in a stock is frenzied and volume rises.

"With volume I can ride the momentum," he said. "It's a powerful

force."

William Beyer began trading stocks in April after receiving his

stimulus check from the federal government. The 28-year-old in

Northfield, Minn., has a roughly $2,000 portfolio featuring stocks

like fuel-cell company Plug Power Inc. and Chinese electric-vehicle

maker NIO Inc.

After losing money earlier in the year trading based on

momentum, Mr. Beyer is now trying to incorporate trends like 5G

broadband technology into his strategy.

"It is very risky," he said of short-term momentum trading. "If

you don't get out at the right time, it's going to turn red really

quickly."

While he and many other investors eventually expect a reversal

in Tesla shares as a result, believers in the company like Mr.

Perkins outside San Diego remain hopeful.

"Taking money off the table at this point would be a mistake,"

Mr. Perkins said.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

July 19, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

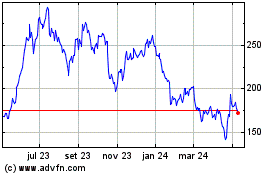

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

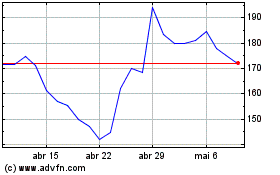

Tesla (NASDAQ:TSLA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024