false

0000021344

0000021344

2024-12-11

2024-12-11

0000021344

ko:CommonStock0.25ParValueMember

2024-12-11

2024-12-11

0000021344

ko:Sec1.875NotesDue2026Member

2024-12-11

2024-12-11

0000021344

ko:Sec0.750NotesDue2026Member

2024-12-11

2024-12-11

0000021344

ko:Sec1.125NotesDue2027Member

2024-12-11

2024-12-11

0000021344

ko:Sec0.125NotesDue2029Member

2024-12-11

2024-12-11

0000021344

ko:Sec0.125NotesDue20291Member

2024-12-11

2024-12-11

0000021344

ko:Sec0.400NotesDue2030Member

2024-12-11

2024-12-11

0000021344

ko:Sec1.250NotesDue2031Member

2024-12-11

2024-12-11

0000021344

ko:Sec3.125NotesDue2032Member

2024-12-11

2024-12-11

0000021344

ko:Sec0.375NotesDue2033Member

2024-12-11

2024-12-11

0000021344

ko:Sec0.500NotesDue2033Member

2024-12-11

2024-12-11

0000021344

ko:Sec1.625NotesDue2035Member

2024-12-11

2024-12-11

0000021344

ko:Sec1.100NotesDue2036Member

2024-12-11

2024-12-11

0000021344

ko:Sec0.950NotesDue2036Member

2024-12-11

2024-12-11

0000021344

ko:Sec3.375NotesDue2037Member

2024-12-11

2024-12-11

0000021344

ko:Sec0.800NotesDue2040Member

2024-12-11

2024-12-11

0000021344

ko:Sec1.000NotesDue2041Member

2024-12-11

2024-12-11

0000021344

ko:Sec3.500NotesDue2044Member

2024-12-11

2024-12-11

0000021344

ko:Sec3.750NotesDue2053Member

2024-12-11

2024-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported)

December

11, 2024

COCA COLA CO

(Exact name of

Registrant as specified in its charter)

| Delaware |

001-02217 |

58-0628465 |

| (State

or other jurisdiction of incorporation) |

(Commission

File Number) |

(I.R.S.

Employer Identification No.) |

| |

|

|

| One

Coca-Cola Plaza |

|

|

| Atlanta, |

Georgia |

|

30313 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| |

|

|

|

Registrant’s

telephone number, including area code: (404) 676-2121

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following

provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, $0.25 Par Value |

KO |

New

York Stock Exchange |

| 1.875%

Notes Due 2026 |

KO26 |

New

York Stock Exchange |

| 0.750%

Notes Due 2026 |

KO26C |

New

York Stock Exchange |

| 1.125%

Notes Due 2027 |

KO27 |

New

York Stock Exchange |

| 0.125%

Notes Due 2029 |

KO29A |

New

York Stock Exchange |

| 0.125%

Notes Due 2029 |

KO29B |

New

York Stock Exchange |

| 0.400%

Notes Due 2030 |

KO30B |

New

York Stock Exchange |

| 1.250%

Notes Due 2031 |

KO31 |

New

York Stock Exchange |

| 3.125% Notes Due 2032 |

KO32 |

New York Stock Exchange |

| 0.375%

Notes Due 2033 |

KO33 |

New

York Stock Exchange |

| 0.500%

Notes Due 2033 |

KO33A |

New

York Stock Exchange |

| 1.625%

Notes Due 2035 |

KO35 |

New

York Stock Exchange |

| 1.100%

Notes Due 2036 |

KO36 |

New

York Stock Exchange |

| 0.950%

Notes Due 2036 |

KO36A |

New

York Stock Exchange |

| 3.375% Notes Due 2037 |

KO37 |

New York Stock Exchange |

| 0.800%

Notes Due 2040 |

KO40B |

New

York Stock Exchange |

| 1.000%

Notes Due 2041 |

KO41 |

New

York Stock Exchange |

| 3.500% Notes Due 2044 |

KO44 |

New York Stock Exchange |

| 3.750% Notes Due 2053 |

KO53 |

New York Stock Exchange |

Indicate by check

mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth

company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

The Coca-Cola Company (the “Company”)

announced that, effective January 1, 2025, Henrique Braun, age 56, has been named Executive Vice President and Chief Operating Officer of

the Company. In this expanded role, Mr. Braun will be responsible for all the Company’s operating units worldwide. Mr. Braun joined

the Company in 1996 and progressed through roles of increasing responsibilities in North America, Europe, Asia and Latin America. Those

positions included supply chain, new business development, marketing, innovation, general management and bottling operations. He has served

in regional, business unit and corporate functions. Mr. Braun served as the President of the Greater China and Korea business unit from

April 2013 to August 2016, the President of the Brazil business unit from September 2016 to September 2020, and the President of the Latin

America operating unit from October 2020 to December 2022. Mr. Braun was named President, International Development, with oversight of

seven of the Company’s operating units in January 2023 and was appointed Executive Vice President in January 2024. He will continue

to serve as Executive Vice President and President, International Development until his appointment to Executive Vice President and Chief

Operating Officer.

On December 11, 2024, the Company provided a letter

to Mr. Braun to confirm his new position and primary compensation elements that will be effective commencing January 1, 2025. Pursuant

to Mr. Braun’s letter, his base salary will be $1,050,000 effective as of January 1, 2025. Mr. Braun will continue to be eligible

to participate in the Company’s Annual Incentive Plan and Long-Term Incentive program, and the Talent and Compensation Committee

of the Board of Directors (the “Compensation Committee”) set Mr. Braun’s target annual incentive at 175% of his annual

base salary. Mr. Braun will continue to be subject to the Company’s share ownership guidelines, and he will receive certain additional

benefits described therein. Details regarding base salary determinations, the Annual Incentive Plan and the Long-Term Incentive program

are included in the Compensation Discussion and Analysis section of the Company’s definitive proxy statement for the 2024 Annual

Meeting of Shareowners filed with the Securities and Exchange Commission on March 18, 2024. The foregoing description is qualified in

its entirety by reference to the letter to Mr. Braun, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

A copy of the Company’s press release announcing

the appointment of Mr. Braun is furnished with this report as Exhibit 99.1.

| Item

9.01. | Financial

Statements and Exhibits. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

|

|

| |

THE

COCA-COLA COMPANY |

| |

(REGISTRANT) |

| |

|

| Date:

December 11, 2024 |

By: |

/s/

Monica Howard Douglas |

| |

|

Monica

Howard Douglas |

| |

|

Executive Vice President and Global General Counsel |

Exhibit 10.1

December 11, 2024

Henrique Braun

Dear Henrique,

I am delighted to confirm your new position as EVP

and Chief Operating Officer, with an effective date of January 1, 2025, as elected by The Coca-Cola Company Board of Directors. You will

report to me. The information contained in this letter provides details of your new position.

| · | Your principal place of employment

will be Atlanta, Georgia. |

| · | Your annual base pay for your

new position will be USD 1,050,000. Your next base salary review will be in April 2026. |

| · | You will continue to be eligible

to participate in the Annual Incentive Plan. Your target annual incentive for your position is 175% of your annual base pay. Any payment

will depend on both the business performance and your personal contributions. Awards are made at the discretion of the Talent and Compensation

Committee of the Board of Directors based upon recommendations by Senior Management. As a discretionary program, the performance factors,

eligibility criteria, payment frequency, award opportunity levels and other provisions are variable. The plan may be modified from time

to time. |

| · | You will continue to be eligible

to participate in The Coca-Cola Company’s Long-Term Incentive (LTI) program. Awards are made at the discretion of the Talent and

Compensation Committee of the Board of Directors based upon recommendations by Senior Management. You will be eligible to receive LTI

awards within guidelines for the level assigned to your position and based upon your leadership potential to impact the company’s

future growth. As a discretionary program, eligibility criteria, award opportunity levels, the award timing, frequency, size and mix of

award vehicles are variable. |

| · | You will be expected to acquire

and maintain share ownership at a level equal to five times your base salary. Because this represents an increase from your prior target

level, you will have an additional two years, or until December 31, 2026, to meet your requirement. You will be asked to provide information

in December each year on your progress toward your ownership goal, and that information will be reviewed with the Talent and Compensation

Committee of the Board of Directors the following February. |

| · | You will be able to utilize the

Company owned aircraft for business use. You, and your immediate family traveling with you, may also utilize the Company owned aircraft

for reasonable personal use. Any such personal use must be pre-approved by the Chief Executive Officer. Any personal use of the

aircraft by you and your immediate family members will result in imputed taxable income. There will be no tax gross-ups for you or your

immediate family regarding personal aircraft use. |

| · | You are required to enter into

the Agreement on Confidentiality, Non-Competition, and Non-Solicitation, as well as the Agreement Covering Inventions, Discoveries, Copyrightable

Material, Trade Secrets, and Confidential Information that will be provided to you soon. |

| · | This letter

is provided as information and does not constitute an employment contract. |

Henrique, I feel certain that you will continue to

find challenge, satisfaction, and opportunity in this role and as we continue our journey during this important time.

Sincerely,

/s/ James Quincey

James Quincey

Chairman and CEO

I, Henrique Braun, accept this offer

Signature: /s/ Henrique Braun

Date: December 11, 2024

Exhibit 99.1

|

News Release |

The Coca-Cola Company Names Henrique Braun

Executive Vice President and Chief Operating Officer

ATLANTA, Dec. 11, 2024 – The Coca-Cola Company today announced

Henrique Braun has been named Executive Vice President and Chief Operating Officer, effective Jan. 1, 2025. In this expanded role, Braun

will be responsible for all of the company’s operating units worldwide. He will report to Chairman and CEO James Quincey.

Braun currently serves as EVP and President, International Development,

overseeing the company’s operating units for Latin America; Japan & South Korea; ASEAN & South Pacific; Greater China

and Mongolia; Africa; India & Southwest Asia; and Eurasia and Middle East.

As COO, Braun will add oversight of the North America and Europe operating

units.

“Henrique has built an impressive track record of driving our growth

strategy along with numerous operational accomplishments, all while keeping the consumer as the center of decisions,” Quincey said.

“He has proven to be a trusted, strategic leader with a reputation for developing talent and delivering results.”

Prior to his current role, Braun served as President of the Latin America

operating unit from 2020 to 2022 and as President of the Brazil business unit from 2016 to 2020. From 2013 to 2016, he was President of

the company’s Greater China & Korea business unit.

Braun, 56, joined The Coca-Cola Company in 1996 in Atlanta and progressed

through roles of increasing responsibilities in North America, Europe, Asia and Latin America. Those positions included supply chain,

new business development, marketing, innovation, general management and bottling operations. Braun has served in regional, business unit

and corporate functions.

“I am energized and honored to take on this broader role and look

forward to partnering with James, our executive leadership team, bottling partners and associates to deliver on our total beverage strategy

and drive growth across the company and our system worldwide,” Braun said.

The following leaders will report to Braun:

| o | Selman Careaga, president, ASEAN & South Pacific operating

unit; |

| o | Nikos Koumettis, president, Europe operating unit; |

| o | Gilles Leclerc, president, Greater China and Mongolia operating

unit; |

| o | Jennifer Mann, EVP and president, North America operating

unit; |

| o | Luisa Ortega, president, Africa operating unit; |

| o | Murat Ozgel, president, Japan & South Korea operating

unit; |

| o | Bruno Pietracci, president, Latin America operating unit;

|

| o | Sanket Ray, president, India & Southwest Asia operating

unit; |

| o | Sedef Salingan Sahin, president, Eurasia and Middle East

operating unit. |

Braun holds a bachelor’s degree in agricultural engineering from the

University Federal of Rio de Janeiro, a master’s of science degree from Michigan State University and an MBA from Georgia State

University.

About The Coca-Cola Company

The Coca-Cola Company (NYSE: KO) is a total beverage company with products

sold in more than 200 countries and territories. Our company’s purpose is to refresh the world and make a difference. We sell

multiple billion-dollar brands across several beverage categories worldwide. Our portfolio of sparkling soft drink brands includes

Coca-Cola, Sprite and Fanta. Our water, sports, coffee and tea brands include Dasani, smartwater, vitaminwater, Topo Chico, BODYARMOR,

Powerade, Costa, Georgia, Gold Peak and Ayataka. Our juice, value-added dairy and plant-based beverage brands include Minute Maid, Simply,

innocent, Del Valle, fairlife and AdeS. We’re constantly transforming our portfolio, from reducing sugar in our drinks to bringing

innovative new products to market. We seek to positively impact people’s lives, communities and the planet through water replenishment,

packaging recycling, sustainable sourcing practices and carbon emissions reductions across our value chain. Together with our bottling

partners, we employ more than 700,000 people, helping bring economic opportunity to local communities worldwide. Learn more at www.coca-colacompany.com

and follow us on Instagram, Facebook and LinkedIn.

Contacts:

Investors and Analysts: Robin Halpern, koinvestorrelations@coca-cola.com

Media: Scott Leith, sleith@coca-cola.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_CommonStock0.25ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec1.875NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec0.750NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec1.125NotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec0.125NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec0.125NotesDue20291Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec0.400NotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec1.250NotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec3.125NotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec0.375NotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec0.500NotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec1.625NotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec1.100NotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec0.950NotesDue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec3.375NotesDue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec0.800NotesDue2040Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec1.000NotesDue2041Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec3.500NotesDue2044Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ko_Sec3.750NotesDue2053Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

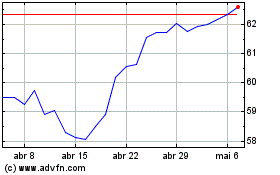

Coca Cola (NYSE:KO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Coca Cola (NYSE:KO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025