UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | | | | | | | | |

Rio Tinto plc (Exact name of registrant as specified in its charter) | |

England and Wales (State or other jurisdiction of incorporation or organization) | None (I.R.S. Employer Identification No.) |

6 St. James’s Square London SW1Y 4AD United Kingdom (Address of principal executive offices) | |

Arcadium Lithium plc Omnibus Incentive Plan Livent Corporation Incentive Compensation and Stock Plan (Full title of the plans) | |

Cheree Finan Corporate Secretary Rio Tinto Services Inc. 80 State Street Albany, New York, 12207-2543 (Name and address of agent for service) (801) 204-2000 (Telephone number, including area code, of agent for service)

Copies to: | |

Michael Z. Bienenfeld Igor Rogovoy Linklaters LLP One Silk Street London EC2Y 8HQ +44 20 7456 2000 | George Casey Andrew Gaines Pierre-Emmanuel Perais Linklaters LLP 1345 Avenue of the Americas New York, NY 10106 +1 212 903 9000 | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Emerging growth company | ☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act of 1933 (the “Securities Act”).

EXPLANATORY NOTE

On 6 March 2025, Rio Tinto completed the previously announced transactions contemplated by the Transaction Agreement, dated as of 9 October 2024, (the “Transaction Agreement”), by and among Arcadium Lithium plc, a public limited company incorporated under the laws of the Bailiwick of Jersey (“Arcadium”), Rio Tinto Western Holdings Limited, a private limited company incorporated under the laws of England and Wales, and Rio Tinto BM Subsidiary Limited, a private limited company incorporated under the laws of England and Wales (the “Buyer”), and Arcadium became a wholly owned subsidiary of the Buyer (or such affiliate of the Buyer designated by the Buyer in accordance with the terms of the transaction). The Buyer is a wholly owned indirect subsidiary of Rio Tinto plc, which together with each of Rio Tinto plc’s subsidiaries, Rio Tinto Limited, and each of Rio Tinto Limited’s subsidiaries, comprise the Rio Tinto Group.

At the effective time of the Merger (as defined in the Transaction Agreement), each outstanding stock option, restricted share right and restricted stock unit, excluding any outstanding equity awards held by any non-employee director (each, a “Legacy Arcadium Award”) granted under the Arcadium Lithium plc Omnibus Incentive Plan (the “Arcadium Plan”) or the Livent Corporation Incentive Compensation and Stock Plan (the “Livent Plan”) was exchanged for a corresponding award with respect to ordinary shares, nominal value 10 pence per share, in the capital of Rio Tinto plc (“Ordinary Shares”), and Rio Tinto plc assumed each Legacy Arcadium Award granted under the Arcadium Plan and the Livent Plan.

This Registration Statement on Form S-8 (this “Registration Statement”) is being filed for the purpose of registering (i) up to 811,088 Ordinary Shares reserved for issuance or issuable upon the exercise or settlement of the converted Legacy Arcadium Awards granted under the Arcadium Plan; and (ii) up to 608,976 Ordinary Shares reserved for issuance or issuable upon the exercise or settlement of the converted Legacy Arcadium Awards granted under the Livent Plan.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

As permitted by Rule 428 under the Securities Act and the instructional Note to Part I of Form S-8, this registration statement omits the information specified in Part I of Form S-8. We have delivered, or will deliver, the documents containing the information specified in Part I to the participants in the plans covered by this registration statement as required by Rule 428(b)(1) under the Securities Act. We are not filing these documents with the Securities and Exchange Commission as part of this registration statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. Such documents and the documents incorporated by reference herein pursuant to Item 3 of Part II of this form, taken together, constitute a prospectus for this registration statement that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents By Reference.

We incorporate by reference into this registration statement:

(a)Rio Tinto’s Annual Report on Form 20-F for the year ended 31 December 2024.

(b)All other reports filed by Rio Tinto plc pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), since 31 December 2024 (other than the portions of those reports not deemed to be filed).

(c)The description of Rio Tinto plc’s Ordinary Shares, nominal value 10 pence per share contained in the Annual Report on Form 20-F of Rio Tinto plc for the year ended 31 December 2024 under the section entitled “Shareholder Information.”

All documents subsequently filed by Rio Tinto plc pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities hereby registered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference and to be part hereof from the date of filing such documents.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document that is or is deemed to be incorporated by reference herein modifies or supersedes such previous statement. Any such statement so modified or superseded will not be deemed to constitute a part of this registration statement, except as so modified or superseded.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Deeds of Indemnity

Directors appointed have entered into deeds of indemnity with Rio Tinto plc as follows: Sam Laidlaw on February 10, 2017, Simon Henry on April 1, 2017, Jakob Stausholm on June 11, 2018, Jennifer Nason on March 1, 2020, Ngaire Woods on March 1, 2020, Peter Cunningham on June 17, 2021, Ben Wyatt on June 3, 2021, Dominic Barton on March 17, 2021, Kaisa Hietala on December 19, 2022, Dean Dalla Valle on March 15, 2023, Susan Lloyd-Hurwitz on March 15, 2023, Joc O’Rourke on October 19, 2023, Martina Merz on December 21, 2023 and Sharon Thorne on May 17, 2024.

English law

Sections 232 to 236 of the Companies Act 2006 provide as follows:

“232. Provisions protecting directors from liability

(1)Any provision that purports to exempt a director of a company (to any extent) from any liability that would otherwise attach to him in connection with any negligence, default, breach of duty or breach of trust in relation to the company is void.

(2)Any provision by which a company directly or indirectly provides an indemnity (to any extent) for a director of the company, or of an associated company, against any liability attaching to him in connection with any negligence, default, breach of duty or breach of trust in relation to the company of which he is a director is void, except as permitted by —

(a)section 233 (provision of insurance),

(b)section 234 (qualifying third party indemnity provision), or

(c)section 235 (qualifying pension scheme indemnity provision).

(3)This section applies to any provision, whether contained in a company’s articles or in any contract with the company or otherwise.

(4)Nothing in this section prevents a company’s articles from making such provision as has previously been lawful for dealing with conflicts of interest.

233. Provision of insurance

Section 232(2) (voidness of provisions for indemnifying directors) does not prevent a company from purchasing and maintaining for a director of the company, or of an associated company, insurance against any such liability as is mentioned in that subsection.

234. Qualifying third party indemnity provision

(1)Section 232(2) (voidness of provisions for indemnifying directors) does not apply to qualifying third party indemnity provision.

(2)Third party indemnity provision means provision for indemnity against liability incurred by the director to a person other than the company or an associated company.

Such provision is qualifying third party indemnity provision if the following requirements are met.

(3)The provision must not provide any indemnity against —

(a)any liability of the director to pay —

(i)a fine imposed in criminal proceedings, or

(ii)a sum payable to a regulatory authority by way of a penalty in respect of non-compliance with any requirement of a regulatory nature (however arising); or

(b)any liability incurred by the director —

(i)in defending criminal proceedings in which he is convicted, or

(ii)in defending civil proceedings brought by the company, or an associated company, in which judgment is given against him, or

(iii)in connection with an application for relief (see subsection (6)) in which the court refuses to grant him relief.

(4)The references in subsection (3)(b) to a conviction, judgment or refusal of relief are to the final decision in the proceedings.

(5)For this purpose —

(a)a conviction, judgment or refusal of relief becomes final —

(i)if not appealed against, at the end of the period for bringing an appeal, or

(ii)if appealed against, at the time when the appeal (or any further appeal) is disposed of; and

(b)an appeal is disposed of —

(i)if it is determined and the period for bringing any further appeal has ended, or

(ii)if it is abandoned or otherwise ceases to have effect.

(6)The reference in subsection (3)(b)(iii) to an application for relief is to an application for relief under —

section 661(3) or (4) (power of court to grant relief in a case of acquisition of shares by innocent nominee), or

section 1157 (general power of court to grant relief in case of honest and reasonable conduct).

235. Qualifying pension scheme indemnity provision

(1)Section 232(2) (voidness of provisions for indemnifying directors) does not apply to qualifying pension scheme indemnity provision.

(2)Pension scheme indemnity provision means provision indemnifying a director of a company that is a trustee of an occupational pension scheme against liability incurred in connection with the company’s activities as trustee of the scheme.

Such provision is qualifying pension scheme indemnity provision if the following requirements are met.

(3)The provision must not provide any indemnity against —

(a)any liability of the director to pay —

(i)a fine imposed in criminal proceedings, or

(ii)a sum payable to a regulatory authority by way of a penalty in respect of non-compliance with any requirement of a regulatory nature (however arising); or

(b)any liability incurred by the director in defending criminal proceedings in which he is convicted.

(4)The reference in subsection (3)(b) to a conviction is to the final decision in the proceedings.

(5)For this purpose —

(a)a conviction becomes final —

(i)if not appealed against, at the end of the period for bringing an appeal, or

(ii)if appealed against, at the time when the appeal (or any further appeal) is disposed of; and

(b)an appeal is disposed of —

(i)if it is determined and the period for bringing any further appeal has ended, or

(ii)if it is abandoned or otherwise ceases to have effect.

(6)In this section “occupational pension scheme” means an occupational pension scheme as defined in section 150(5) of the Finance Act 2004 (c 12) that is established under a trust.

236. Qualifying indemnity provision to be disclosed in directors’ report

(1)This section requires disclosure in the directors’ report of —

(a)qualifying third party indemnity provision, and

(b)qualifying pension scheme indemnity provision.

Such provision is referred to in this section as “qualifying indemnity provision”.

(2)If when a directors’ report is approved any qualifying indemnity provision (whether made by the company or otherwise) is in force for the benefit of one or more directors of the company, the report must state that such provision is in force.

(3)If at any time during the financial year to which a directors’ report relates any such provision was in force for the benefit of one or more persons who were then directors of the company, the report must state that such provision was in force.

(4)If when a directors’ report is approved qualifying indemnity provision made by the company is in force for the benefit of one or more directors of an associated company, the report must state that such provision is in force.

(5)If at any time during the financial year to which a directors’ report relates any such provision was in force for the benefit of one or more persons who were then directors of an associated company, the report must state that such provision was in force”.

Section 1157 of the Companies Act 2006 provides as follows:

“1157. Power of court to grant relief in certain cases:

(1)If in proceedings for negligence, default, breach of duty or breach of trust against —

(a)an officer of a company, or

(b)a person employed by a company as auditor (whether he is or is not an officer of the company),

it appears to the court hearing the case that the officer or person is or may be liable but that he acted honestly and reasonably, and that having regard to all the circumstances of the case (including those connected with his appointment) he ought fairly to be excused, the court may relieve him, either wholly or in part, from his liability on such terms as it thinks fit.

(2)If any such officer or person has reason to apprehend that a claim will or might be made against him in respect of negligence, default, breach of duty or breach of trust —

(a)he may apply to the court for relief, and

(b)the court has the same power to relieve him as it would have had if it had been a court before which proceedings against him for negligence, default, breach of duty or breach of trust had been brought.

(3)Where a case to which subsection (1) applies is being tried by a judge with a jury, the judge, after hearing the evidence, may, if he is satisfied that the defendant (in Scotland, the defender) ought in pursuance of that subsection to be relieved either in whole or in part from the liability sought to be enforced against him, withdraw the case from the jury and forthwith direct judgment to be entered for the defendant (in Scotland, grant decree of absolvitor) on such terms as to costs (in Scotland, expenses) or otherwise as the judge may think proper”.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. Exhibits.

| | | | | | | | |

Exhibit No. |

| Exhibit Description |

4.1 |

| |

4.2 |

| |

4.3 |

| |

5.1* |

| |

23.1* |

| |

23.2* |

| |

24.1* |

| |

107* |

| |

Item 9. Undertakings.

(a)The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii)To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement; provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(a)The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(b)Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of London, United Kingdom, on 7 March 2025.

| | |

Rio Tinto plc (Registrant) |

/s/ Andy Hodges

Andy Hodges

Group Company Secretary (Signature and Title) |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below severally constitutes and appoints each Director listed below (with full power to each of them to act alone), his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities to do any and all things and execute any and all instruments that such attorney may deem necessary or advisable under the Securities Act of 1933 (the “Securities Act”), and any rules, regulations and requirements of the Securities and Exchange Commission (the “Commission”) in connection with the registration under the Securities Act of the Securities and any securities or Blue Sky law of any of the states of the United States of America in order to effect the registration or qualification (or exemption therefrom) of the said securities for issue, offer, sale or trade under the Blue Sky or other securities laws of any of such states and in connection therewith to execute, acknowledge, verify, deliver, file and cause to be published applications, reports, consents to service of process, appointments of attorneys to receive service of process and other papers and instruments which may be required under such laws, including specifically, but without limiting the generality of the foregoing, the power and authority to sign his or her name in his or her capacity as an Officer, Director or Authorized Representative in the United States of America or in any other capacity with respect to this registration statement and any registration statement in respect of the Securities that is to be effective upon filing pursuant to Rule 462(b) (collectively, the “Registration Statement”) and/or such other form or forms as may be appropriate to be filed with the Commission or under or in connection with any Blue Sky laws or other securities laws of any state of the United States of America or with such other regulatory bodies and agencies as any of them may deem appropriate in respect of the Securities, and with respect to any and all amendments, including post-effective amendments, to this Registration Statement and to any and all instruments and documents filed as part of or in connection with this Registration Statement.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

Signature | Title | Date |

/s/ Dominic Barton | Chairman | 7 March 2025 |

Dominic Barton |

/s/ Jakob Stausholm | Director and Chief Executive | 7 March 2025 |

Jakob Stausholm |

/s/ Peter Cunningham | Director and Chief Financial Officer | 7 March 2025 |

Peter Cunningham |

/s/ Dean Dalla Valle | Non Executive Director | 7 March 2025 |

Dean Dalla Valle |

/s/ Simon Henry | Non Executive Director | 7 March 2025 |

Simon Henry |

/s/ Kaisa Hietala | Non Executive Director | 7 March 2025 |

Kaisa Hietala |

/s/ Sam Laidlaw | Non Executive Director | 7 March 2025 |

Sam Laidlaw |

/s/ Susan Lloyd-Hurwitz | Non Executive Director | 7 March 2025 |

Susan Lloyd-Hurwitz |

/s/ Jennifer Nason | Non Executive Director | 7 March 2025 |

Jennifer Nason |

/s/ Ngaire Woods | Non Executive Director | 7 March 2025 |

Ngaire Woods |

/s/ Joc O’Rourke | Non Executive Director | 7 March 2025 |

Joc O’Rourke |

/s/ Sharon Thorne | Non Executive Director | 7 March 2025 |

Sharon Thorne |

/s/ Martina Merz | Non Executive Director | 7 March 2025 |

Martina Merz |

/s/ Ben Wyatt |

Non Executive Director |

7 March 2025 |

| Ben Wyatt |

SIGNATURE OF AUTHORIZED U.S. REPRESENTATIVE

Pursuant to the requirements of Section 6(a) of the Securities Act of 1933, the undersigned has signed the registration statement on 7 March 2025 in the capacity of the duly authorized representative of Rio Tinto plc in the United States.

RIO TINTO PLC.

By: /s/ Cheree Finan

Name: Cheree Finan

Title: Authorized Representative

Pursuant to the requirements of Section 6(a) of the Securities Act of 1933, the undersigned has signed the registration statement on 7 March 2025 in the capacity of the duly authorized representative of Rio Tinto Limited in the United States.

RIO TINTO LIMITED

By: /s/ Cheree Finan

Name: Cheree Finan

Title: Authorized Representative

S-8

S-8

EX-FILING FEES

0000863064

RIO TINTO PLC

Fees to be Paid

Fees to be Paid

Fees to be Paid

Fees to be Paid

0000863064

2025-03-07

2025-03-07

0000863064

1

2025-03-07

2025-03-07

0000863064

2

2025-03-07

2025-03-07

0000863064

3

2025-03-07

2025-03-07

0000863064

4

2025-03-07

2025-03-07

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

RIO TINTO PLC

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Rio Tinto plc ordinary Shares, nominal value 10p per share (Ordinary Shares)

|

Other

|

394,295

|

$

59.8828

|

$

23,611,488.63

|

0.0001531

|

$

3,614.92

|

|

2

|

Equity

|

Ordinary Shares

|

Other

|

46,202

|

$

59.8828

|

$

2,766,705.13

|

0.0001531

|

$

423.58

|

|

3

|

Equity

|

Ordinary Shares

|

Other

|

416,793

|

$

41.5568

|

$

17,320,583.34

|

0.0001531

|

$

2,651.78

|

|

4

|

Equity

|

Ordinary Shares

|

Other

|

562,774

|

$

59.0759

|

$

33,246,380.55

|

0.0001531

|

$

5,090.02

|

|

Total Offering Amounts:

|

|

$

76,945,157.65

|

|

$

11,780.30

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

11,780.30

|

|

1

|

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the number of ordinary shares (Ordinary Shares) of Rio Tinto plc (Registrant) registered hereunder includes an indeterminable number of Ordinary Shares that become issuable by reason of any share dividend, share split or other similar transaction.

(2) Represents Ordinary Shares issuable under outstanding restricted stock units (Legacy Arcadium RSU Awards) granted pursuant to the Arcadium Lithium plc Omnibus Incentive Plan (Arcadium Plan) that were assumed by the Registrant in connection with the completion of the transactions contemplated by the transaction agreement (Transaction Agreement), dated as of 9 October 2024, by and between Rio Tinto BM Subsidiary Limited (a wholly owned indirect subsidiary of the Registrant), Rio Tinto Western Holdings Limited, and Arcadium Lithium plc (such transaction, Merger) and thereupon converted into awards with respect to Ordinary Shares.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act. The proposed maximum offering price per unit was calculated on the basis of the average of the high and low market prices of Rio Tinto plc ordinary shares of 10p each quoted on the London Stock Exchange on 28 February 2025 (GBP47.56). The translation of pounds sterling into U.S. dollars has been made at the noon buying rate, New York City time, as posted by Bloomberg on 28 February 2025 of US$1.2591 per GBP1.00.

(4) Rounded up to the nearest penny.

|

|

|

|

2

|

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the number of ordinary shares (Ordinary Shares) of Rio Tinto plc (Registrant) registered hereunder includes an indeterminable number of Ordinary Shares that become issuable by reason of any share dividend, share split or other similar transaction.

(2) Represents Ordinary Shares issuable under outstanding restricted stock units (Legacy Livent RSU Awards) granted pursuant to the Livent Corporation Incentive Compensation and Stock Plan (Livent Plan) that were assumed by the Registrant in connection with the completion of the Merger and thereupon converted into awards with respect to Ordinary Shares.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act. The proposed maximum offering price per unit was calculated on the basis of the average of the high and low market prices of Rio Tinto plc ordinary shares of 10p each quoted on the London Stock Exchange on 28 February 2025 (GBP47.56). The translation of pounds sterling into U.S. dollars has been made at the noon buying rate, New York City time, as posted by Bloomberg on 28 February 2025 of US$1.2591 per GBP1.00.

(4) Rounded up to the nearest penny.

|

|

|

|

3

|

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the number of ordinary shares (Ordinary Shares) of Rio Tinto plc (Registrant) registered hereunder includes an indeterminable number of Ordinary Shares that become issuable by reason of any share dividend, share split or other similar transaction.

(2) Represents Ordinary Shares issuable under outstanding stock options (Legacy Arcadium Option Awards) granted pursuant to the Arcadium Plan that were assumed by the Registrant in connection with the completion of the Merger and thereupon converted into awards with respect to Ordinary Shares at a conversion ratio of 0.116048.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) under the Securities Act based upon the weighted average per share exercise price (rounded to nearest cent).

(4) Rounded up to the nearest penny.

|

|

|

|

4

|

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the number of ordinary shares (Ordinary Shares) of Rio Tinto plc (Registrant) registered hereunder includes an indeterminable number of Ordinary Shares that become issuable by reason of any share dividend, share split or other similar transaction.

(2) Represents Ordinary Shares issuable under outstanding stock options (Legacy Livent Option Awards) granted pursuant to the Livent Plan that were assumed by the Registrant in connection with the completion of the Merger and thereupon converted into awards with respect to Ordinary Shares at a conversion ratio of 0.116048.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) under the Securities Act based upon the weighted average per share exercise price (rounded to nearest cent).

(4) Rounded up to the nearest penny.

|

|

|

Exhibit 5.1

| | | | | |

| Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom |

7 March 2025

The Directors

Rio Tinto plc

6 St. James’s Square

London, SW1Y 4AD

Ladies and Gentlemen,

This opinion relates to the registration statement on Form S-8 (the “Registration Statement”) of Rio Tinto plc, a company registered in England and Wales, in connection with the registration under the United States Securities Act of 1933 (the “Act”) of 1,420,064 ordinary shares, nominal value 10 pence per share, in the capital of Rio Tinto plc (“Ordinary Shares”). The Ordinary Shares subject to the Registration Statement are reserved for issuance or issuable pursuant to the assumption by Rio Tinto plc of each outstanding stock option, restricted share right and restricted stock unit, excluding any equity awards held by any non-employee director (each, a “Legacy Arcadium Award”) granted under the Arcadium Lithium plc Omnibus Incentive Plan (the “Arcadium Plan”) or the Livent Corporation Incentive Compensation and Stock Plan (the “Livent Plan”), in connection with Rio Tinto’s acquisition of Arcadium, and pursuant to the Transaction Agreement dated as of 9 October 2024 (the “Transaction Agreement”).

The Ordinary Shares subject to the Registration Statement consist of (i) 811,088 Ordinary Shares reserved for issuance or issuable upon the exercise or settlement of the converted Legacy Arcadium Awards granted under the Arcadium Plan; and (ii) up to 608,976 Ordinary Shares reserved for issuance or issuable upon the exercise or settlement of the converted Legacy Arcadium Awards granted under the Livent Plan.

In arriving at the opinion expressed below, I have examined and relied on copies of such corporate records and other documents, including the Registration Statement and the Transaction Agreement, and reviewed such matters of law as I have deemed necessary or appropriate for the purpose of this opinion. I have also assumed that there are no agreements or understandings between or among Rio Tinto plc and any participants in the Arcadium Plan or the Livent Plan that would expand, modify or otherwise affect the terms of the plans or the respective rights or obligations of the participants thereunder. This opinion is limited to English law as applied by the English courts and is given on the basis that it will be governed by and be construed in accordance with English law.

On the basis of, and subject to, the foregoing and having regard to such consideration of English law in force at the date of this letter as I consider relevant, I am of the opinion that:

| | | | | |

| (i) | the Company has been duly organized and is an existing corporation in good standing under the laws of England and Wales; |

| | | | | |

| (ii) | any Ordinary Shares to be issued by Rio Tinto plc pursuant to and in accordance with the Arcadium Plan will, when issued and delivered pursuant to Rio Tinto plc’s Articles of Association and in accordance with the Transaction Agreement, be validly issued, fully paid and non-assessable (i.e., no further contributions in respect thereof will be required to be made to the Company by the holders thereof, by reason only of their being such holders); and |

| (iii) | any Ordinary Shares to be issued by Rio Tinto plc pursuant to and in accordance with the Livent Plan will, when issued and delivered pursuant to Rio Tinto plc’s Articles of Association and in accordance with the Transaction Agreement, be validly issued, fully paid and non-assessable (i.e., no further contributions in respect thereof will be required to be made to the Company by the holders thereof, by reason only of their being such holders). |

I consent to the filing of this opinion as an exhibit to the Registration Statement on Form S-8 relating to such ordinary shares in the capital of Rio Tinto plc. In giving such consent, I do not thereby admit that I am within the category of persons whose consent is required under Section 7 of the Act.

This opinion is rendered as of the date above and I disclaim any obligation to advise you of facts, circumstances, events or developments which may alter, affect or modify the opinion expressed herein.

Yours faithfully,

/s/ Steve Allen .

| | |

| Steve Allen |

| Solicitor |

| Deputy Chief Legal Officer |

| Rio Tinto plc |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS

We consent to the use of our report dated February 20, 2025, with respect to the consolidated financial statements of Rio Tinto Group (comprising Rio Tinto plc and Rio Tinto Limited, together with their subsidiaries), and the effectiveness of internal control over financial reporting, incorporated herein by reference.

| | | | | | | | |

/s/ KPMG LLP | | /s/ KPMG LLP |

KPMG LLP | | KPMG |

| London, United Kingdom | | Perth, Australia |

7 March 2025 | | 7 March 2025 |

KPMG LLP, a UK limited liability partnership, is a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by Guarantee.

KPMG Australia’s liability limited by a scheme approved under Professional Standards Legislation.

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings

|

Mar. 07, 2025

USD ($)

shares

|

| Offering: 1 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Rio Tinto plc ordinary Shares, nominal value 10p per share (Ordinary Shares)

|

| Amount Registered | shares |

394,295

|

| Proposed Maximum Offering Price per Unit |

59.8828

|

| Maximum Aggregate Offering Price |

$ 23,611,488.63

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 3,614.92

|

| Offering Note |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the number of ordinary shares (Ordinary Shares) of Rio Tinto plc (Registrant) registered hereunder includes an indeterminable number of Ordinary Shares that become issuable by reason of any share dividend, share split or other similar transaction.

(2) Represents Ordinary Shares issuable under outstanding restricted stock units (Legacy Arcadium RSU Awards) granted pursuant to the Arcadium Lithium plc Omnibus Incentive Plan (Arcadium Plan) that were assumed by the Registrant in connection with the completion of the transactions contemplated by the transaction agreement (Transaction Agreement), dated as of 9 October 2024, by and between Rio Tinto BM Subsidiary Limited (a wholly owned indirect subsidiary of the Registrant), Rio Tinto Western Holdings Limited, and Arcadium Lithium plc (such transaction, Merger) and thereupon converted into awards with respect to Ordinary Shares.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act. The proposed maximum offering price per unit was calculated on the basis of the average of the high and low market prices of Rio Tinto plc ordinary shares of 10p each quoted on the London Stock Exchange on 28 February 2025 (GBP47.56). The translation of pounds sterling into U.S. dollars has been made at the noon buying rate, New York City time, as posted by Bloomberg on 28 February 2025 of US$1.2591 per GBP1.00.

(4) Rounded up to the nearest penny.

|

| Offering: 2 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Ordinary Shares

|

| Amount Registered | shares |

46,202

|

| Proposed Maximum Offering Price per Unit |

59.8828

|

| Maximum Aggregate Offering Price |

$ 2,766,705.13

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 423.58

|

| Offering Note |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the number of ordinary shares (Ordinary Shares) of Rio Tinto plc (Registrant) registered hereunder includes an indeterminable number of Ordinary Shares that become issuable by reason of any share dividend, share split or other similar transaction.

(2) Represents Ordinary Shares issuable under outstanding restricted stock units (Legacy Livent RSU Awards) granted pursuant to the Livent Corporation Incentive Compensation and Stock Plan (Livent Plan) that were assumed by the Registrant in connection with the completion of the Merger and thereupon converted into awards with respect to Ordinary Shares.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act. The proposed maximum offering price per unit was calculated on the basis of the average of the high and low market prices of Rio Tinto plc ordinary shares of 10p each quoted on the London Stock Exchange on 28 February 2025 (GBP47.56). The translation of pounds sterling into U.S. dollars has been made at the noon buying rate, New York City time, as posted by Bloomberg on 28 February 2025 of US$1.2591 per GBP1.00.

(4) Rounded up to the nearest penny.

|

| Offering: 3 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Ordinary Shares

|

| Amount Registered | shares |

416,793

|

| Proposed Maximum Offering Price per Unit |

41.5568

|

| Maximum Aggregate Offering Price |

$ 17,320,583.34

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 2,651.78

|

| Offering Note |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the number of ordinary shares (Ordinary Shares) of Rio Tinto plc (Registrant) registered hereunder includes an indeterminable number of Ordinary Shares that become issuable by reason of any share dividend, share split or other similar transaction.

(2) Represents Ordinary Shares issuable under outstanding stock options (Legacy Arcadium Option Awards) granted pursuant to the Arcadium Plan that were assumed by the Registrant in connection with the completion of the Merger and thereupon converted into awards with respect to Ordinary Shares at a conversion ratio of 0.116048.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) under the Securities Act based upon the weighted average per share exercise price (rounded to nearest cent).

(4) Rounded up to the nearest penny.

|

| Offering: 4 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Ordinary Shares

|

| Amount Registered | shares |

562,774

|

| Proposed Maximum Offering Price per Unit |

59.0759

|

| Maximum Aggregate Offering Price |

$ 33,246,380.55

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 5,090.02

|

| Offering Note |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the number of ordinary shares (Ordinary Shares) of Rio Tinto plc (Registrant) registered hereunder includes an indeterminable number of Ordinary Shares that become issuable by reason of any share dividend, share split or other similar transaction.

(2) Represents Ordinary Shares issuable under outstanding stock options (Legacy Livent Option Awards) granted pursuant to the Livent Plan that were assumed by the Registrant in connection with the completion of the Merger and thereupon converted into awards with respect to Ordinary Shares at a conversion ratio of 0.116048.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) under the Securities Act based upon the weighted average per share exercise price (rounded to nearest cent).

(4) Rounded up to the nearest penny.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ffd_OfferingAxis=2 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ffd_OfferingAxis=3 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ffd_OfferingAxis=4 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

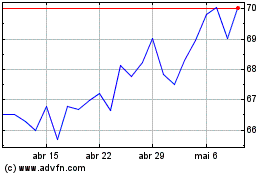

Rio Tinto (NYSE:RIO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

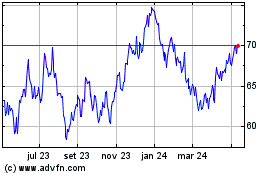

Rio Tinto (NYSE:RIO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025