Artificial Intelligence company, AnalytixInsight Inc.

(“AnalytixInsight”, or the “Company”) (

TSX-V: ALY; OTCQB:

ATIXF), is pleased to announce its financial results for

the three and nine months ended September 30, 2019.

During the quarter, the Company continued

delivering its AI-driven machine-created content to Refinitiv

within its strategic initiative to provide research coverage on

approximately 3,000 dividend-paying companies in Canada, the US and

the UK. AI-driven content is becoming increasingly important as

financial businesses move to embrace AI and analytics as the

content cornerstones for their client offerings. Revenue for the

three-month period ended September 30, 2019, was $754,703 which

compares to $1,296,239 during the same period in the previous year.

Revenue for the nine-month period ended September 30, 2019, was

$2,852,177 which compares to $3,637,339 during the same period in

the previous year. At September 30, 2019, the Company had working

capital of $2,188,481 and no debt.

AnalytixInsight’s 49%-owned FinTech subsidiary,

Marketwall, has applied to become an online

financial broker in Europe and, following completion of regulatory

approvals, Marketwall expects to initiate a formal process to

determine its appropriate valuation within a peer-based context of

online brokerage firms with innovative technology and partnerships

with world-leading banks. Marketwall has advised the Company that

following such process, Marketwall will then raise suitable funds

to enable its global growth expansion plans. Completion of this

process will allow AnalytixInsight to move forward with a spinout

to unlock the value of its Marketwall holdings in an IPO or other

such strategies.

During its four-year operating history,

Marketwall has developed leading-edge FinTech solutions which

include:

Financial

portal – marketwall.com offers financial content, news,

real-time quotes, and video news stories. As a Samsung

Electronics partner, Marketwall’s financial app is pre-loaded on

certain devices – such as Smart TVs. Marketwall draws an audience

of over 3.5 million monthly views across its digital channels.

Mobile

Stock-Trading App – launched as Investo in 2018 by Italy’s

leading bank Intesa Sanpaolo and facilitated 20% of their customer

trading orders shortly after deployment.

GlobalMarket – a trading & research platform

offering analyst research and stock-trading in one common

enterprise digital platform. It is marketed and sold by a leading

investment research provider and has already been installed by a

leading bank in Western Europe for their approximately 4,000

professional users.

Research

Portal – an elegant financial research information portal

for use by banks and brokerage firms to better serve their

institutional buy-side clients. Research reports are organized and

summarized in a password-protected portal, allowing a client to

quickly search with ease, replacing the cumbersome email-based

distribution methods traditionally used.

Marketwall’s revenue for the nine-month period

ended September 30, 2019, was $3,452,697 which compares to

$2,808,130 during the same period in the previous year. Net income

for the nine-month period was $628,265 which compares to $542,712

during the same period in the previous year. Marketwall is an

associated company 49%-owned by AnalytixInsight, and as such,

Marketwall’s revenue is not included in AnalytixInsight’s

consolidated revenue.

AnalytixInsight believes its key strategic

initiatives - Artificial Intelligence and FinTech - are well

positioned to capitalize on the market trends occurring in the

industry.

Management Commentary

Prakash Hariharan, President & CEO of

AnalytixInsight, commented: “Our service offerings are well

developed, and we are working closely with several of the

industry’s leading corporations. The financial brokerage industry

is changing, and leading companies are embracing AI and FinTech as

an integral part of their offerings. Our platform capabilities and

service delivery solutions are being utilized by some of the

world’s leading organizations, and we are also eagerly awaiting

regulatory approvals for Marketwall to become a European financial

broker.”

AnalytixInsight Selected Financial

Information:

|

AnalytixInsight$ Canadian (unaudited) |

Three months ended Sept 30 |

|

Nine months ended Sept 30 |

|

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

Revenue |

754,703 |

|

1,296,239 |

|

2,852,177 |

|

3,637,339 |

|

|

Basic net income (loss) per share |

(0.01 |

) |

(0.01 |

) |

(0.02 |

) |

(0.02 |

) |

|

|

|

|

|

|

|

|

Sept 30, 2019 |

|

Dec 31, 2018 |

|

|

|

|

Total assets |

5,726,442 |

|

5,096,567 |

|

|

|

|

Total liabilities |

531,501 |

|

663,754 |

|

|

|

|

|

|

|

|

|

|

|

Marketwall Selected Financial

Information:

AnalytixInsight owns 49% of Marketwall which is

considered an associated company as its financial results are not

consolidated in AnalytixInsight’s financial results.

|

Marketwall (Associated investment of

AnalytixInsight, $ Canadian) |

Nine months endedSept 30,

2019 |

Nine months ended Sept 30,

2018 |

|

Revenue |

3,452,697 |

2,808,130 |

|

Net income (loss) |

628,265 |

542,712 |

|

|

|

|

|

|

Sept 30, 2019 |

Dec 31, 2018 |

|

Total assets |

3,780,328 |

3,919,233 |

|

Total liabilities |

1,553,674 |

2,250,174 |

|

|

|

|

CapitalCube

AnalytixInsight is an established AI-driven

content supplier to Refinitiv with ability to provide content on

small & mid-cap companies worldwide through its CapitalCube

platform, which provides machine-created content with ability to

scale. The platform is a powerful analytics engine capable of 100

billion daily computations and currently provides analysis on

approximately 50,000 worldwide stocks and North American ETFs.

CapitalCube began publishing pre-revenue research reports to

Refinitiv’s Eikon users in November 2018. On June 17, 2019, the

Company expanded the scope of the pre-revenue analysis reports to

now include companies located in Italy, Germany, Hong Kong and

Japan in response to the increasing Refinitiv client usage of the

North American reports currently in production.

During the quarter, the Company continued

delivering its AI-driven machine-created content to Refinitiv

within its strategic initiative to provide research coverage on

approximately 3,000 dividend-paying companies in Canada, the US and

the UK. The CapitalCube dividend analysis report provides powerful

insights, analysis and scoring regarding a company’s dividend

quality, yield, coverage, flexibility, payment history, peer

comparisons and sustainability.

AnalytixInsight is pleased to be an AI-driven

content provider to Refinitiv and believes that its ability to

create scalable financial content on worldwide companies is being

recognized with increasing importance as global industry leaders

embrace analytics within the financial industry. On August 1, 2019,

the London Stock Exchange agreed to buy Refinitiv in a US$27

billion transaction to create a global financial markets

infrastructure provider with leading data and analytics to

Refinitiv’s 40,000 institutions in over 190 countries.

Workforce Optimization

AnalytixInsight’s Workforce Optimization

division joined the IFS Partner Network in 2018, and during the

quarter, the Company continued to advance its sales initiatives in

this market. IFS is a world leader in developing workforce

optimization enterprise software for global customers who manage

service-focused operations. AnalytixInsight plans to explore

opportunities with IFS to jointly develop machine intelligence

solutions to help organizations maximize operational efficiency,

increase revenue, reduce costs and improve customer

satisfaction.

Marketwall

Marketwall, a developer of FinTech solutions, is

49% owned by AnalytixInsight and 33% owned by Intesa Sanpaolo. On

July 15, 2019, the Company announced that Marketwall applied to

become an online financial broker (“Marketwall Brokerage”) to offer

leading FinTech-enabled services for receiving, transmitting and

executing stock trading orders; using the Investment Bank of Intesa

Sanpaolo as its execution broker. Marketwall Brokerage has

requested regulatory approvals for brokerage services initially in

Italy with intentions to expand to other European countries.

Marketwall Brokerage intends to develop multi-device trading

platforms, combining research and financial education.

Marketwall was established in Milan, Italy in

2014 by AnalytixInsight as a FinTech company with a focus on

stock-trading and financial apps. In September 2015, Marketwall and

Intesa Sanpaolo announced a partnership agreement to develop

stock-trading apps, and in April 2016 Intesa Sanpaolo acquired 33%

of Marketwall.

Intesa Sanpaolo is a leading bank in Europe with

approximately 11.9 million customers, a network of approximately

4,400 branches throughout Italy, and has emerged as Italy's

first digital bank. Intesa Sanpaolo now reports 8 million

multi-channel customers, of which 3 million are now using the

Intesa Sanpaolo Mobile banking app with 56 million logins per month

on the app alone, and 53 million mobile transactions with the app

since the start of 2018. On November 30, 2018, Intesa Sanpaolo

announced plans to invest 2.8 billion euros over the following

three years to increase the bank’s digitized business to 70%.

Mobile is at the heart of the bank's digital ecosystem. The "app

constellation" is centered around Intesa Sanpaolo Mobile, which

provides access to banking services, financing, savings and is

enhanced with the Intesa Sanpaolo Investo app (developed by

Marketwall) that enables customers to trade securities and monitor

their investment assets using their mobile device. CONTACT

INFORMATION:

Scott UrquhartVP Corporate

DevelopmentScott.Urquhart@AnalytixInsight.comTel: (416)

522-3975

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight Inc. is an Artificial

Intelligence, machine-learning company. AnalytixInsight’s financial

analytics platform CapitalCube.com algorithmically analyzes market

price data and regulatory filings to create insightful actionable

narratives and research on approximately 50,000 global companies

and ETFs, providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight also designs and implements Workforce Optimization

solutions for large global enterprises. AnalytixInsight holds a 49%

interest in Marketwall, a developer of FinTech solutions for

financial institutions. For more information, visit

AnalytixInsight.com.

Regulatory Statements

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, statements regarding the growth of the Company’s

business operations; the adoption of AI in various

industries; the Company’s ability to spin out or monetize it’s

interest in Marketwall, the valuation of Marketwall, Marketwall’s

ability to raise adequate capital, Marketwall’s ability to obtain a

brokerage licence; the use of the Company’s content by various

parties; the impact of the distribution agreement with Refinitiv;

the Company’s ongoing relationship with IFS and the

Company’s ability to enter into commercial transactions with

members thereof; the Company’s ability to expand its content

distribution; and the Company’s future performance. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved”.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of AnalytixInsight

Inc., as the case may be, to be materially different from those

expressed or implied by such forward-looking information, including

but not limited to: general business, economic, competitive,

geopolitical and social uncertainties; the Company’s technology and

revenue generation; risks associated with operation in the

technology sector; ability to successfully integrate new technology

and employees; foreign operations risks; and other risks inherent

in the technology industry. Although AnalytixInsight has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. AnalytixInsight does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

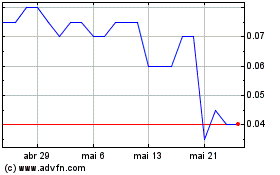

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024