Form 10-Q - Quarterly report [Sections 13 or 15(d)]

26 Outubro 2023 - 5:23PM

Edgar (US Regulatory)

Enphase Energy (NASDAQ:ENPH)

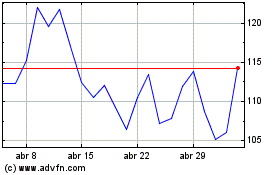

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Enphase Energy (NASDAQ:ENPH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024