UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | | | | | | | | | | | | | | |

Rio Tinto plc

(Exact name of registrant as specified in its charter) | Rio Tinto Limited

ABN 96 004 458 404 (Exact name of registrant as specified in its charter) | |

England and Wales (State or other jurisdiction of incorporation or organization) | None (I.R.S. Employer Identification No.) | Australia (State or other jurisdiction of incorporation or organization) | None (I.R.S. Employer Identification No.) |

6 St. James’s Square London SW1Y 4AD United Kingdom (Address of principal executive offices) | Level 43, 120 Collins Street Melbourne, Victoria 3000 Australia (Address of principal executive offices) | |

Rio Tinto plc Equity Incentive Plan 2018 (Full title of plans) | Rio Tinto Limited Equity Incentive Plan 2018 (Full title of plans) | |

Cheree Finan Corporate Secretary Rio Tinto Services Inc. 80 State Street Albany, New York, 12207-2543 (Name and address of agent for service) (801) 204-2000 (Telephone number, including area code, of agent for service)

Copies to: | |

Michael Z. Bienenfeld Igor Rogovoy Linklaters LLP One Silk Street London EC2Y 8HQ

+44 20 7456 2000 | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

Emerging growth company | ☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act of 1933 (the “Securities Act”).

EXPLANATORY NOTE

This registration statement on Form S-8 (“Registration Statement”) is being filed pursuant to General Instruction E to Form S-8 for the purpose of registering: (i) an aggregate of 1,130,000 additional ordinary shares, nominal value 10 pence per share, in the capital of Rio Tinto plc (the “plc Shares”) under the Rio Tinto plc Equity Incentive Plan 2018 (the “2018 plc Plan”) and (ii) an aggregate of 25,000 additional shares in the capital of Rio Tinto Limited (the “Limited Shares”) under the Rio Tinto Limited Equity Incentive Plan 2018, (the “2018 Limited Plan”).

These additional plc Shares and Limited Shares are additional securities of the same class as other securities for which a registration statement on Form S-8 (File No. 333-224907) was filed with the Securities and Exchange Commission (the “Commission”) on May 14, 2018 (the “Prior S-8 Registration Statement”), and were not previously registered under the Prior S-8 Registration Statement. Pursuant to General Instruction E to Form S-8, the contents of the Prior S-8 Registration Statement are incorporated by reference into this Registration Statement, except as otherwise set forth herein.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents By Reference.

We incorporate by reference into this registration statement:

(a)Annual Report on Form 20-F of Rio Tinto plc and Rio Tinto Limited for the year ended 31 December 2024.

(b)All other reports filed by Rio Tinto plc and Rio Tinto Limited pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), since 31 December 2024 (other than the portions of those reports not deemed to be filed).

(c)The description of (i) Rio Tinto plc’s ordinary shares, nominal value 10 pence per share and (ii) Rio Tinto Limited’s shares, each contained in the Annual Report on Form 20-F of Rio Tinto plc and Rio Tinto Limited for the year ended 31 December 2024 under the section entitled “Shareholder Information.”

All documents subsequently filed by either Rio Tinto plc or Rio Tinto Limited pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities hereby registered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference and to be part hereof from the date of filing such documents.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document that is or is deemed to be incorporated by reference herein modifies or supersedes such previous statement. Any such statement so modified or superseded will not be deemed to constitute a part of this registration statement, except as so modified or superseded.

Item 8. Exhibits.

| | | | | | | | |

Exhibit No. |

| Exhibit Description |

4.1 |

| |

4.2 |

| |

4.3 |

| |

4.4 |

| |

5.1* |

| |

5.2* |

| |

23.1* |

| |

23.2* |

| |

23.3* |

| |

24.1* |

| |

107* |

| |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of London, United Kingdom, on 7 March 2025.

| | | | | |

Rio Tinto plc (Registrant) | Rio Tinto Limited (Registrant) |

/s/ Andy Hodges

Andy Hodges

Group Company Secretary (Signature and Title) | /s/ Tim Paine

Tim Paine

Company Secretary (Signature and Title) |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below severally constitutes and appoints each Director listed below (with full power to each of them to act alone), his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities to do any and all things and execute any and all instruments that such attorney may deem necessary or advisable under the Securities Act of 1933 (the “Securities Act”), and any rules, regulations and requirements of the Securities and Exchange Commission (the “Commission”) in connection with the registration under the Securities Act of the Securities and any securities or Blue Sky law of any of the states of the United States of America in order to effect the registration or qualification (or exemption therefrom) of the said securities for issue, offer, sale or trade under the Blue Sky or other securities laws of any of such states and in connection therewith to execute, acknowledge, verify, deliver, file and cause to be published applications, reports, consents to service of process, appointments of attorneys to receive service of process and other papers and instruments which may be required under such laws, including specifically, but without limiting the generality of the foregoing, the power and authority to sign his or her name in his or her capacity as an Officer, Director or Authorized Representative in the United States of America or in any other capacity with respect to this registration statement and any registration statement in respect of the Securities that is to be effective upon filing pursuant to Rule 462(b) (collectively, the “Registration Statement”) and/or such other form or forms as may be appropriate to be filed with the Commission or under or in connection with any Blue Sky laws or other securities laws of any state of the United States of America or with such other regulatory bodies and agencies as any of them may deem appropriate in respect of the Securities, and with respect to any and all amendments, including post-effective amendments, to this Registration Statement and to any and all instruments and documents filed as part of or in connection with this Registration Statement.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

Signature | Title | Date |

/s/ Dominic Barton | Chairman | 7 March 2025 |

Dominic Barton |

/s/ Jakob Stausholm | Director and Chief Executive | 7 March 2025 |

Jakob Stausholm |

/s/ Peter Cunningham | Director and Chief Financial Officer | 7 March 2025 |

Peter Cunningham |

/s/ Dean Dalla Valle | Non Executive Director | 7 March 2025 |

Dean Dalla Valle |

/s/ Simon Henry | Non Executive Director | 7 March 2025 |

Simon Henry |

/s/ Kaisa Hietala | Non Executive Director | 7 March 2025 |

Kaisa Hietala |

/s/ Sam Laidlaw | Non Executive Director | 7 March 2025 |

Sam Laidlaw |

/s/ Susan Lloyd-Hurwitz | Non Executive Director | 7 March 2025 |

Susan Lloyd-Hurwitz |

/s/ Jennifer Nason | Non Executive Director | 7 March 2025 |

Jennifer Nason |

/s/ Ngaire Woods | Non Executive Director | 7 March 2025 |

Ngaire Woods |

/s/ Joc O’Rourke | Non Executive Director | 7 March 2025 |

Joc O’Rourke |

/s/ Sharon Thorne | Non Executive Director | 7 March 2025 |

Sharon Thorne |

/s/ Martina Merz | Non Executive Director | 7 March 2025 |

Martina Merz |

/s/ Ben Wyatt | Non Executive Director | 7 March 2025 |

| Ben Wyatt |

SIGNATURE OF AUTHORIZED U.S. REPRESENTATIVE

Pursuant to the requirements of Section 6(a) of the Securities Act of 1933, the undersigned has signed the registration statement on 7 March 2025 in the capacity of the duly authorized representative of Rio Tinto plc in the United States.

RIO TINTO PLC.

By: /s/ Cheree Finan

Name: Cheree Finan

Title: Authorized Representative

Pursuant to the requirements of Section 6(a) of the Securities Act of 1933, the undersigned has signed the registration statement on 7 March 2025 in the capacity of the duly authorized representative of Rio Tinto Limited in the United States.

RIO TINTO LIMITED

By: /s/ Cheree Finan

Name: Cheree Finan

Title: Authorized Representative

S-8

S-8

EX-FILING FEES

0000863064

RIO TINTO PLC

Fees to be Paid

Fees to be Paid

0000863064

2025-03-07

2025-03-07

0000863064

1

2025-03-07

2025-03-07

0000863064

2

2025-03-07

2025-03-07

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

RIO TINTO PLC

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Rio Tinto plc ordinary shares of 10p each

|

Other

|

1,130,000

|

$

59.8828

|

$

67,667,564.00

|

0.0001531

|

$

10,359.90

|

|

2

|

Equity

|

Rio Tinto Limited shares

|

Other

|

25,000

|

$

71.0663

|

$

1,776,657.50

|

0.0001531

|

$

272.01

|

|

Total Offering Amounts:

|

|

$

69,444,221.50

|

|

$

10,631.91

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

10,631.91

|

|

1

|

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the Registration Statement to which this exhibit 107 is a part includes an indeterminable number of additional ordinary shares, nominal value 10 pence per share in the capital of Rio Tinto plc (Ordinary Shares), that may become issuable in the event of a share dividend, share split or similar transactions.

(2) Represents additional plc Shares reserved for issuance under the Rio Tinto plc Equity Incentive Plan 2018.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act. The proposed maximum offering price per unit was calculated on the basis of the average of the high and low market prices of Rio Tinto plc ordinary shares of 10p each quoted on the London Stock Exchange on 28 February 2025 (GBP47.56). The translation of pounds sterling into U.S. dollars has been made at the noon buying rate, New York City time, as posted by Bloomberg on 28 February 2025 of US$1.2591 per GBP1.00.

(4) Rounded up to the nearest penny.

|

|

|

|

2

|

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the Registration Statement to which this exhibit 107 is a part includes an indeterminable number of additional shares in the capital of Rio Tinto Limited (Limited Shares), that may become issuable in the event of a share dividend, share split or similar transactions.

(2) Represents additional Limited Shares reserved for issuance under the Rio Tinto Limited Equity Incentive Plan 2018.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act. The proposed maximum offering price per unit was calculated on the basis of the average of the high and low market prices of Rio Tinto Limited shares quoted on the Australian Securities Exchange on 28 February 2025 (A$114.42). The translation of Australian dollars into U.S. dollars has been made at the noon buying rate, New York City time, as posted by Bloomberg on 28 February 2025 of US$0.6211 per A$1.00.

(4) Rounded up to the nearest penny.

|

|

|

Exhibit 5.1

| | | | | |

| Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom |

7 March 2025

The Directors

Rio Tinto plc

6 St. James’s Square

London, SW1Y 4AD

Ladies and Gentlemen,

This opinion is given in connection with the registration under the United States Securities Act of 1933, as amended ( of 1,130,000 ordinary shares of 10p each in the capital of Rio Tinto plc, a company registered in England and Wales, to be issued in connection with the Rio Tinto plc Equity Incentive Plan 2018 (the “ Rio Tinto plc Equity Incentive Plan 2018”).

This opinion is limited to English law as applied by the English courts and is given on the basis that it will be governed by and be construed in accordance with English law.

I have examined and relied on copies of such corporate records and other documents, including the Registration Statement, and reviewed such matters of law as I have deemed necessary or appropriate for the purpose of this opinion.

On the basis of, and subject to, the foregoing and having regard to such consideration of English law in force at the date of this letter as I consider relevant, I am of the opinion that:

| | | | | |

| (i) | the Company has been duly organized and is an existing corporation in good standing under the laws of England and Wales; and |

| | | | | |

| (ii) | any ordinary shares of 10p each to be issued by Rio Tinto plc pursuant to and in accordance with the Rio Tinto plc Equity Incentive Plan 2018 will, when issued and delivered pursuant to the Company’s Memorandum and Articles of Association and in accordance with the Rio Tinto plc Equity Incentive Plan 2018, be validly issued, fully paid and non-assessable (i.e., no further contributions in respect thereof will be required to be made to the Company by the holders thereof, by reason only of their being such holders). |

I consent to the filing of this opinion as an exhibit to the Registration Statement on Form S-8 relating to such ordinary shares in the capital of Rio Tinto plc. In giving such consent, I do not thereby admit that I am within the category of persons whose consent is required under Section 7 of the Act.

This opinion is rendered as of the date above and I disclaim any obligation to advise you of facts, circumstances, events or developments which may alter, affect or modify the opinion expressed herein.

Yours faithfully,

/s/ Steve Allen .

| | |

| Steve Allen |

| Solicitor |

| Deputy Chief Legal Officer |

| Rio Tinto plc |

Exhibit 5.2

| | | | | |

| Rio Tinto Limited Level 43 120 Collins Street Melbourne Australia 3000 |

7 March 2025

The Directors

Rio Tinto Limited

Level 43

120 Collins Street

Melbourne

Australia 3000

Dear Sirs,

This opinion is given in connection with the registration under the United States Securities Act of 1933, as amended (the “Act”) of 25,000 shares in the capital of Rio Tinto Limited, a company registered in Australia to be issued in connection with the Rio Tinto Limited Equity Incentive Plan 2018 (the “Rio Tinto Limited Equity Incentive Plan 2018”).

This opinion is limited to the laws of Australia and its States and Territories, as applied by the Australian courts and is given on the basis that it will be governed by and be construed in accordance with those laws.

I have examined and relied on copies of such corporate records and other documents, including the Registration Statement, and reviewed such matters of law as I have deemed necessary or appropriate for the purpose of this opinion.

On the basis of, and subject to, the foregoing and having regard to such consideration of Australian law in force at the date of this letter as I consider relevant, I am of the opinion that:

| | | | | |

| (i) | the Company has been duly incorporated as a company limited by shares and is validly existing under the laws of the Commonwealth of Australia; and |

| | | | | |

| (ii) | any Shares to be issued by the Company pursuant to and in accordance with the Rio Tinto Limited Equity Incentive Plan 2018 and appropriate board and/or shareholder resolutions will, when issued and delivered pursuant to the Company’s Constitution and in accordance with the Rio Tinto Limited Equity Incentive Plan 2018, be validly issued, fully paid and non-assessable (i.e., no further contributions in respect thereof will be required to be made to the Company by the holders thereof, by reason only of their being such holders). |

I consent to the filing of this opinion as an exhibit to the Registration Statement on Form S-8 relating to such Shares. In giving such consent, I do not thereby admit that I am within the category of persons whose consent is required under Section 7 of the Act.

This opinion is rendered as of the date above and I disclaim any obligation to advise you of facts, circumstances, events or developments which may alter, affect or modify the opinion expressed herein.

Yours faithfully,

/s/ Tim Paine .

Tim Paine

(an Australian Legal Practitioner within the meaning of the Legal Profession Uniform Law (Victoria))

Company Secretary

Rio Tinto Limited

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS

We consent to the use of our report dated February 20, 2025, with respect to the consolidated financial statements of Rio Tinto Group (comprising Rio Tinto plc and Rio Tinto Limited, together with their subsidiaries), and the effectiveness of internal control over financial reporting, incorporated herein by reference.

| | | | | |

/s/ KPMG LLP . | /s/ KPMG . |

| KPMG LLP | KPMG |

| London, United Kingdom | Perth, Australia |

| 7 March 2025 | 7 March 2025 |

| | |

| |

KPMG, an Australian partnership and KPMG LLP, a UK limited liability partnership, are member firms of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by Guarantee.

KPMG Australia’s liability limited by a scheme approved under Professional Standards Legislation.

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings

|

Mar. 07, 2025

USD ($)

shares

|

| Offering: 1 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Rio Tinto plc ordinary shares of 10p each

|

| Amount Registered | shares |

1,130,000

|

| Proposed Maximum Offering Price per Unit |

59.8828

|

| Maximum Aggregate Offering Price |

$ 67,667,564.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 10,359.90

|

| Offering Note |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the Registration Statement to which this exhibit 107 is a part includes an indeterminable number of additional ordinary shares, nominal value 10 pence per share in the capital of Rio Tinto plc (Ordinary Shares), that may become issuable in the event of a share dividend, share split or similar transactions.

(2) Represents additional plc Shares reserved for issuance under the Rio Tinto plc Equity Incentive Plan 2018.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act. The proposed maximum offering price per unit was calculated on the basis of the average of the high and low market prices of Rio Tinto plc ordinary shares of 10p each quoted on the London Stock Exchange on 28 February 2025 (GBP47.56). The translation of pounds sterling into U.S. dollars has been made at the noon buying rate, New York City time, as posted by Bloomberg on 28 February 2025 of US$1.2591 per GBP1.00.

(4) Rounded up to the nearest penny.

|

| Offering: 2 |

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Rio Tinto Limited shares

|

| Amount Registered | shares |

25,000

|

| Proposed Maximum Offering Price per Unit |

71.0663

|

| Maximum Aggregate Offering Price |

$ 1,776,657.50

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 272.01

|

| Offering Note |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), the Registration Statement to which this exhibit 107 is a part includes an indeterminable number of additional shares in the capital of Rio Tinto Limited (Limited Shares), that may become issuable in the event of a share dividend, share split or similar transactions.

(2) Represents additional Limited Shares reserved for issuance under the Rio Tinto Limited Equity Incentive Plan 2018.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act. The proposed maximum offering price per unit was calculated on the basis of the average of the high and low market prices of Rio Tinto Limited shares quoted on the Australian Securities Exchange on 28 February 2025 (A$114.42). The translation of Australian dollars into U.S. dollars has been made at the noon buying rate, New York City time, as posted by Bloomberg on 28 February 2025 of US$0.6211 per A$1.00.

(4) Rounded up to the nearest penny.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

ffd_OfferingAxis=2 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

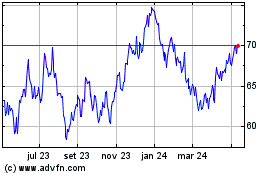

Rio Tinto (NYSE:RIO)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

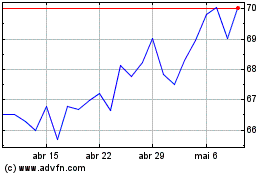

Rio Tinto (NYSE:RIO)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025