U.S. index futures rose in Tuesday’s pre-market as investors

anticipate key corporate earnings. Reports from companies like

Pfizer (NYSE:PFE), McDonald’s

(NYSE:MCD), and later Alphabet (NASDAQ:GOOGL),

AMD (NASDAQ:AMD), and Visa

(NYSE:V) are on investors’ radars.

At 4:41 AM, Dow Jones futures (DOWI:DJI) were up 4 points, or

0.01%. S&P 500 futures gained 0.10%, while Nasdaq-100 futures

advanced 0.17%. The 10-year Treasury yield stood at 4.306%.

In commodities, West Texas Intermediate crude for December rose

0.82%, reaching $67.92 per barrel, while Brent for December

increased 0.78%, to $71.97 per barrel.

Oil prices slightly rebounded after a 6% drop in the previous

session, supported by the U.S.’s intention to replenish the

Strategic Petroleum Reserve (SPR).

The U.S. plans to purchase up to 3 million barrels of oil for

the Strategic Reserve by May 2025, but the government will need

additional congressional funding for further acquisitions. This

buyback aims to restock after selling 180 million barrels in 2022,

while the Department of Energy collaborates with lawmakers to

prevent scheduled sales and reduce the impact on strategic

reserves.

Global demand concerns still pressure the market, while attacks

between Israel and Iran, targeting military sites, have not

affected oil infrastructure. Tensions remain high, yet a temporary

stability is expected.

Gold (PM:XAUUSD) neared a record, rising 0.6% to $2,751.07 per

ounce, with investors awaiting crucial economic data ahead of the

next Federal Reserve decision. Rate cut expectations favor the

non-yielding metal, and safe-haven demand has grown amid the U.S.

presidential race, supporting gold’s gains.

Today’s U.S. economic agenda includes the September S&P

Case-Shiller home price index for 20 cities at 9 a.m. At 10 a.m.,

the October consumer confidence index is expected at 99.2, up from

the prior 98.7. September’s job openings data is also due at the

same time, with an expectation of 7.9 million, slightly down from 8

million.

Asia-Pacific markets mostly closed higher. Japan’s Nikkei 225

rose 0.77%, South Korea’s Kospi gained 0.21%, Australia’s ASX 200

climbed 0.34%. In Hong Kong, the Hang Seng rose 0.35% near session

end, while China’s CSI 300 dropped 1%.

The Biden administration is finalizing rules, effective January

2, restricting U.S. investments in AI, semiconductors, and quantum

technology in China to safeguard national security. This measure,

based on a 2023 executive order, prevents U.S. expertise and

capital from advancing China’s military.

ByteDance founder Zhang Yiming now tops China’s rich list with

$49.3 billion, surpassing Zhong Shanshan, whose fortune dropped 24%

to $47.9 billion. ByteDance boosted Zhang’s wealth

with $110 billion in revenue.

In Japan, the government coalition’s loss of majority suggests

increased spending, complicating potential interest rate hikes. The

Liberal Democratic Party (LDP) will seek alliances, notably with

parties advocating for tax cuts and subsidies, to maintain

stability. Political uncertainty challenges the Bank of Japan’s

interest rate strategy as yen weakening and U.S. policies pressure

new economic measures.

Japan’s September unemployment rate dropped to 2.4%, down from

2.5% in August and below Reuters’ 2.5% forecast.

European markets opened higher on Tuesday, with investors

assessing recent earnings reports and anticipating Germany’s GfK

consumer confidence data.

On Monday, U.S. stocks edged higher after a strong start and a

day of fluctuations, driven by declining oil prices. The Dow Jones

gained 0.7%, the Nasdaq rose 0.3%, and the S&P 500 also

increased 0.3%. With no significant economic data that day,

investors awaited crucial upcoming data like the jobs and inflation

reports, which could impact the Fed’s rate decisions, alongside

quarterly reports from major tech names.

In quarterly earnings, results are expected from

SoFi (NASDAQ:SOFI), PayPal (NASDAQ:PYPL), BP (NYSE:BP), McDonald’s (NYSE:MCD), Pfizer (NYSE:PFE), Royal

Caribbean

Group (NYSE:RCL), JetBlue (NASDAQ:JBLU), Crocs (NASDAQ:CROX), Tenet

Health (NYSE:THC) and Enterprise

Products Partners (NYSE:EPD) before the open.

After the close, results are anticipated from

AMD (NASDAQ:AMD), Alphabet (NASDAQ:GOOGL), Snap

Inc. (NYSE:SNAP), Chipotle (NYSE:CMG), Visa (NYSE:V), First

Solar (NASDAQ:FSLR), Reddit (NYSE:RDDT), Qorvo (NASDAQ:QRVO), Chubb (NYSE:CB)

and Enovix (NASDAQ:ENVX), among

others.

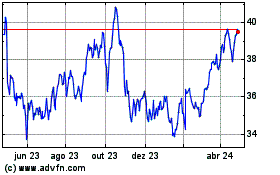

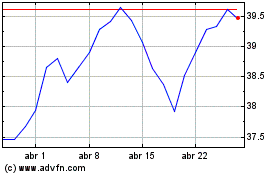

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024