Osisko Mining Shareholders Overwhelmingly Approve Acquisition by Gold Fields

17 Outubro 2024 - 4:16PM

Osisko Mining Inc. ("

Osisko") (TSX:OSK) is pleased

to announce that shareholders of Osisko

("

Shareholders") overwhelmingly approved the

Arrangement Resolution (as defined herein) at the special meeting

of Shareholders (the "

Meeting") held earlier today

at the Offices of Bennett Jones LLP.

The Meeting was called for Shareholders to

consider and, if deemed advisable, approve the previously-announced

plan of arrangement of Osisko (the "Plan of

Arrangement"), pursuant to which Gold Fields Limited,

through a 100% owned Canadian subsidiary (the

"Purchaser" or "Gold Fields"),

would, among other things, acquire all of the issued and

outstanding common shares of Osisko ("Osisko

Shares") for cash consideration of C$4.90 per Osisko

Share.

A total of 241,670,665 Osisko Shares were

represented at the Meeting, in person or by proxy, representing

approximately 63.31% of the total number of issued and outstanding

Osisko Shares outstanding as of the record date for the

Meeting.

The resolution approving the Plan of Arrangement

(the "Arrangement Resolution") was overwhelmingly

approved at the Meeting by (i) 99.546% of the votes cast by

Shareholders voting in person or represented by proxy at the

Meeting, and (ii) 99.539% of the votes cast by the minority

Shareholders voting in person or represented by proxy at the

Meeting, excluding the Osisko Shares required to be excluded

pursuant to Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions ("MI

61-101").

To be effective, the Arrangement Resolution

required the affirmative vote of at least (i) two-thirds of the

votes cast by the Shareholders, present or represented by proxy at

the Meeting, and (ii) a simple majority of the votes cast by the

minority Shareholders, present or represented by proxy at the

Meeting, excluding the Osisko Shares required to be excluded

pursuant to MI 61-101 (being the Osisko Shares held by Mr.

Vizquerra-Benavides). Accordingly, all shareholder

approvals required in order to proceed with the Plan of Arrangement

have been obtained.

The Plan of Arrangement is expected to become

effective on or about October 25, 2024, subject to, among other

things, Osisko obtaining a Final Order from the Ontario Superior

Court of Justice (Commercial List) in respect of the Plan of

Arrangement and the satisfaction or waiver of certain other

customary closing conditions. It is expected that, within two to

three business days following the completion of the Plan of

Arrangement, the Osisko Shares will be delisted from the Toronto

Stock Exchange.

Additional details of the voting results will be

included in a report of voting results to be filed on SEDAR+

(www.sedarplus.ca) under Osisko's issuer profile. Additional

details about the Plan of Arrangement and the Arrangement

Resolution can be found in the management information circular of

Osisko dated September 6, 2024, a copy of which is available on

SEDAR+ (www.sedarplus.ca) under Osisko's issuer profile.

About Osisko

Osisko is a mineral exploration company focused

on the acquisition, exploration, and development of precious metal

resource properties in Canada. Osisko holds a 50% interest in the

high-grade Windfall gold deposit located between Val-d'Or and

Chibougamau in Québec and holds a 50% interest in a large area of

claims in the surrounding Urban Barry area and nearby Quévillon

area (over 2,300 square kilometers).

Cautionary Statement Regarding

Forward-Looking Statements

This news release may contain forward-looking

statements (within the meaning of applicable securities laws) which

reflect Osisko's current expectations regarding future events.

Forward-looking statements are identified by words such as

"believe", "anticipate", "project", "expect", "intend", "plan",

"will", "may", "estimate" and other similar expressions. The

forward-looking statements in this news release include statements

regarding the proposed acquisition by Gold Fields of all of the

Osisko Shares and the terms thereof, the expected date of

completion of the Arrangement, the delisting of the Osisko Shares

from the Toronto Stock Exchange and the timing thereof, the receipt

of all required regulatory approvals and other statements that are

not historical fact. The forward-looking statements in this news

release are based on a number of key expectations and assumptions

made by Osisko including, without limitation: the Arrangement will

be completed on the terms currently contemplated; the Arrangement

will be completed in accordance with the timing currently expected;

and all conditions to the completion of the Arrangement will be

satisfied or waived. Although the forward-looking statements

contained in this news release are based on what Osisko's

management believes to be reasonable assumptions, Osisko cannot

assure investors that actual results will be consistent with such

statements. The forward-looking statements in this news release are

not guarantees of future performance and involve risks and

uncertainties that are difficult to control or predict. Several

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements. Such factors

include, among others: the Arrangement not being completed in

accordance with the terms currently contemplated or the timing

currently expected, or at all; expenses incurred by Osisko in

connection with the Arrangement that must be paid by Osisko in

whole or in part regardless of whether or not the Arrangement is

completed; the conditions to the Arrangement not being satisfied by

Osisko and Gold Fields; currency fluctuations; disruptions or

changes in the credit or security markets; results of operations;

and general developments, market and industry conditions.

Additional factors are identified in Osisko's annual information

form for the year ended December 31, 2023, the most recent

Management's Discussion and Analysis, and in the management

information circular of Osisko dated September 6, 2024 each of

which is available on SEDAR+ (www.sedarplus.ca) under Osisko's

issuer profile. Readers, therefore, should not place undue reliance

on any such forward-looking statements. There can be no assurance

that the Arrangement will be completed or that it will be completed

on the terms and conditions contemplated in this news release. The

proposed Arrangement could be modified or terminated in accordance

with its terms. Further, these forward-looking statements are made

as of the date of this news release and, except as expressly

required by applicable law, Osisko assumes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.

Contact Information:

John BurzynskiChairman & Chief Executive

OfficerTelephone (416) 363-8563

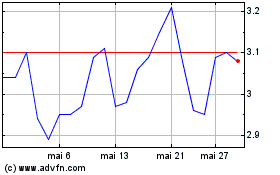

Osisko Mining (TSX:OSK)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Osisko Mining (TSX:OSK)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025