Oxbridge Re to Evaluate Strategic Alternatives

10 Junho 2024 - 9:00AM

Oxbridge Re Holdings Limited

(NASDAQ: OXBR),

(the “Company”), together with its subsidiaries is engaged in the

business of tokenized Real-World Assets (“RWAs”) initially in the

form of tokenized reinsurance securities, and reinsurance solutions

primarily to property and casualty insurers, today announced that

its Board of Directors has initiated a process to evaluate

strategic alternatives to maximize shareholder value. As part of

the evaluation process, the Company will consider a full range of

strategic alternatives for the Company, and/or its Web-3 division

subsidiary SurancePlus Holdings Ltd, including a sale, spinout,

merger, divestiture, recapitalization, and other strategic

transactions, or continuing to operate as a public, independent

company.

"To reinforce our strategic vision, we are

committed to exploring opportunities that will deliver value to our

stakeholders and ensure continued success in our evolving

industries,” commented Oxbridge Re Holdings Chairman and Chief

Executive Officer Jay Madhu.

The Company cannot assure that its evaluation

will result in the Company and/or its subsidiaries pursuing a

transaction or that any transaction, if pursued, will be completed

on attractive terms. The Board has not set a timetable for the

conclusion of this review. There can be no assurance that the

review will result in any transaction or other strategic change or

outcome. The Company does not intend to comment further until it

determines that further disclosure is appropriate or necessary.

About Oxbridge Re Holdings

LimitedOxbridge Re Holdings Limited (www.OxbridgeRe.com)

(NASDAQ: OXBR, OXBRW) (“Oxbridge Re”) is headquartered in the

Cayman Islands. The company offers tokenized Real-World Assets

(“RWAs”) as tokenized reinsurance securities and reinsurance

business solutions to property and casualty insurers, through its

wholly owned subsidiaries SurancePlus Inc., Oxbridge Re NS, and

Oxbridge Reinsurance Limited.

Insurance businesses in the Gulf Coast region of

the United States purchase property and casualty reinsurance

through our licensed reinsurers Oxbridge Reinsurance Limited and

Oxbridge Re NS.

Our Web3-focused subsidiary, SurancePlus Inc.

(“SurancePlus”), has developed the first “on-chain” reinsurance RWA

of its kind to be sponsored by a subsidiary of a publicly traded

company. By digitizing interests in reinsurance contracts as

on-chain RWAs, SurancePlus has democratized the availability of

reinsurance as an alternative investment to both U.S. and non-U.S.

investors.

Forward-Looking StatementsThis

press release may contain forward-looking statements made pursuant

to the Private Securities Litigation Reform Act of 1995. Words such

as “anticipate,” “estimate,” “expect,” “intend,” “plan,” “project”

and other similar words and expressions are intended to signify

forward-looking statements. Forward-looking statements are not

guarantees of future results and conditions but rather are subject

to various risks and uncertainties. A detailed discussion of risks

and uncertainties that could cause actual results and events to

differ materially from such forward-looking statements is included

in the section entitled “Risk Factors” contained in our Form 10-K

filed with the Securities and Exchange Commission (“SEC”) on 26th

March 2024. The occurrence of any of these risks and uncertainties

could have a material adverse effect on the Company’s business,

financial condition and results of operations. Any forward-looking

statements made in this press release speak only as of the date of

this press release and, except as required by law, the Company

undertakes no obligation to update any forward-looking statement

contained in this press release, even if the Company’s expectations

or any related events, conditions or circumstances change.

Company Contact:Oxbridge Re Holdings LimitedJay

Madhu, CEO345-749-7570jmadhu@oxbridgere.com

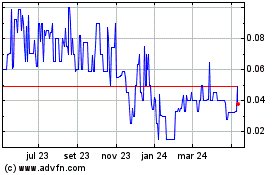

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

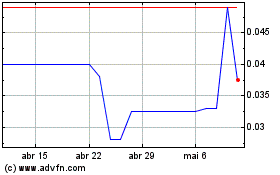

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025