WHIRLPOOL CORP /DE/0000106640false00001066402025-01-292025-01-290000106640exch:XNYS2025-01-292025-01-290000106640exch:XCHI2025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) January 29, 2025

WHIRLPOOL CORPORATION

(Exact name of registrant as Specified in Charter)

| | | | | | | | | | | | | | | | | |

| Delaware | | 1-3932 | | 38-1490038 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | |

| 2000 North M-63, | | | | |

Benton Harbor, | Michigan | | | | 49022-2692 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code (269) 923-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $1.00 per share | | WHR | | Chicago Stock Exchange | and | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 29, 2025, Whirlpool Corporation issued a press release providing information regarding earnings for the fourth quarter and full year of 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Form 8-K, including the Exhibits hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Exhibit |

| |

| Exhibit 99.1 | |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Website Disclosure

We routinely post important information for investors on our website, whirlpoolcorp.com, in the "Investors" section. We also intend to update the Hot Topics Q&A portion of this webpage as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 29, 2025 WHIRLPOOL CORPORATION

By: /s/ JAMES W. PETERS

Name: James W. Peters

Title: Executive Vice President and Chief Financial and

Administrative Officer

| | | | | |

|

| Whirlpool Announces Fourth-Quarter and Full-Year Results; Provides 2025 Guidance |

•Fourth-quarter net sales decline of (18.7)% due to the Europe divestiture; organic net sales(1) growth of 1.9% driven by strong small domestic appliances and international businesses

•Delivered approximately $300 million of net cost take out in 2024, as expected

•Q4 GAAP net earnings margin (loss) of (9.5)%; GAAP earnings (loss) per diluted share of $(7.10) driven by the non-cash impact of Maytag brand impairment, GAAP tax rate of (44)%

•Q4 Ongoing (non-GAAP) EBIT margin(2) of 6.0%; ongoing earnings per diluted share(3) of $4.57 supported by favorable adjusted (non-GAAP) effective tax rate of (54)%

•2025 outlook includes full-year GAAP earnings per diluted share of approximately $8.75, and ongoing earnings per diluted share(3) of approximately $10.00; including GAAP and adjusted (non-GAAP) tax rate of 20 to 25%; cash provided by operating activities of approximately $1 billion and free cash flow(4) of approximately $500 to $600 million

•Intend to reduce ownership stake in Whirlpool of India Ltd. to ~20% in 2025 via market sale

•Expect to pay down approximately $700 million of debt in 2025

BENTON HARBOR, Mich., January 29, 2025 - Whirlpool Corporation (NYSE: WHR), today reported fourth-quarter and full-year 2024 financial results.

“In 2024, we continued to make progress in our operations and delivered on our cost take out commitment of $300 million while achieving the closure of the Europe transaction, supporting our ongoing portfolio transformation,” said Marc Bitzer. “In 2025, we expect to deliver more than $200 million of cost take out and position our business for the eventual U.S. housing recovery.” MARC BITZER, CHAIRMAN AND CHIEF EXECUTIVE OFFICER

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings Results | | | | | | | | | | Fourth Quarter Results | | Full Year Results |

| | | | | | 2024* | 2023 | Change | | 2024* | 2023 | Change |

| Net sales ($M) | | | | | | | | | | $4,136 | $5,088 | (18.7)% | | $16,607 | $19,455 | (14.6)% |

Organic net sales ($M)(1) | | | | | | | | | | $4,174 | $4,254 | 1.9% | | $16,052 | $15,991 | (0.4)% |

| GAAP net earnings (loss) available to Whirlpool ($M) | | | | | | | | | | $(393) | $491 | nm | | $(323) | $481 | nm |

Ongoing EBIT(2) ($M) | | | | | | | | | | $248 | $266 | (6.8)% | | $887 | $1,191 | (25.5)% |

| GAAP net earnings margin | | | | | | | | | | (9.5)% | 9.7% | (19.2pts) | | (1.9)% | 2.5% | (4.4pts) |

Ongoing EBIT margin(2) | | | | | | | | | | 6.0% | 5.2% | 0.8pts | | 5.3% | 6.1% | (0.8pts) |

| GAAP earnings (loss) per diluted share | | | | | | | | | | $(7.10) | $8.90 | nm | | $(5.87) | $8.72 | nm |

Ongoing earnings per diluted share(3) | | | | | | | | | | $4.57 | $3.85 | 18.7% | | $12.21 | $16.16 | (24.4)% |

| *Excludes net sales from our previously-owned MDA Europe business; full-year results exclude net sales from the second through fourth quarter |

| Free Cash Flow | | | | | | | | | | 2024 | 2023 | Change | | | | |

| Cash provided by (used in) operating activities ($M) | | | | | | | | | | $835 | $915 | $(80) | | | | |

Free cash flow(4) ($M) | | | | | | | | | | $385 | $366 | $19 | | | | |

"We are proud of the actions we took to strengthen our balance sheet, paying down $500 million in debt and driving significant working capital efficiency," said Jim Peters. "In 2025, our clear capital allocation priorities along with the anticipated India transaction will maximize shareholder value and further strengthen our balance sheet." JIM PETERS, CHIEF FINANCIAL AND ADMINISTRATIVE OFFICER

SEGMENT REVIEW

| | | | | | | | | | | | | | | | | | | | |

| SEGMENT INFORMATION ($M) | | | | | Q4 2024 | Q4 2023 | Change |

| MDA North America | Net Sales | | | | | $2,595 | $2,632 | (1.4)% |

| EBIT | | | | | $173 | $213 | (18.8)% |

| % of sales | | | | | 6.7% | 8.1% | (1.4pts) |

| MDA Latin America | Net Sales | | | | | $920 | $958 | (4.0)% |

| EBIT | | | | | $70 | $50 | 40.0% |

| % of sales | | | | | 7.6% | 5.2% | 2.4pts |

| MDA Asia | Net Sales | | | | | $238 | $221 | 7.6% |

| EBIT | | | | | $3 | $(1) | nm |

| % of sales | | | | | 1.2% | (0.5)% | 1.7pts |

| SDA Global | Net Sales | | | | | $384 | $363 | 5.7% |

| EBIT | | | | | $48 | $50 | (4.0)% |

| % of sales | | | | | 12.5% | 13.8% | (1.3pts) |

| | | | | | | | |

| | | | | | | |

| | | | | | | |

| MDA: Major Domestic Appliances; SDA: Small Domestic Appliances | | | | | | | |

MDA NORTH AMERICA

•Excluding currency, net sales decreased 1.2 percent year-over-year, and EBIT margin(5) decreased year-over-year, driven by a sizeable trade inventory reduction coupled with strong sell through in the quarter, negatively impacting price/mix

MDA LATIN AMERICA

•Excluding currency, net sales increased 7.3 percent year-over-year, with strong industry demand in Brazil and Mexico

•EBIT margin(5) increased year-over-year, driven by cost take out actions and fixed cost leverage

MDA ASIA

•Excluding currency, net sales increased 8.8 percent year-over-year, with increased volumes from share gains and industry growth

•EBIT margin(5) increased year-over-year, driven by fixed cost leverage

SDA GLOBAL

•Excluding currency, net sales increased 6.4 percent year-over-year, driven by strong direct-to-consumer sales and new product launches

•EBIT margin(5) decreased year-over-year, impacted by marketing investments in new product launches

FULL-YEAR 2025 OUTLOOK

| | | | | | | | | | | | | | |

| Guidance Summary | 2024 Reported | 2024 Like-for- Like (6) | 2025 Guidance |

| Net sales ($B) | $16.6 | ~$15.4 | ~$15.8 |

| Cash provided by operating activities ($M) | $835 | N/A | ~$1,000 |

Free cash flow ($M)(4) | $385 | N/A | $500 - $600 |

| GAAP net earnings margin (%) | (1.9)% | N/A | 3.0% |

Ongoing EBIT margin (%)(2) | 5.3% | ~5.8% | ~6.8% |

| GAAP earnings per diluted share | $(5.87) | N/A | ~$8.75 |

Ongoing earnings per diluted share(3) | $12.21 | N/A | ~$10.00 |

| GAAP tax rate | (5.5)% | N/A | 20 - 25% |

| Adjusted (non-GAAP) tax rate | (28.6)% | N/A | 20 - 25% |

•Expect full-year net sales of approximately $15.8 billion; approximately 3% growth on a like-for-like(6) basis

•Expect to deliver more than $200 million of structural cost take out actions

•Expect full-year GAAP earnings per diluted share of approximately $8.75 and full-year ongoing earnings per diluted share(3) of approximately $10.00

•Cash provided by operating activities of approximately $1 billion and free cash flow(4) of $500 to $600 million

•Expect net cash proceeds of $550 to $600 million from the anticipated India transaction

•Our capital allocation priorities demonstrate our strong commitment to strengthen our balance sheet; expect approximately $700 million of debt pay down in 2025

(1)A reconciliation of organic net sales, a non-GAAP financial measure, to reported net sales and other important information, appears below.

(2)A reconciliation of earnings before interest and taxes (EBIT) and ongoing EBIT, non-GAAP financial measures, to reported net earnings (loss) available to Whirlpool, and a reconciliation of EBIT margin and ongoing EBIT margin, non-GAAP financial measures, to net earnings (loss) margin and other important information, appears below.

(3)A reconciliation of ongoing earnings per diluted share, a non-GAAP financial measure, to reported net earnings (loss) per diluted share available to Whirlpool and other important information, appears below.

(4)A reconciliation of free cash flow, a non-GAAP financial measure, to cash provided by (used in) operating activities and other important information, appears below.

(5)Segment EBIT represents our consolidated EBIT broken down by the Company's reportable segments and are metrics used by the chief operating decision maker in accordance with ASC 280. Consolidated EBIT also includes corporate "Other/Eliminations" of $(507) million and $67 million for the fourth quarters of 2024 and 2023, respectively.

(6)Like-for-like refers to pro forma results for 2024, which exclude the first quarter results for the historical Europe major domestic appliances business (MDA Europe) and July through December results for the Whirlpool of India business, to provide a comparative baseline for 2025 guidance. This comparison uses a prior period baseline that is aligned to the ongoing business expectations for 2025, with the Europe transaction closed April 1, 2024 and the intended Whirlpool of India transaction expected to close by mid to late 2025. The like-for-like GAAP net earnings margin and corresponding reconciliation cannot be provided without unreasonable effort or expense. Please see below for a reconciliation of ongoing EBIT for the full year to GAAP net earnings.

Contact Whirlpool Corporation: Media: 269/923-7405, Media@Whirlpool.com, Financial: Scott Cartwright, Investor_Relations@Whirlpool.com

ABOUT WHIRLPOOL CORPORATION

Whirlpool Corporation (NYSE: WHR) is a leading home appliance company, in constant pursuit of improving life at home. As the last-remaining major U.S.-based manufacturer of kitchen and laundry appliances, the company is driving meaningful innovation to meet the evolving needs of consumers through its iconic brand portfolio, including Whirlpool, KitchenAid, JennAir, Maytag, Amana, Brastemp, Consul, and InSinkErator. In 2024, the company reported approximately $17 billion in annual sales - close to 90% of which were in the Americas - 44,000 employees and 40 manufacturing and technology research centers. Additional information about the company can be found at WhirlpoolCorp.com.

WEBSITE DISCLOSURE

We routinely post important information for investors on our website, WhirlpoolCorp.com, in the "Investors" section. We also intend to update the "Hot Topics Q&A" portion of this webpage as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the "Investors" section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document.

WHIRLPOOL ADDITIONAL INFORMATION

This document contains forward-looking statements about Whirlpool Corporation and its consolidated subsidiaries ("Whirlpool") within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Whirlpool intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with those safe harbor provisions. Any statements made in this press release that are not statements of historical fact, including statements regarding future financial results, long-term value creation goals, restructuring expectations, productivity, raw material prices and related costs, supply chain, portfolio transformation expectations, asset impairment, debt repayment expectations, India transaction timing and benefits expectations, trade customer inventory expectations, and the impact of housing recovery-related benefits on our operations are forward-looking statements and should be evaluated as such. Such statements can be identified by the use of terminology such as "may," "could," "will," "should," "possible," "plan," "predict," "forecast," "potential," "anticipate," "estimate," "expect," "project," "intend," "believe," "may impact," "on track," "margin lift," and similar words or expressions. Many risks, contingencies and uncertainties could cause actual results to differ materially from Whirlpool's forward-looking statements. Among these factors are: (1) intense competition in the home appliance industry, and the impact of the changing retail environment, including direct-to-consumer sales; (2) Whirlpool's ability to maintain or increase sales to significant trade customers; (3) Whirlpool's ability to maintain its reputation and brand image; (4) the ability of Whirlpool to achieve its business objectives and successfully manage its strategic portfolio transformation; (5) Whirlpool’s ability to understand consumer preferences and successfully develop new products; (6) Whirlpool's ability to obtain and protect intellectual property rights; (7) acquisition, divestiture, and investment-related risks, including risks associated with our past acquisitions; (8) the ability of suppliers of critical parts, components and manufacturing equipment to deliver sufficient quantities to Whirlpool in a timely and cost-effective manner; (9) risks related to our international operations; (10) Whirlpool's ability to respond to unanticipated social, political and/or economic events, including epidemics/pandemics; (11) information technology system and cloud failures, data security breaches, data privacy compliance, network disruptions, and cybersecurity attacks; (12) product liability and product recall costs; (13) Whirlpool's ability to attract, develop and retain executives and other qualified employees; (14) the impact of labor relations; (15) fluctuations in the cost of

key materials (including steel, resins, and base metals) and components and the ability of Whirlpool to offset cost increases; (16) Whirlpool's ability to manage foreign currency fluctuations; (17) impacts from goodwill, intangible asset and/or inventory impairment charges; (18) health care cost trends, regulatory changes and variations between results and estimates that could increase future funding obligations for pension and postretirement benefit plans; (19) impacts from credit rating agency downgrades; (20) litigation, tax, and legal compliance risk and costs; (21) the effects and costs of governmental investigations or related actions by third parties; (22) changes in the legal and regulatory environment including environmental, health and safety regulations, data privacy, taxes and generative AI; (23) the impacts of changes in foreign trade policies, including tariffs; (24) Whirlpool's ability to respond to the impact of climate change and climate change or other environmental regulation; and (25) the uncertain global economy and changes in economic conditions. In addition, factors that could cause actual results to differ materially from our India transaction expectations include, among other things, failure or delays in launching transaction based on Board approval, market conditions or other factors, failure or delays in share settlement and closing, transaction proceeds being lower than expected, alternative uses for proceeds received, brand license valuation expectations not being met, and strategic, economic or industry expectations for India not being realized. Additional information concerning these and other factors can be found in Whirlpool's filings with the Securities and Exchange Commission, including the most recent annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. These cautionary statements should not be construed by you to be exhaustive and the forward-looking statements are made only as of the date of this press release. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

WHIRLPOOL CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF INCOME (LOSS) (UNAUDITED)

FOR THE PERIODS ENDED DECEMBER 31

(Millions of dollars, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 4,136 | | | $ | 5,088 | | | $ | 16,607 | | | $ | 19,455 | |

| Expenses | | | | | | | |

| Cost of products sold | 3,465 | | | 4,296 | | | 14,026 | | | 16,285 | |

| Gross margin | 671 | | | 792 | | | 2,581 | | | 3,170 | |

| Selling, general and administrative | 418 | | | 557 | | | 1,684 | | | 1,993 | |

| Intangible amortization | 7 | | | 1 | | | 31 | | | 40 | |

| Restructuring costs | (2) | | | 2 | | | 79 | | | 16 | |

| Impairment of goodwill and other intangibles | 381 | | | — | | | 381 | | | — | |

| Loss (gain) on sale and disposal of businesses | 4 | | | (180) | | | 264 | | | 106 | |

| Operating profit | (136) | | | 412 | | | 143 | | | 1,015 | |

| Other (income) expense | | | | | | | |

| Interest and sundry (income) expense | — | | | (6) | | | (27) | | | 71 | |

| Interest expense | 83 | | | 92 | | | 358 | | | 351 | |

| Earnings (loss) before income taxes | (218) | | | 326 | | | (188) | | | 593 | |

| Income tax expense (benefit) | 95 | | | (191) | | | 10 | | | 77 | |

| Equity method investment income (loss), net of tax | (76) | | | (25) | | | (107) | | | (28) | |

| Net earnings (loss) | (391) | | | 492 | | | (305) | | | 488 | |

| Less: Net earnings (loss) available to noncontrolling interests | 2 | | | 1 | | | 18 | | | 7 | |

| Net earnings (loss) available to Whirlpool | $ | (393) | | | $ | 491 | | | $ | (323) | | | $ | 481 | |

| Per share of common stock | | | | | | | |

| Basic net earnings (loss) available to Whirlpool | $ | (7.10) | | | $ | 8.93 | | | $ | (5.87) | | | $ | 8.76 | |

| Diluted net earnings (loss) available to Whirlpool | $ | (7.10) | | | $ | 8.90 | | | $ | (5.87) | | | $ | 8.72 | |

| Dividends declared | $ | 1.75 | | | $ | 1.75 | | | $ | 7.00 | | | $ | 7.00 | |

| Weighted-average shares outstanding (in millions) | | | | | | | |

| Basic | 55.4 | | | 55.1 | | | 55.1 | | | 55.0 | |

| Diluted | 55.4 | | | 55.2 | | | 55.1 | | | 55.2 | |

WHIRLPOOL CORPORATION

CONSOLIDATED CONDENSED BALANCE SHEETS

(Millions of dollars, except share data)

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| (Unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 1,275 | | | $ | 1,570 | |

| Accounts receivable, net of allowance of $46 and $47, respectively | 1,317 | | | 1,529 | |

| Inventories | 2,035 | | | 2,247 | |

| | | |

| Prepaid and other current assets | 612 | | | 717 | |

| Assets held for sale | — | | | 144 | |

| Total current assets | 5,239 | | | 6,207 | |

| Property, net of accumulated depreciation of $5,414 and $5,259, respectively | 2,275 | | | 2,234 | |

| Right of use assets | 841 | | | 721 | |

| Goodwill | 3,322 | | | 3,330 | |

| Other intangibles, net of accumulated amortization of $447 and $440, respectively | 2,717 | | | 3,124 | |

| Deferred income taxes | 1,433 | | | 1,317 | |

| Other noncurrent assets | 474 | | | 379 | |

| Total assets | $ | 16,301 | | | $ | 17,312 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 3,530 | | | $ | 3,598 | |

| Accrued expenses | 455 | | | 491 | |

| Accrued advertising and promotions | 682 | | | 603 | |

| Employee compensation | 228 | | | 238 | |

| Notes payable | 18 | | | 17 | |

| Current maturities of long-term debt | 1,850 | | | 800 | |

| Other current liabilities | 560 | | | 614 | |

| Liabilities held for sale | — | | | 587 | |

| Total current liabilities | 7,323 | | | 6,948 | |

| Noncurrent liabilities | | | |

| Long-term debt | 4,758 | | | 6,414 | |

| Pension benefits | 122 | | | 147 | |

| Postretirement benefits | 96 | | | 107 | |

| Lease liabilities | 711 | | | 612 | |

| Other noncurrent liabilities | 357 | | | 547 | |

| Total noncurrent liabilities | 6,045 | | | 7,827 | |

| Stockholders' equity | | | |

Common stock, $1 par value, 250 million shares authorized, 65 million and 114 million shares issued, respectively, and 55 million and 55 million shares outstanding, respectively | 64 | | | 114 | |

| Additional paid-in capital | 3,462 | | | 3,078 | |

| Retained earnings | 1,311 | | | 8,358 | |

| Accumulated other comprehensive loss | (1,545) | | | (2,178) | |

Treasury stock, 9 million and 60 million shares, respectively | (609) | | | (7,010) | |

| Total Whirlpool stockholders' equity | 2,683 | | | 2,362 | |

| Noncontrolling interests | 250 | | | 175 | |

| Total stockholders' equity | 2,933 | | | 2,537 | |

| Total liabilities and stockholders' equity | $ | 16,301 | | | $ | 17,312 | |

WHIRLPOOL CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE PERIODS ENDED DECEMBER 31

(Millions of dollars)

| | | | | | | | | | | |

| Twelve Months Ended |

| 2024 | | 2023 |

| | | |

| Operating activities | | | |

| Net earnings (loss) | $ | (305) | | | $ | 488 | |

| Adjustments to reconcile net earnings to cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 333 | | | 361 | |

| Impairment of goodwill and other intangibles | 381 | | | — | |

| Loss (gain) on sale and disposal of businesses | 264 | | | 106 | |

| Equity method investment (income) loss, net of tax | 107 | | | 28 | |

| | | |

| | | |

| | | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (14) | | | 159 | |

| Inventories | 172 | | | (123) | |

| Accounts payable | 125 | | | 1 | |

| Accrued advertising and promotions | 63 | | | (37) | |

| Accrued expenses and current liabilities | 7 | | | 122 | |

| Taxes deferred and payable, net | (183) | | | (97) | |

| Accrued pension and postretirement benefits | (24) | | | (59) | |

| Employee compensation | 97 | | | 103 | |

| | | |

| Other | (188) | | | (137) | |

| Cash provided by (used in) operating activities | 835 | | | 915 | |

| Investing activities | | | |

| Capital expenditures | (451) | | | (549) | |

| Proceeds from sale of assets and businesses | 95 | | | 10 | |

| | | |

| | | |

| Acquisition of businesses, net of cash acquired | — | | | (14) | |

| Cash held by divested businesses | (245) | | | — | |

| Other | (1) | | | — | |

| Cash provided by (used in) investing activities | (602) | | | (553) | |

| Financing activities | | | |

| Net proceeds from borrowings of long-term debt | 300 | | | 304 | |

| Net repayments of long-term debt | (801) | | | (750) | |

| Net proceeds (repayments) from short-term borrowings | 11 | | | 34 | |

| Dividends paid | (384) | | | (384) | |

| Repurchase of common stock | (50) | | | — | |

| Sale of minority interest in subsidiary | 462 | | | — | |

| Common stock issued | — | | | 4 | |

| Other | (14) | | | — | |

| Cash provided by (used in) financing activities | (476) | | | (792) | |

| Effect of exchange rate changes on cash and cash equivalents | (149) | | | 45 | |

| Less: change in cash classified as held for sale | — | | | (3) | |

| Increase (decrease) in cash and cash equivalents | (391) | | | (388) | |

Cash and cash equivalents at beginning of year (1) | 1,667 | | | 1,958 | |

| Cash and cash equivalents at end of period | $ | 1,275 | | | $ | 1,570 | |

(1) Cash and cash equivalent at the beginning of 2024 include $1,570 million of cash and cash equivalents and cash of $97 million classified as held for sale as of December 31, 2023.

SUPPLEMENTAL INFORMATION - CONSOLIDATED FINANCIAL STATEMENTS RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Millions of dollars except per share data) (Unaudited)

We supplement the reporting of our financial information determined under U.S. generally accepted accounting principles (GAAP) with certain non-GAAP financial measures, some of which we refer to as "ongoing" measures. These measures may include earnings before interest and taxes (EBIT), EBIT margin, ongoing EBIT, ongoing EBIT margin, ongoing earnings per diluted share, ongoing interest and sundry (income) expense, adjusted effective tax rate, organic net sales, net debt leverage (Net Debt/Ongoing EBITDA), return on invested capital (ROIC) and free cash flow.

Ongoing measures exclude items that may not be indicative of, or are unrelated to, results from our ongoing operations and provide a better baseline for analyzing trends in our underlying businesses.

Sales excluding foreign currency: Current period net sales translated in functional currency, to U.S. dollars using the applicable prior period's exchange rate compared to the applicable prior period net sales. Management believes that sales excluding foreign currency provides stockholders with a clearer basis to assess our results over time, excluding the impact of exchange rate fluctuations.

Organic net sales: Sales excluding the impact of certain acquisitions or divestitures, and foreign currency. Management believes that organic net sales provides stockholders with a clearer basis to assess our results over time, excluding the impact of exchange rate fluctuations and certain acquisitions and/or divestitures.

Ongoing EBIT margin: Ongoing earnings before interest and taxes divided by net sales. Ongoing measures exclude items that may not be indicative of, or are unrelated to, results from our ongoing operations and provide a better baseline for analyzing trends in our underlying businesses.

Ongoing earnings per diluted share: Diluted net earnings per share from continuing operations, adjusted to exclude items that may not be indicative of, or are unrelated to, results from our ongoing operations. Ongoing measures provide a better baseline for analyzing trends in our underlying businesses.

Ongoing interest and sundry (income) expense: Reported interest and sundry (income) expense adjusted to exclude certain unique items. Management believes that ongoing interest and sundry (income) expense provides stockholders with a meaningful, consistent comparison of the Company's interest and sundry (income) expense, excluding the impact of certain unique items.

Ongoing equity method income (loss): Reported equity method income (loss) adjusted to exclude equity method investee restructuring charges. Management believes that ongoing equity method income (loss) provides stockholders with a meaningful, consistent comparison of the Company's equity method income (loss), excluding the impact of equity method investee restructuring charges.

Net debt leverage: Net debt to ongoing earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio is net debt outstanding, including long-term debt, current maturities of long-term debt, and notes payable, less cash and cash equivalents, divided by ongoing EBITDA. Management believes that net debt leverage provides stockholders with a view of our ability to generate earnings sufficient to service our debt.

Return on invested capital: Ongoing EBIT after taxes divided by total invested capital, defined as total assets less non-interest bearing current liabilities (NIBCLS). NIBCLS is defined as current liabilities less current maturities of long-term debt and notes payable. This ROIC definition may differ from other companies' methods and therefore may not be comparable to those used by other companies. Management believes that ROIC provides stockholders with a view of capital efficiency, a key driver of stockholder value creation.

Adjusted effective tax rate: Effective tax rate, excluding pre-tax income and tax effect of certain unique items. Management believes that adjusted tax rate provides stockholders with a meaningful, consistent comparison of the Company's effective tax rate, excluding the pre-tax income and tax effect of certain unique items.

Free cash flow: Cash provided by (used in) operating activities less capital expenditures. Management believes that free cash flow provides stockholders with a relevant measure of liquidity and a useful basis for assessing the Company's ability to fund its activities and obligations.

Whirlpool does not provide a non-GAAP reconciliation for its forward-looking long-term value creation goals, such as organic net sales, EBIT, free cash flow conversion, free cash flow benefit as a result of Europe transaction closing, ROIC and net debt leverage, as these long-term management goals are not annual guidance, and the reconciliation of these long-term measures would rely on market factors and certain other conditions and assumptions that are outside of the Company’s control.

We believe that these non-GAAP measures provide meaningful information to assist investors and stockholders in understanding our financial results and assessing our prospects for future performance, and reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP financial measures, provide a more complete understanding of our business. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. These ongoing financial measures should not be considered in isolation or as a substitute for reported net earnings available to Whirlpool per diluted share, net earnings, net earnings available to Whirlpool, net earnings margin, return on assets, net sales, effective tax rate and cash provided by (used in) operating activities, the most directly comparable GAAP financial measures.

We also disclose segment EBIT as an important financial metric used by the Company's Chief Operating Decision Maker to evaluate performance and allocate resources in accordance with ASC 280 - Segment Reporting.

GAAP net earnings available to Whirlpool per basic or diluted share (as applicable) and ongoing earnings per diluted share are presented net of tax, while individual adjustments in each reconciliation are presented on a pre-tax basis; the income tax impact line item aggregates the tax impact for these adjustments. The tax impact of individual line item adjustments may not foot precisely to the aggregate income tax impact amount, as each line item adjustment may include non-taxable components. Historical quarterly earnings per share amounts are presented based on a normalized tax rate adjustment to reconcile quarterly tax rates to full-year tax rate expectations. We strongly encourage investors and stockholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure.

FOURTH-QUARTER 2024 ONGOING EARNINGS BEFORE INTEREST AND TAXES AND ONGOING EARNINGS PER DILUTED SHARE

The reconciliation provided below reconciles the non-GAAP financial measures ongoing earnings before interest and taxes and ongoing earnings per diluted share, with the most directly comparable GAAP financial measures, net earnings (loss) available to Whirlpool and net earnings (loss) per diluted share available to Whirlpool, for the three months ended December 31, 2024. Net earnings (loss) margin is calculated by dividing net earnings (loss) available to Whirlpool by net sales. Ongoing EBIT margin is calculated by dividing ongoing EBIT by net sales. EBIT margin is calculated by dividing EBIT by net sales. The earnings per diluted share GAAP measure and ongoing measure are presented net of tax, while each adjustment is presented on a pre-tax basis. Our fourth-quarter GAAP tax rate was (43.6)%. The aggregate income tax impact of the taxable components of each adjustment is presented in the income tax impact line item at our fourth-quarter adjusted tax rate (non-GAAP) of (53.8)%.

| | | | | |

| Three Months Ended |

| Earnings Before Interest & Taxes Reconciliation: | December 31, 2024 |

| Net earnings (loss) available to Whirlpool | $ | (393) | |

| Net earnings (loss) available to noncontrolling interests | 2 | |

| Income tax expense (benefit) | 95 | |

| Interest expense | 83 | |

| Earnings before interest & taxes | $ | (212) | |

| Net sales | $ | 4,136 | |

| Net earnings (loss) margin | (9.5) | % |

| | | | | | | | | | | | | | | | | |

| Results classification | | Earnings before interest & taxes | | Earnings per diluted share |

| Reported measure | | | $ | (212) | | | $ | (7.10) | |

Restructuring expense (a) | Restructuring costs | | (2) | | | (0.04) | |

Impairment of goodwill, intangibles and other assets (b) | Impairment of goodwill and other intangibles | | 381 | | | 6.88 | |

Impact of M&A transactions (c) | (Gain) loss on sale and disposal of businesses & Selling, general and administrative | | 9 | | | 0.16 | |

Legacy EMEA legal matters (d) | Interest and sundry (income) expense | | (2) | | | (0.04) | |

Equity method investee - restructuring charges (e) | Equity method investment income (loss), net of tax | | 74 | | | 1.34 | |

| Income tax impact | Income tax impact | | | | 4.47 | |

Normalized tax rate adjustment (f) | Normalized tax rate adjustment | | | | (1.10) | |

| | | | | |

| Ongoing measure | | | $ | 248 | | | $ | 4.57 | |

| Net sales | | | $ | 4,136 | | | |

| Ongoing EBIT margin | | | 6.0 | % | | |

Note: Numbers may not reconcile due to rounding.

FOURTH-QUARTER 2023 ONGOING EARNINGS BEFORE INTEREST AND TAXES AND ONGOING EARNINGS PER DILUTED SHARE

The reconciliation provided below reconciles the non-GAAP financial measures ongoing earnings before interest and taxes and ongoing earnings per diluted share, with the most directly comparable GAAP financial measures, net earnings (loss) available to Whirlpool and net earnings (loss) per diluted share available to Whirlpool, for the three months ended December 31, 2023. Net earnings (loss) margin is calculated by dividing net earnings (loss) available to Whirlpool by net sales. Ongoing EBIT margin is calculated by dividing ongoing EBIT by net sales. EBIT margin is calculated by dividing EBIT by net sales. The earnings per diluted share GAAP measure and ongoing measure are presented net of tax, while each adjustment is presented on a pre-tax basis. Our fourth-quarter GAAP tax rate was (58.6)%. The aggregate income tax impact of the taxable components of each adjustment is presented in the income tax impact line item at our fourth-quarter adjusted tax rate (non-GAAP) of (19.0)%.

| | | | | |

| Three Months Ended |

| Earnings Before Interest & Taxes Reconciliation: | December 31, 2023 |

| Net earnings (loss) available to Whirlpool | $ | 491 | |

| Net earnings (loss) available to noncontrolling interests | 1 | |

| Income tax expense (benefit) | (191) | |

| Interest expense | 92 | |

| Earnings before interest & taxes | $ | 393 | |

| Net sales | $ | 5,088 | |

| Net earnings (loss) margin | 9.7 | % |

| | | | | | | | | | | | | | | | | |

| Results classification | | Earnings before interest & taxes | | Earnings per diluted share |

| Reported measure | | | $ | 393 | | | $ | 8.90 | |

| | | | | |

Impact of M&A transactions (c) | (Gain) loss on sale and disposal of businesses & Selling, general and administrative & including equity method investment | | (123) | | | (2.23) | |

Legacy EMEA legal matters (d) | Interest and sundry (income) expense | | (4) | | | (0.06) | |

| Total income tax impact | | | | | (0.44) | |

Normalized tax rate adjustment (f) | | | | | (2.32) | |

| | | | | |

| | | | | |

| Ongoing measure | | | $ | 266 | | | $ | 3.85 | |

| Net sales | | | $ | 5,088 | | | |

| Ongoing EBIT margin | | | 5.2 | % | | |

Note: Numbers may not reconcile due to rounding.

FULL-YEAR 2024 ONGOING EARNINGS BEFORE INTEREST AND TAXES AND ONGOING EARNINGS PER DILUTED SHARE

The reconciliation provided below reconciles the non-GAAP financial measures ongoing earnings before interest and taxes and ongoing earnings per diluted share, with the most directly comparable GAAP financial measures, net earnings (loss) available to Whirlpool and net earnings (loss) per diluted share available to Whirlpool, for the twelve months ended December 31, 2024. Net earnings (loss) margin is calculated by dividing net earnings (loss) available to Whirlpool by

net sales. Ongoing EBIT margin is calculated by dividing ongoing EBIT by net sales. EBIT margin is calculated by dividing EBIT by net sales. The earnings per diluted share GAAP measure and ongoing measure are presented net of tax, while each adjustment is presented on a pre-tax basis. Our full-year GAAP tax rate was (43.6)%. The aggregate income tax impact of the taxable components of each adjustment is presented in the income tax impact line item at our full-year adjusted tax (non-GAAP) rate of (28.6)%.

| | | | | |

| Twelve Months Ended |

| Earnings Before Interest & Taxes Reconciliation: | December 31, 2024 |

| Net earnings (loss) available to Whirlpool | $ | (323) | |

| Net earnings (loss) available to noncontrolling interests | 18 | |

| Income tax expense (benefit) | 10 | |

| Interest expense | 358 | |

| Earnings before interest & taxes | $ | 63 | |

| Net sales | $ | 16,607 | |

| Net earnings (loss) margin | (1.9) | % |

| | | | | | | | | | | | | | | | | |

| Results classification | | Earnings before interest & taxes | | Earnings per diluted share |

| Reported measure | | | $ | 63 | | | $ | (5.87) | |

Restructuring expense (a) | Restructuring costs | | 79 | | | 1.44 | |

Impairment of goodwill, intangibles and other assets (b) | Impairment of goodwill and other intangibles | | 381 | | | 6.92 | |

Impact of M&A transactions (c) | (Gain) loss on sale and disposal of businesses & Selling, general and administrative | | 292 | | | 5.30 | |

Legacy EMEA legal matters (d) | Interest and sundry (income) expense | | (2) | | | (0.04) | |

Equity method investee - restructuring charges (e) | Equity method investment income (loss), net of tax | | 74 | | | 1.34 | |

| Total income tax impact | | | | | 4.28 | |

Normalized tax rate adjustment (f) | | | | | (1.16) | |

| | | | | |

| Ongoing measure | | | $ | 887 | | | $ | 12.21 | |

| Net Sales | | | $ | 16,607 | | | |

| Ongoing EBIT Margin | | | 5.3 | % | | |

Note: Numbers may not reconcile due to rounding.

FULL-YEAR 2023 ONGOING EARNINGS BEFORE INTEREST AND TAXES AND ONGOING EARNINGS PER DILUTED SHARE

The reconciliation provided below reconciles the non-GAAP financial measures ongoing earnings before interest and taxes and ongoing earnings per diluted share, with the most directly comparable GAAP financial measures, net earnings (loss) available to Whirlpool and net earnings (loss) per diluted share available to Whirlpool, for the twelve months ended December 31, 2023. Net earnings (loss) margin is calculated by dividing net earnings (loss) available to Whirlpool by

net sales. Ongoing EBIT margin is calculated by dividing ongoing EBIT by net sales. EBIT margin is calculated by dividing EBIT by net sales. The earnings per diluted share GAAP measure and ongoing measure are presented net of tax, while each adjustment is presented on a pre-tax basis. Our full-year GAAP tax rate was 13.0%. The aggregate income tax impact of the taxable components of each adjustment is presented in the income tax impact line item at our full-year adjusted tax (non-GAAP) rate of (6.7)%.

| | | | | |

| Twelve Months Ended |

| Earnings Before Interest & Taxes Reconciliation: | December 31, 2023 |

| Net earnings (loss) available to Whirlpool | $ | 481 | |

| Net earnings (loss) available to noncontrolling interests | 7 | |

| Income tax expense (benefit) | 77 | |

| Interest expense | 351 | |

| Earnings before interest & taxes | $ | 916 | |

| Net sales | $ | 19,455 | |

| Net earnings (loss) margin | 2.5 | % |

| | | | | | | | | | | | | | | | | |

| Results classification | | Earnings before interest & taxes | | Earnings per diluted share |

| Reported measure | | | $ | 916 | | | $ | 8.72 | |

Impact of M&A transactions (c) | (Gain) loss on sale and disposal of businesses & Selling, general and administrative & including equity method investment | | 181 | | | 3.27 | |

Legacy EMEA legal matters (d) | Interest and sundry (income) expense | | 94 | | | 1.71 | |

| Total income tax impact | | | | | 0.35 | |

Normalized tax rate adjustment (f) | | | | | 2.11 | |

| Ongoing measure | | | $ | 1,191 | | | $ | 16.16 | |

| Net Sales | | | $ | 19,455 | | | |

| Ongoing EBIT Margin | | | 6.1 | % | | |

Note: Numbers may not reconcile due to rounding

FULL-YEAR 2025 OUTLOOK FOR ONGOING EARNINGS BEFORE INTEREST AND TAXES AND ONGOING EARNINGS PER DILUTED SHARE

The reconciliation provided below reconciles the non-GAAP financial measures ongoing earnings before interest and taxes and ongoing earnings per diluted share, with the most directly comparable GAAP financial measures, net earnings available to Whirlpool and net earnings per diluted share available to Whirlpool, for the twelve months ending December 31, 2025. Net earnings margin is calculated by dividing net earnings available to Whirlpool by net sales. Ongoing EBIT margin is calculated by dividing ongoing EBIT by net sales. EBIT margin is calculated by dividing EBIT by net sales. The earnings per diluted share GAAP measure and ongoing measure are presented net of tax, while each adjustment is presented on a pre-tax basis. Our anticipated full-year GAAP tax rate is approximately 20 - 25%. The aggregate income tax impact of the taxable components of each adjustment is presented in the income tax impact line item at our anticipated full-year adjusted tax (non-GAAP) rate of 20 - 25%.

| | | | | | | | | | | | | | | | | |

| | | |

| | | |

| | | Twelve Months Ending

December 31, 2025 |

| Results classification | | Earnings before interest & taxes* | | Earnings per diluted share |

| Reported measure | | | ~$975 | | | ~$8.75 | |

| Restructuring Expense | Restructuring Costs | | ~75 | | | ~1.25 | |

| Impact of M&A transactions | (Gain) loss on sale and disposal of businesses & Selling, general and administrative | | ~20 | | | ~0.25 | |

| | | | | |

| Total income tax impact | | | | | (~0.25) | |

| | | | | |

| Ongoing measure | | | ~$1,070 | | | ~$10.00 | |

Note: Numbers may not reconcile due to rounding.

*Earnings Before Interest & Taxes (EBIT) is a non-GAAP measure. The Company does not provide a forward-looking quantitative reconciliation of EBIT to the most directly comparable GAAP financial measure, net earnings available to Whirlpool, because the net earnings available to noncontrolling interests item of such reconciliation -- which has historically represented a relatively insignificant amount of the Company's overall net earnings -- implicates the Company's projections regarding the earnings of the Company's non wholly-owned subsidiaries and joint ventures that cannot be quantified precisely or without unreasonable efforts.

FOOTNOTES

a.RESTRUCTURING EXPENSE - In March 2024, the Company committed to workforce reduction plans in the United States and globally, in an effort to reduce complexity and simplify our organizational model after the European major domestic appliance transaction. The workforce reduction plans included involuntary severance actions as of the end of the first quarter of 2024. Total costs for these actions were $21 million, of which we incurred $14 million in employee termination costs and $7 million other associated costs.

During the second quarter of 2024, the Company evaluated additional restructuring actions as part of the Company's organizational simplification efforts. Total costs for these actions were $58 million, which were primarily employee termination costs.

b.IMPAIRMENT OF GOODWILL, INTANGIBLES AND OTHER ASSETS - During the fourth quarter of 2024, we determined that the carrying value of the Maytag trademark exceeded its fair value, resulting in an impairment charge of $381 million.

c.IMPACT OF M&A TRANSACTIONS - On January 16, 2023, the Company signed a contribution agreement to contribute our European major domestic appliance business into a newly formed entity with Arcelik. In connection with the transaction, which closed on April 1, 2024, the Company recorded a loss on disposal of $298 million and $106 million for the twelve months ended December 31, 2024 and December 31, 2023, respectively.

Additionally, the Company incurred other unique transaction related costs related to portfolio transformation for a total of $28 million and $75 million for the twelve months ended December 31, 2024 and December 31, 2023, respectively. These transaction costs are recorded in Selling, General and Administrative expenses on our Consolidated Statements of Comprehensive Income (Loss).

The Company also recorded a gain of $34 million during the third quarter of 2024 related to the sale of the Company's Brastemp-branded water filtration subscription business related to our portfolio transformation.

d.LEGACY EMEA LEGAL MATTERS - During the fourth quarter of 2024 we recorded immaterial amounts related to legacy matters of our European major domestic appliance business.

During the first quarter of 2023, the Company accrued $62 million related to the Competition Investigation and unrelated trade customer insolvency matter of our European major domestic appliance business. During the second quarter of 2023, the accrual was increased by $36 million resulting in an aggregate amount of $98 million for the six months ended June 30, 2023. An immaterial adjustment was made in the fourth quarter of 2023 related to these matters. For certain additional information, see Note 7 to the Consolidated Financial Statements.

e.EQUITY METHOD INVESTEE - RESTRUCTURING CHARGES - During the fourth quarter of 2024, we recorded our proportionate share of restructuring charges related to certain previously announced restructuring actions by our European equity method investee.

f.NORMALIZED TAX RATE ADJUSTMENT - For the full year 2024, the Company calculated a GAAP tax rate of (5.5)%. Ongoing earnings per share was calculated using an adjusted tax rate of (28.6)%, which excludes the tax impacts related to M&A transactions, the Maytag intangible impairment charge, and certain other tax impacts related to the Europe transaction.

For the full-year 2023, the Company calculated a GAAP tax rate of 13%. Ongoing earnings per share was calculated using an adjusted tax rate of (6.7)%, which excludes certain tax related impacts of M&A transactions and certain tax related impacts to legal entity restructuring transactions.

ONGOING EBIT EXCLUDING MDA EUROPE FIRST QUARTER AND JULY THROUGH DECEMBER INDIA

The reconciliation provided below reconciles the impact of removing Q1 MDA Europe and July through December India from our net sales and ongoing EBIT, for the twelve months ended December 31, 2024 for the Whirlpool business. Please see elsewhere in this Supplemental Information section for a reconciliation of Ongoing EBIT to GAAP reported net earnings (loss) available to Whirlpool.

| | | | | | | | | | | | | | |

| 2024 As Reported | Q1 2024 MDA Europe* | July - December 2024 India** | 2024 Like-for-Like |

Net Sales (in billions) | $16.6 | | $0.8 | | $0.4 | | ~$15.4 | |

| | | | |

| | | | |

Ongoing EBIT (in millions) | 887 | | (9) | | 3 | | ~893 | |

| Ongoing EBIT Margin | 5.3 | % | (1.1) | % | 0.7 | % | ~5.8 | % |

Note: Numbers may not reconcile due to rounding.

*Q1 historical segment financial data (unaudited).

** July through December India financial data (unaudited).

FREE CASH FLOW

Free cash flow is cash provided by (used in) operating activities after capital expenditures. The reconciliation provided below reconciles twelve months ended December 31, 2024 and 2023 and 2025 full-year free cash flow with cash provided by (used in) operating activities, the most directly comparable GAAP financial measure. Free cash flow as a percentage of net sales is calculated by dividing free cash flow by net sales.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Twelve Months Ended | | |

| December 31, | | |

| (millions of dollars) | 2024 | | 2023 | | 2025 Outlook |

| Cash provided by (used in) operating activities | $835 | | $915 | | ~$1,000 |

| Capital expenditures | (451) | | (549) | | (~450) |

| Free cash flow | $385 | | $366 | | $500 - $600 |

| | | | | |

| Cash provided by (used in) investing activities* | (602) | | (553) | | |

| Cash provided by (used in) financing activities* | (476) | | (792) | | |

*Financial guidance on a GAAP basis for cash provided by (used in) financing activities and cash provided by (used in) investing activities has not been provided because in order to prepare any such estimate or projection, the Company would need to rely on market factors and certain other conditions and assumptions that are outside of its control.

ORGANIC NET SALES

The reconciliation provided below reconciles the non-GAAP financial measure organic net sales

to GAAP reported net sales, for twelve months ended December 31, 2023 and 2024 for the

Whirlpool business.

| | | | | | | | | | | | | | | | | |

| Twelve Months Ended | | |

| December 31, | | |

| (Approximate impact in dollars) | 2024 | | 2023 | | Change |

| Net Sales | $16,607 | | $19,455 | | (14.6)% |

| Less: EMEA Divested Business | 804 | | 3,403 | | |

| Less: Currency | (188) | | — | | |

| Organic Net Sales | $15,991 | | $16,052 | | (0.4)% |

The reconciliation provided below reconciles the non-GAAP financial measure organic net sales to GAAP reported net sales, for three months ended December 31, 2023 and 2024 for the Whirlpool business.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended | | |

| December 31, | | |

| (Approximate impact in dollars) | 2024 | | 2023 | | Change |

| Net Sales | $4,136 | | $5,088 | | (18.7)% |

| Less: EMEA Divested Business | — | | 914 | | |

| Less: Currency | (118) | | — | | |

| Organic Net Sales | $4,254 | | $4,174 | | 1.9% |

The reconciliation provided below reconciles the non-GAAP financial measure organic net sales to GAAP reported net sales, for three months ended September 30, 2023 and 2024 for the Whirlpool business.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended | | |

| September 30, | | |

| (Approximate impact in dollars) | 2024 | | 2023 | | Change |

| Net Sales | $3,993 | | $4,926 | | (18.9)% |

| Less: EMEA Divested Business | — | | 829 | | |

| Less: Currency | (76) | | — | | |

| Organic Net Sales | $4,069 | | $4,097 | | (0.7)% |

The reconciliation provided below reconciles the non-GAAP financial measure organic net sales to GAAP reported net sales, for three months ended June 30, 2023 and 2024 for the Whirlpool business.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended | | |

| June 30, | | |

| (Approximate impact in dollars) | 2024 | | 2023 | | Change |

| Net Sales | $3,989 | | $4,792 | | (16.8)% |

| Less: EMEA Divested Business | — | | 814 | | |

| Less: Currency | (37) | | — | | |

| Organic Net Sales | $4,026 | | $3,978 | | 1.2% |

The reconciliation provided below reconciles the non-GAAP financial measure organic net sales to GAAP reported net sales, for three months ended March 31, 2023 and 2024 for the Whirlpool business.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Three Months Ended | | |

| March 31, | | |

| (Approximate impact in dollars) | 2024 | | 2023 | | Change |

| Net Sales | $4,490 | | $4,649 | | (3.4)% |

| Less: EMEA Divested Business | 804 | | 846 | | |

| Less: Currency | 43 | | — | | |

| Organic Net Sales | $3,643 | | $3,803 | | (4.2)% |

Note: Numbers may not reconcile due to rounding.

v3.24.4

Document and Entity Information

|

Jan. 29, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

WHIRLPOOL CORP /DE/

|

| Entity Central Index Key |

0000106640

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-3932

|

| Entity Tax Identification Number |

38-1490038

|

| Entity Address, Address Line One |

2000 North M-63,

|

| Entity Address, City or Town |

Benton Harbor,

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

49022-2692

|

| City Area Code |

269

|

| Local Phone Number |

923-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Chicago Stock Exchange |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $1.00 per share

|

| Trading Symbol |

WHR

|

| Security Exchange Name |

CHX

|

| New York Stock Exchange |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $1.00 per share

|

| Trading Symbol |

WHR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

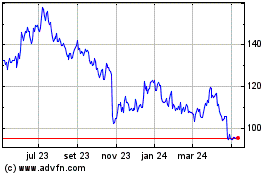

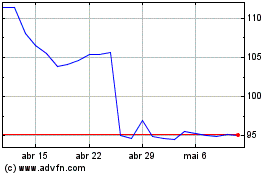

Whirlpool (NYSE:WHR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Whirlpool (NYSE:WHR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025