Form 8-K - Current report

20 Dezembro 2024 - 6:29PM

Edgar (US Regulatory)

0001664703FALSEDecember 16, 2024December 20, 202400016647032024-12-162024-12-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 16, 2024

___________________________________________

BLOOM ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

001-38598

(Commission File Number)

___________________________________________

| | | | | | | | | | | |

| Delaware | 77-0565408 |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

| | |

| 4353 North First Street, | San Jose, | California | 95134 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| (408) | 543-1500 |

| (Registrant’s telephone number, including area code) |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | | BE | | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective December 18, 2024, the Board of Directors (the “Board”) of Bloom Energy Corporation (the “Company”) approved, based on the recommendation of the Compensation and Organizational Development Committee (the “Compensation Committee”), the cancellation of 1,150,000 performance-based stock units from the equity package Dr. Sridhar received on May 12, 2021 (the “2021 PSUs”) under the Company’s 2018 Equity Incentive Plan. The 2021 PSUs were intended to replace all annual equity awards Dr. Sridhar would otherwise have received over a five-year period through 2026. The canceled awards include 1,000,000 PSUs for which vesting was based on stock price performance through 2030 and continued service (the “Stock Price Hurdle Award”) and 150,000 PSUs for which vesting was based on financial performance for the year 2025 and continued service (the “Revenue/Gross Margin Award”).

With consultation from the Company’s compensation consultant, Meridian Compensation Partners, the Compensation Committee recommended and the Board approved, the cancellation of the awards based on the belief that the 2021 PSUs no longer have retentive value and in light of the fact that the Company’s strategic priorities and growth opportunities are different than 2021. The Company believes it is appropriate to better align Dr. Sridhar’s incentives over a shorter time span and with the Company’s updated strategic goals.

As a result, the Compensation Committee recommended, the Board approved and Dr. Sridhar has consented to, the cancellation of the 2021 PSUs, and in exchange, the Compensation Committee recommended and the Board approved effective December 18, 2024, a new front-loaded three-year equity award to Dr. Sridhar (the “2025 Equity Package”) consisting of: (i) 1,500,000 PSUs and (ii) 500,000 RSUs. The performance criteria under the 2025 Equity Package PSUs is equally weighted between product revenue growth and adjusted product gross margin, which the Board has concluded better aligns with the Company’s strategic priority to secure large megawatt product sales that deliver time to market power for AI data center, industrial and utility customers. Dr. Sridhar is eligible to receive up to 300% of the target PSUs under the 2025 Equity Package. In addition to aligning Dr. Sridhar’s incentives with the Company’s strategic objectives, the 2025 Equity Package is intended to provide a meaningful retention incentive for Dr. Sridhar over the next several years. The 2025 Equity Package PSUs have a three-year cliff performance vesting period and the RSUs vest in three equal annual installments over a three-year period.

In addition, the Compensation Committee recommended and the Board approved effective December 18, 2024, a one-time grant of 600,000 PSUs of the Company (the “One-Time Grant”). The One-Time Grant consists of two awards: (i) a grant of 300,000 PSUs that fully vested on December 18, 2024, and (ii) a grant of 300,000 PSUs that will be earned and vest following the Compensation Committee’s certification that Dr. Sridhar has achieved specific, objective criteria tied to strategic priorities prior to December 31, 2027. The maximum amount of shares Dr. Sridhar can earn under the One-Time Grant is 600,000 shares. Both the Compensation Committee and the Board agreed that the One-Time Grant addresses and recognizes Dr. Sridhar’s deemed level of performance that was not reflected in the compensation realized under the 2021 PSUs. Dr. Sridhar’s performance included, amongst other things, product development for the AI data center market, manufacturing automation and scale, margin expansion and a strengthened balance sheet. The 2025 Equity Package and the One-Time Grant are intended to be the only equity awards Dr. Sridhar is awarded through calendar year 2027.

Item 9.01 Financial Statements and Exhibits

Exhibits

| | | | | |

| |

Exhibit | Description |

| 104 | Cover page interactive data file (embedded within the inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | |

| BLOOM ENERGY CORPORATION |

| | | | | |

| Date: | December 20, 2024 | By: | | | /s/ Shawn Soderberg | |

| | | | | | Shawn Soderberg | |

| | | | | | Chief Legal Officer and Corporate Secretary | |

| | | | | |

v3.24.4

Cover

|

Dec. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 16, 2024

|

| Document Creation Date |

Dec. 20, 2024

|

| Entity Registrant Name |

BLOOM ENERGY CORPORATION

|

| Entity File Number |

001-38598

|

| Entity Tax Identification Number |

77-0565408

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Postal Zip Code |

95134

|

| Entity Address, State or Province |

CA

|

| Entity Address, City or Town |

San Jose,

|

| Entity Address, Address Line One |

4353 North First Street,

|

| Local Phone Number |

543-1500

|

| City Area Code |

(408)

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value

|

| Trading Symbol |

BE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001664703

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

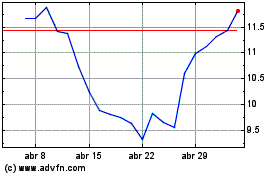

Bloom Energy (NYSE:BE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

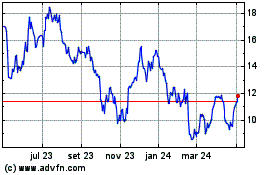

Bloom Energy (NYSE:BE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025