Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

18 Novembro 2024 - 1:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or

15d-16 of

the Securities Exchange Act of 1934

Dated 18 November 2024

Commission File Number 1-06262

BP p.l.c.

(Translation

of registrant’s name into English)

1 ST

JAMES’S SQUARE, LONDON, SW1Y 4PD, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN THE PROSPECTUS INCLUDED IN THE REGISTRATION

STATEMENT ON FORM F-3 (FILE NOS. 333-277842, 333-277842-01 AND 333-277842-02) OF BP CAPITAL MARKETS AMERICA INC., BP CAPITAL MARKETS p.l.c. AND BP p.l.c., AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE

EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

BP p.l.c. AND SUBSIDIARIES

FORM 6-K DATED 18 November 2024

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

BP p.l.c.

(Registrant) |

|

|

|

|

| Dated: 18 November 2024 |

|

|

|

|

|

/s/ Ben J.S. Mathews |

|

|

|

|

|

|

Ben J.S. Mathews |

|

|

|

|

|

|

Company Secretary |

|

|

|

| Managing Counsel |

|

BP p.l.c. 1 St James’s

Square London SW1Y 4PD

United Kingdom |

| BP Legal |

| 18 November 2024 |

| Direct 020 3683 5338 |

| Main 020 7496 4000 |

| Fax 020 7948 7982 |

|

|

| Jo.Norman@uk.bp.com |

|

|

| www.bp.com |

|

|

November 18, 2024

BP

p.l.c.

1 St. James’s Square

London SW1Y 4PD, England

BP Capital Markets p.l.c.

Chertsey Road

Sunbury on Thames

Middlesex TW16 7BP, England

Ladies and Gentlemen:

In connection with the registration

under the Securities Act of 1933, as amended (the “Act”), of $1,250,000,000 in aggregate principal amount of 6.125% Perpetual Subordinated Fixed Rate Reset Notes (the “Securities”) of BP Capital Markets p.l.c., an English company

(“BPCM”), and the related guarantees (the “Guarantees”) of the Securities by BP p.l.c., an English company (“BP”), pursuant to a Registration Statement on Form F-3 (the

“Registration Statement”), as Managing Counsel – Treasury of BP, I have examined such corporate records, certificates and other documents and such questions of law as I have considered necessary or appropriate for the purposes of this

opinion.

Upon the basis of such examination, I advise you that, in my opinion:

1. each of BP and BPCM is a public limited company duly incorporated and each is a validly existing company under the laws of England and Wales;

2. the Indenture, dated as of March 8, 2002, among BPCM, BP and The Bank of New York Mellon Trust Company, N.A. (as successor to JPMorgan Chase Bank

N.A.), as Trustee (the “Trustee”) (the “Base Indenture”), as supplemented by a Thirty-Third Supplemental Indenture, dated as of November 18, 2024 (the “Thirty-Third Supplemental Indenture” and, together with the

Base Indenture, the “Indenture”), relating to the Securities has been duly authorised, executed and delivered by each of BP and BPCM; and

3. when (a) the Securities and the Guarantees have been duly executed and, in the case of the

Securities, authenticated in accordance with the Indenture relating thereto, and (b) the Securities and the Guarantees have been issued and sold as contemplated in the Registration Statement, the Guarantees and Securities will constitute valid

and legally binding obligations of BP and BPCM, respectively, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general

equity principles.

The foregoing opinion is limited to the laws of England in force on this date and I am expressing no opinion as to the effect of the

laws of any other jurisdiction. I understand you are relying as to all matters governed by the laws of the state of New York upon the opinion dated the date hereof of Sullivan & Cromwell LLP, United States counsel to BP, which opinion is

being delivered to you by such counsel.

I consent to the filing of this opinion as an exhibit to the Registration Statement relating to the Securities

and the Guarantees on Form 6-K and to the references to me under the caption “Validity of Securities” in the Prospectus as supplemented by the Prospectus Supplement dated as of November 13,

2024. In giving such consent I do not thereby admit that I am within the category of persons whose consent is required under Section 7 of the Act.

Yours faithfully,

/s/ Jo Norman

Jo Norman

[Signature Page to the AGC Exhibit

5 Opinion]

Exhibit 5.2

|

|

|

|

|

|

A LIMITED LIABILITY

PARTNERSHIP TELEPHONE: +44 (0)20-7959-8900

FACSIMILE: +44 (0)20-7959-8950

WWW.SULLCROM.COM |

|

|

|

One New Fetter Lane

London EC4A 1AN, England

BRUSSELS • FRANKFURT • PARIS

LOS ANGELES • NEW YORK • PALO ALTO • WASHINGTON, D.C.

BEIJING • HONG KONG • TOKYO

MELBOURNE • SYDNEY |

November 18, 2024

BP p.l.c.,

1 St. James’s Square,

London SW1Y 4PD, England.

BP Capital Markets

p.l.c.,

Chertsey Road,

Sunbury on Thames,

Middlesex

TW16 7BP, England.

Ladies and Gentlemen:

In connection with the registration under the Securities Act of 1933 (the “Act”), of U.S.$1,250,000,000 in aggregate principal

amount of 6.125% Perpetual Subordinated Fixed Rate Reset Notes (the “Securities”) of BP Capital Markets p.l.c., an English company (“BPCM”), and the related guarantees (the “Guarantees”) of the Securities by BP p.l.c.,

an English company (“BP”), we, as your United States counsel, have examined such corporate records, certificates and other documents and such questions of law as we have considered necessary or appropriate for the purposes of this opinion.

Sullivan & Cromwell LLP carries on business in England and Wales through Sullivan & Cromwell MNP LLP, a registered limited

liability partnership established under the laws of the State of New York.

The personal liability of our partners is limited to the extent

provided in such laws. Additional information is available upon request or at www.sullcrom.com.

Sullivan & Cromwell MNP LLP is

authorized and regulated by the Solicitors Regulation Authority (Number 00308712).

A list of the partners’ names and professional

qualifications is available for inspection at 1 New Fetter Lane, London EC4A 1AN. All partners are either registered foreign lawyers or solicitors.

|

|

|

| BP p.l.c. BP Capital Markets p.l.c. |

|

-2- |

Upon the basis of such examination, we advise you that, in our opinion, (1) assuming

the Securities have been duly authorized, executed, issued and delivered by BPCM insofar as the laws of England and Wales are concerned, the Securities constitute valid and legally binding obligations of BPCM and (2) assuming the Guarantees

have been duly authorized, executed and delivered by BP insofar as the laws of England and Wales are concerned, the Guarantees constitute valid and legally binding obligations of BP, subject, in each case, to bankruptcy, insolvency, fraudulent

transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles.

In rendering the foregoing opinion, we are not passing upon, and assume no responsibility for, any disclosure in any registration statement

or any related prospectus or other offering material relating to the offer and sale of the Securities.

The foregoing opinion is limited

to the Federal laws of the United States and the laws of the State of New York, and we are expressing no opinion as to the effect of the laws of any other jurisdiction. For purposes of our opinion, we have assumed that (i) each of BP and BPCM

has been duly incorporated and is an existing public limited company under laws of England and Wales and (ii) the Indenture relating to the Securities has been duly authorized, executed and delivered by each of BP and BPCM insofar as the laws

of England and Wales are concerned. With respect to all matters of English law, we note that you have received an opinion, dated as of the date hereof, of Jo Norman, Managing Counsel – Treasury of BP.

|

|

|

| BP p.l.c. BP Capital Markets p.l.c. |

|

-3- |

We have relied as to certain factual matters on information obtained from public officials,

officers of BP and BPCM and other sources believed by us to be responsible, and we have assumed that the Indenture has been duly authorized, executed and delivered by The Bank of New York Mellon Trust Company, N.A. (the “Trustee”), that

the Securities conform to the specimens thereof examined by us, that the Trustee’s certificate of authentication of the Securities has been signed by one of the Trustee’s authorized officers and that the signatures on all documents

examined by us are genuine, assumptions which we have not independently verified.

We hereby consent to the filing of this opinion as an

exhibit to the Registration Statement on Form 6-K and to the references to us under the heading “Validity of Securities” in the Prospectus as supplemented by the Prospectus Supplement dated

November 13, 2024. In giving such consent we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

|

| Very truly yours, |

|

| /s/ Sullivan & Cromwell LLP |

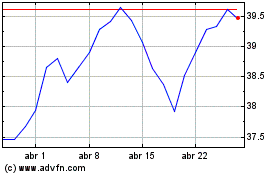

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

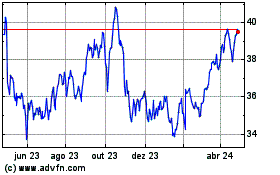

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024