0001809104FALSEAlight, Inc. / Delaware00018091042025-02-202025-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________________

FORM 8-K

__________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2025

__________________________________________

Alight, Inc.

(Exact name of Registrant as Specified in Its Charter)

__________________________________________

| | | | | | | | |

| Delaware | 001-39299 | 86-1849232 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

320 South Canal Street, | | |

50th Floor, Suite 5000, Chicago, IL | | 60606 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (224)737-7000

(Former Name or Former Address, if Changed Since Last Report)

__________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | ALIT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 20, 2025, Alight, Inc. ("Alight" or the “Company”) issued a press release announcing its financial results for the fourth quarter and fiscal year ended December 31, 2024. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”) and is incorporated herein by reference.

The information contained in Item 2.02 of this Report, including Exhibit 99.1 hereto, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” with the Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section and will not be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | ALIGHT, INC. |

| | | |

| Date: | February 20, 2025 | By: | /s/ Martin Felli |

| | | Martin Felli, Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

Alight Reports Fourth Quarter and Full Year 2024 Results

– Fourth quarter revenue of $680 million –

– ARR bookings growth of 18% to $114 million in 2024 –

– Increased stock repurchase program by $200 million –

– Announces Board of Directors leadership transition –

– Introduces 2025 outlook with improved revenue growth rate, profit margins and cash flow –

CHICAGO, IL – February 20, 2025 – Alight, Inc. (NYSE: ALIT), a leading cloud-based human capital and technology-enabled services provider, today reported results for the fourth quarter and full year ended December 31, 2024.

“Alight concluded a transformative year on a strong note, with fourth quarter results that met expectations and included recurring revenue expansion and strong cash flow,” said CEO Dave Guilmette. “We enter 2025 as a market-leading, technology-enabled services provider with a simplified foundation and an enviable client roster. With our multi-year technology modernization now complete and a strong leadership team in place, we expect 2025 will be a transitional year focused on execution and steady progress across the key financial measures that drive profitable growth and attractive cash flow.”

Presentation of Results

Beginning with the quarter ended March 31, 2024, the Company began accounting for the assets, liabilities and operating results of the Payroll & Professional Services business as discontinued operations. As such, the financial information contained in this release is presented on a continuing operations basis, unless otherwise noted. The Payroll & Professional Services business transaction closed on July 12, 2024.

Fourth Quarter 2024 Highlights (all comparisons are relative to fourth quarter 2023)

•Revenue decreased 0.3% to $680 million

•Business Process as a Service (BPaaS) revenue grew 9.8% to $146 million, representing 21.5% of total revenue

•Gross profit of $271 million and gross profit margin of 39.9%, compared to $270 million and 39.6% in the prior year period, respectively, and adjusted gross profit of $300 million and adjusted gross profit margin of 44.1%, compared to $297 million and 43.5% in the prior year period, respectively

•Net income of $29 million compared to the prior year period net loss of $121 million

•Adjusted EBITDA of $217 million compared to the prior year period of $206 million

•Diluted earnings (loss) per share of $0.05 compared to $(0.23) in the prior year period, and adjusted diluted earnings per share of $0.24 compared to $0.13 per share in the prior year period

•New wins or expanded relationships with companies including Fortune Brands Innovations and Agilis Partners

•Repurchased $12 million of common stock under existing share repurchase program

•Declared and paid a $0.04 per share dividend

Full Year 2024 Highlights (all comparisons are relative to full year 2023)

•Revenue decreased 2.3% to $2,332 million

•Business Process as a Service (BPaaS) revenue grew 15.0% to $499 million, representing 21.4% of total revenue

•Gross profit of $794 million and gross profit margin of 34.0%, compared to $810 million and 33.9% in the prior year period, respectively, and adjusted gross profit of $904 million and adjusted gross profit margin of 38.8%, compared to $912 million and 38.2% in the prior year period, respectively

•Net loss of $140 million compared to the prior year period net loss of $317 million

•Adjusted EBITDA of $556 million compared to the prior year period of $537 million

•Diluted earnings (loss) per share of $(0.25) compared to $(0.61) in the prior year period, and adjusted diluted earnings per share of $0.48 compared to $0.43 per share in the prior year period

•Repurchased $167 million of common stock under existing share repurchase program

•Initiated dividend program with first payment in the fourth quarter

Fourth Quarter 2024 Results

Revenue decreased 0.3% to $680 million, as compared to $682 million in the prior year period. The change was due to lower project revenue, partially offset by higher net commercial activity. Recurring revenues were 90.7% of total revenue.

Gross profit was $271 million, or 39.9% of revenue, compared to $270 million, or 39.6% of revenue in the prior year period. The increase in gross profit was primarily driven by productivity savings.

Selling, general and administrative expenses improved $3 million when compared to the prior year period. This was due to a reduction in compensation expenses primarily related to non-cash share-based awards, partially offset by restructuring costs and higher professional fees incurred related to the sale and separation of the Payroll & Professional Services business.

Interest expense of $20 million improved $11 million from the prior year period. Interest expense benefited from the repricing of the 2028 term loan and the $740 million debt pay down in the third quarter.

The Company’s income from continuing operations before income tax expense was $55 million compared to loss from continuing operations before income tax expense of $96 million in the prior year period. The improvement was primarily attributable to lower interest expense as a result of the debt pay down, other income recorded in conjunction with the transition services agreement entered into with the purchaser of the divested Payroll & Professional Services business and by the non-operating fair value remeasurements of financial instruments and the tax receivable agreement.

Full Year 2024 Results

Revenue decreased 2.3% to $2,332 million, as compared to $2,386 million in the prior year period. The change was due to lower volumes, net commercial activity and project revenue, in addition to the wind-down of the Hosted business operations. Excluding the exited Hosted business, revenue decreased 1.2%. Recurring revenues were 91.6% of total revenue.

Gross profit was $794 million, or 34.0% of revenue, compared to $810 million, or 33.9% of revenue in the prior year period. The decrease in gross profit was primarily driven by lower revenue as noted above, partially offset by productivity savings.

Selling, general and administrative expenses improved $5 million when compared to the prior year period. The change was due to reduced compensation expenses primarily related to non-cash share-based awards and lower restructuring costs, partially offset by higher professional fees incurred related to the sale and separation of the Payroll & Professional Services business.

Interest expense of $103 million improved $28 million from the prior year period. Interest expense benefited from the repricing of the 2028 term loan and the $740 million debt pay down in the third quarter.

The Company’s loss from continuing operations before income tax benefit was $148 million compared to loss from continuing operations before income tax benefit of $337 million in the prior year period. The improvement was primarily attributable to lower interest expense as a result of the debt pay down and other income recorded in conjunction with the transition services agreement entered into with the purchaser of the divested Payroll & Professional Services business and by the non-operating fair value remeasurements of financial instruments and the tax receivable agreement.

Balance Sheet Highlights

As of December 31, 2024, the Company’s cash and cash equivalents balance was $343 million, total debt was $2,025 million and total debt net of cash and cash equivalents was $1,682 million.

Subsequent Events

Complementing its existing stock repurchase program, the Company’s Board of Directors has authorized the repurchase of up to an additional $200 million of the Company’s Class A common stock, providing a total amount authorized for repurchase of $281 million after giving effect to the increase. Repurchases may be conducted through open market purchases or privately negotiated transactions in compliance with Rule 10b-18 under the Securities Exchange Act of 1934, as amended, including pursuant to Rule 10b5-1 trading plans. The actual timing and amount of future repurchases are subject to business and market conditions, corporate and regulatory requirements, stock price, acquisition opportunities and other factors. The stock repurchase program does not obligate Alight to acquire any amount of common stock, and the program may be suspended or terminated at any time by Alight at its discretion without prior notice.

Business Outlook

"2025 revenue is impacted by the lagging effect of contract losses from 2023 and early 2024,” continued Guilmette. “Absent these historical losses, our revenue growth rate would be over two points higher in 2025. Our operating trends today are vastly improved with full-year 2024 retention rates up 8 points compared to the prior year and that will play through favorably for revenue later this year and into next year. Coupled with strong bookings growth and visibility into contracted go-lives, we expect to see revenue growth in the second half and moving forward. We plan to share more detail of our long-range plan during our investor day, scheduled for March 20th, 2025.”

The Company's 2025 outlook includes:

•Revenue of $2,318 million to $2,388 million.

•Adjusted EBITDA of $620 million to $645 million.

•Adjusted diluted EPS of $0.58 to $0.64.

•Free cash flow of $250 million to $285 million.

Reconciliations of the historical financial measures used in this press release that are not recognized under U.S. generally accepted accounting principles ("GAAP") are included below. Because GAAP financial measures on a forward-looking basis are not accessible, and reconciling information is not

available without unreasonable effort, we have not provided reconciliations for forward-looking non-GAAP measures. For the same reasons, we are unable to address the probable significance of the unavailable information, which could be material to future results.

Earnings Conference Call and Webcast Information

A conference call to discuss the Company’s fourth quarter and full year 2024 financial results is scheduled for today, February 20, 2025 at 7:30 a.m. Central Time (8:30 a.m. Eastern Time). Interested parties can access the live webcast and accompanying presentation materials by logging on to the Investor Relations section on the Company’s website at http://investor.alight.com. A replay of the conference call and the accompanying presentation materials will be available on the investor relations website for approximately 90 days.

About Alight Solutions

Alight is a leading cloud-based human capital technology and services provider for many of the world’s largest organizations and over 35 million people and dependents. Through the administration of employee benefits, Alight helps clients gain a benefits advantage while building a healthy and financially secure workforce by unifying the benefits ecosystem across health, wealth, wellbeing, absence management and navigation. Our Alight Worklife® platform empowers employers to gain a deeper understanding of their workforce and engage them throughout life’s most important moments with personalized benefits management and data-driven insights, leading to increased employee wellbeing, engagement and productivity. Learn more about the Alight Benefits Advantage™ at alight.com.

Contacts

Investors:

Jeremy Cohen

investor.relations@alight.com

Media:

Mariana Fischbach

mariana.fischbach@alight.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our expected revenue under contract and ARR bookings, statements related to our ability to execute on our strategy, statements regarding our ability to enhance shareholder value, statements regarding our expected quarterly dividend and stock repurchase programs, and statements related to the expectations regarding the performance and outlook for Alight’s business, financial results, liquidity and capital resources, including statements in the "Business Outlook" section of this press release. In some cases, these forward-looking statements can be identified by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “would,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties including, among others, risks related to declines in economic activity in the industries, markets, and regions our clients serve, including as a result of changes in monetary and fiscal policies, competition in our industry, risks related to our ability to successfully separate our Payroll and Professional Services business, risks related to the performance of our information technology systems and networks, risks related to our ability to maintain the security and privacy of confidential and proprietary information, risks related to actions or proposals from activist stockholders, risks related to the use of certain operational measures that may not have standard

definitions, and risks related to changes in regulation, including developments on the use of artificial intelligence and machine learning. Additional factors that could cause Alight’s results to differ materially from those described in the forward-looking statements can be found under the section entitled “Risk Factors” of Alight’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the "SEC") on February 29, 2024 and in the Quarterly Report on Form 10-Q filed with the SEC on May 8, 2024 and on November 12, 2024, as such factors may be updated from time to time in Alight's filings with the SEC, which are, or will be, accessible on the SEC's website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be considered along with other factors noted in this presentation and in Alight’s filings with the SEC. Alight undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Non-GAAP Financial Measures and Other Information

The Company refers to certain non-GAAP financial measures in this press release, including: Adjusted EBITDA From Continuing Operations, Adjusted EBITDA Margin From Continuing Operations, Adjusted Net Income From Continuing Operations, Adjusted Diluted Earnings Per Share From Continuing Operations, Free Cash Flow, Adjusted Gross Profit and Adjusted Gross Profit Margin. Please see below for additional information and for reconciliations of such non-GAAP financial measures. The presentation of non-GAAP financial measures is used to enhance our investors’ and lenders’ understanding of certain aspects of our financial performance. This discussion is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with GAAP.

Adjusted EBITDA From Continuing Operations, which is defined as earnings from continuing operations before interest, taxes, depreciation and intangible amortization adjusted for the impact of certain non-cash and other items that we do not consider in the evaluation of ongoing operational performance. Adjusted EBITDA Margin From Continuing Operations is defined as Adjusted EBITDA From Continuing Operations divided by revenue. Both Adjusted EBITDA From Continuing Operations and Adjusted EBITDA Margin From Continuing Operations are non-GAAP financial measures used by management and our stakeholders to provide useful supplemental information that enables a better comparison of our performance across periods as well as to evaluate our core operating performance.

Adjusted Net Income From Continuing Operations, which is defined as net income (loss) from continuing operations adjusted for intangible amortization and the impact of certain non-cash items that we do not consider in the evaluation of ongoing operational performance, is a non-GAAP financial measure used solely for the purpose of calculating Adjusted Diluted Earnings Per Share From Continuing Operations.

Adjusted Diluted Earnings Per Share From Continuing Operations is defined as Adjusted Net Income From Continuing Operations divided by the adjusted weighted-average number of shares of Alight Inc. common stock, diluted. Adjusted Diluted Earnings Per Share From Continuing Operations is used by us and our investors to evaluate our core operating performance and to benchmark our operating performance against our competitors.

Free Cash Flow is defined as cash provided by operating activities net of capital expenditures.

Adjusted Gross Profit is defined as revenue less cost of services adjusted for depreciation, amortization and share-based compensation, and Adjusted Gross Profit Margin is defined as Adjusted Gross Profit divided by revenue. Management uses Adjusted Gross Profit and Adjusted Gross Profit Margin as key measures in making financial, operating and planning decisions and in evaluating our performance. We believe that presenting Adjusted Gross Profit and Adjusted Gross Profit Margin is useful to investors as it eliminates the impact of certain non-cash expenses and allows a direct comparison between periods.

ARR bookings is an operational metric that represents management’s estimate of new long-term agreements closed in the period referenced. This metric does not reflect potential future events such as unexpected client volume fluctuations, early contract terminations or early contract renewals. Our metric may differ from similar terms used by other companies and therefore comparability may be limited.

Condensed Consolidated Statements of Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| (in millions, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 680 | | | $ | 682 | | | $ | 2,332 | | | $ | 2,386 | |

| Cost of services, exclusive of depreciation and amortization | 383 | | | 394 | | | 1,442 | | | 1,504 | |

| Depreciation and amortization | 26 | | | 18 | | | 96 | | | 72 | |

| Gross Profit | 271 | | | 270 | | | 794 | | | 810 | |

| | | | | | | |

| Operating Expenses | | | | | | | |

| Selling, general and administrative | 151 | | | 154 | | | 585 | | | 590 | |

| Depreciation and intangible amortization | 76 | | | 76 | | | 299 | | | 301 | |

| Total Operating expenses | 227 | | | 230 | | | 884 | | | 891 | |

| Operating Income (Loss) From Continuing Operations | 44 | | | 40 | | | (90) | | | (81) | |

| Other (Income) Expense | | | | | | | |

| (Gain) Loss from change in fair value of financial instruments | (3) | | | 21 | | | (57) | | | 10 | |

| (Gain) Loss from change in fair value of tax receivable agreement | (17) | | | 88 | | | 34 | | | 118 | |

| Interest expense | 20 | | | 31 | | | 103 | | | 131 | |

| Other (income) expense, net | (11) | | | (4) | | | (22) | | | (3) | |

| Total Other (income) expense, net | (11) | | | 136 | | | 58 | | | 256 | |

| Income (Loss) From Continuing Operations Before Taxes | 55 | | | (96) | | | (148) | | | (337) | |

| Income tax expense (benefit) | 26 | | | 25 | | | (8) | | | (20) | |

| Net Income (Loss) From Continuing Operations | 29 | | | (121) | | | (140) | | | (317) | |

| Net Income (Loss) From Discontinued Operations, Net of Tax | (21) | | | (49) | | | (19) | | | (45) | |

| Net Income (Loss) | 8 | | | (170) | | | (159) | | | (362) | |

| Net income (loss) attributable to noncontrolling interests | — | | | (8) | | | (2) | | | (17) | |

| Net Income (Loss) Attributable to Alight, Inc. | $ | 8 | | | $ | (162) | | | $ | (157) | | | $ | (345) | |

| | | | | | | |

| Earnings (Loss) Per Share | | | | | | | |

| Basic and Diluted | | | | | | | |

| Continuing operations | $ | 0.05 | | | $ | (0.23) | | | $ | (0.25) | | | $ | (0.61) | |

| Discontinued operations | $ | (0.04) | | | $ | (0.10) | | | $ | (0.04) | | | $ | (0.09) | |

| Net Income (Loss) | $ | 0.01 | | | $ | (0.33) | | | $ | (0.29) | | | $ | (0.70) | |

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| | December 31,

2024 | | December 31,

2023 |

| (in millions, except par values) | | | |

| Assets | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 343 | | | $ | 324 | |

| Receivables, net | 471 | | | 435 | |

| Other current assets | 214 | | | 260 | |

| Fiduciary assets | 239 | | | 234 | |

| Current assets of discontinued operations | — | | | 1,523 | |

| Total Current Assets | 1,267 | | | 2,776 | |

| Goodwill | 3,212 | | | 3,212 | |

| Intangible assets, net | 2,855 | | | 3,136 | |

| Fixed assets, net | 396 | | | 331 | |

| Deferred tax assets, net | 41 | | | 38 | |

| Other assets | 422 | | | 341 | |

| Long-term assets of discontinued operations | — | | | 948 | |

| Total Assets | $ | 8,193 | | | $ | 10,782 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Liabilities | | | |

| Current Liabilities | | | |

| Accounts payable and accrued liabilities | $ | 355 | | | $ | 325 | |

| Current portion of long-term debt, net | 25 | | | 25 | |

| Other current liabilities | 273 | | | 233 | |

| Fiduciary liabilities | 239 | | | 234 | |

| Current liabilities of discontinued operations | — | | | 1,370 | |

| Total Current Liabilities | 892 | | | 2,187 | |

| Deferred tax liabilities | 22 | | | 32 | |

| Long-term debt, net | 2,000 | | | 2,769 | |

| Long-term tax receivable agreement | 757 | | | 733 | |

| Financial instruments | 51 | | | 109 | |

| Other liabilities | 158 | | | 142 | |

| Long-term liabilities of discontinued operations | — | | | 68 | |

| Total Liabilities | $ | 3,880 | | | $ | 6,040 | |

| Commitments and Contingencies | | | |

| Stockholders' Equity | | | |

Preferred stock at $0.0001 par value: 1.0 shares authorized, none issued and outstanding | $ | — | | | $ | — | |

Class A Common Stock: $0.0001 par value, 1,000.0 shares authorized; 560.5 and 517.3 shares issued, and 531.7 and 510.9 shares outstanding as of December 31, 2024 and December 31, 2023, respectively | — | | | — | |

Class B Common Stock: $0.0001 par value, 20.0 shares authorized; 10.0 and 9.9 issued and outstanding as of December 31, 2024 and December 31, 2023, respectively | — | | | — | |

Class V Common Stock: $0.0001 par value, 175.0 shares authorized; 0.5 and 29.0 issued and outstanding as of December 31, 2024 and December 31, 2023, respectively | — | | | — | |

Class Z Common Stock: $0.0001 par value, 12.9 shares authorized; 0.0 and 3.4 issued and outstanding as of December 31, 2024 and December 31, 2023, respectively | — | | | — | |

Treasury stock, at cost (28.8 and 6.4 shares at December 31, 2024 and December 31, 2023, respectively) | (219) | | | (52) | |

| Additional paid-in-capital | 5,141 | | | 4,946 | |

| Retained deficit | (660) | | | (503) | |

| Accumulated other comprehensive income | 47 | | | 71 | |

| Total Alight, Inc. Stockholders' Equity | $ | 4,309 | | | $ | 4,462 | |

| Noncontrolling interest | 4 | | | 280 | |

| Total Stockholders' Equity | $ | 4,313 | | | $ | 4,742 | |

| Total Liabilities and Stockholders' Equity | $ | 8,193 | | | $ | 10,782 | |

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| | Year Ended December 31, |

| (in millions) | 2024 | | 2023 |

| Operating activities: | | | |

| Net Income (Loss) From Continuing Operations | $ | (140) | | | $ | (317) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation | 115 | | | 92 | |

| Intangible asset amortization | 280 | | | 281 | |

| Noncash lease expense | 11 | | | 13 | |

| Financing fee and premium amortization | — | | | (2) | |

| Share-based compensation expense | 76 | | | 139 | |

| (Gain) loss from change in fair value of financial instruments | (57) | | | 10 | |

| (Gain) loss from change in fair value of tax receivable agreement | 34 | | | 118 | |

| Release of unrecognized tax provision | (1) | | | (1) | |

| Deferred tax expense (benefit) | (19) | | | (9) | |

| Other | (1) | | | 2 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (37) | | | (20) | |

| Accounts payable and accrued liabilities | 31 | | | (61) | |

| Other assets and liabilities | (99) | | | 2 | |

| Cash provided by operating activities - continuing operations | 193 | | | 247 | |

| Cash provided by operating activities - discontinued operations | 59 | | | 139 | |

| Net cash provided by operating activities | $ | 252 | | | $ | 386 | |

| Investing activities: | | | |

| Net proceeds from sale of business | 968 | | | — | |

| Acquisition of businesses, net of cash acquired | — | | | 1 | |

| Capital expenditures | (121) | | | (140) | |

| Cash provided by (used in) investing activities - continuing operations | 847 | | | (139) | |

| Cash used in investing activities - discontinued operations | (11) | | | (20) | |

| Net cash provided by (used in) investing activities | $ | 836 | | | $ | (159) | |

| Financing activities: | | | |

| Dividend payments | (21) | | | — | |

| Net increase (decrease) in fiduciary liabilities | 5 | | | (21) | |

| Repayments to banks | (765) | | | (25) | |

| Principal payments on finance lease obligations | (27) | | | (25) | |

| Payments on tax receivable agreements | (62) | | | (7) | |

| Tax payment for shares/units withheld in lieu of taxes | (59) | | | (16) | |

| Deferred and contingent consideration payments | — | | | (9) | |

| Repurchase of shares | (167) | | | (40) | |

| Other financing activities | — | | | (1) | |

| Cash used for financing activities - continuing operations | (1,096) | | | (144) | |

| Cash provided by (used in) financing activities - discontinued operations | 22 | | | (87) | |

| Net Cash provided by (used in) financing activities | $ | (1,074) | | | $ | (231) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash - continuing operations | 1 | | | — | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash - discontinued operations | (3) | | | 4 | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 12 | | | — | |

| Cash, cash equivalents and restricted cash balances from: | | | |

| Continuing operations - beginning of year | $ | 558 | | | $ | 482 | |

Discontinued operations - beginning of year(a) | 1,201 | | | 1,277 | |

Less discontinued operations - end of period(a) | — | | | 1,201 | |

| Less fiduciary cash transferred with sale of business | 1,189 | | | — | |

| Continuing operations - end of period | $ | 582 | | | $ | 558 | |

(a)Reported as discontinued operations on our consolidated balance sheets. | | | |

Reconciliation of Net Income (Loss) From Continuing Operations to Adjusted EBITDA from Continuing Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| (in millions) | 2024 | | 2023 | | 2024 | | 2023 |

Net Income (Loss) From Continuing Operations (1) | $ | 29 | | | $ | (121) | | | $ | (140) | | | $ | (317) | |

| Interest expense | 20 | | | 31 | | | 103 | | | 131 | |

| Income tax expense (benefit) | 26 | | | 25 | | | (8) | | | (20) | |

| Depreciation | 32 | | | 23 | | | 115 | | | 92 | |

| Intangible amortization | 70 | | | 71 | | | 280 | | | 281 | |

| EBITDA From Continuing Operations | 177 | | | 29 | | | 350 | | | 167 | |

| Share-based compensation | 17 | | | 46 | | | 76 | | | 139 | |

Transaction and integration expenses (2) | 25 | | | 13 | | | 82 | | | 29 | |

| Restructuring | 18 | | | 10 | | | 63 | | | 73 | |

| (Gain) Loss from change in fair value of financial instruments | (3) | | | 21 | | | (57) | | | 10 | |

| (Gain) Loss from change in fair value of tax receivable agreement | (17) | | | 88 | | | 34 | | | 118 | |

| Other | — | | | (1) | | | 8 | | | 1 | |

| Adjusted EBITDA From Continuing Operations | $ | 217 | | | $ | 206 | | | $ | 556 | | | $ | 537 | |

| Revenue | $ | 680 | | | $ | 682 | | | $2,332 | | $2,386 |

Adjusted EBITDA Margin From Continuing Operations (3) | 31.9 | % | | 30.2 | % | | 23.8 | % | | 22.5 | % |

(1)Adjusted EBITDA excludes the impact of discontinued operations. Comparable periods have been recast to exclude these impacts.

(2)Transaction and integration expenses primarily relate to acquisition and divestiture activities.

(3)Adjusted EBITDA Margin From Continuing Operations is defined as Adjusted EBITDA from Continuing Operations as a percentage of revenue.

Reconciliation of Net Income (Loss) From Continuing Operations to Adjusted Net Income and Adjusted Diluted Earnings per Share From Continuing Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in millions, except share and per share amounts) | | | | | | | |

| Numerator: | | | | | | | |

Net Income (Loss) From Continuing Operations Attributable to Alight, Inc. (1) | $ | 29 | | | $ | (113) | | | $ | (138) | | | $ | (300) | |

| Conversion of noncontrolling interest | — | | | (8) | | | (2) | | | (17) | |

| Intangible amortization | 70 | | | 71 | | | 280 | | | 281 | |

| Share-based compensation | 17 | | | 46 | | | 76 | | | 139 | |

Transaction and integration expenses (2) | 25 | | | 13 | | | 82 | | | 29 | |

| Restructuring | 18 | | | 10 | | | 63 | | | 73 | |

| (Gain) Loss from change in fair value of financial instruments | (3) | | | 21 | | | (57) | | | 10 | |

| (Gain) Loss from change in fair value of tax receivable agreement | (17) | | | 88 | | | 34 | | | 118 | |

| Other | — | | | (1) | | | 8 | | | 1 | |

Tax effect of adjustments (3) | (12) | | | (54) | | | (85) | | | (100) | |

| Adjusted Net Income From Continuing Operations | $ | 127 | | | $ | 73 | | | $ | 261 | | | $ | 234 | |

| | | | | | | |

| Denominator: | | | | | | | |

| Weighted average shares outstanding - basic | 532,282,913 | | 497,702,644 | | 539,861,208 | | 489,461,259 |

| Dilutive effect of the exchange of noncontrolling interest units | 510,237 | | — | | 510,237 | | — |

| Dilutive effect of RSUs | 1,287,553 | | — | | — | | — |

| Weighted average shares outstanding - diluted | 534,080,703 | | 497,702,644 | | 540,371,445 | | 489,461,259 |

Exchange of noncontrolling interest units(4) | 28,080 | | 35,520,344 | | 518,412 | | 44,569,341 |

Impact of unvested RSUs(5) | 6,037,553 | | 10,080,390 | | 7,325,106 | | 10,080,390 |

Adjusted shares of Class A Common Stock outstanding - diluted(6)(7) | 540,146,336 | | 543,303,378 | | 548,214,963 | | 544,110,990 |

| | | | | | | |

| Basic (Net Loss) Earnings Per Share From Continuing Operations | $ | 0.05 | | | $ | (0.23) | | | $ | (0.25) | | | $ | (0.61) | |

| Diluted (Net Loss) Earnings Per Share From Continuing Operations | $ | 0.05 | | | $ | (0.23) | | | $ | (0.25) | | | $ | (0.61) | |

| Adjusted Diluted Earnings Per Share From Continuing Operations | $ | 0.24 | | | $ | 0.13 | | | $ | 0.48 | | | $ | 0.43 | |

(1)Excludes the impact of discontinued operations. Comparable periods have been recast to exclude these impacts.

(2)Transaction and integration expenses primarily relate to acquisition and divestiture activities.

(3)Income tax effects have been calculated based on the statutory tax rates for both U.S. and foreign jurisdictions based on the Company's mix of income and adjusted for significant changes in fair value measurement.

(4)Assumes the full exchange of the units held by noncontrolling interests for shares of Class A Common Stock of Alight, Inc. pursuant to the exchange agreement.

(5)Includes non-vested time-based restricted stock units that were determined to be antidilutive for U.S. GAAP diluted earnings per share purposes.

(6)Excludes two tranches of contingently issuable seller earnout shares: (i) 7.5 million shares will be issued if the Company's Class A Common Stock's volume-weighted average price ("VWAP") is >$12.50 for any 20 trading days within a consecutive period of 30 trading days; (ii) 7.5 million shares will be issued if the Company's Class A Common Stock VWAP is >$15.00 for any 20 trading days within a consecutive period of 30 trading days. Both tranches have a seven-year duration.

(7)Excludes approximately 10.9 million and 27.4 million performance-based units, which represents the gross number of shares expected to vest based on achievement of performance conditions as of December 31, 2024 and 2023, respectively.

Gross Profit to Adjusted Gross Profit Reconciliation by Segment

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2024 |

| ($ in millions) | Employer Solutions | | Other | | Total |

| Gross Profit | $ | 271 | | | $ | — | | | $ | 271 | |

| Add: stock-based compensation | 3 | | | — | | | 3 | |

| Add: depreciation and amortization | 26 | | | — | | | 26 | |

| Adjusted Gross Profit | $ | 300 | | | $ | — | | | $ | 300 | |

| Gross Profit Margin | 39.9 | % | | 0.0 | % | | 39.9 | % |

| Adjusted Gross Profit Margin | 44.1 | % | | 0.0 | % | | 44.1 | % |

| | | | | |

| Three Months Ended December 31, 2023 |

| ($ in millions) | Employer Solutions | | Other | | Total |

| Gross Profit | $ | 270 | | | $ | — | | | $ | 270 | |

| Add: stock-based compensation | 9 | | | — | | | 9 | |

| Add: depreciation and amortization | 18 | | | — | | | 18 | |

| Adjusted Gross Profit | $ | 297 | | | $ | — | | | $ | 297 | |

| Gross Profit Margin | 39.6 | % | | 0.0 | % | | 39.6 | % |

| Adjusted Gross Profit Margin | 43.5 | % | | 0.0 | % | | 43.5 | % |

| | | | | |

| Year Ended December 31, 2024 |

| ($ in millions) | Employer Solutions | | Other | | Total |

| Gross Profit | $ | 794 | | | $ | — | | | $ | 794 | |

| Add: stock-based compensation | 14 | | | — | | | 14 | |

| Add: depreciation and amortization | 96 | | | — | | | 96 | |

| Adjusted Gross Profit | $ | 904 | | | $ | — | | | $ | 904 | |

| Gross Profit Margin | 34.0 | % | | 0.0 | % | | 34.0 | % |

| Adjusted Gross Profit Margin | 38.8 | % | | 0.0 | % | | 38.8 | % |

| | | | | |

| Year Ended December 31, 2023 |

| Employer Solutions | | Other | | Total |

| Gross Profit | $ | 812 | | | $ | (2) | | | $ | 810 | |

| Add: stock-based compensation | 30 | | | — | | | 30 | |

| Add: depreciation and amortization | 70 | | | 2 | | | 72 | |

| Adjusted Gross Profit | $ | 912 | | | $ | — | | | $ | 912 | |

| Gross Profit Margin | 34.4 | % | | (7.7) | % | | 33.9 | % |

| Adjusted Gross Profit Margin | 38.6 | % | | 0.0 | % | | 38.2 | % |

Other Select Financial Data

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| ($ in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Segment Revenues | | | | | | | |

| Employer Solutions: | | | | | | | |

| Recurring | $ | 617 | | | $ | 606 | | | $ | 2,135 | | | $ | 2,141 | |

| Project | 63 | | | 76 | | | 197 | | | 219 | |

| Total Employer Solutions | 680 | | | 682 | | | 2,332 | | | 2,360 | |

Other (1) | — | | | — | | | — | | | 26 | |

| Total revenue | $ | 680 | | | $ | 682 | | | $ | 2,332 | | | $ | 2,386 | |

| | | | | | | |

| Segment Gross Profit | | | | | | | |

| Employer Solutions | $ | 271 | | | $ | 270 | | | $ | 794 | | | $ | 812 | |

| Other | — | | | — | | | — | | | (2) | |

| Total gross profit | $ | 271 | | | $ | 270 | | | $ | 794 | | | $ | 810 | |

| | | | | | | |

| Segment Gross Margin | | | | | | | |

| Employer Solutions | 39.9 | % | | 39.6 | % | | 34.0 | % | | 34.4 | % |

| Other | 0.0 | % | | 0.0 | % | | 0.0 | % | | (7.7) | % |

| Total gross margin | 39.9 | % | | 39.6 | % | | 34.0 | % | | 33.9 | % |

| | | | | | | |

| Segment Adjusted Gross Profit | | | | | | | |

| Employer Solutions | $ | 300 | | | $ | 297 | | | $ | 904 | | | $ | 912 | |

| Other | — | | | — | | | — | | | — | |

| Total adjusted gross profit | $ | 300 | | | $ | 297 | | | $ | 904 | | | $ | 912 | |

| | | | | | | |

| Segment Adjusted Gross Margin Percent | | | | | | | |

| Employer Solutions | 44.1 | % | | 43.5 | % | | 38.8 | % | | 38.6 | % |

| Other | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % |

| Total adjusted gross margin percent | 44.1 | % | | 43.5 | % | | 38.8 | % | | 38.2 | % |

| | | | | | | |

| Adjusted EBITDA From Continuing Operations | $ | 217 | | | $ | 206 | | | $ | 556 | | | $ | 537 | |

| | | | | | | |

| Cash provided by continuing operating activities | | | | | $ | 193 | | | $ | 247 | |

| | | | | | | |

| Other Key Statistics | | | | | | | |

| Recurring revenue, Ex. Other | $ | 617 | | | $ | 606 | | | $ | 2,135 | | | $ | 2,141 | |

| BPaaS revenue | $ | 146 | | | $ | 133 | | | $ | 499 | | | $ | 434 | |

| BPaaS revenue as % of total revenue | 21.5 | % | | 19.5 | % | | 21.4 | % | | 18.2 | % |

(1)Other primarily attributable to the former Hosted Segment.

v3.25.0.1

Document And Entity Information

|

Feb. 20, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 20, 2025

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39299

|

| Entity Tax Identification Number |

86-1849232

|

| Entity Address, Address Line One |

320 South Canal Street,

|

| Entity Address, Address Line Two |

50th Floor, Suite 5000

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60606

|

| City Area Code |

(224)

|

| Local Phone Number |

737-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ALIT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001809104

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Alight, Inc. / Delaware

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

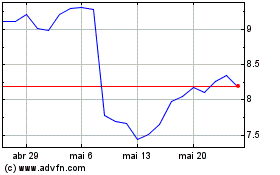

Alight (NYSE:ALIT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Alight (NYSE:ALIT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025