AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON February 26, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ASGN Incorporated

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

Delaware | 95-4023433 |

(State or other jurisdiction of incorporation or

organization) | (I.R.S. Employer Identification No.) |

4400 Cox Road, Suite 110

Glen Allen, Virginia 2360

(888) 482-8068

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Office)

Second Amendment to the Second Amended and Restated ASGN Incorporated

2012 Employment Inducement Incentive Award Plan

(Full title of the plan(s))

ASGN Incorporated

Jennifer Hankes Painter

Senior Vice President, Chief Legal Officer and Secretary

26745 Malibu Hills Road

Calabasas, California 91301

(818) 878-7900

Copy to:

Steven B. Stokdyk, Esq.

Latham & Watkins LLP

10250 Constellation Blvd. Suite 1100

Los Angeles, California 90067

(424) 653-5500

(Name, address and telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer | | Accelerated filer |

Non-accelerated filer (Do not check if a smaller reporting company) | | Smaller reporting company |

| | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

REGISTRATION OF ADDITIONAL SECURITIES

ASGN Incorporated (the “Company”) filed with the Securities and Exchange Commission Registration Statements on Form S-8 (File Nos. 333-181426, 333-183863, 333-204776, 333-223952, 333-256948) on May 15, 2012, September 12, 2012, June 5, 2015, March 27, 2018 and June 9, 2021 relating to shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), to be offered and sold under the Second Amendment to the Second Amended and Restated ASGN Incorporated 2012 Employment Inducement Incentive Award Plan (the “Plan”) and the contents of the Registration Statement on Form S-8 (File Nos. 333-181426, 333-183863, 333-204776, 333-223952, 333-256948) are incorporated by reference in this Registration Statement. The Company is hereby registering an additional 200,000 shares of Common Stock issuable under the Plan, none of which have been issued as of the date of this Registration Statement.

Item 8. Exhibits

| | | | | | | | | | | |

| | | |

Exhibit Number | | | Exhibit Description |

| | | |

| 4.1 | | | Specimen Common Stock Certificate (P) |

| 4.2 | | | |

| 4.3 | | | |

| 4.4 | | | |

| 5.1 | | | |

| 23.1 | | | |

| 23.2 | | | Consent of Latham & Watkins LLP (included in Exhibit 5.1)* |

| 24.1 | | | Power of Attorney (included in page S-1)* |

| 99.1 | | | First Amendment to the Second Amended and Restated ASGN Incorporated ASGN Incorporated 2012 Employment Inducement Incentive Award Plan, effective as of June 8, 2021 (incorporated by reference from Exhibit 10.1 to our Quarterly Report on Form Q-1 filed with the SEC on August 9, 2021) |

| 99.2 | | | |

| 107 | | | |

________________________________

| | | | | |

| |

* | Filed herewith. |

| |

(P) | Incorporated by reference from an exhibit filed with Registrant’s Registration Statement on Form S-1 (File No. 03350646) declared effective by the SEC on September 21, 1992. This exhibit originally filed in paper format. Accordingly, a hyperlink has not been provided. |

| |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Glen Allen, State of Virginia, on this 25th day of February, 2025.

| | | | | | | | |

|

| | |

| ASGN INCORPORATED |

| | |

| By: | /s/ Theodore S. Hanson |

| | Theodore S. Hanson |

| | Chief Executive Officer |

POWER OF ATTORNEY

The undersigned directors and officers of ASGN Incorporated hereby constitute and appoint Theodore S. Hanson, Marie L. Perry and Jennifer Hankes Painter each with full power to act with full power of substitution and re-substitution, as our true and lawful attorneys-in-fact and agents with full power to execute in our name and behalf in the capacities indicated below any and all amendments (including post-effective amendments and amendments thereto) to this Registration Statement and to file the same, with all exhibits and other documents relating thereto and any other registration statement relating to any offering made pursuant to this Registration Statement and hereby ratify and confirm all that such attorney-in-fact or his or her substitute shall lawfully do or case to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons in the capacities indicated on February 25th, 2025, with the exception of Ms. Cunningham who signed on February 26th, 2025.

| | | | | | | | | | | |

|

| | | |

| Signature | | Title |

| /s/ Theodore S. Hanson | | Chief Executive Officer and Director (Principal Executive Officer) |

| Theodore S. Hanson | | |

| /s/ Marie L. Perry | | Executive Vice President and Chief Financial Officer (Principal Financial Officer) |

| Marie L. Perry | | |

| /s/ Rose Cunningham | | Vice President, Chief Accounting Officer and Controller (Principal Accounting Officer) |

| Rose Cunningham | | |

| /s/ Brian J. Callaghan | | Director |

| Brian J. Callaghan | | |

| /s/ Joseph W. Dyer | | Director |

| Joseph W. Dyer | | |

| /s/ Mark A. Frantz | | Director |

| Mark A. Frantz | | |

| | | |

| | | | | | | | | | | |

| /s/ Maria R. Hawthorne | | Director |

| Maria R. Hawthorne | | |

| /s/ Jonathan S. Holman | | Director |

| Jonathan S. Holman | | |

| /s/ Patricia L. Obermaier | | Director |

| Patricia L. Obermaier | | |

| /s/ Carol J. Lindstrom | | Director |

| Carol J. Lindstrom | | |

| /s/ Arshad Matin | | Director |

| Arshad Matin | | |

| /s/ Edwin A. Sheridan, IV | | Director |

| Edwin A. Sheridan, IV | | |

S-8

S-8

EX-FILING FEES

0000890564

ASGN Inc

Fees to be Paid

0000890564

2025-02-26

2025-02-26

0000890564

1

2025-02-26

2025-02-26

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

ASGN Inc

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common stock, $0.01 par value per share to be issued under the Second Amended and Restated 2012 Employment Inducement Incentive Award Plan, as amended

|

Other

|

200,000

|

$

67.925

|

$

13,585,000.00

|

0.0001531

|

$

2,079.86

|

|

Total Offering Amounts:

|

|

$

13,585,000.00

|

|

$

2,079.86

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

2,079.86

|

|

1

|

In accordance with Rule 416(a) under the Securities Act of 1933, as amended ("Securities Act"), this registration statement shall be deemed to cover any additional securities that may from time to time be offered or issued under the Registrant's Second Amended and Restated 2012 Employment Inducement Incentive Award Plan (the "Plan") to prevent dilution resulting from stock splits, stock dividends or similar transactions. In addition, pursuant to Rule 416(c) under the Securities Act, this registration statement also covers an indeterminate amount of interests to be offered or sold pursuant to the Plan.

The Second Amendment to the Plan authorizes the issuance of a maximum of 1,685,861 shares of common stock, of which 200,000 shares are being registered hereunder and 1,485,861 shares have been registered previously. In the event of a stock split, stock dividend or other transaction involving the Registrant's common stock, the number of shares registered hereby shall automatically be increased to cover additional shares in accordance with Rule 416(a) under the Securities Act.

Maximum Aggregate Offering Price estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) of the Securities Act and based upon the average of the high and low prices per share of Common Stock as reported on the New York Stock Exchange on February 24, 2025.

The Registrant does not have any fee offsets.

|

|

|

| | | | | | | | |

| 10250 Constellation Blvd., Suite 1100 Los Angeles, California 90067 Tel: +1.424.653.5500 Fax: +1.424.653.5501 www.lw.com |

| FIRM / AFFILIATE OFFICES |

| Austin | Milan |

| Beijing | Munich |

| Boston | New York |

| Brussels | Orange County |

| Century City | Paris |

| Chicago | Riyadh |

| February 26, 2025 | Dubai | San Diego |

| Düsseldorf | San Franciso |

| Frankfurt | Seoul |

| Hamburg | Silicon Valley |

| Hong Kong | Singapore |

| Houston | Tel Aviv |

ASGN Incorporated

400 Cox Road, Suite 110

Glen Allen, Virginia 23060 | London | Tokyo |

| Los Angeles | Washington, D.C. |

| Madrid | |

| |

Re: Registration Statement on Form S-8 of ASGN Incorporated; 200,000 shares of Common Stock, par value $0.01 per share

To the addressee set forth above:

We have acted as special counsel to ASGN Incorporated, a Delaware corporation (the “Company”), in connection with the registration of an aggregate of 200,000 shares of common stock, $0.01 par value per share (the “Shares”), issuable pursuant to the Second Amendment to the Second Amended and Restated ASGN Incorporated 2012 Employment Inducement Incentive Award Plan, effective as of February 25, 2025 (the “Plan”). The Shares are included in a registration statement on Form S–8 under the Securities Act of 1933, as amended (the “Act”), filed with the Securities and Exchange Commission (the “Commission”) on February 26, 2025 (the “Registration Statement”). This opinion is being furnished in connection with the requirements of Item 601(b)(5) of Regulation S-K under the Act, and no opinion is expressed herein as to any matter pertaining to the contents of the Registration Statement or any related prospectus, other than as expressly stated herein with respect to the issue of the Shares.

As such counsel, we have examined such matters of fact and questions of law as we have considered appropriate for purposes of this letter. With your consent, we have relied upon certificates and other assurances of officers of the Company and others as to factual matters without having independently verified such factual matters. We are opining herein as to the General Corporation Law of the State of Delaware, and we express no opinion with respect to any other laws.

Subject to the foregoing and the other matters set forth herein, it is our opinion that, as of the date hereof, when the Shares shall have been duly registered on the books of the transfer agent and registrar therefor in the name or on behalf of the recipients, and have been issued by the Company for legal consideration in excess of par value in the circumstances contemplated by the Plan, assuming in each case that the individual grants or awards under the Plan are duly authorized by all necessary corporate action and duly granted or awarded and exercised in accordance with the requirements of law and the Plan (and the agreements and awards duly adopted thereunder and in accordance therewith), the issue and sale of the Shares will have been duly authorized by all necessary corporate action of the Company, and the Shares will be validly issued, fully paid and nonassessable. In rendering the foregoing opinion, we have assumed that the Company will comply with all applicable notice requirements regarding uncertificated shares provided in the General Corporation Law of the State of Delaware.

This opinion is for your benefit in connection with the Registration Statement and may be relied upon by you and by persons entitled to rely upon it pursuant to the applicable provisions of the Act. We consent to your filing this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission thereunder.

| | | | | |

| Sincerely, |

| /s/ Latham & Watkins LLP |

| |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated February 21, 2025, relating to the financial statements of ASGN Incorporated and the effectiveness of ASGN Incorporated's internal control over financial reporting, appearing in the Annual Report on Form 10-K of ASGN Incorporated for the year ended December 31, 2024.

/s/ DELOITTE & TOUCHE LLP

Richmond, Virginia

February 26, 2025

SECOND AMENDMENT TO

THE SECOND AMENDED AND RESTATED ASGN INCORPORATED

2012 EMPLOYMENT INDUCEMENT INCENTIVE AWARD PLAN

This Amendment (“Amendment”) to the Second Amended and Restated ASGN Incorporated 2012 Employment Inducement Incentive Award Plan (the “Plan”) is adopted by the Board of Directors (the “Board”) of ASGN Incorporated, a Delaware corporation (the “Company”), effective as of the 25th day of February, 2025 (the “Effective Date”). Capitalized terms used in this Amendment and not otherwise defined shall have the same meanings assigned to them in the Plan.

RECITALS

A. The Company currently maintains the Plan.

B. Pursuant to Section 12.1 of the Plan, the Board has the authority to amend the Plan.

C. The Board believes it to be in the best interest of the Company to amend the Plan to increase the Share Limit.

AMENDMENT

1. The first sentence of Section 3.1(a) of the Plan is hereby amended and restated in its entirety to read as follows:

“Subject to Section 3.1(b) and Section 12.2 hereof, the aggregate number of Shares which may be issued or transferred pursuant to Awards under the Plan shall be 1,685,861 (the “Share Limit”).”

This Amendment shall be and hereby is incorporated in and forms a part of the Plan, effective as of the Effective Date. Except as expressly provided herein, all terms and conditions of the Plan shall remain in full force and effect.

IN WITNESS WHEREOF, the Board has caused this Amendment to be executed by a duly authorized officer of the Company as of the 25th day of February, 2025.

ASGN Incorporated

By: /s/Theodore S. Hanson

Theodore S. Hanson

Chief Executive Officer

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings - Offering: 1

|

Feb. 26, 2025

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common stock, $0.01 par value per share to be issued under the Second Amended and Restated 2012 Employment Inducement Incentive Award Plan, as amended

|

| Amount Registered | shares |

200,000

|

| Proposed Maximum Offering Price per Unit |

67.925

|

| Maximum Aggregate Offering Price |

$ 13,585,000.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 2,079.86

|

| Offering Note |

In accordance with Rule 416(a) under the Securities Act of 1933, as amended ("Securities Act"), this registration statement shall be deemed to cover any additional securities that may from time to time be offered or issued under the Registrant's Second Amended and Restated 2012 Employment Inducement Incentive Award Plan (the "Plan") to prevent dilution resulting from stock splits, stock dividends or similar transactions. In addition, pursuant to Rule 416(c) under the Securities Act, this registration statement also covers an indeterminate amount of interests to be offered or sold pursuant to the Plan.

The Second Amendment to the Plan authorizes the issuance of a maximum of 1,685,861 shares of common stock, of which 200,000 shares are being registered hereunder and 1,485,861 shares have been registered previously. In the event of a stock split, stock dividend or other transaction involving the Registrant's common stock, the number of shares registered hereby shall automatically be increased to cover additional shares in accordance with Rule 416(a) under the Securities Act.

Maximum Aggregate Offering Price estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) of the Securities Act and based upon the average of the high and low prices per share of Common Stock as reported on the New York Stock Exchange on February 24, 2025.

The Registrant does not have any fee offsets.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

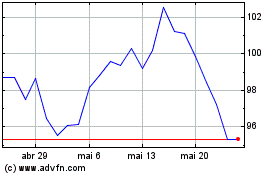

ASGN (NYSE:ASGN)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

ASGN (NYSE:ASGN)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025