0001809104FALSEAlight, Inc. / Delaware00018091042025-02-202025-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________________

FORM 8-K

__________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2025

__________________________________________

Alight, Inc.

(Exact name of Registrant as Specified in Its Charter)

__________________________________________

| | | | | | | | |

| Delaware | 001-39299 | 86-1849232 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

320 South Canal Street, | | |

50th Floor, Suite 5000, Chicago,IL | | 60606 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (224)737-7000

(Former Name or Former Address, if Changed Since Last Report)

__________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | ALIT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 20, 2025, Mr. Daniel S. Henson, Ms. Erika Meinhardt and Ms. Regina M. Paolillo notified the board of directors (the “Board”) of Alight, Inc. (the “Company” or “Alight”) of their decision to step down, effective March 1, 2025 (the “Effective Date”), from their positions as members of the Board. None of Mr. Henson’s, Ms. Meinhardt’s or Ms. Paolillo’s decisions to leave the Board resulted from any disagreements with management or with the Board or any matter relating to the operations, policies or practices of the Company.

On February 20, 2025, the Board increased the size of the Board from ten (10) directors to eleven (11) and appointed (i) Mr. Russell P. Fradin as a director and the Chair of the Board and (ii) Mr. Michael E. Hayes, Mr. Robert A. Lopes, Jr. and Mr. Robert A. Schriesheim as directors, in each case effective as of the Effective Date. Mr. Hayes and Mr. Schriesheim will each serve as a Class I director with a term expiring at the Company’s 2025 annual meeting and each is expected to be nominated for reelection at the 2025 annual meeting and Mr. Fradin and Mr. Lopes will each serve as a Class II director with a term expiring at the Company’s 2026 annual meeting.

Following such actions, the Board composition will be as follows effective as of March 1, 2025:

Class I: David D. Guilmette, Michael E. Hayes, Kausik Rajgopal, and Robert A. Schriesheim

Class II: Robert A. Lopes, Jr., Richard N. Massey, and Russell P. Fradin

Class III: Siobhan Nolan Mangini, Coretha M. Rushing, and Denise Williams

The Board also appointed (i) Mr. Hayes as a member of the Audit Committee and the Compensation Committee, (ii) Mr. Lopes as a member of the Audit Committee and the Nominating and Corporate Governance Committee and (iii) Mr. Schriesheim as a member of the Audit Committee and the Compensation Committee. The Board does not anticipate appointing Mr. Fradin to any Board committees at this time.

Each of Messrs. Fradin, Hayes, Lopes and Schriesheim has no family relationship with any director or executive officer of the Company and has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. Mr. Fradin was designated to the Board by the Sponsor Designator (as such term is defined in the Investor Rights Agreement) in accordance with the Investor Rights Agreement, dated as of July 2, 2021 (as amended, the “Investor Rights Agreement”), described in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on July 12, 2021. There is no arrangement or understanding between Messrs. Hayes, Lopes or Schriesheim and any other person pursuant to which any of them was selected as a director.

Additionally, on February 13, 2025, the Board, upon recommendation of the Compensation Committee, approved revisions to the compensation program for non-employee directors (as revised, the “Director Compensation Program”). Pursuant to the Director Compensation Program, eligible directors (including Messrs. Hayes, Lopes and Schriesheim) will receive an annual cash retainer of $85,000 and an annual equity retainer of $200,000, and the Chair of the Board (Mr. Fradin) will receive an annual cash retainer of $200,000 and an annual equity retainer of $300,000, in each case prorated for the applicable dates of service. Additionally, members of the Audit Committee (including Messrs. Hayes, Lopes and Schriesheim) will receive an additional annual cash retainer of $15,000 and members of the Compensation Committee (including Messrs. Hayes and Schriesheim) and of the Nominating and Corporate Governance Committee (including Mr. Lopes) will receive an additional annual cash retainer of $10,000. The Director Compensation Program will apply to Messrs. Fradin, Hayes, Lopes and Schriesheim as of the Effective Date and will become effective for continuing directors on April 1, 2025. In connection with his appointment as Chair of the Board, Mr. Fradin will also receive an additional grant of restricted stock units having a value of $500,000.

Item 7.01 Regulation FD Disclosure.

On February 20, 2025, the Company issued a press release announcing the foregoing director appointments and resignations, a copy of which is attached as Exhibit 99.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | ALIGHT, INC. |

| | | |

| Date: | February 20, 2025 | By: | /s/ Martin Felli |

| | | Martin Felli, Chief Legal Officer and Corporate Secretary |

Alight Announces Board Leadership Transition

— William P. Foley, II, to step down as Chairman, will continue to serve as board member —

— Industry-veteran Russell P. Fradin appointed Chairman of the Board —

— Robert Schriesheim, Robert Lopes, Jr. and Mike Hayes named to Board of Directors —

Chicago, Ill., February 20, 2025—Alight, Inc. (NYSE: ALIT or the “Company”), a leading cloud-based human capital and technology-enabled services provider, today announced that its Board of Directors (the “Board”) appointed Russell (Russ) P. Fradin as its Chairman of the Board of Directors, succeeding William P. Foley, II, who will continue to serve as a board member, effective March 1, 2025.

In addition, Robert (Rob) Schriesheim, Robert (Bob) Lopes, Jr., and Mike Hayes have been appointed to the Company’s Board of Directors, replacing Erika Meinhardt, Regina Paolillo and Dan Henson who have each chosen to step down, also effective as of March 1, 2025. Mr. Schriesheim will serve on the Audit and Compensation committees of the Board, Mr. Lopes will serve on the Audit and Nominating and Corporate Governance committees of the Board and Mr. Hayes will serve on the Audit and Compensation committees of the Board.

"I would like to share my deep appreciation for Erika, Regina and Dan, who have been a tremendous asset to our Board of Directors, guiding Alight through its early evolution as a public company,” said Dave Guilmette, CEO of Alight. "I am equally grateful to have Bill’s continued presence coupled with Russ, Rob, Bob, and Mike joining our Board, providing unique expertise that supports our next phase of growth and our client-centric work of building a healthy and financially secure workforce.”

“It has been a privilege to serve as Alight’s Chairman during such a critical chapter that included Alight entering the public markets, executing its technology transformation and divesting its Payroll and Professional Services business,” said William P. Foley, II. “These numerous milestones have positioned Alight for a bright future and I remain a champion of their cause and mission. With his highly relevant industry expertise, Russ is an outstanding choice to succeed me as Chairman, and I look forward to working with him, Dave, and the rest of the Alight Board as the Company continues to execute its strategy. There is a significant value creation opportunity ahead for Alight, and I am confident its leaders have the tools and positioning to deliver profitable growth and robust cash flow. As a result, I intend to remain a meaningful shareholder.”

“It is truly an honor to be appointed as Alight’s Chairman of the Board, overseeing the team that every day supports 35 million people and many of the world’s most prestigious organizations,” said incoming Chairman of the Board Russell P. Fradin. “I have known the power and impact of Alight in various capacities throughout my career and believe the Company is uniquely positioned to guide the benefits industry forward and capitalize on its recent transformation. I want to thank Bill for his leadership and vision and look forward to working closely with him, Dave and the rest of the Board to deliver best-in-class services and unmatched value to our stakeholders."

Alight worked closely with Starboard Value, LP (“Starboard”), the Company’s largest shareholder, on the appointment of the new directors. Peter Feld, Managing Member, Portfolio Manager and Head of Research of Starboard said, “We appreciate the constructive engagement we have had with Alight over the last year. We welcomed the opportunity to work with Alight on these changes to the Board of Directors, which position the Company well for future success. We continue to believe there is a significant opportunity to improve revenue growth, profitability, and free cash flow generation at Alight, and we look forward to seeing the Company realize the benefits of new leadership and improved Board oversight.”

These changes satisfy Alight’s remaining obligations under its May 2024 Cooperation Agreement with Starboard.

Russell P. Fradin

Mr. Fradin joined CD&R in 2016. He played the lead operating role in the Firm’s investments in Capco, Sirius and TRANZACT, serving as chairman until CD&R’s exit. He served as president and CEO at SunGard Data Systems, a $3 billion software and IT services provider with 15,000 customers across more than 70 countries from 2011 until the company’s acquisition by FIS in 2015. Prior to SunGard, he served as the chairman and CEO of Aon Hewitt, a global leader in human resource solutions. During his tenure, Mr. Fradin oversaw the 2010 merger between Aon

Consulting and Hewitt Associates, having been CEO of Hewitt since 2006. Previously, he was CEO of BISYS Group, Inc. and held a range of senior executive positions at Automatic Data Processing, both providers of business outsourcing solutions. He worked many years as a management consultant at McKinsey & Company, where he was a senior partner. Mr. Fradin has been an experienced Board and Advisory Committee member of several public and private companies over the years. Mr. Fradin has an M.B.A. from Harvard Business School and a B.S. in economics and finance from The Wharton School of the University of Pennsylvania.

Robert Schriesheim

Rob is chairman of Truax Partners LLC and leads large, complex transformations in partnership with Boards, CEOs and institutional investors as an investor and director. He has served on 12 public boards ranging from under $1 billion in revenue to Fortune 500, including as chairman, and has served as CFO of 4 public companies varying in revenue from $1 billion to $40 billion.

From 2019 to 2021 he served in a full-time capacity as chairman of the finance committee of telecom services provider Frontier Communications leading its transformation and chapter 11 reorganization to restructure $17.5 billion in debt creating $5 billion in stakeholder value. Previously, he was EVP and Chief Financial Officer of Sears Holdings, a broad-based retailer, from 2011 until 2016; SVP and Chief Financial Officer of Hewitt Associates (Alight’s predecessor company), a global human resource consulting and outsourcing company, until its acquisition by Aon in 2010. From 2006 to 2009, he was EVP, Chief Financial Officer and a board director of Lawson Software a publicly traded global ERP software provider until its acquisition by Golden Gate Capital/Infor in 2010.

Rob is a director of publicly traded Houlihan Lokey (“HLI”), a global investment bank, where he serves as the lead independent director and chairman of the audit committee; Indivior PLC a pharmaceutical company where he serves as a member of the Nominating and Governance Committee; and of Skyworks Solutions (“SWKS”), an S&P 500 semiconductor company, serving on the audit and compensation committees. In addition, he is an adjunct associate professor of finance focused in the area of Corporate Board Governance and Activism at The University of Chicago Booth School of Business. Previously, Rob was a director of numerous public companies including NII Holdings, formerly Nextel International (acquired by América Móvil S.A.B. de C.V.), Forest City Realty Trust (acquired by Brookfield Asset Management), Co-Chairman MSC Software (acquired by Symphony Technology Group and Elliott Associates) and Dobson Communications (acquired by ATT).

Rob received an AB in Chemistry from Princeton University and an MBA from the University of Chicago Booth School of Business with concentrations in business economics and finance.

Robert Lopes, Jr.

Bob Lopes is well known in the HR outsourcing and HR/Staffing Services Industry. His extensive experience in reorganizing and scaling operations resulted in profitable growth for multiple companies approaching $1 billion in revenues. Bob’s versatility is shown over his career where he has held multiple executive roles within the same company both focused on strategic growth and business efficiency. In addition to Bob’s executive management responsibilities at Randstad, he has been active in the due diligence of acquisition targets, a member of the Executive Diversity Council, and executive supporter of Business Resource Groups (BRGs). Bob assumed the CHRO role for Randstad North America after the COVID outbreak to help guide the businesses and 90,000+ employees through significant change. Prior to Randstad, Bob ran and also served as board member for a privately-held healthcare technology company that was acquired by one of his former employers. At Fidelity, Bob was CEO of Veritude, a HR services and staffing company. At the same time, he was a Managing Director for the holding company (Fidelity Capital). In this role, Bob was responsible for a portfolio that included several Fidelity Capital Companies, including BostonCoach (limousine service), Seaport Companies (including Seaport Hotel), Sebastians (retail café chain), and Veritude (staffing/RPO). Prior to Fidelity, Bob was the Global Managing partner for all of Towers Perrin’s HR & benefits outsourcing businesses where he was responsible for operations in North America and Europe; Bob was a leader in the sale of this business to EDS. Bob’s versatility in both technology and HR services is a common thread throughout his career.

Bob holds a business degree from the University of Notre Dame. He resides in the Asheville, North Carolina area.

Mike Hayes

Mike Hayes is Managing Director, Insight Partners, a global software investment firm with over $90B regulatory assets under management as of September 30, 2024, and 800+ portfolio companies across every stage of growth. Prior to Insight, Mike was Chief Operating Officer at VMware, where he led the company's worldwide business operations, their SaaS transition, and the successful acquisition into Broadcom for $94B. Before that, Mike served as Senior Vice President and Head of Strategic Operations for Cognizant Technologies, where he ran a $2B P&L for Cognizant’s global financial services clients. Mike previously spent four years at Bridgewater Associates, an investment management firm, where he served in Chief of Staff to CEO and COO roles.

Prior to Bridgewater, he spent 20 years in the U.S. Navy SEALs where his career began as one of 19 graduates from a class of 120. Mike served throughout South America, Europe, the Middle East, and Central Asia, including the conflicts in Bosnia, Kosovo, Iraq, and Afghanistan. His last job in the Navy was the Commanding Officer of SEAL Team TWO, which included ten months as the Commander of a 2,000 person Special Operations Task Force in southeastern Afghanistan. Before that, Mike was selected as a White House Fellow ('08/'09) and served two years as Director, Defense Policy and Strategy at the National Security Council. In the Bush Administration, Mike was responsible for the START Treaty, where he produced a new proposed START Treaty and flew to Russia for negotiations. In the Obama administration, he led the White House response to President Obama's first major foreign policy showdown - the hijacking of the Maersk Alabama off the coast of Somalia. Prior to the White House Fellowship, Mike served as the Deputy Commander for all Special Operations in Anbar Province, Iraq. Mike holds an M.A. in Public Policy from Harvard's Kennedy School and received his B.A. from Holy Cross College, where he was an active Big Brother. His military decorations include the Bronze Star for valor in combat in Iraq, a Bronze Star for Afghanistan, and the Defense Superior Service Medal from the White House. Mike is the author of best-seller “Never Enough: A Navy SEAL Commander on Living a Life of Excellence, Agility, and Meaning" and donates all profits to a 501c3 he started that pays off mortgages for Gold Star widows and children.

Mike serves on the board of Immuta, a data governance company, and is the founding board member of the National Medal of Honor Museum. Mike is a lifetime member of the Council on Foreign Relations, is fluent in German and Spanish, frequently speaks about leadership and elite organizations, and enjoys mentoring others to success. He is a life-long Sox/Pats fan, but most enjoys laughing with his wife, Anita, and their 23-year old daughter, Maeson.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements regarding our board transition plans and the impact on our business. In some cases, these forward-looking statements can be identified by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties including, among others, risks described under the section entitled “Risk Factors” of Alight’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 29, 2024, and in the Quarterly Reports on Form 10-Q filed with the SEC on May 8, 2024 and on November 12, 2024, as such factors may be updated from time to time in Alight's filings with the SEC, which are, or will be, accessible on the SEC's website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be considered along with other factors noted in this presentation and in Alight’s filings with the SEC. Alight undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

About Alight Solutions

Alight is a leading cloud-based human capital technology and services provider for many of the world’s largest organizations and over 35 million people and dependents. Through the administration of employee benefits, Alight helps clients gain a benefits advantage while building a healthy and financially secure workforce by unifying the

benefits ecosystem across health, wealth, wellbeing, absence management and navigation. Our Alight Worklife® platform empowers employers to gain a deeper understanding of their workforce and engage them throughout life’s most important moments with personalized benefits management and data-driven insights, leading to increased employee wellbeing, engagement and productivity. Learn more about the Alight Benefits Advantage™ at alight.com.

Investor Contact:

Jeremy Cohen

Investor.Relations@alight.com

Media Contacts:

Mariana Fischbach

Mariana.Fischbach@alight.com

v3.25.0.1

Document And Entity Information

|

Feb. 20, 2025 |

| Cover [Abstract] |

|

| Document Period End Date |

Feb. 20, 2025

|

| Document Type |

8-K

|

| Entity Registrant Name |

Alight, Inc. / Delaware

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39299

|

| Entity Tax Identification Number |

86-1849232

|

| Entity Address, Address Line One |

320 South Canal Street,

|

| Entity Address, Address Line Two |

50th Floor, Suite 5000

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60606

|

| City Area Code |

(224)

|

| Local Phone Number |

737-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ALIT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001809104

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

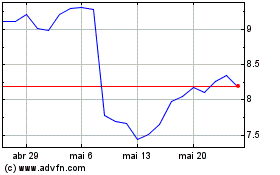

Alight (NYSE:ALIT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Alight (NYSE:ALIT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025