Gold Fields Completes Acquisition of Osisko Mining

25 Outubro 2024 - 2:58PM

Osisko Mining Inc. ("

Osisko") (TSX:OSK) is

pleased to announce the successful completion of its previously

announced plan of arrangement transaction (the

"

Arrangement"), pursuant to which, among other

things, Gold Fields Limited, through a 100% owned Canadian

subsidiary, Gold Fields Windfall Holdings Inc., acquired all of the

issued and outstanding common shares of Osisko (the

"

Shares").

Osisko's Chairman and

Chief Executive Officer, John Burzynski, commented:

"This premium

transaction represents a strong and near-term outcome for our

shareholders and is reflective of the truly world class nature of

the Windfall Project. In the span of nine years, we've transformed

Windfall into one of the largest and highest-grade gold development

projects globally, and this transaction is a testament to the

extraordinary entrepreneurial effort of the Osisko Mining team.

Gold Fields is a globally diversified senior gold producer with an

impressive track record of successfully building and operating

mines. As our (now former) joint venture partner at Windfall, Gold

Fields knows the asset well and understands the significance of the

strong relationships that we have built in Québec with all of our

stakeholders. Moreover, Gold Fields share our core principles of

operating in a safe, inclusive and socially responsible manner.

They are well suited to take Windfall into production and we wish

them all the best going forward."

Under the terms of the Arrangement, each former

shareholder of Osisko is entitled to receive C$4.90 for each Share

(the "Consideration") held immediately prior to

the effective time of the Arrangement. A Final Order approving the

Arrangement was granted by the Ontario Superior Court of Justice on

October 22, 2024. The Arrangement became effective earlier

today.

Former registered shareholders of Osisko are

reminded that, in order to receive the Consideration to which they

are entitled under the Arrangement, they must complete, sign and

return the letter of transmittal to TSX Trust Company, in its

capacity as depositary under the Arrangement, together with their

certificate(s) or DRS advice(s) representing their Shares. If you

have any questions or require further information regarding the

procedures for receiving the Consideration, please contact TSX

Trust Company: (i) by telephone at 1-866-600-5869 (North American

Toll Free) or 416-342-1091 (Outside North America); (ii) by

facsimile at 416-361-0470; (iii) by email at tsxtis@tmx.com; or

(iv) online at www.tsxtrust.com/issuer-and-investor-services.

Former non-registered shareholders should

receive the Consideration to which they are entitled under the

Arrangement directly in their brokerage accounts. Non-registered

shareholders should contact their broker or other intermediary if

they have any questions or require further information regarding

the procedures for receiving the Consideration to which they are

entitled under the Arrangement.

As a result of the completion of the

Arrangement, the Shares are expected to be delisted from the

Toronto Stock Exchange within two business days of closing. Osisko

intends to submit an application to the applicable securities

regulators to cease to be a reporting issuer and to terminate its

public reporting obligations. Each of the directors and senior

officers of Osisko have resigned from their respective positions

with Osisko upon completion of the Arrangement.

Further details regarding the Arrangement are

set out in Osisko's management information circular dated September

6, 2024 which is available on SEDAR+ (www.sedarplus.ca) under

Osisko's issuer profile.

Advisors

Maxit Capital LP and Canaccord Genuity Corp.

acted as financial advisors to Osisko. Bennett Jones LLP acted as

legal advisor to Osisko. Fort Capital Partners acted as financial

advisor to the special committee of independent directors of Osisko

(the "Special Committee"). Cassels Brock &

Blackwell LLP acted as independent legal advisors to the Special

Committee.

About Osisko

Osisko is a mineral exploration company focused

on the acquisition, exploration, and development of precious metal

resource properties in Canada.

About Gold Fields

Gold Fields is a globally diversified gold

producer with nine operating mines in Australia, South Africa,

Ghana, Chile and Peru and one project in Canada. Gold Fields shares

are listed on the Johannesburg Stock Exchange (JSE) and its

American depositary shares trade on the New York Exchange

(NYSE).

Cautionary Statement

Regarding Forward-Looking

Statements

This news release may contain forward-looking

statements (within the meaning of applicable securities laws) which

reflect Osisko's current expectations regarding future events.

Forward-looking statements are identified by words such as

"believe", "anticipate", "project", "expect", "intend", "plan",

"will", "may", "estimate" and other similar expressions. The

forward-looking statements in this news release include all

statements that are not historical fact. The forward-looking

statements in this news release are based on a number of key

expectations and assumptions made by Osisko including, without

limitation: the timing and ability of Osisko to cause the Shares of

Osisko to be delisted from the Toronto Stock Exchange; and the

timing and ability of Osisko to obtain an order that it has ceased

to be a reporting issuer and to terminate its public reporting

requirements. Although the forward-looking statements contained in

this news release are based on what Osisko's management believes to

be reasonable assumptions, Osisko cannot assure investors that

actual results will be consistent with such statements. The

forward-looking statements in this news release are not guarantees

of future performance and involve risks and uncertainties that are

difficult to control or predict. Several factors could cause actual

results to differ materially from the results discussed in the

forward-looking statements. Such factors include, among others:

currency fluctuations; disruptions or changes in the credit or

security markets; results of operations; and general developments,

market and industry conditions. Additional factors are identified

in Osisko's annual information form for the year ended December 31,

2023 and most recent Management's Discussion and Analysis, each of

which is available on SEDAR+ (www.sedarplus.ca) under Osisko's

issuer profile. Readers, therefore, should not place undue reliance

on any such forward-looking statements. These forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, Osisko assumes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Contact

Information:

John BurzynskiChairman & Chief Executive Officer(416)

363-8563

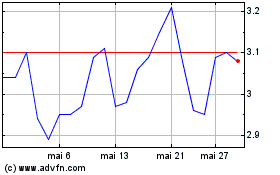

Osisko Mining (TSX:OSK)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Osisko Mining (TSX:OSK)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025