Altus Group Limited (“Altus Group” or “the Company”) (TSX: AIF), a

leading provider of asset and fund intelligence for commercial real

estate (“CRE”), announced today that the Company has signed a

definitive agreement to sell its global Property Tax business to

Ryan, LLC (“Ryan”), a leading global tax services and software

provider, for total cash consideration of C$700 million. In

addition to the definitive agreement, Ryan has also committed to

enter a C$15 million Altus Market Insights subscription agreement

at the close of the transaction, with an initial three-year term of

C$5 million per year.

“This transaction strategically positions Altus

Group to focus on the substantial growth opportunities in our core

Analytics business unit to enhance revenue growth, expand

margins, and increase cash flows,” said Jim Hannon, Chief Executive

Officer of Altus Group. “We are monetizing the value of our

Property Tax business today so that we can invest in higher-value

growth opportunities at a time when market demand for asset

intelligence is accelerating and CRE investment activity is set to

pick up. In addition to significantly transforming our Company,

this transaction improves our financial and strategic flexibility

to drive growth and return capital to our shareholders.”

“Altus Group has built an impressive property

tax business that is highly regarded as a trusted advisor in the

industry,” commented G. Brint Ryan, Chairman and Chief Executive

Officer of Ryan. “We believe we are the perfect home for its many

talented employees and loyal customers who will benefit from our

combined platform to effectively manage their property tax

liabilities. This acquisition, along with the commercial

subscription for Altus Group’s Market Insights offer, significantly

bolsters our growing Property Tax practice.”

Strategic Rationale for

Divestiture

Altus Group and its board of directors routinely

consider strategic alternatives to maximize shareholder value.

Following a robust review of options for Property Tax, the Company

engaged in a sale process to unlock value for Altus Group’s

shareholders and to find the right long-term home for its Property

Tax business.

Strategic merits of this transaction for Altus

Group include:

- Sharpens strategic focus on

Analytics: Concentrate resources on higher-growth

Analytics business unit, delivering more resilient Organic Revenue*

growth and more predictable cash generation. With focused

operations, Altus Group can accelerate its strategic plan to lead

CRE asset intelligence with new advanced analytics.

- Enhances financial and

operational flexibility: Enables Altus Group to invest

organically and via acquisitions in Analytics, return capital to

shareholders, including through a significantly expanded share

buyback program, and pay down debt to target levels. Additionally,

Altus Group will benefit from more streamlined operations and a

reduced corporate cost structure.

- Strengthens financial

profile: Altus Group’s revenue predictability will improve

due to reduced jurisdictional cyclicality and volatility associated

with the timing of tax appeal processing. Earnings quality will

improve with an increased mix of high margin Recurring Revenue*, a

reduced debt balance and lower interest expense. Pro forma

financial performance is expected to be in-line with other leading

software, data and analytics companies.

Transaction Details

The C$700 million total cash consideration

represents a 10.1x 2023 Adjusted EBITDA multiple for the business

segment and over 16x 2023 Free Cash Flow* (over 14x net proceeds).

After taxes, fees and restructuring expenses, net proceeds are

estimated to be approximately C$600 million.

At closing Ryan will also enter into a C$5

million per year Altus Market Insights subscription agreement with

Altus Group, with an initial term of three years.

Altus Group expects the transaction to close in

the first half of 2025, subject to customary closing conditions,

including receipt of regulatory approvals. The closing of the

transaction is not subject to any financing conditions.

Evercore is serving as financial advisor to

Altus Group and provided a fairness opinion to Altus Group’s board

of directors. Stikeman Elliott LLP and Cravath, Swaine & Moore

LLP are serving as legal counsel to Altus Group.

Use of Proceeds

Post closing, the Company intends to use

proceeds from the Property Tax divestiture to:

- Strengthen balance

sheet: Pay down its outstanding bank debt (C$328.6 million

as at the end of March 31, 2024) to target 2.5x pro forma Funded

debt to EBITDA ratio.

- Facilitate value-creating

growth investments: Pursue organic investments to

accelerate the commercialization of advanced analytics offerings

and continue evaluating high-quality, strategic acquisitions.

- Return capital to

shareholders: Following closing, the board of directors

intends to expand the Company’s share buyback program from

approximately C$72 million** today to C$250 million and evaluate

other options to return excess capital. The Company intends to

maintain its existing quarterly dividend payments of C$0.15 per

share.

- Restructure corporate

overhead: With a more streamlined business unit structure,

Altus Group will simplify back-office operations and ensure no

stranded costs related to this transaction.

** Based on the purchase of the remaining number

of shares available under Altus’ current Normal Course Issuer Bid

(NCIB) as of Q1 2024 at yesterday’s closing price.

FY 2026 Targets for Pro Forma

Consolidated Financial Profile

Following the divestiture of Property Tax, Altus

Group expects its new pro forma financial profile for FY 2026 will

be:

- Consolidated

revenue growth in the high single-digits;

- Recurring

Revenue mix of ~75%;

- Consolidated

Adjusted EBITDA margin between 24-26%; and

- Adjusted EBITDA

to Free Cash Flow conversion between 65-70%.

“Sharpening our focus on the Analytics business

unit is expected to drive double-digit revenue growth and ~35%

Adjusted EBITDA margin for the segment in 2026,” added Pawan

Chhabra, Chief Financial Officer of Altus Group. “With simplified

and scaled operations, Altus Group will continue to optimize for

peak performance.”

All FY 2026 targets are presented in Constant

Currency* and on an organic basis.

Forecasting future results or trends is

inherently difficult for any business and actual results or trends

may vary significantly. The FY 2026 targets are forward-looking

information that is based upon the assumptions and subject to the

material risks discussed under the “Forward-Looking Information”

section. Key assumptions for the FY 2026 targets assume

that Altus Group has successfully divested the Property Tax

business in the first half of 2025 and achieved its cost action

plans, including the associated restructuring activities, as

well as the following assumptions by segment: Analytics:

consistency and growth in number of assets on the Valuation

Management Solutions platform, continued ARGUS cloud conversions,

new sales (including New Bookings converting to revenue within

Management’s expected timeline), client and software retention

consistent with 2023 levels, pricing action, improved operating

leverage, as well as consistent and increasingly stable economic

conditions in financial and CRE markets. Appraisal &

Development Advisory: improved client profitability and improved

operating leverage.

Planned Investor Updates

- The Company will

host a conference call and webcast today (July 9, 2024) at 8:00 am

Eastern Time to discuss the transaction.

- Altus Group also

plans to host a conference call on August 8, 2024 at 5:00 pm

Eastern Time to discuss its second quarter 2024 financial

results.

- Following the

close of the transaction, Altus Group plans to host an investor day

to discuss its go-forward strategy and capital allocation

priorities in more detail.

|

|

|

Property Tax Disposition Announcement Conference

Call & Webcast: |

|

Date:Time:Webcast:Live Call: |

Tuesday, July 9, 20248:00 am

(ET)https://events.q4inc.com/attendee/9933767201-888-660-6785

(North America toll-free) (Conference ID: 8366990) |

|

|

|

Q2 2024 Financial Results Conference Call &

Webcast: |

|

Date:Time:Webcast:Live Call: |

Thursday, August 8, 20245:00 pm

(ET)https://events.q4inc.com/attendee/9485807961-888-660-6785

(North America toll-free) (Conference ID: 8366990) |

|

|

|

A replay of both webcasts will be available on the Company’s

website. |

*Altus Group uses certain non-GAAP financial

measures including total of segments measures such as Adjusted

EBITDA; capital management measures such as Free Cash Flow; and

supplementary financial and other measures such as Constant

Currency, Adjusted EBITDA margin, Organic Revenue and Recurring

Revenue. Refer to the “Non-GAAP and Other Measures” section in the

Company’s most recent MD&A report for more information on each

measure and a reconciliation of Adjusted EBITDA to Profit (Loss)

and Free Cash Flow to Net cash provided by (used in) operating

activities.

About Altus Group

Altus Group is a leading provider of asset and

fund intelligence for commercial real estate. We deliver

intelligence as a service to our global client base through a

connected platform of industry-leading technology, advanced

analytics, and advisory services. Trusted by the largest CRE

leaders, our capabilities help commercial real estate investors,

developers, proprietors, lenders, and advisors manage risks and

improve performance returns throughout the asset and fund

lifecycle. Altus Group is a global company headquartered in Toronto

with approximately 3,000 employees across North America, EMEA and

Asia Pacific. For more information about Altus Group (TSX: AIF)

please visit altusgroup.com.

Forward-looking Information

Certain information in this press release may

constitute “forward-looking information” within the meaning of

applicable securities legislation. All information contained in

this press release, other than statements of current and historical

fact, is forward-looking information. Forward-looking information

includes, but is not limited to, the discussion of the Company’s

business, strategies and expectations of future performance,

including any guidance on financial expectations, use of net

proceeds from the transaction contemplated in this press release

and its expectations with respect to enhance revenue growth, margin

expansion and increased cash flows and liquidity, debt repayment,

organic investments and return of capital to shareholders.

Generally, forward-looking information can be identified by use of

words such as “may”, “will”, “expect”, “believe”, “anticipate”,

“estimate”, “intend”, “plan”, “would”, “could”, “should”,

“continue”, “goal”, “objective”, “remain” and other similar

terminology.

Forward-looking information is not, and cannot

be, a guarantee of future results or events. Forward-looking

information is based on, among other things, opinions, assumptions,

estimates and analyses that, while considered reasonable by us at

the date the forward-looking information is provided, inherently

are subject to significant risks, uncertainties, contingencies and

other factors that may not be known and may cause actual results,

performance or achievements, industry results or events to be

materially different from those expressed or implied by the forward

looking information. The material factors or assumptions that the

Company identified and applied in drawing conclusions or making

forecasts or projections set out in the forward-looking information

(including the “FY 2026 Organic Targets for Pro Forma Consolidated

Financial Profile”) include, but are not limited to the ones listed

above under “FY 2026 Organic Targets for Pro Forma Consolidated

Financial Profile” as well as: engagement and product pipeline

opportunities in Analytics will result in associated definitive

agreements; continued adoption of cloud subscriptions by the

Company’s customers; retention of material clients and bookings;

sustaining the Company’s software and subscription renewals;

development or acquisition of advanced analytics applications;

successful execution of the Company’s business strategies;

consistent and stable economic conditions or conditions in the

financial markets including stable interest rates and credit

availability for CRE; consistent and stable legislation in the

various countries in which the Company operate; consistent and

stable foreign exchange conditions; no disruptive changes in the

technology environment; opportunity to acquire accretive businesses

and the absence of negative financial and other impacts resulting

from strategic investments or acquisitions on short term results;

successful integration of acquired businesses; continued

availability of qualified professionals; successful completion of

the transaction contemplated by this press release in accordance

with the term thereof, unamended, absence of any material purchase

price adjustment for working capital or otherwise; and execution of

Altus Market Insights subscription agreement. In addition, any

return of capital initiative will be dependent on various factors

present at the time, including share price, tax impacts, absence of

any other capital allocation priorities, and receipt of any

regulatory approvals. As such, this press release does not

constitute an offer to buy or the solicitation of an offer to sell

any shares or an intention to conduct an issuer bid.

Inherent in the forward-looking information are

known and unknown risks, uncertainties and other factors that could

cause the Company’s actual results, performance or achievements, or

industry results, to differ materially from any results,

performance or achievements expressed or implied by such

forward-looking information. Those risks include, but are not

limited to: the commercial real estate market, the general state of

the economy; the Company’s financial performance; the Company’s

financial targets; the Company’s international operations;

acquisitions; business interruption events; third party information

and data; cybersecurity; industry competition; professional talent;

the Company’s subscription renewals; the Company’s sales pipeline;

client concentration and loss of material clients; the Company’s

cloud transition; product enhancements and new product

introductions; technological strategy; intellectual property;

property tax appeals and seasonality; compliance with laws and

regulations; privacy and data protection; artificial intelligence;

the Company’s use of technology; the Company’s leverage and

financial covenants; interest rates; inflation; the Company’s brand

and reputation; fixed price and contingency engagements; currency

fluctuations; credit; tax matters; health and safety hazards; the

Company’s contractual obligations; legal proceedings; regulatory

review; the Company’s insurance limits; the Company’s ability to

meet the solvency requirements necessary to make dividend payments

and repurchase shares; the Company’s share price; the Company’s

capital investments; the issuance of additional common shares and

debt, the Company’s internal and disclosure controls;

environmental, social and governance (“ESG”) matters; climate risk;

and geopolitical risks, as well as those described in the Company’s

annual publicly filed documents, including the Annual Information

Form for the year ended December 31, 2023 (which are available on

SEDAR+ at www.sedarplus.ca).

Investors should not place undue reliance on

forward-looking information as a prediction of actual results. The

forward-looking information reflects management’s current

expectations and beliefs regarding future events and operating

performance and is based on information currently available to

management. Although The Company has attempted to identify

important factors that could cause actual results to differ

materially from the forward-looking information contained herein,

there are other factors that could cause results not to be as

anticipated, estimated or intended. The forward-looking information

contained herein is current as of the date of this press release

and, except as required under applicable law, we do not undertake

to update or revise it to reflect new events or circumstances.

Additionally, the Company undertakes no obligation to comment on

analyses, expectations or statements made by third parties in

respect of Altus Group, the Company’s financial or operating

results, or the Company’s securities.

Certain information in this press release,

including sections entitled “FY 2026 Organic Targets for Pro Forma

Consolidated Financial Profile”, may be considered as “financial

outlook” within the meaning of applicable securities legislation.

The purpose of this financial outlook is to provide readers with

disclosure regarding Altus Group’s reasonable expectations as to

the anticipated results of its proposed business activities for the

periods indicated. Readers are cautioned that the financial outlook

may not be appropriate for other purposes.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Camilla BartosiewiczChief Communications

Officer, Altus Group(416)

641-9773Camilla.Bartosiewicz@altusgroup.com

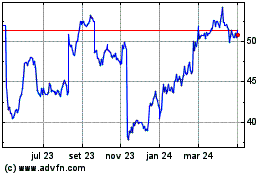

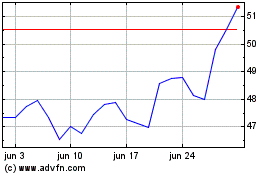

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Altus (TSX:AIF)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024