Iris Energy Limited (NASDAQ: IREN) (together with its subsidiaries,

“Iris Energy” or “the Company”), a leading owner and operator of

institutional-grade, highly efficient Bitcoin mining data centers

powered by 100% renewable energy, today reported its financial

results for the full year ended June 30, 2023. All $ amounts are in

United States Dollars (“USD”) unless otherwise stated.

“FY23 was a transformational year for Iris

Energy”, stated Daniel Roberts, Co-Founder and Co-Chief Executive

Officer of Iris Energy. “We increased our operating hashrate to 5.6

EH/s but importantly also expanded our power capacity to an

industry-leading 760MW, thereby activating an expansion pathway to

30 EH/s. We also remain excited by our next-gen compute and

generative AI strategy, providing an additional potential growth

area for the Company.”

Full Year FY23 Financial Results

- Record Bitcoin

mining revenue of $75.5 million, as compared to $59.0 million in

fiscal year 2022, primarily driven by increase in number of Bitcoin

mined, partially offset by a decrease in the Bitcoin price

- Record 3,259 Bitcoin

mined, as compared to 1,399 Bitcoin mined in fiscal year 2022,

primarily driven by growth in operating hashrate

- Electricity costs of

$35.8 million, as compared to $11.0 million in fiscal year 2022,

primarily driven by growth in operating hashrate, with 3 new sites

commissioned during the year

- Other costs of $38.3

million, as compared to $21.8 million in fiscal year 2022. Cost

base reflects materially expanded business with growth beyond

existing 5.6 EH/s

- Net loss after

income tax of $171.9 million, as compared to a $419.8 million loss

in fiscal year 2022. The decrease in net loss after income tax

primarily reflects impact of non-cash mark-to-market of convertible

instruments converted into equity at IPO during the prior

period

- Non-cash impairment

charge of $105.2 million recorded in fiscal year 2023, primarily

relating to the limited-recourse financing SPVs and impairment of

mining hardware. The limited-recourse financing SPVs were

deconsolidated on February 3, 2023 with the appointment of the

Receiver

- Adjusted EBITDA of

$1.4 million as compared to $26.2 million in fiscal year 20221

- $68.9 million cash

and cash equivalents as of June 30, 2023 and no debt

facilities2

Key Operational and Corporate Highlights:

- Increased

self-mining operating capacity by 380% from 1.2 EH/s to 5.6

EH/s3

- Announced 9.1 EH/s

expansion plan and revitalization of HPC strategy

- Expanded available

power capacity from 80MW to 760MW across the platform (180MW

operating)

- Energized additional

30MW at Mackenzie and 50MW at Prince George

- Energized 600MW at

Childress (20MW operating)

- Appointed Raymond

Chabot Grant Thornton LLP as the Company’s auditor

- Post financial year

end:

- Purchased 248 NVIDIA

H100 GPUs to target generative AI

- Appointed Sunita

Parasuraman to Board of Directors

|

Webcast and Conference DetailsA live webcast of

the earnings conference call, along with the associated

presentation, may be accessed at

https://investors.irisenergy.co/events-and-presentations and will

be available for replay for one year. |

|

Date: |

Wednesday, September 13, 2023 |

|

|

Time: |

5:00 p.m. USA Eastern Time (2:00 p.m. Pacific Time or September 14,

2023 at 7:00 a.m. Australian Eastern Standard Time) |

|

|

Participant |

Registration Link |

|

|

|

Live Webcast |

Use this link |

|

|

|

Phone Dial-In with Live Q&A |

Use this link |

|

Please note, participants joining the conference call via the

phone dial-in option will receive their dial-in number, passcode

and PIN following registration using the link above. It would be

appreciated if all callers could dial in approximately 5 minutes

prior to the scheduled start time.

There will be a Q&A session after the Company delivers its

FY23 financial results. Those dialling in via phone can elect to

ask a question via the moderator. Participants on the live webcast

have the ability to pre-submit a question upon registering to join

the webcast or can submit a question during the live webcast.

About Iris Energy

Iris Energy is a sustainable Bitcoin mining

company that supports the decarbonization of energy markets and the

global Bitcoin network.

- 100% renewables: Iris Energy

targets sites with low-cost, under-utilized renewable energy, and

supports local communities

- Long-term security over

infrastructure, land and power supply: Iris Energy builds, owns and

operates its electrical infrastructure and proprietary data

centers, providing long-term security and operational control over

its assets

- Seasoned management team: Iris

Energy’s team has an impressive track record of success across

energy, infrastructure, renewables, finance, digital assets and

data centers with cumulative experience in delivering >$25bn in

energy and infrastructure projects globally

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally relate to

future events or Iris Energy’s future financial or operating

performance. For example, forward-looking statements include but

are not limited to the Company’s business strategy, expected

operational and financial results, and expected increase in power

capacity and hashrate. In some cases, you can identify

forward-looking statements by terminology such as “anticipate,”

“believe,” “may,” “can,” “should,” “could,” “might,” “plan,”

“possible,” “project,” “strive,” “budget,” “forecast,” “expect,”

“intend,” “target”, “will,” “estimate,” “predict,” “potential,”

“continue,” “scheduled” or the negatives of these terms or

variations of them or similar terminology, but the absence of these

words does not mean that statement is not forward-looking. Such

forward-looking statements are subject to risks, uncertainties, and

other factors which could cause actual results to differ materially

from those expressed or implied by such forward-looking statements.

In addition, any statements or information that refer to

expectations, beliefs, plans, projections, objectives, performance

or other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking.

These forward looking statements are based on

management’s current expectations and beliefs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

Iris Energy’s actual results, performance or achievements to be

materially different from any future results performance or

achievements expressed or implied by the forward looking

statements, including, but not limited to: Bitcoin price and

foreign currency exchange rate fluctuations; Iris Energy’s ability

to obtain additional capital on commercially reasonable terms and

in a timely manner to meet our capital needs and facilitate its

expansion plans; the terms of any future financing or any

refinancing, restructuring or modification to the terms of any

future financing, which could require Iris Energy to comply with

onerous covenants or restrictions, and its ability to service its

debt obligations; Iris Energy’s ability to successfully execute on

its growth strategies and operating plans, including its ability to

continue to develop its existing data center sites and to increase

its diversification into the market for potential HPC solutions;

Iris Energy’s limited experience with respect to new markets it has

entered or may seek to enter, including the market for HPC

solutions; expectations with respect to the ongoing profitability,

viability, operability, security, popularity and public perceptions

of the Bitcoin network; expectations with respect to the

profitability, viability, operability, security, popularity and

public perceptions of any potential HPC solutions that Iris Energy

may offer in the future; Iris Energy’s ability to secure customers

on commercially reasonable terms or at all, particularly as it

relates to its potential expansion into HPC solutions; Iris

Energy’s ability to manage counterparty risk (including credit

risk) associated with potential customers and other counterparties;

Iris Energy’s ability to secure renewable energy and renewable

energy certificates, power capacity, facilities and sites on

commercially reasonable terms or at all; the risk that

counterparties may terminate, default on or underperform their

contractual obligations; Bitcoin network hashrate fluctuations;

delays associated with, or failure to obtain or complete,

permitting approvals, grid connections and other development

activities customary for greenfield or brownfield infrastructure

projects; our reliance on third party mining pools, exchanges,

banks, insurance providers and our ability to maintain

relationships with such parties; expectations regarding

availability and pricing of electricity; Iris Energy’s

participation and ability to successfully participate in demand

response products and services and other load management programs

run, operated or offered by electricity network operators,

regulators or electricity market operators; the availability,

reliability and cost of electricity supply, hardware and electrical

and data center infrastructure, including with respect to any

electricity outages and any laws and regulations that may restrict

the electricity supply available to Iris Energy; any variance

between the actual operating performance of Iris Energy’s hardware

achieved compared to the nameplate performance including hashrate;

Iris Energy’s ability to curtail its electricity consumption and/or

monetize electricity depending on market conditions, including

changes in Bitcoin mining economics and prevailing electricity

prices; actions undertaken by electricity network and market

operators, regulators, governments or communities in the regions in

which Iris Energy operates; the availability, suitability,

reliability and cost of internet connections at Iris Energy’s

facilities; Iris Energy’s ability to secure additional hardware,

including hardware for Bitcoin mining and potential HPC solutions

it may offer, on commercially reasonable terms or at all, and any

delays or reductions in the supply of such hardware or increases in

the cost of procuring such hardware; expectations with respect to

the useful life and obsolescence of hardware (including hardware

for Bitcoin mining as well as hardware for other applications,

including HPC solutions); delays, increases in costs or reductions

in the supply of equipment used in Iris Energy’s operations; Iris

Energy’s ability to operate in an evolving regulatory environment;

Iris Energy’s ability to successfully operate and maintain its

property and infrastructure; reliability and performance of Iris

Energy’s infrastructure compared to expectations; malicious attacks

on Iris Energy’s property, infrastructure or IT systems; Iris

Energy’s ability to maintain in good standing the operating and

other permits and licenses required for its operations and

business; Iris Energy ability to obtain, maintain, protect and

enforce its intellectual property rights and other confidential

information; whether the secular trends Iris Energy expects to

drive growth in its business materialize to the degree it expects

them to, or at all; the occurrence of any environmental, health and

safety incidents at Iris Energy’s sites; any material costs

relating to environmental, health and safety requirements or

liabilities; damage to our property and infrastructure and the risk

that any insurance Iris Energy maintains may not fully cover all

potential exposures; ongoing securities litigation and proceedings

relating to the default by two of Iris Energy’s wholly-owned

special purpose vehicles under limited recourse equipment financing

facilities; ongoing securities litigation relating in part to the

default; and any future litigation, claims and/or regulatory

investigations, and the costs, expenses, use of resources,

diversion of management time and efforts, liability and damages

that may result therefrom; any laws, regulations and ethical

standards that may relate to Iris Energy’s business, including

those that relate to Bitcoin and the Bitcoin mining industry and

those that relate to any other solutions we may offer (such as

potential HPC solutions), including regulations related to data

privacy, cybersecurity and the storage, use or processing of

information; any intellectual property infringement and product

liability claims; our ability to attract, motivate and retain

senior management and qualified employees; increased risks to our

global operations including, but not limited to, political

instability, acts of terrorism, theft and vandalism, cyberattacks

and other cybersecurity incidents and unexpected regulatory and

economic sanctions changes, among other things; climate change and

natural and man-made disasters that may materially adversely affect

our business, financial condition and results of operations; the

ongoing effects of COVID-19 or any other outbreak of an infectious

disease and any governmental or industry measures taken in

response; our ability to remain competitive in dynamic and rapidly

evolving industries; damage to our brand and reputation; and other

important factors discussed under the caption “Risk Factors” in

Iris Energy’s annual report on Form 20-F filed with the SEC on

September 13, 2023 as such factors may be updated from time to time

in its other filings with the SEC, accessible on the SEC’s website

at www.sec.gov and the Investor Relations section of Iris Energy’s

website at https://investors.irisenergy.co.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this press release. Any

forward-looking statement that Iris Energy makes in this press

release speaks only as of the date of such statement. Except as

required by law, Iris Energy disclaims any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise.

Non-IFRS Financial Measures

This press release includes non-IFRS financial

measures, including Adjusted EBITDA and Adjusted EBITDA Margin. We

provide Adjusted EBITDA and Adjusted EBITDA Margin in addition to,

and not as a substitute for, measures of financial performance

prepared in accordance with IFRS. There are a number of limitations

related to the use of Adjusted EBTIDA and Adjusted EBITDA Margin.

For example, other companies, including companies in our industry,

may calculate Adjusted EBITDA and Adjusted EBITDA Margin

differently. The Company believes that these measures are important

and supplement discussions and analysis of its results of

operations and enhances an understanding of its operating

performance.

EBITDA is calculated as our IFRS profit/(loss)

after income tax expense, excluding interest income, finance

expense and non-cash fair value loss and interest expense on hybrid

financial instruments, income tax expense, depreciation and

amortization, which are important components of our IFRS

profit/(loss) after income tax expense. Further, “Adjusted EBITDA”

also excludes share-based payments expense, which is an important

component of our IFRS profit/(loss) after income tax expense,

impairment of assets, loss on other receivables, loss on disposal

of assets, foreign exchange gains and losses and other one-time

expenses and income.

|

Adjusted EBITDA

Reconciliation1(USD$m) |

Year endedJune 30, 2023 |

Year endedJune 30, 2022 |

|

Bitcoin mining revenue |

75.5 |

59.0 |

|

Electricity costs |

(35.8) |

(11.0) |

|

Other costs |

(38.3) |

(21.8) |

|

Adjusted EBITDA |

1.4 |

26.2 |

|

Adjusted EBITDA

Margin |

1.9% |

44.0% |

|

|

|

|

|

Reconciliation to consolidated statement of profit or

loss |

|

|

|

Add/(deduct): |

|

|

|

Other income |

3.1 |

0.0 |

|

Foreign exchange gains/(losses) |

(0.2) |

8.0 |

|

Non-cash share-based payments expense – $75 exercise price

options |

(11.8) |

(10.0) |

|

Non-cash share-based payments expense |

(2.6) |

(3.9) |

|

Impairment of assets |

(105.2) |

- |

|

Gain/(loss) on disposal of subsidiaries |

3.3 |

- |

|

Loss on disposal of property, plant and equipment |

(6.6) |

- |

|

Other expense items2 |

(4.6) |

(4.3) |

|

EBITDA |

(123.2) |

16.1 |

|

Fair value loss and interest expense on hybrid financial

instruments |

- |

(418.7) |

|

Other finance expense |

(16.4) |

(6.7) |

|

Interest income |

0.9 |

0.1 |

|

Depreciation |

(30.9) |

(7.7) |

|

Loss before

income tax

expense |

(169.5) |

(417.0) |

|

Income tax expense |

(2.4) |

(2.7) |

|

Loss after income tax expense for the year |

(171.9) |

(419.8) |

1) For further detail, see our audited financial statements for

the year ended June 30, 2023, included in our Annual Report on Form

20-F filed with the SEC on September 13, 2023.2) FY23

other expense items include one-off professional fees, legal fees

and additional remuneration.

Contacts

MediaJon SnowballDomestique+61 477 946 068

InvestorsLincoln TanIris Energy+61 407 423

395lincoln.tan@irisenergy.co

To keep updated on Iris Energy’s news releases and SEC filings,

please subscribe to email alerts at

https://investors.irisenergy.co/ir-resources/email-alerts.

______________________________________________________

1 Adjusted EBITDA is a non-IFRS metric. See page 5 for a

reconciliation to the nearest IFRS metric.2 Reflects USD

equivalent, audited cash and cash equivalents as of June 30, 2023.3

Comparative period: June 2022 average operating capacity vs. June

2023 average operating capacity.

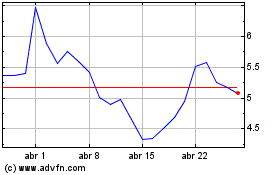

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024