false

0001218683

0001218683

2025-01-23

2025-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2025

Mawson Infrastructure Group

Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40849 |

|

88-0445167 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 950 Railroad Avenue, Midland,

Pennsylvania |

|

15059 |

| (Address of principal executive offices) |

|

(Zip Code) |

| |

|

|

Registrant’s telephone number, including area code: +1-412-515-0896

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant

to Section 12(b) of the Act: |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value |

|

MIGI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard;

Transfer of Listing.

On January 24, 2025, Mawson Infrastructure Group Inc. (the “Company”) received written

notice (the “MVLS Notice”) from the Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market

LLC (“Nasdaq”) notifying the Company that for the last 33 consecutive business days prior to the date of the MVLS Notice,

the Company’s Market Value of Listed Securities (“MVLS”) was less than the $35.0 million minimum required for continued

listing on The Nasdaq Capital Market, as required by Nasdaq Listing Rule 5550(b)(2) (the “MVLS Rule”). In accordance with

Nasdaq Listing Rule 5810(c)(3)(C), the Staff has provided the Company with 180 calendar days, or until July 23, 2025, to regain compliance

with the MVLS Rule. The MVLS Notice has no immediate effect on the listing of the Company’s securities on The Nasdaq Capital Market,

and the Company’s common stock continues to trade under the symbol “MIGI.”

If the Company regains compliance with the MVLS Rule during the 180-day compliance period ending

on July 23, 2025 (the “Compliance Period”), the Staff will provide written confirmation to the Company and close the matter.

To regain compliance with the MVLS Rule, the Company’s MVLS must meet or exceed $35.0 million for a minimum of ten consecutive business

days during the Compliance Period (unless the Staff exercises its discretion to extend such ten business day period under Nasdaq Listing

Rule 5810(c)(3)(H)). In the event the Company does not regain compliance with the MVLS Rule prior to the expiration of the Compliance

Period, it will receive written notification that its securities are subject to delisting. At that time, the Company may appeal the delisting

determination to a Nasdaq Hearings Panel.

The Company will continue to monitor its MVLS and consider its available options to regain compliance

with the MVLS Rule. However, there can be no assurance that the Company will be able to regain compliance with the MVLS Rule during the

Compliance Period or otherwise maintain compliance with the MVLS Rule or the other Nasdaq listing requirements.

Item 8.01. Other Events.

As previously disclosed by the Company, the Company and two of its subsidiaries, Luna Squares,

LLC (“Luna Squares”) and Cosmos Infrastructure LLC have been made respondents in certain arbitration proceedings filed by

Celsius Network Ltd., Celsius Mining LLC, and Ionic Digital Mining LLC (collectively “Celsius”) on July 18, 2024, with the

American Arbitration Association in the matter entitled, “Celsius Network Ltd., Celsius Mining LLC, and Ionic Digital Mining LLC

v. Mawson Infrastructure Group, Luna Squares LLC, and Cosmos Infrastructure LLC - Case 01-24-0006-4462”. The Company and Luna Squares

have denied Celsius’ claims in arbitration. In addition, the Company has filed counter claims and cross claims against Celsius alleging

claims and damages of $6,957,226.01 in unpaid invoices and $115,000,000 in breach of contract damages, plus interest and attorney fees,

against Celsius.

On January 23, 2025, the arbitrator issued a Partial Final Award (the “Partial Final Award”)

granting in part Celsius’ claim against Luna Squares on the outstanding promissory note executed by Luna Squares in favor of Celsius.

The Partial Final Award granted Celsius monetary damages in the amount of $8,144,000, plus interest and attorney fees. The ruling does

not directly affect the Company, and the guarantee of the Company for the promissory note has not been litigated. In addition, the Company’s

counterclaims and damages against Celsius are still in litigation and the Company continues to pursue its counterclaims and damages expeditiously.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Company cautions that statements in this report that are not a description

of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words referencing future events or circumstances such as “expect,” “intend,”

“plan,” “anticipate,” “believe,” and “will,” among others. Examples of forward-looking

statements herein include, among others, statements regarding the Company’s ability to regain compliance with Nasdaq’s listing

standards and anticipated actions to be taken by Nasdaq in the future.

Because such statements are subject to risks and uncertainties, actual

results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are

based upon the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual

results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various

risks and uncertainties, which include, without limitation, the possibility of the Company’s need and ability to raise additional

capital, the development and acceptance of digital asset networks and digital assets and their protocols and software, the reduction in

incentives to mine digital assets over time, the costs associated with digital asset mining, the volatility in the value and prices of

cryptocurrencies, further or new regulation of digital assets, the evolution of the AI and HPC market and changing technologies, the slower

than expected growth in demand for AI, HPC and other accelerated computing technologies than expected, the ability to timely implement

and execute on AI and HPC digital infrastructure, and the ability to timely complete the digital infrastructure build-out in order to

achieve its revenue expectations for the periods mentioned. More detailed information about the risks and uncertainties affecting the

Company is contained under the heading “Risk Factors” included in the Company’s Annual Report on Form 10-K filed with

the SEC on April 1, 2024, and the Company’s Quarterly Reports on Form 10-Q filed with the SEC on May 15, 2024, August 19, 2024,

and November 14, 2024, and in other filings that the Company has made and may make with the SEC in the future. One should not place undue

reliance on these forward-looking statements, which speak only as of the date on which they were made. Because such statements are subject

to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. The

Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on

which they were made, except as may be required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Mawson Infrastructure Group Inc. |

| |

|

|

| Date: January 29, 2025 |

By: |

/s/ Kaliste Saloom |

| |

|

Kaliste Saloom |

| |

|

General Counsel and Corporate Secretary |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

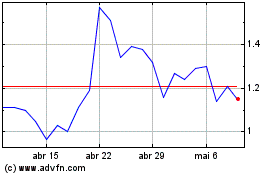

Mawson Infrastructure (NASDAQ:MIGI)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Mawson Infrastructure (NASDAQ:MIGI)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025