Bloom Energy Announces Project Funding Partnership with Industry Leaders HPS Investment Partners and Industrial Development Funding

11 Dezembro 2024 - 11:00AM

Business Wire

- Long-Term Partnership will Enable Funding of Large Projects and

Allow Customers to Pay for Electricity Use with Zero Upfront

Payment

- Over $125 million committed to fund 19 MW of Energy Server

Deployments in First Tranche

Bloom Energy (NYSE: BE), the world leader in stationary fuel

cell power generation, announced today that it has formed a project

financing partnership with certain funds managed by HPS Investment

Partners (HPS) and Industrial Development Funding (IDF), two

leading global providers of infrastructure capital. As part of the

agreement, HPS and IDF will acquire 19 MW of Bloom’s Energy

Servers, including several advanced on-site microgrid solutions.

The approximately $125 million in funding will support the

installation of Bloom equipment contracted under PPA structures,

which can deliver clean, on-site and highly reliable power to

commercial and industrial customers at zero upfront cost.

Bloom’s growth has accelerated alongside increasing demand for

reliable and rapidly deployable energy solutions needed to support

data centers, new manufacturing plants and other industrial

facilities. The partnership with HPS and IDF provides Bloom with

new sources of debt and equity capital to create special purpose

project companies that can sell electricity to customers. For HPS

and IDF, the partnership expands opportunities to invest in the

energy transition underway around the world, one that demands new

technologies that can meet the needs for time-to-power and

non-combustion sources of reliable power supply.

“Bloom Energy is excited to launch this long-term partnership

with HPS and IDF, two experienced and innovative companies when it

comes to funding the rapidly changing energy transition,” said Aman

Joshi, Bloom Energy’s Chief Commercial Officer. “With growing

demand for shorter contract lengths and larger-scale projects, this

partnership enhances Bloom’s ability to provide financed solutions

that address customers’ power supply and reliability needs without

impacting their capital budgets.”

“Bloom’s technology provides a proven solution to the challenges

customers are facing with the U.S. grid today and offers a unique

opportunity to invest in this fast-growing market,” said Michael

Dorenfeld, Managing Director for HPS Investment Partners. “We’re

pleased to be partnering with IDF and Bloom on this portfolio, and

to mark the beginnings of a successful long-term partnership.”

“With the rapid growth of the global demand for electric power,

this is an ideal time for us to partner with Bloom Energy,” said

Nik Nunes, CEO of Industrial Development Funding. “We view this

portfolio as the first step in a larger project funding

relationship.”

About HPS Investment Partners

HPS Investment Partners, LLC is a leading global, credit-focused

alternative investment firm that seeks to provide creative capital

solutions and generate attractive risk-adjusted returns for our

clients. We manage various strategies across the capital structure,

including privately negotiated senior debt; privately negotiated

junior capital solutions in debt, preferred and equity formats;

liquid credit including syndicated leveraged loans, collateralized

loan obligations and high yield bonds; asset-based finance and real

estate. The scale and breadth of our platform offers the

flexibility to invest in companies large and small, through

standard or customized solutions. At our core, we share a common

thread of intellectual rigor and discipline that enables us to

create value for our clients, who have entrusted us with

approximately $148 billion of assets under management as of

September 2024. For more information, please visit

www.hpspartners.com.

About Industrial Development Funding

Industrial Development Funding, LLC (“IDF”) is an investment

advisor registered with SEC that manages capital for Qualified

Institutional Buyers. IDF’s proprietary funding solutions enable

large industrial companies to sell existing products or introduce

new products to the marketplace. IDF provides bespoke capital

solutions to companies across the digital infrastructure, power and

transportation sectors. Website: www.indevfunding.com

About Bloom Energy

Bloom Energy empowers businesses and communities to responsibly

take charge of their energy. The company’s leading solid oxide

platform for distributed generation of electricity and hydrogen is

changing the future of energy. Fortune 100 companies around the

world turn to Bloom Energy as a trusted partner to deliver lower

carbon energy today and a net-zero future. For more information,

visit www.bloomenergy.com.

Forward Looking Statements

This press release contains certain forward-looking statements,

which are subject to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally relate to future events or our future

financial or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “should,” “will” and “would” or the negative of these words

or similar terms or expressions that concern Bloom’s expectations,

strategy, priorities, plans, or intentions. These forward-looking

statements include, but are not limited to, HPS and IDF’s

acquisition of Bloom Energy Servers, funding of installation of

Bloom equipment, new sources of capital, and Bloom’s ability to

provide financed solutions without impacting capital budgets.

Readers are cautioned that these forward-looking statements are

only predictions and may differ materially from actual future

events or results due to a variety of factors including, risks and

uncertainties detailed in Bloom’s SEC filings. More information on

potential risks and uncertainties that may impact Bloom’s business

are set forth in Bloom’s periodic reports filed with the SEC,

including its Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the SEC on February 15, 2024, its

Quarterly Report on Form 10-Q for the quarters ended March 31,

2024, June 30, 2024, and September 30, 2024 ,filed with the SEC on

May 9, 2024, August 8, 2024, and November 7, 2024, respectively, as

well as subsequent reports filed with or furnished to the SEC.

Bloom assumes no obligation to, and does not intend to, update any

such forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211562454/en/

Media Bloom Energy – Katja Gagen, press@bloomenergy.com

Industrial Development Funding – Doug Rivenburgh,

doug.rivenburgh@indevfunding.com

Investors Bloom Energy - Michael Tierney

(investor@bloomenergy.com)

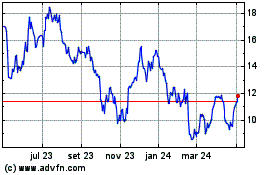

Bloom Energy (NYSE:BE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

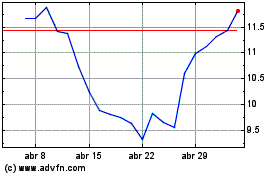

Bloom Energy (NYSE:BE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024