false

0001433270

0001433270

2024-03-11

2024-03-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

March 11, 2024

ANTERO RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36120 |

|

80-0162034 |

(State or Other

Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

1615 Wynkoop Street

Denver, Colorado 80202

(Address of Principal Executive Offices) (Zip Code)

Registrant’s

Telephone Number, Including Area Code (303)

357-7310

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $0.01 Per Share |

|

AR |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On March 11, 2024, Antero

Resources Corporation (the “Company”) issued a press release, a copy of which is attached hereto as Exhibit 99.1, announcing

that it has called all $26,386,000 aggregate principal amount of its outstanding 4.25% Convertible Senior Notes Due 2026 (the “Notes”)

for redemption on Monday, April 1, 2024 (the “Redemption Date”). The redemption price will be equal to 100% of the principal

amount of each Note called for redemption, plus accrued and unpaid interest on such Note to, but excluding, the Redemption Date for such

Note (the “Redemption Price”).

Notes called for redemption

may be converted at any time before 5:00 p.m., New York City time, on Thursday, March 28, 2024 (or, if the Company fails to pay the Redemption

Price due on the Redemption Date in full, at any time until such time as the Company pays such Redemption Price in full) (the “Conversion

Deadline”). The Company has elected to settle all conversions of Notes between now and the

Conversion Deadline by delivering shares of common stock, par value $0.01 per share, and paying cash in lieu of fractional shares, as

applicable, upon such conversion.

This

Current Report on Form 8-K is not a notice of redemption of the Notes. The redemption is being made solely pursuant to the Notice of Redemption,

dated March 11, 2024, relating to the Notes.

The information furnished

in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly

set forth by specific reference in such filing.

| |

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANTERO RESOURCES CORPORATION |

| |

|

| |

By: |

/s/ Michael N. Kennedy |

| |

|

Michael N. Kennedy |

| |

|

Chief Financial Officer and Senior Vice President—Finance |

| Dated: March 11, 2024 |

Exhibit 99.1

Antero Resources Announces Redemption of Outstanding

4.25% Convertible Senior Notes Due 2026

Denver, Colorado, March 11, 2024—Antero

Resources Corporation (NYSE: AR) (“Antero Resources,” “Antero,” or the “Company”) today announced

that it has called all of its outstanding 4.25% Convertible Senior Notes Due 2026 (the “Notes”) (CUSIP No. 03674X AM8) for

redemption on Monday, April 1, 2024 (the “Redemption Date”).

The aggregate principal amount of the Notes being

redeemed is $26,386,000. This is equal to the current aggregate principal amount of Notes outstanding. The redemption price will be equal

to 100% of the principal amount of each Note called for redemption, plus accrued and unpaid interest on such Note to, but excluding, the

Redemption Date for such Note (the "Redemption Price"). For each $1,000 principal amount of Notes, the Redemption Price is equal

to $1,003.54.

To receive payment of the Redemption Price, any

certificated Notes must be surrendered to Computershare Trust Company, National Associations, as successor trustee to Wells Fargo Bank,

National Association, at 1505 Energy Park Drive, St. Paul, MN 55108, on or prior to the Redemption Date. Any Notes in book-entry form

must be surrendered through the facilities of The Depository Trust Company in the usual manner to be paid the Redemption Price.

Notes called for redemption may be converted at

any time before 5:00 p.m., New York City time, on Thursday, March 28, 2024 (or, if the Company fails to pay the Redemption Price due on

the Redemption Date in full, at any time until such time as the Company pays such Redemption Price in full) (the “Conversion Deadline”).

The Company has elected to settle all conversions of Notes between now and the Conversion Deadline by delivering shares of common stock,

par value $0.01 per share (“Common Stock”), and paying cash in lieu of fractional shares, as applicable, upon such conversion.

The sending of the notice of redemption is a make-whole

fundamental change under the indenture governing the Notes (the “Indenture”), and therefore the current conversion rate is

required to be adjusted for all conversions of Notes as set forth in the Indenture. However, based on the current trading price of the

Company’s Common Stock, no additional shares will be added to the conversion rate. As of today, the conversion rate for all conversions

of Notes after today and before the Conversion Deadline is 230.2026 shares of Common Stock per $1,000 principal amount of Notes. This

conversion rate will remain subject to adjustment in accordance with the Indenture from time to time for certain events.

This press release is neither an offer to sell

nor a solicitation of an offer to buy the Notes or any other securities and shall not constitute an offer to sell or a solicitation of

an offer to buy, or a sale of, the Notes or any other securities in any jurisdiction in which such offer, solicitation or sale is unlawful.

No representation is made as to the correctness or accuracy of the CUSIP number either as printed on the Notes or as contained in this

press release.

Antero Resources is an independent natural

gas and natural gas liquids company engaged in the acquisition, development and production of unconventional properties located in the

Appalachian Basin in West Virginia and Ohio. In conjunction with its affiliate, Antero Midstream (NYSE: AM), Antero is one of the most

integrated natural gas producers in the U.S. The Company’s website is located at www.anteroresources.com.

This release includes "forward-looking

statements." Such forward-looking statements are subject to a number of risks and uncertainties, many of which are not under Antero

Resources’ control. All statements, except for statements of historical fact, made in this release regarding activities, events

or developments Antero Resources expects, believes or anticipates will or may occur in the future, such as those regarding the Redemption

of the Notes, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All forward-looking statements speak only as of the date of this release. Although Antero Resources believes that

the plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, there is no assurance

that these plans, intentions or expectations will be achieved. Therefore, actual outcomes and results could materially differ from what

is expressed, implied or forecast in such statements. Except as required by law, Antero Resources expressly disclaims any obligation to

and does not intend to publicly update or revise any forward-looking statements.

Antero Resources cautions you that these forward-looking

statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the Antero Resources’

control. These risks include, but are not limited to, the risks described under the heading "Item 1A. Risk Factors" in Antero

Resources’ Annual Report on Form 10-K for the year ended December 31, 2023.

For more information, contact Daniel Katzenberg,

Director - Finance and Investor Relations of Antero Resources at (303) 357-7219 or dkatzenberg@anteroresources.com.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

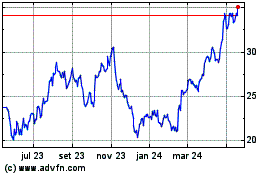

Antero Resources (NYSE:AR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

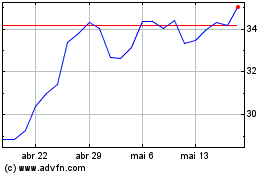

Antero Resources (NYSE:AR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024