As filed with the Securities and Exchange Commission

on November 26, 2024

Registration No. 333-235688

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Youdao, Inc.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

No. 399, Wangshang Road, Binjiang District

Hangzhou 310051, People’s Republic of China |

|

310051 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Share

Incentive Plan

(Full title of the plan)

| |

Cogency

Global Inc.

122 East

42nd Street, 18th Floor

New York,

NY 10168

|

|

(Name and address of agent for service)

+1 800-221-0102

(Telephone number, including area code, of agent for service)

Copies

to:

|

Feng Zhou

Chief Executive Officer

Youdao, Inc.

No. 399, Wangshang Road, Binjiang District Hangzhou

310051,

People’s Republic of China

+86 0571-8985-2163

|

Li He, Esq.

James C. Lin, Esq.

Davis Polk & Wardwell LLP

c/o 10th Floor, The Hong Kong Club Building, 3A

Chater Road,

Central

Hong Kong

+852 2533-3300

|

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☒ |

| Non-accelerated filer ☐ |

Smaller reporting company ☐ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 is being filed

solely for the purpose of filing Exhibit 10.2 to this registration statement on Form S-8 (Registration No. 333-235688), which was initially filed on December 23, 2019 (the “Registration Statement”), and

amending the exhibit index of the Registration Statement, to reflect an amendment of the First Amended and Restated 2015 Share Incentive

Plan. The Second Amended and Restated 2015 Share Incentive Plan is filed herewith as Exhibit 10.2. No additional securities are being

registered. No changes have been made to the Registration Statement other than this explanatory note and the exhibit index of the Registration

Statement. Accordingly, this Post-Effective Amendment No. 1 consists only of the cover page, this explanatory note, the amended exhibit

index of the Registration Statement and the exhibits filed herewith.

EXHIBIT INDEX

* Filed herewith.

† Previously filed.

Signatures

Pursuant to the requirements of the Securities

Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused this Post-Effective Amendment No.1 to the Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in Beijing, China, on November 26, 2024.

| |

Youdao, Inc. |

| |

|

|

| |

By: |

/s/ Feng Zhou |

| |

Name: |

Feng Zhou |

| |

Title: |

Chief Executive Officer and Director |

POWER OF ATTORNEY

Pursuant to the requirements of the Securities

Act of 1933, this Post-Effective Amendment No.1 to the Registration Statement has been signed by the following persons in the capacities

indicated on November 26, 2024.

| Signature |

Title |

| |

|

|

* |

Director |

| Name: William Lei Ding |

|

| |

|

| |

|

|

/s/ Feng Zhou |

Chief Executive Officer, Director |

| Name: Feng Zhou |

(principal executive officer) |

| |

|

| |

|

|

* |

Independent Director |

| Name: Harry Heung Yeung Shum |

|

| |

|

| |

|

|

* |

Independent Director |

| Name: Jimmy Lai |

|

| |

|

| |

|

|

* |

Vice President of Finance |

| Name: Yongwei Li |

(principal financial officer and principal accounting officer) |

| * By: |

/s/ Feng Zhou |

| |

Name: Feng Zhou |

| |

Attorney-in-fact |

SIGNATURE OF AUTHORIZED

REPRESENTATIVE IN THE UNITED STATES

Pursuant to the Securities

Act of 1933, the undersigned, the duly authorized representative in the United States of Youdao, Inc., has signed this this Post-Effective

Amendment No.1 to the Registration Statement in New York on November 26, 2024.

| |

Authorized U.S. Representative |

| |

|

| |

Cogency Global Inc. |

| |

|

| |

By: |

/s/ Colleen A. De Vries |

| |

|

Name: |

Colleen A. De Vries |

| |

|

Title: |

Senior Vice President |

Exhibit 10.2

YOUDAO, INC.

SECOND AMENDED AND RESTATED

2015 SHARE INCENTIVE PLAN

Article

I

PURPOSE

The purpose of this 2015 Share Incentive Plan (the

“Plan”) is to promote the success and enhance the value of Youdao, Inc., an exempted company formed under the laws

of the Cayman Islands (the “Company”) by linking the personal interests of the Directors, Employees, and Consultants

to those of the shareholders of the Company and by providing such individuals with an incentive for outstanding performance to generate

superior returns to the shareholders of the Company. The Plan is further intended to provide flexibility to the Company in its ability

to motivate, attract, and retain the services of the Directors, Employees, and Consultants upon whose judgment, interest, and special

effort the successful conduct of the Company’s operation is largely dependent.

Article

II

DEFINITIONS AND CONSTRUCTION

Wherever the following terms are used in the Plan

they shall have the meanings specified below, unless the context clearly indicates otherwise. The singular pronoun shall include the plural

where the context so indicates.

2.1

“Applicable Laws” means the legal requirements relating to the Plan and the Awards under applicable provisions

of the corporate and securities laws of the Cayman Islands, the Code, the PRC tax laws, rules, regulations and government orders, the

rules of any applicable stock exchange or national market system, and the laws and the rules of any jurisdiction applicable to Awards

granted to residents therein.

2.2

“Applicable Accounting Standards” shall mean Generally Accepted Accounting Principles in the United States,

International Financial Reporting Standards or such other accounting principles or standards as may apply to the Company’s financial

statements under applicable securities laws from time to time.

2.3

“Award” means an Option, a Restricted Share award, a Restricted Share Unit award, a Share Appreciation Right

award, a Dividend Equivalents award, a Share Payment award, or a Deferred Share award granted to a Participant pursuant to the Plan or

any other types of award as designed and approved from time to time by the Committee or the Board, as the case may be, pursuant to Article

XII of the Plan in compliance with Applicable Laws.

2.4

“Award Agreement” means any written agreement, contract, or other instrument or document evidencing the grant

of an Award executed by the Company and the Participant and any amendment thereto, including through electronic medium.

2.5

“Board” means the Board of Directors of the Company.

2.6

“Change of Control” means a change in ownership or control of the Company effected through either of the following

transactions:

(a)

the direct or indirect acquisition by any person or related group of persons (other than an acquisition from or by the Company

or by a Company-sponsored employee

benefit plan or by a person that directly or indirectly controls, is

controlled by, or is under common control with, the Company) of beneficial ownership (within the meaning of Rule 13d-3 of the Exchange

Act) of securities possessing more than fifty percent (50%) of the total combined voting power of the Company’s outstanding securities

pursuant to a tender or exchange offer made directly to the Company’s shareholders which a majority of the Incumbent Board (as defined

below) who are not affiliates or associates of the offeror under Rule 12b-2 promulgated under the Exchange Act do not recommend such shareholders

accept, or

(b)

the individuals who, as of the Effective Date, are members of the Board (the “Incumbent Board”), cease for any reason

to constitute at least fifty percent (50%) of the Board; provided that if the election, or nomination for election by the Company’s

shareholders, of any new member of the Board is approved by a vote of at least fifty percent (50%) of the Incumbent Board, such new member

of the Board shall be considered as a member of the Incumbent Board.

2.7

“Code” means the Internal Revenue Code of 1986 of the United States, as amended.

2.8

“Committee” means the committee of the Board described in Article XII.

2.9

“Consultant” means any consultant or adviser if: (a) the

consultant or adviser renders bona fide services to a Service Recipient; (b) the services

rendered by the consultant or adviser are not in connection with the offer or sale of securities in a capital-raising transaction and

do not directly or indirectly promote or maintain a market for the Company’s securities; and (c)

the consultant or adviser is a natural person who has contracted directly with the Service Recipient to render such services.

2.10

“Corporate Transaction” means any of the following transactions, provided, however, that the Committee shall

determine under (d) and (e) whether multiple transactions are related, and its determination shall be final, binding and conclusive:

(a)

an amalgamation, arrangement or consolidation in which the Company is not the surviving entity, except for a transaction the principal

purpose of which is to change the jurisdiction in which the Company is incorporated;

(b)

the sale, transfer or other disposition of all or substantially all of the assets of the Company;

(c)

the complete liquidation or dissolution of the Company;

(d)

any reverse takeover or series of related transactions culminating in a reverse takeover (including, but not limited to, a tender

offer followed by a reverse takeover) in which the Company is the surviving entity but (A) the Company’s equity securities outstanding

immediately prior to such takeover are converted or exchanged by virtue of the takeover into other property, whether in the form of securities,

cash or otherwise, or (B) in which securities possessing more than fifty percent (50%) of the total combined voting power of the Company’s

outstanding securities are transferred to a person or persons different from those who held such securities immediately prior to such

takeover or the initial transaction culminating in such takeover, but excluding any such transaction or series of related transactions

that the Committee determines shall not be a Corporate Transaction; or

(e)

acquisition in a single or series of related transactions by any person or related group of persons (other than the Company or

by a Company-sponsored employee benefit plan) of beneficial ownership (within the meaning of Rule 13d-3 of the Exchange Act) of securities

possessing more than fifty percent (50%) of the total combined voting power of the Company’s

outstanding securities but excluding any such transaction or series

of related transactions that the Committee determines shall not be a Corporate Transaction.

2.11

“Deferred Share” means a right to receive a specified number of Shares during specified time periods pursuant

to Article IX.

2.12

“Director” means a member of the Board or a member of the board of directors of any Parent, Subsidiary or Related

Entity of the Company.

2.13

“Disability” means that the Participant qualifies to receive long-term disability payments under the Service

Recipient’s long-term disability insurance program, as it may be amended from time to time, to which the Participant provides services

regardless of whether the Participant is covered by such policy. If the Service Recipient to which the Participant provides service does

not have a long-term disability plan in place, “Disability” means that a Participant is unable to carry out the responsibilities

and functions of the position held by the Participant by reason of any medically determinable physical or mental impairment for a period

of not less than ninety (90) consecutive days. A Participant will not be considered to have incurred a Disability unless he or she furnishes

proof of such impairment sufficient to satisfy the Committee in its discretion.

2.14

“Dividend Equivalents” means a right granted to a Participant pursuant to Article IX to receive the equivalent

value (in cash or securities) of dividends paid with respect to the Shares.

2.15

“Effective Date” shall have the meaning set forth in Section 13.1.

2.16

“Employee” means any person, including an officer or member of the Board of the Company, any Parent or Subsidiary

of the Company, any Subsidiary of a Parent of the Company, or any Related Entity, who is in the employ of a Service Recipient, subject

to the control and direction of the Service Recipient as to both the work to be performed and the manner and method of performance. The

payment of a director’s fee by a Service Recipient shall not be sufficient to constitute “employment” by the Service

Recipient.

2.17

“Exchange Act” means the Securities Exchange Act of 1934 of the United States, as amended.

2.18

“Fair Market Value” means, as of any date, the value of Shares determined as follows:

(a)

If the Shares are listed on one or more established stock exchanges or national market systems, including without limitation, the

New York Stock Exchange or the NASDAQ Stock Market, its Fair Market Value shall be the closing sales price for such shares (or the closing

bid, if no sales were reported) as quoted on the principal exchange or system on which the Shares are listed (as determined by the Committee)

on the date of determination (or, if no closing sales price or closing bid was reported on that date, as applicable, on the last trading

date such closing sales price or closing bid was reported), as reported in The Wall Street Journal or such other source as the Committee

deems reliable;

(b)

If the Shares are regularly quoted on an automated quotation system (including the OTC Bulletin Board) or by a recognized securities

dealer, its Fair Market Value shall be the closing sales price for such shares as quoted on such system or by such securities dealer on

the date of determination, but if selling prices are not reported, the Fair Market Value of a Share shall be the mean between the high

bid and low asked prices for the Shares on the date of determination (or, if no such prices were reported on that date, on the last date

such prices were reported), as reported in The Wall Street Journal or such other source as the Committee deems reliable; or

(c)

In the absence of an established market for the Shares of the type described in (a) and (b), above, the Fair Market Value thereof

shall be determined by the Committee in good faith by reference to (i) the placing

price of the latest private placement of the Shares and the development of the Company’s business operations and the general economic

and market conditions since such latest private placement, (ii) other third party

transactions involving the Shares and the development of the Company’s business operation and the general economic and market conditions

since such transaction, (iii) an independent valuation of the Shares, or (iv)

such other methodologies or information as the Committee determines to be indicative of Fair Market Value and relevant.

2.19

“Group Entity” means any of the Company and Parents, Subsidiaries and Related Entities of the Company.

2.20

“Incentive Share Option” means an Option that is intended to meet the requirements of Section 422 of the Code

or any successor provision thereto.

2.21

“Independent Director” means (i) before the Shares or other securities representing the Shares are listed on

a stock exchange, a member of the Board who is a Non-Employee Director; and (ii) after the Shares or other securities representing the

Shares are listed on a stock exchange, a member of the Board who meets the independence standards under the applicable corporate governance

rules of the stock exchange.

2.22

“Non-Employee Director” means a member of the Board who qualifies as a “Non-Employee Director” as

defined in Rule 16b-3(b)(3) of the Exchange Act, or any successor definition adopted by the Board.

2.23

“Non-Qualified Share Option” means an Option that is not intended to be an Incentive Share Option.

2.24

“Option” means a right granted to a Participant pursuant to Article V of the Plan to purchase a specified number

of Shares at a specified price during specified time periods. An Option may be either an Incentive Share Option or a Non-Qualified Share

Option.

2.25

“Participant” means a person who, as a Director, Consultant or Employee, has been granted an Award pursuant

to the Plan.

2.26

“Parent” means a parent corporation under Section 424(e) of the Code.

2.27

“Plan” means this 2015 Share Incentive Plan, as amended from time to time.

2.28

“PRC” means the People’s Republic of China.

2.29

“Related Entity” means any business, corporation, partnership, limited liability company or other entity in

which the Company, a Parent or Subsidiary of the Company holds a substantial ownership interest, directly or indirectly, or controls through

contractual arrangements and consolidates the financial results according to the Applicable Accounting Standards, but which is not a Subsidiary

and which the Board designates as a Related Entity for purposes of the Plan.

2.30

“Restricted Share” means a Share awarded to a Participant pursuant to Article VI that is subject to certain

restrictions and may be subject to risk of forfeiture.

2.31

“Restricted Share Unit” means an Award granted pursuant to Article VII.

2.32

“Securities Act” means the Securities Act of 1933 of the United States, as amended.

2.33

“Service Recipient” means the Company, any Parent, Subsidiary or Related Entity of the Company to which a Participant

provides services as an Employee, Consultant or as a Director.

2.34

“Share” means the ordinary share of the Company, par value US$ 0.0001 per share, and such other securities of

the Company that may be substituted for Shares pursuant to Article XI.

2.35

“Share Appreciation Right” or “SAR” means a right granted pursuant to Article VIII to receive

a payment equal to the excess of the Fair Market Value of a specified number of Shares on the date the SAR is exercised over the Fair

Market Value on the date the SAR was granted as set forth in the applicable Award Agreement.

2.36

“Share Payment” means (a) a payment in the form of Shares,

or (b) an option or other right to purchase Shares as part of any bonus, deferred

compensation or other arrangement made in lieu of all or any portion of the compensation granted pursuant to Article IX.

2.37

“Subsidiary” means any corporation or other entity of which a majority of the outstanding voting shares or voting

power is beneficially owned directly or indirectly by the Company, or an affiliated entity that the Company controls through contractual

arrangements and consolidates the financial results according to the Applicable Accounting Standards.

2.38

“Trading Date” means the closing of the first sale to the general public of the Shares pursuant to a registration

statement filed with and declared effective by the U.S. Securities and Exchange Commission under the Securities Act.

Article

III

SHARES SUBJECT TO THE PLAN

3.1

Number of Shares.

(a)

Subject to the provisions of Article XI and Section 3.1(b), the maximum aggregate number of Shares which may be issued pursuant

to all Awards (including Incentive Share Options) is 10,222,222 Shares.

(b)

To the extent that an Award terminates, expires, or lapses for any reason, any Shares subject to the Award shall again be available

for the grant of an Award pursuant to the Plan. To the extent permitted by Applicable Law, Shares issued in assumption of, or in substitution

for, any outstanding awards of any entity acquired in any form or combination by a Group Entity shall not be counted against Shares available

for grant pursuant to the Plan. Shares delivered by the Participant or withheld by the Company upon the exercise of any Award under the

Plan, in payment of the exercise price thereof or tax withholding thereon, may again be optioned, granted or awarded hereunder, subject

to the limitations of Section 3.1(a). If any Restricted Shares are forfeited by the Participant or repurchased by the Company, such Shares

may again be optioned, granted or awarded hereunder, subject to the limitations of Section 3.1(a). Notwithstanding the provisions of this

Section 3.1(b), no Shares may again be optioned, granted or awarded if such action would cause an Incentive Share Option to fail to qualify

as an incentive share option under Section 422 of the Code.

3.2

Shares Distributed. Any Shares distributed pursuant to an Award may consist, in whole or in part, of authorized and unissued

Shares, treasury Shares or Shares purchased on the open market. Additionally, in the discretion of the Committee, American Depositary

Shares in an amount equal to the number of Shares which otherwise would be distributed pursuant to an Award may be distributed in lieu

of Shares in settlement of any Award. If the number of Shares represented

by an American Depositary Share is other than on a one-to-one

basis, the limitations of Section 3.1 shall be adjusted to reflect the distribution of American Depositary Shares in lieu of Shares.

Article

IV

ELIGIBILITY AND PARTICIPATION

4.1

Eligibility. Persons eligible to participate in this Plan include Employees, Consultants, and Directors, as determined by

the Committee.

4.2

Participation. Subject to the provisions of the Plan, the Committee may, from time to time, select from among all eligible

individuals those to whom Awards shall be granted and shall determine the nature and amount of each Award. No individual shall have any

right to be granted an Award pursuant to this Plan.

4.3

Jurisdictions. In order to assure the viability of Awards granted to Participants in various jurisdictions, the Committee

may provide for such special terms as it may consider necessary or appropriate to accommodate differences in local law, tax policy, or

custom applicable in the jurisdiction in which the Participant resides or is employed. Moreover, the Committee may approve such supplements

to, or amendments, restatements, or alternative versions of, the Plan as it may consider necessary or appropriate for such purposes without

thereby affecting the terms of the Plan as in effect for any other purpose; provided, however, that no such supplements, amendments, restatements,

or alternative versions shall increase the share limitations contained in Section 3.1 of the Plan. Notwithstanding the foregoing, the

Committee may not take any actions hereunder, and no Awards shall be granted, that would violate any Applicable Laws.

Article

V

OPTIONS

5.1

General. The Committee is authorized to grant Options to Participants on the following terms and conditions:

(a)

Exercise Price. The exercise price per Share subject to an Option shall be determined by the Committee and set forth in

the Award Agreement which may be a fixed or variable price related to the Fair Market Value of the Shares. The exercise price per Share

subject to an Option may be adjusted in the absolute discretion of the Committee, the determination of which shall be final, binding and

conclusive. For the avoidance of doubt, to the extent not prohibited by Applicable Law, a re-pricing of Options mentioned in the preceding

sentence shall be effective without the approval of the Company’s shareholders or the approval of the Participants. Notwithstanding

the foregoing, the exercise price per Share subject to an Option under an Award Agreement shall not be increased without the approval

of the relevant Participants.

(b)

Time and Conditions of Exercise. The Committee shall determine the time or times at which an Option may be exercised in

whole or in part, including exercise prior to vesting; provided that the term of any Option granted under the Plan shall not exceed ten

years, except as provided in Section 10.2. The Committee shall also determine any conditions, if any, that must be satisfied before all

or part of an Option may be exercised.

(c)

Payment. The Committee shall determine the methods by which the exercise price of an Option may be paid, the form of payment,

including, without limitation (i) cash or check denominated in U.S. Dollars, (ii)

cash or check in Chinese Renminbi, (iii) cash or check denominated in any other

local currency as approved by the Committee, (iv) Shares held for such period of

time as may be required by the Committee in order to avoid adverse financial accounting consequences and having a Fair Market Value on

the date of delivery equal to the aggregate exercise price of the Option or exercised portion thereof, (v)

after the Trading Date the delivery of a notice that

the Participant has placed a market sell order with a broker with respect to Shares

then issuable upon exercise of the Option, and that the broker has been directed to pay a sufficient portion of the net proceeds of the

sale to the Company in satisfaction of the Option exercise price; provided that payment of such proceeds is then made to the Company upon

settlement of such sale, and the methods by which Shares shall be delivered or deemed to be delivered to Participants,

(vi) other property acceptable to the Committee with a Fair Market Value equal to

the exercise price, or (vii) any combination of the foregoing. Notwithstanding any

other provision of the Plan to the contrary, no Participant who is a member of the Board or an “executive officer” of the

Company within the meaning of Section 13(k) of the Exchange Act shall be permitted to pay the exercise price of an Option in any method

which would violate Section 13(k) of the Exchange Act.

(d)

Evidence of Grant. All Options shall be evidenced by an Award Agreement between the Company and the Participant. The Award

Agreement shall include such additional provisions as may be specified by the Committee.

5.2

Incentive Share Options. Incentive Share Options shall be granted only to Employees of the Company, a Parent or Subsidiary

of the Company. Incentive Share Options may not be granted to Employees of a Related Entity or to Independent Directors or Consultants.

The terms of any Incentive Share Options granted pursuant to the Plan, in addition to the requirements of Section 5.1, must comply with

the following additional provisions of this Section 5.2:

(a)

Expiration of Option. An Incentive Share Option may not be exercised to any extent by anyone after the first to occur of

the following events:

(i)

Ten years from the date it is granted, unless an earlier time is set in the Award Agreement, provided, however, that in the case

of an Incentive Share Option granted to a Participant who, at the time the Option is granted, owns Shares possessing more than ten percent

of the total combined voting power of all classes of shares of the Company or any Parent or Subsidiary of the Company, the term of the

Incentive Share Option shall be five years from the date of grant thereof or such shorter term as set forth in the Award Agreement;

(ii)

Three months after the Participant’s termination of employment as an Employee; and

(iii)

One year after the date of the Participant’s termination of employment or service on account of Disability or death. Upon

the Participant’s Disability or death, any Incentive Share Options exercisable at the Participant’s Disability or death may

be exercised by the Participant’s legal representative or representatives, by the person or persons entitled to do so pursuant to

the Participant’s last will and testament, or, if the Participant fails to make testamentary disposition of such Incentive Share

Option or dies intestate, by the person or persons entitled to receive the Incentive Share Option pursuant to the applicable laws of descent

and distribution.

(b)

Individual Dollar Limitation. The aggregate Fair Market Value (determined as of the time the Option is granted) of all Shares

with respect to which Incentive Share Options are first exercisable by a Participant in any calendar year may not exceed US$100,000 or

such other limitation as imposed by Section 422(d) of the Code, or any successor provision. To the extent that Incentive Share Options

are first exercisable by a Participant in excess of such limitation, the excess shall be considered Non-Qualified Share Options.

(c)

Exercise Price. The exercise price of an Incentive Share Option shall be equal to the Fair Market Value on the date of

grant. However, the exercise price of any Incentive Share Option granted to any individual who, at the date of grant, owns Shares possessing

more than

ten percent of the total combined voting power of all classes of shares of the Company or any Parent or Subsidiary of the Company

may not be less than 110% of Fair Market Value on the date of grant.

(e)

Transfer Restriction. The Participant shall give the Company prompt notice of any disposition of Shares acquired by exercise

of an Incentive Share Option within (i) two years from the date of grant of such Incentive

Share Option or (ii) one year after the transfer of such Shares to the Participant.

(f)

Expiration of Incentive Share Options. No Award of an Incentive Share Option may be made pursuant to this Plan after the

fifth anniversary of the Effective Date to any individual who, at the date of grant, owns Shares possessing more than ten percent of the

total combined voting power of all classes of shares of the Company or any Parent or Subsidiary of the Company.

(g)

Right to Exercise. During a Participant’s lifetime, an Incentive Share Option may be exercised only by the Participant.

5.3

Substitution of Share Appreciation Rights. The Committee may provide in the Award Agreement evidencing the grant of an Option

that the Committee, in its sole discretion, shall have the right to substitute a Share Appreciation Right for such Option at any time

prior to or upon exercise of such Option, provided that such Share Appreciation Right shall be exercisable for the same number of shares

of Share as such substituted Option would have been exercisable for.

Article

VI

RESTRICTED SHARES

6.1

Grant of Restricted Shares. The Committee is authorized to make Awards of Restricted Shares to any Participant selected

by the Committee in such number and subject to such terms and conditions as determined by the Committee. All Awards of Restricted Shares

shall be evidenced by an Award Agreement.

6.2

Issuance and Restrictions. Restricted Shares shall be subject to such restrictions on transferability and other restrictions

as the Committee may impose (including, without limitation, limitations on the right to vote Restricted Shares or the right to receive

dividends on the Restricted Share). These restrictions may lapse separately or in combination at such times, pursuant to such circumstances,

in such installments, or otherwise, as the Committee determines at the time of the grant of the Award or thereafter.

6.3

Forfeiture/Repurchase. Except as otherwise determined by the Committee at the time of the grant of the Award or thereafter,

upon termination of employment or service during the applicable restriction period, Restricted Shares that are at that time subject to

restrictions shall be forfeited or repurchased in accordance with the Award Agreement; provided, however, that the Committee may (a)

provide in any Restricted Share Award Agreement that restrictions or forfeiture and repurchase conditions relating to Restricted Shares

will be waived in whole or in part in the event of terminations resulting from specified causes, and (b)

in other cases waive in whole or in part restrictions or forfeiture and repurchase conditions relating to Restricted Shares.

6.4

Certificates for Restricted Shares. Restricted Shares granted pursuant to the Plan may be evidenced in such manner as the

Committee shall determine. If certificates representing Restricted Shares are registered in the name of the Participant, certificates

must bear an appropriate legend referring to the terms, conditions, and restrictions applicable to such Restricted Shares, and the Company

may, at its discretion, retain physical possession of the certificate until such time as all applicable restrictions lapse.

6.5

Removal of Restrictions. After the restrictions have lapsed, the Participant shall be entitled to have any legend or legends

under Section 6.4 removed from his or her Share certificate, and the Shares shall be freely transferable by the Participant, subject to

applicable legal restrictions. The Committee (in its discretion) may establish procedures

regarding the removal of legends, as necessary or appropriate to minimize administrative burdens on the Company.

Article

VII

RESTRICTED SHARE UNITS

7.1

Grant of Restricted Share Units. The Committee, at any time and from time to time, may grant

Restricted Share Units to Participants as the Committee, in its sole discretion, shall determine. The Committee, in its sole discretion,

shall determine the number of Restricted Share Units to be granted to each Participant.

7.2

Restricted Share Units Award Agreement. Each Award of Restricted Share Units shall be evidenced by an Award Agreement that

shall specify any vesting conditions, the number of Restricted Share Units granted, and such other terms and conditions as the Committee,

in its sole discretion, shall determine.

7.3

Performance Objectives and Other Terms. The Committee, in its discretion, may set performance objectives or other vesting

criteria which, depending on the extent to which they are met, will determine the number or value of Restricted Share Units that will

be paid out to the Participants.

7.4

Form and Timing of Payment of Restricted Share Units. At the time of grant, the Committee shall specify the date or dates

on which the Restricted Share Units shall become fully vested and nonforfeitable. Upon vesting, the Committee, in its sole discretion,

may pay Restricted Share Units in the form of cash, in Shares or in a combination thereof.

7.5

Forfeiture/Repurchase. Except as otherwise determined by the Committee at the time of the grant of the Award or thereafter,

upon termination of employment or service during the applicable restriction period, Restricted Share Units that are at that time unvested

shall be forfeited or repurchased in accordance with the Award Agreement; provided, however, the Committee may (a) provide in any

Restricted Share Unit Award Agreement that restrictions or forfeiture and repurchase conditions relating to Restricted Share Units will

be waived in whole or in part in the event of terminations resulting from specified causes, and (b) in other cases waive in whole or in

part restrictions or forfeiture and repurchase conditions relating to Restricted Share Units.

Article

VIII

SHARE APPRECIATION RIGHTS

8.1

Grant of Share Appreciation Rights.

(a)

A Share Appreciation Right may be granted to any Participant selected by the Committee. A Share Appreciation Right shall be subject

to such terms and conditions not inconsistent with the Plan as the Committee shall impose and shall be evidenced by an Award Agreement.

(b)

A Share Appreciation Right shall entitle the Participant (or other person entitled to exercise the Share Appreciation Right pursuant

to the Plan) to exercise all or a specified portion of the Share Appreciation Right (to the extent then exercisable pursuant to its terms)

and to receive from the Company an amount determined by multiplying the difference obtained by subtracting the exercise price per share

of the Share Appreciation Right from the Fair Market Value of a Share on the date of exercise of the Share Appreciation Right by the number

of Shares with respect

to which the Share Appreciation Right shall have been exercised, subject to any limitations the Committee may impose.

8.2

Payment and Limitations on Exercise.

(a)

Payment of the amounts determined under Section 8.1(b) above shall be in cash, in Shares (based on its Fair Market Value as of

the date the Share Appreciation Right is exercised) or a combination of both, as determined by the Committee in the Award Agreement.

(b)

To the extent payment for a Share Appreciation Right is to be made in cash the Award Agreements shall, to the extent necessary

to comply with the requirements to Section 409A of the Code, specify the date of payment which may be different than the date of exercise

of the Share Appreciation right. If the date of payment for a Share Appreciation Right is later than the date of exercise, the Award Agreement

may specify that the Participant be entitled to earnings on such amount until paid.

(c)

To the extent any payment under Section 8.1(b) is effected in Shares it shall be made subject to satisfaction of all provisions

of Article V above pertaining to Options.

Article

IX

OTHER TYPES OF AWARDS

9.1

Dividend Equivalents. Any Participant selected by the Committee may be granted Dividend Equivalents based on the dividends

declared on the Shares that are subject to any Award, to be credited as of dividend payment dates, during the period between the date

the Award is granted and the date the Award is exercised, vests or expires, as determined by the Committee. Such Dividend Equivalents

shall be converted to cash or additional Shares by such formula and at such time and subject to such limitations as may be determined

by the Committee.

9.2

Share Payments. Any Participant selected by the Committee may receive Share Payments in the manner determined from time

to time by the Committee; provided, that unless otherwise determined by the Committee such Share Payments shall be made in lieu of base

salary, bonus, or other cash compensation otherwise payable to such Participant. The number of shares shall be determined by the Committee

and may be based upon the performance criteria or other specific criteria determined appropriate by the Committee, determined on the date

such Share Payment is made or on any date thereafter.

9.3

Deferred Shares. Any Participant selected by the Committee may be granted an award of Deferred Shares in the manner determined

from time to time by the Committee. The number of shares of Deferred Shares shall be determined by the Committee and may be linked to

such specific criteria determined to be appropriate by the Committee, in each case on a specified date or dates or over any period or

periods determined by the Committee. Shares underlying a Deferred Share award will not be issued until the Deferred Share award has vested

pursuant to a vesting schedule or criteria set by the Committee. Unless otherwise provided by the Committee, a Participant awarded Deferred

Shares shall have no rights as a Company shareholder with respect to such Deferred Shares until such time as the Deferred Share Award

has vested and the Shares underlying the Deferred Share Award have been issued.

9.4

Term. Except as otherwise provided herein, the term of any Award of Dividend Equivalents, Share Payments or Deferred Shares

shall be set by the Committee in its discretion.

9.5

Exercise or Purchase Price. The Committee may establish the exercise or purchase price, if any, of any Award of Share Payments

or Deferred Shares.

9.6

Exercise Upon Termination of Employment or Service. An Award of Dividend Equivalents, Share Payments or Deferred Shares

shall only be exercisable or payable while the Participant is an Employee, Consultant or a Director, as applicable; provided, however,

that the Committee in its sole and absolute discretion may provide that an Award

of Dividend Equivalents, Share Payments or Deferred Shares may be exercised or paid subsequent to a termination of employment or service,

as applicable, or following a Change of Control of the Company, or because of the Participant’s retirement, death or Disability,

or otherwise.

9.7

Form of Payment. Payments with respect to any Awards granted under this Article IX shall be made in cash, in Shares or a

combination of both, as determined by the Committee.

9.8

Award Agreement. All Awards under this Article IX shall be subject to such additional terms and conditions as determined

by the Committee and shall be evidenced by an Award Agreement.

Article

X

PROVISIONS APPLICABLE TO AWARDS

10.1

Stand-Alone and Tandem Awards. Awards granted pursuant to the Plan may, in the discretion of the Committee, be granted either

alone, in addition to, or in tandem with, any other Award granted pursuant to the Plan. Awards granted in addition to or in tandem with

other Awards may be granted either at the same time as or at a different time from the grant of such other Awards.

10.2

Award Agreement. Awards under the Plan shall be evidenced by Award Agreements that set forth the terms, conditions and limitations

for each Award which may include the term of an Award, the provisions applicable in the event the Participant’s employment or service

terminates, and the Company’s authority to unilaterally or bilaterally amend, modify, suspend, cancel or rescind an Award.

10.3

Limits on Transfer. No right or interest of a Participant in any Award may be pledged, encumbered, or hypothecated to or

in favor of any party other than the Group Entity, or shall be subject to any lien, obligation, or liability of such Participant to any

other party other than the Group Entity. Except as otherwise provided by the Committee, no Award shall be assigned, transferred, or otherwise

disposed of by a Participant other than by will or the laws of descent and distribution. The Committee by express provision in the Award

Agreement or an amendment thereto may permit an Award (other than an Incentive Share Option) to be transferred to, exercised by and paid

to certain persons or entities related to the Participant, including but not limited to members of the Participant’s family, charitable

institutions, or trusts or other entities whose beneficiaries or beneficial owners are members of the Participant’s family and/or

charitable institutions, or to such other persons or entities as may be expressly approved by the Committee, pursuant to such conditions

and procedures as the Committee may establish. Any permitted transfer shall be on a basis consistent with the Company’s lawful issue

of securities.

10.4

Beneficiaries. Notwithstanding Section 10.3, a Participant may, in the manner determined by the Committee, designate a beneficiary

to exercise the rights of the Participant and to receive any distribution with respect to any Award upon the Participant’s death.

A beneficiary, legal guardian, legal representative, or other person claiming any rights pursuant to the Plan is subject to all terms

and conditions of the Plan and any Award Agreement applicable to the Participant, except to the extent the Plan and Award Agreement otherwise

provide, and to any additional restrictions deemed necessary or appropriate by the Committee. If the Participant is married and resides

in a community property state, a designation of a person other than the Participant’s spouse as his or her beneficiary with respect

to more than 50% of the Participant’s interest in the Award shall not be effective without the prior written consent of the Participant’s

spouse. If no beneficiary has been designated or survives the Participant, payment shall be made to the person entitled thereto pursuant

to the Participant’s will

or the laws of descent and distribution. Subject to the foregoing, a beneficiary designation may be changed

or revoked by a Participant at any time provided the change or revocation is filed with the Committee.

10.5

Share Certificates.

(a)

Notwithstanding anything herein to the contrary, the Company shall not be required to issue or deliver any certificates evidencing

the Shares pursuant to the exercise of any Award, unless and until the Committee has determined, with advice of counsel, that the issuance

and delivery of such certificates is in compliance with all Applicable Laws, regulations of governmental authorities and, if applicable,

the requirements of any exchange on which the Shares are listed or traded. All Share certificates delivered pursuant to the Plan are subject

to any stop-transfer orders and other restrictions as the Committee deems necessary or advisable to comply with federal, state, or foreign

jurisdiction, securities or other laws, rules and regulations and the rules of any national securities exchange or automated quotation

system on which the Shares are listed, quoted, or traded. The Committee may place legends on any Share certificate to reference restrictions

applicable to the Shares. In addition to the terms and conditions provided herein, the Committee may require that a Participant make such

reasonable covenants, agreements, and representations as the Committee, in its discretion, deems advisable in order to comply with any

such laws, regulations, or requirements. The Committee shall have the right to require any Participant to comply with any timing or other

restrictions with respect to the settlement or exercise of any Award, including a window-period limitation, as may be imposed in the discretion

of the Committee.

(b)

Notwithstanding any other provision of the Plan, unless otherwise determined by the Committee or required by Applicable Laws, the

Company shall not deliver to any Participant certificates evidencing Shares issued in connection with any Award and instead such Shares

shall be recorded on the books of the Company or, as applicable, its transfer agent or share plan administrator.

10.6

Paperless Administration. Subject to Applicable Laws, the Committee may make Awards, provide applicable disclosure and procedures

for exercise of Awards by an internet website or interactive voice response system for the paperless administration of Awards.

10.7

Foreign Currency. A Participant may be required to provide evidence that any currency used to pay the exercise price of

any Award was acquired and taken out of the jurisdiction in which the Participant resides in accordance with Applicable Laws, including

foreign exchange control laws and regulations. In the event the exercise price for an Award is paid in Chinese Renminbi or other foreign

currency, as permitted by the Committee, the amount payable will be determined by conversion from U.S. dollars at the official rate promulgated

by the People’s Bank of China for Chinese Renminbi, or for jurisdictions other than the PRC, the exchange rate as selected by the

Committee on the date of exercise.

Article

XI

CHANGES IN CAPITAL STRUCTURE

11.1

Adjustments. In the event of any dividend, share split, combination or exchange of Shares, amalgamation, arrangement or

consolidation, spin-off, recapitalization or other distribution (other than normal cash dividends) of Company assets to its shareholders,

or any other change affecting the shares of Shares or the share price of a Share, the Committee shall make such proportionate adjustments,

if any, as necessary to reflect such change with respect to (a) the aggregate number and type of shares that may be issued under the

Plan (including, but not limited to, adjustments of the limitations in Section 3.1); (b) the terms and conditions of any outstanding

Awards (including, without limitation, any applicable performance targets or criteria with respect thereto); and (c) the grant or exercise

price per share for any outstanding Awards under the Plan.

11.2 Change

of Control. Upon a Change of Control, any Award previously granted pursuant to the Plan shall vest immediately unless the

Committee determines otherwise. Except as may otherwise be provided in any Award Agreement or any other written agreement entered

into by and between the Company and a Participant, upon, or in anticipation of, a Change of Control, the Committee may in its sole

discretion provide for (i) any and all Awards outstanding hereunder to terminate at a specific time in the future and shall give

each Participant the right to exercise such Awards during a period of time as the Committee shall determine, (ii) either the

purchase of any Award for an amount of cash equal to the amount that could have been attained upon the exercise of such Award or

realization of the Participant’s rights had such Award been currently exercisable or payable or fully vested (and, for the

avoidance of doubt, if as of such date the Committee determines in good faith that no amount would have been attained upon the

exercise of such Award or realization of the Participant’s rights, then such Award may be terminated by the Company without

payment), (iii) the replacement of such Award with other rights or property selected by the Committee in its sole discretion the

assumption of or substitution of such Award by the successor or surviving corporation, or a parent or subsidiary thereof, with

appropriate adjustments as to the number and kind of Shares and prices, or (iv) payment of Awards in cash based on the value of

Shares on the date of the Change of Control plus reasonable interest on the Award through the date such Award would otherwise be

vested or have been paid in accordance with its original terms, if necessary to comply with Section 409A of the Code.

11.3

Outstanding Awards — Corporate Transactions. Except as may otherwise be provided in any Award Agreement or any other

written agreement entered into by and between the Company and a Participant, if the Committee anticipates the occurrence, or upon the

occurrence, of a Corporate Transaction, the Committee may, in its sole discretion, provide for (i) any and all Awards outstanding hereunder

to terminate at a specific time in the future and shall give each Participant the right to exercise the vested portion of such Awards

during a period of time as the Committee shall determine, or (ii) the purchase of any Award for an amount of cash equal to the amount

that could have been attained upon the exercise of such Award (and, for the avoidance of doubt, if as of such date the Committee determines

in good faith that no amount would have been attained upon the exercise of such Award, then such Award may be terminated by the Company

without payment), or (iii) the replacement of such Award with other rights or property selected by the Committee in its sole discretion

or the assumption of or substitution of such Award by the successor or surviving corporation, or a Parent or Subsidiary thereof, with

appropriate adjustments as to the number and kind of Shares and prices, or (iv) payment of such Award in cash based on the value of Shares

on the date of the Corporate Transaction plus reasonable interest on the Award through the date as determined by the Committee when such

Award would otherwise be vested or have been paid in accordance with its original terms, if necessary to comply with Section 409A of the

Code.

11.4

Outstanding Awards — Other Changes. In the event of any other change in the capitalization of the Company or corporate

change other than those specifically referred to in this Article XI, the Committee may, in its absolute discretion, make such adjustments

in the number and class of shares subject to Awards outstanding on the date on which such change occurs and in the per share grant or

exercise price of each Award as the Committee may consider appropriate to prevent dilution or enlargement of rights.

11.5

No Other Rights. Except as expressly provided in the Plan, no Participant shall have any rights by reason of any subdivision

or consolidation of Shares of any class, the payment of any dividend, any increase or decrease in the number of shares of any class or

any dissolution, liquidation, merger, or consolidation of the Company or any other corporation. Except as expressly provided in the Plan

or pursuant to action of the Committee under the Plan, no issuance by the Company of shares of any class, or securities convertible into

shares of any class, shall affect, and no adjustment by reason thereof shall be made with respect to, the number of shares subject to

an Award or the grant or exercise price of any Award.

Article

XII

ADMINISTRATION

12.1

Committee. The Plan shall be administered by the Board or a committee of one or more members of the Board (such committee

being the “Committee”) to whom the Board shall delegate the authority to grant or amend Awards to Participants other than

any of the Committee members, Independent Directors and executive officers of the Company. Reference to the Committee shall refer to the

Board in absence of the Committee. Notwithstanding the foregoing, the full Board, acting by majority of its members in office, shall conduct

the general administration of the Plan if required by Applicable Law, and with respect to Awards granted to the Committee members, Independent

Directors and executive officers of the Company and for purposes of such Awards the term “Committee” as used in the Plan shall

be deemed to refer to the Board.

12.2

Action by the Committee. A majority of the Committee shall constitute a quorum. The acts of a majority of the members present

at any meeting at which a quorum is present, and acts approved in writing by a majority of the Committee in lieu of a meeting, shall be

deemed the acts of the Committee. Each member of the Committee is entitled to, in good faith, rely or act upon any report or other information

furnished to that member by any officer or other employee of a Group Entity, the Company’s independent certified public accountants,

or any executive compensation consultant or other professional retained by the Company to assist in the administration of the Plan.

12.3

Authority of the Committee. Subject to any specific designation in the Plan, the Committee has the exclusive power, authority

and discretion to:

(a)

Designate Participants to receive Awards;

(b)

Determine the type or types of Awards to be granted to each Participant;

(c)

Determine the number of Awards to be granted and the number of Shares to which an Award will relate;

(d)

Determine the terms and conditions of any Award granted pursuant to the Plan, including, but not limited to, the exercise price,

grant price, or purchase price, any restrictions or limitations on the Award, any schedule for lapse of forfeiture restrictions or restrictions

on the exercisability of an Award, and accelerations or waivers thereof, any provisions related to non-competition and recapture of gain

on an Award, based in each case on such considerations as the Committee in its sole discretion determines;

(e)

Determine whether, to what extent, and pursuant to what circumstances an Award may be settled in, or the exercise price of an Award

may be paid in, cash, Shares, other Awards, or other property, or an Award may be canceled, forfeited, or surrendered;

(f)

Prescribe the form of each Award Agreement, which need not be identical for each Participant;

(g)

Decide all other matters that must be determined in connection with an Award;

(h)

Subject to Article XIV, establish, adopt, or revise any rules and regulations as it may deem necessary or advisable to administer

the Plan;

(i)

Interpret the terms of, and any matter arising pursuant to, the Plan or any Award Agreement;

(j)

Reduce the exercise price per Share subject to an Option; and

(k)

Make all other decisions and determinations that may be required pursuant to the Plan or as the Committee deems necessary or advisable

to administer the Plan, including design and adopt from time to time new types of Awards that are in compliance with Applicable Laws.

12.4

Decisions Binding. The Committee’s interpretation of the Plan, any Awards granted pursuant to the Plan, any Award

Agreement and all decisions and determinations by the Committee with respect to the Plan are final, binding, and conclusive on all parties.

Article

XIII

EFFECTIVE AND EXPIRATION DATE

13.1

Effective Date. This Plan shall become effective as of the date on which the Plan is approved by the shareholders of the

Company according to its Memorandum of Association and Articles of Association (the “Effective Date”).

13.2

Expiration Date. The Plan will expire on, and no Award may be granted pursuant to the Plan after, the twentieth anniversary

of the Effective Date. Any Awards that are outstanding on the twentieth anniversary of the Effective Date shall remain in force according

to the terms of the Plan and the applicable Award Agreement.

Article

XIV

AMENDMENT, MODIFICATION, AND TERMINATION

14.1

Amendment, Modification, And Termination. With the approval of the Board, at any time and from time to time, the Committee

may terminate, amend or modify the Plan; provided, however, that to the extent necessary and desirable to comply with any Applicable Law,

regulation, or stock exchange rule, unless the Company decides to follow home country practice not to seek the shareholder approval for

any amendment or modification of the Plan, the Company shall obtain shareholder approval of any Plan amendment in such a manner and to

such a degree as required, including any amendment to the Plan that (i) increases the number of Shares available under the Plan (other

than any adjustment as provided by Article XI), (ii) permits the Committee to extend the exercise period for an Option beyond ten years

from the date of grant, or (iii) results in a change in eligibility requirements.

14.2

Awards Previously Granted. Except with respect to amendments made pursuant to Section 14.1, no termination, amendment, or

modification of the Plan shall adversely affect in any material way any Award previously granted pursuant to the Plan without the prior

written consent of the Participant.

Article

XV

GENERAL PROVISIONS

15.1

No Rights to Awards. No Participant, employee, or other person shall have any claim to be granted any Award pursuant to

the Plan, and neither the Company nor the Committee is obligated to treat Participants, employees, and other persons uniformly.

15.2

No Shareholders Rights. No Award gives the Participant any of the rights of a shareholder of the Company unless and until

Shares are in fact issued to such person in connection with such Award.

15.3

Taxes. No Shares shall be delivered under the Plan to any Participant until such Participant has made arrangements acceptable

to the Committee for the satisfaction of any income and employment tax withholding obligations under Applicable Laws, including without

limitation the PRC tax laws, rules, regulations and government orders or the U.S. Federal, state or local tax laws, as applicable. The

relevant Group Entity shall have the authority and the right to deduct or withhold, or require a Participant to remit to the Company,

an amount sufficient to satisfy federal, state, local and foreign taxes (including the Participant’s payroll tax obligations) required

by law to be withheld with respect to any taxable event concerning a Participant arising as a result of this Plan. The Committee may in

its discretion and in satisfaction of the foregoing requirement allow a Participant to elect to have the Company withhold Shares otherwise

issuable under an Award (or allow the return of Shares) having a Fair Market Value equal to the sums required to be withheld. Notwithstanding

any other provision of the Plan, the number of Shares which may be withheld with respect to the issuance, vesting, exercise or payment

of any Award (or which may be repurchased from the Participant of such Award after such Shares were acquired by the Participant from the

Company) in order to satisfy the Participant’s federal, state, local and foreign income and payroll tax liabilities with respect

to the issuance, vesting, exercise or payment of the Award shall, unless specifically approved by the Committee, be limited to the number

of Shares which have a Fair Market Value on the date of withholding or repurchase equal to the aggregate amount of such liabilities based

on the minimum statutory withholding rates for federal, state, local and foreign income tax and payroll tax purposes that are applicable

to such supplemental taxable income.

15.4

No Right to Employment or Services. Nothing in the Plan or any Award Agreement shall interfere with or limit in any way

the right of the Service Recipient to terminate any Participant’s employment or services at any time, nor confer upon any Participant

any right to continue in the employ or service of any Service Recipient.

15.5

Unfunded Status of Awards. The Plan is intended to be an “unfunded” plan for incentive compensation. With respect

to any payments not yet made to a Participant pursuant to an Award, nothing contained in the Plan or any Award Agreement shall give the

Participant any rights that are greater than those of a general creditor of the relevant Group Entity.

15.6

Indemnification. To the extent allowable pursuant to Applicable Law, each member of the Committee or of the Board shall

be indemnified and held harmless by the Company from any loss, cost, liability, or expense that may be imposed upon or reasonably incurred

by such member in connection with or resulting from any claim, action, suit, or proceeding to which he or she may be a party or in which

he or she may be involved by reason of any action or failure to act pursuant to the Plan and against and from any and all amounts paid

by him or her in satisfaction of judgment in such action, suit, or proceeding against him or her; provided he or she gives the Company

an opportunity, at its own expense, to handle and defend the same before he or she undertakes to handle and defend it on his or her own

behalf. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which such persons may

be entitled pursuant to Section 15.15. of the Plan, the Company’s Memorandum of Association and Articles of Association, as a matter

of law, or otherwise, or any power that the Company may have to indemnify them or hold them harmless.

15.7

Relationship to other Benefits. No payment pursuant to the Plan shall be taken into account in determining any benefits

pursuant to any pension, retirement, savings, profit sharing, group insurance, welfare or other benefit plan of any Group Entity except

to the extent otherwise expressly provided in writing in such other plan or an agreement thereunder.

15.8

Expenses. The expenses of administering the Plan shall be borne by the Group Entities.

15.9

Titles and Headings. The titles and headings of the Sections in the Plan are for convenience of reference only and, in

the event of any conflict, the text of the Plan, rather than such titles or headings, shall control.

15.10

Fractional Shares. If an exercise of any Award shall result in the creation of a fractional Share under the Award, the Committee

may determine, in its discretion, whether (i) such fractional Share shall be issued, or (ii) cash (in the amount equal to the product

of such fraction multiplied by the Fair Market Value of a Share on the date the fractional Share otherwise would have been issued) shall

be given in lieu of such fractional Share, or (iii) such fractional Share shall be eliminated by rounding up or down as appropriate.

15.11

Government and Other Regulations. The obligation of the Company to make payment of awards in Share or otherwise shall be

subject to all Applicable Laws, rules, and regulations, and to such approvals by government agencies as may be required. The Company shall

be under no obligation to register any of the Shares paid pursuant to the Plan under the Securities Act or any other similar law in any

applicable jurisdiction. If the Shares paid pursuant to the Plan may in certain circumstances be exempt from registration pursuant to

the Securities Act or other Applicable Laws, the Company may restrict the transfer of such Shares in such manner as it deems advisable

to ensure the availability of any such exemption.

15.12

Governing Law. The Plan and all Award Agreements shall be construed in accordance with and governed by the laws of the Cayman

Islands.

15.13

Section 409A. To the extent that the Committee determines that any Award granted under the Plan is or may become subject

to Section 409A of the Code, the Award Agreement evidencing such Award shall incorporate the terms and conditions required by Section

409A of the Code. To the extent applicable, the Plan and the Award Agreements shall be interpreted in accordance with Section 409A of

the Code and the U.S. Department of Treasury regulations and other interpretative guidance issued thereunder, including without limitation

any such regulation or other guidance that may be issued after the Effective Date. Notwithstanding any provision of the Plan to the contrary,

in the event that following the Effective Date the Committee determines that any Award may be subject to Section 409A of the Code and

related Department of Treasury guidance (including such Department of Treasury guidance as may be issued after the Effective Date), the

Committee may adopt such amendments to the Plan and the applicable Award agreement or adopt other policies and procedures (including amendments,

policies and procedures with retroactive effect), or take any other actions, that the Committee determines are necessary or appropriate

to (a) exempt the Award from Section 409A of the Code and/or preserve the intended

tax treatment of the benefits provided with respect to the Award, or (b) comply with

the requirements of Section 409A of the Code and related U.S. Department of Treasury guidance.

15.14

Appendices. With the approval of the Board, the Committee may approve such supplements, amendments or appendices to the

Plan as it may consider necessary or appropriate for purposes of compliance with Applicable Laws or otherwise and such supplements, amendments

or appendices shall be considered a part of the Plan; provided, however, that no such supplements shall increase the share limitations

contained in Section 3.1 of the Plan.

15.15

Disclaimer with Respect to PRC Residents. Each Participant who is a resident of the PRC under applicable PRC laws and regulations

(a “PRC Resident”) may be required to (a) file or register with, individually or collectively, as the case may be,

the State Administration of Foreign Exchange of the PRC (“SAFE”) and any other governmental authorities having jurisdiction

over the PRC Resident before the PRC Resident can lawfully own any Shares, and (ii) secure approval from SAFE according to the applicable

rules and regulations then in effect before the PRC Resident can purchase foreign exchange with Renminbi, unless the PRC Resident otherwise

legally owns foreign exchange for the exercise or settlement of the PRC Resident’s Awards, and such filing or approval is not always

attainable, and if the PRC Resident fails to secure filing with or approval

from the PRC authorities, the PRC Resident may have difficulties either

to remit foreign exchange to the Company to exercise or settle the PRC Resident’s Awards or to receive proceeds and/or to convert

the proceeds into Renminbi when the PRC Resident sells Shares issued pursuant to the Award. Failure to comply with these rules may also

result in sanctions under the PRC foreign exchange regulations. It is the PRC Resident’s duty to ensure full compliance with these

PRC regulations at the PRC Resident’s own expense, and the Company assumes no responsibility to seek proper filing or approval on

the PRC Resident’s behalf prior to the initial public offering of the Company. The PRC Resident may have the foreign exchange related

issues handled by a domestic agency selected by a PRC Subsidiary, if applicable. However, the PRC Resident shall undertake all the agency

fees thereof. The PRC Resident shall indemnify the Company and any of its Related Entities in the event that any such PRC Resident is

penalized by SAFE as a result of such PRC Resident’s failure to comply with any applicable rules and regulations then in effect.

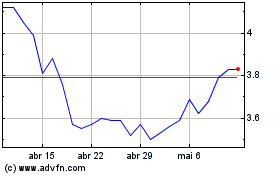

Youdao (NYSE:DAO)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Youdao (NYSE:DAO)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025