UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

November, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 9th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras announces teaser for transfer

of minority stake in the Tartaruga Field in the Sergipe-Alagoas Basin

—

Rio de Janeiro, November 27,

2024 – Petróleo Brasileiro S.A. - Petrobras informs that it has started the teaser stage for the transfer of its 25%

minority stake in the Tartaruga Field, located in the town of Pirambu-SE, in shallow waters of the Sergipe-Alagoas Basin, operated by

SPE Tiêta (Petrorecôncavo).

The teaser, which

contains the main information about the opportunity and the eligibility criteria for selecting potential participants, is available on

the Petrobras website: https://www.investidorpetrobras.com.br/en/results-and-announcements/teasers .

Petrobras' share of production

from the Tartaruga Field, considering the average for the first nine months of 2024, was approximately 41 bpd of oil and 723 m³/day

of associated gas. The total production of the field is less than 1% of the total production of the state of Sergipe. The decision to

divest takes into account the fact that it is a non-operated asset with no synergies with the company's portfolio.

The possible transfer of Petrobras'

stake in the field will not affect the company's other activities in the region. As set out in the 2025-2029 Business Plan, Petrobras

will maintain important investments in the state of Sergipe, with the contracting of two FPSOs for the Sergipe Deepwater area (SEAP) with

a production capacity of up to 120,000 barrels per day each and the construction of a gas pipeline with a capacity of 18 million m3/day.

As this is a field not operated

by Petrobras, there are no company employees working exclusively on the asset. Therefore, the transfer of Petrobras' stake in the Tartaruga

Field will have no impact on its own or outsourced workforce.

This disclosure is in accordance

with Petrobras' internal rules and with the provisions of the special procedure for the assignment of rights to explore, develop and produce

oil, natural gas and other fluid hydrocarbons, provided for in Decree 9.355/2018.

The main subsequent stages of

the project will be informed to the market in due course.

About the Tartaruga Field

The Tartaruga field is located

on the north coast of the state of Sergipe, in the municipality of Pirambu, in shallow waters of the Sergipe-Alagoas Basin. The wells

were drilled directionally, from the base located in the onshore portion of the field. Petrobras holds a 25% stake in the asset and SPE

TIETA (a company controlled by Petrorecôncavo) is the operator, with a 75% stake.

This material is being provided

pursuant to Brazilian regulatory requirements, does not constitute an offering, under the U.S. securities laws, and is not a solicitation,

invitation or offer to buy or sell any securities. The information on our website is not and shall not be deemed part of this report on

Form 6-K.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

Email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9th floor –

20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 27, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Fernando Sabbi Melgarejo

______________________________

Fernando Sabbi Melgarejo

Chief Financial Officer and Investor Relations

Officer

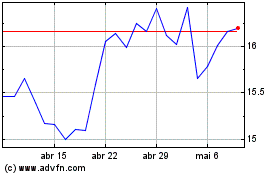

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024