Abbott Labs Sees Lower Covid-19 Sales, But Expects Better Fiscal Year Organic Sales Growth

20 Julho 2023 - 9:21AM

Dow Jones News

By Ben Glickman

Abbott Laboratories continued to see declines in profit because

of lower revenues from Covid-19 tests in the latest quarter but

topped estimates on growth in other parts of its business.

The Abbott Park, Ill.-based healthcare products company said it

had a profit of $1.375 billion, or 78 cents a share, in the quarter

ended June 30, compared with $2.018 billion, or $1.14 a share, a

year earlier. Analysts polled by FactSet had expected per-share

earnings of 76 cents a share.

Stripping out certain one-time expenses, earnings were $1.08 a

share, beating the $1.05 expected by analysts polled by

FactSet.

The company's sales fell 11.4% to $9.978 billion in the quarter

from $11.257 billion a year earlier. Analysts polled by FactSet had

expected sales of $9.711 billion.

Excluding the drop in sales of Covid-19 tests, organic sales

rose 11.5% in the quarter.

The company slightly lowered its full-year guidance on earnings

per share, expecting profit between $3.02 and $3.22 a share,

compared with prior guidance of $3.05 to $3.25.

But the company reaffirmed its guidance for full-year adjusted

per-share earnings between $4.30 and $4.50, which the company said

was a sign of strength in its business with lower Covid-19 test

revenue.

After previously saying it expected organic sales growth to be

at least in the high single digits, the company now projects

full-year sales growth in the low double digits.

Write to Ben Glickman at ben.glickman@wsj.com

(END) Dow Jones Newswires

July 20, 2023 08:06 ET (12:06 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

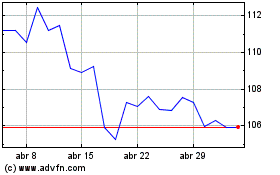

Abbott Laboratories (NYSE:ABT)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

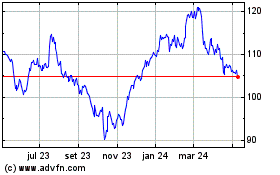

Abbott Laboratories (NYSE:ABT)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024