Delay in Mt. Gox settlement impacts crypto market

Bitcoin (COIN:BTCUSD), Ethereum (COIN:ETHUSD), and other

altcoins such as BNB (COIN:BNBUSD), XRP (COIN:XRPUSD) faced

declines, following the decision of bankrupt cryptocurrency

exchange Mt. Gox to extend the deadline for their payments until

October 31, 2024. Some investors anticipated that this movement

could reverberate through the market, with possible influences on

valuations. The extension was approved by the Tokyo District

Court and is not the first change to the deadline. Some

compensation for creditors may occur later this year.

Private sale of OP tokens by Optimism founders

The layer-2 Optimism blockchain team sold 116 million of its OP

(COIN:OPUSD) tokens for $157 million to seven different

buyers in a private, scheduled event, as announced on its

governance portal. These tokens come from an unallocated

section of the OP token treasury, which still holds around $1.25

billion worth of tokens. These buyers now have the right to

delegate tokens for involvement in blockchain governance. The

OP value is down -5.76% at the time of writing, trading at

$1.31.

Ethereum value falls against Bitcoin after transition to proof of

stake

So far in 2023, Ether (COIN:ETHUSD) has experienced 36% price

growth, but is still trading at a value 66% lower than its peak in

November 2021. On September 20, it reached its all-time high low in

relation to Bitcoin (COIN:BTCUSD) in 14 months, causing concerns

among investors. The Ethereum community remained hopeful with

improvements to the protocol, resulting in a significantly reduced

issuance rate and exceeding staking expectations, even after the

price decline. Investors are now looking for new catalysts to

reverse Ether’s downward trend.

Venmo introduces PayPal USD stablecoin: Adoption progresses slowly

Since September 20, PayPal’s (NASDAQ:PYPL) mobile payments

platform Venmo has made the PayPal USD (COIN:PYUSDUSD)

stablecoin available to select users, with plans for full expansion

in the following weeks. PYUSD, backed by US dollars,

facilitates transfers between Venmo and PayPal at no additional

cost. Although it has received approval from the NYDFS and is

available on several exchanges, adoption of PYUSD has been slow,

facing stiff competition and potential regulatory complications,

remaining in 19th place by market capitalization among

stablecoins.

Development of the AstroPepeX token by integrating ChatGPT into

Ethereum network

An Ethereum developer known as CroissantETH integrated ChatGPT

into a custom application via the OpenAI API, resulting in the

creation of the ERC-20 AstroPepeX (APX) token. Modeled based

on data from the most traded tokens on Uniswap, APX has achieved a

market cap of approximately $3.5 million, with over 2,300

registered holders. The token, generated completely by ChatGPT

without human intervention, has been promoted and listed on several

exchanges, including Poloniex, and has links to social networks and

a Telegram community group.

New Ethereum standard, ERC-7512, seeks to increase transparency in

DeFi

Ethereum developers have introduced ERC-7512, a new standard for

smart contracts that seeks to improve transparency and facilitate

access to audits for DeFi protocols. Proposed by Richard

Meissner, co-founder of Safe, along with other notable developers,

the standard aspires to establish an on-chain representation of

audit reports, enabling users to obtain pertinent audit

information, such as the auditors involved and verified standards,

directly from the blockchain. The proposal generated intense

discussions about its implementation among the developer

community.

Alpha: New social token project on the Bitcoin network challenges

Friend.tech

The recently introduced Alpha project is creating an innovative

social token environment on the Bitcoin network, similar to the

famous Ethereum platform, Friend.tech. This new system allows

users to capitalize on their online presence and content production

through social tokens, but with structural differences, being

mainly based on the Bitcoin blockchain and using Polygon for data

storage. Punk3700, one of the co-founders, explained that

Alpha seeks flexibility, efficiency and security for decentralized

applications, promoting a community-centric development

approach. He emphasized that these features allow for a

significant reduction in transaction costs, benefiting users and

encouraging the creation of valuable content.

Binance faces criticism after spending nearly $1 million on

Ethereum gas fees

A wallet associated with Binance consumed approximately 530

Ether, equivalent to about $843,797, in gas fees in a single day,

as evidenced by Etherscan. On September 21, the Ethereum

network gas fee fluctuated between $0.17 to $11.2 per

transaction. This significant gas spend was attributed to the

“Binance 14” wallet, raising questions about the platform’s

technical capabilities and generating criticism of Binance’s

security and technology practices, especially amid its ongoing

legal disputes and controversies.

Tether ventures into artificial intelligence with strategic

partnership and robust investment

Stablecoin issuer Tether (COIN:USDTUSD) is expanding into

artificial intelligence via Northern Data Group’s (CHIX:NB2D)

subsidiary Damoon. Damoon acquired $427 million worth of GPUs

from Nvidia (NASDAQ:NVDA). The chips will bolster the Taiga

cloud service, available later in the quarter. Tether,

criticized for lack of transparency, ventures beyond

stablecoins, and ensures that the investment does not impact

the reserves of your stablecoins.

Chainlink and Arbitrum integrate to enhance development of

Inter-Blockchain dApps

The Oracle Blockchain Chainlink network has collaborated with

Ethereum’s layer-2 scaling protocol, Arbitrum, to accelerate the

development of cross-chain decentralized applications

(DApps). They revealed the introduction of the Chainlink

Cross-Chain Interoperability Protocol (CCIP) on Arbitrum One on

September 21st. This launch provides software creators with

access to Chainlink solutions utilizing Arbitrum’s efficient and

cost-effective scaling capabilities, with the aim of exploring a

wide range of applications from tokenization to blockchain

gaming. Arbitrum’s optimistic rollup technology and

Chainlink’s CCIP protocol seek to deliver faster, more

cost-effective transactions, promoting innovation and growth in the

blockchain ecosystem. The native tokens of Chainlink and Arbitrum

are (COIN:LINKUSD) and (COIN:ARBUSD), respectively.

Leadership change at Near Foundation

Marieke Flament, who was heading the Near Foundation as CEO,

decided to resign from her position. Chris Donovan will take

on the role of CEO in his place. During Flament’s time, the

Near Foundation has seen significant growth, growing from 50,000 to

3 million daily users and significantly expanding its presence and

partnerships in the digital and cryptocurrency ecosystem, including

collaborations with giants like Google

(NASDAQ:GOOGL) , Amazon (NASDAQ:AMZN) and Alibaba

(NYSE:BABA). Flament’s departure was not justified for

specific reasons.

Binance may withdraw stablecoins from the European market due to

new legislation

Due to the implementation of the Markets in Crypto Assets Act

(MiCA) in Europe, Binance may remove stablecoins from the European

market by June 2024, as stated by an executive during a hearing

with the European Banking Authority. Marina Parthuisot,

Binance’s legal representative in France, expressed concerns about

the potential impact of this withdrawal on the European market

compared to other regions, as the regulation could significantly

affect the use of cryptocurrencies in Europe.

Galaxy Digital plans European expansion in the face of regulatory

advancement

Galaxy Digital, led by Mike Novogratz, is outlining plans for

European expansion, leveraging the progressive regulation of

cryptocurrencies in the region. Leon Marshall, former head of

sales and now European executive president of the company, will

lead the operation, aiming to solidify its presence in a market

that has been favorably adopting digital assets.

eToro expands crypto services in Europe after regulatory approval

Trading platform eToro is expanding its crypto services

footprint globally after gaining significant regulatory approval in

Europe. The company obtained Crypto Asset Service Provider

(CASP) registration granted by the Cyprus Securities and Exchange

Commission (CySEC) on September 21. This registration will

allow eToro to provide regulated crypto services to all European

Union countries under the eToro Europe Digital Assets entity once

the EU Markets in Crypto-Assets Regulation (MiCA) is applied in

December 2024.

Union Bank of the Philippines advances in cryptocurrency services

Union Bank of the Philippines has obtained a license from the

Bangko Sentral ng Pilipinas, becoming the country’s first bank

authorized as a Virtual Asset Service Provider (VASP). It will

offer, through its application, a platform that allows

cryptocurrency trading and digital and banking asset

management. Edwin Bautista, president of the bank, sees this

development as a revolution in the Philippine banking sector,

meeting the growing demands for digital innovations and

improvements in customer-bank interaction.

Balancer recovers domain after DNS attack and considers change for

greater security

Decentralized finance (DeFi) protocol Balancer said it has

regained control over its domain following a domain name service

(DNS) attack that resulted in a loss of around $240,000. The

compromise occurred through a targeted social engineering attack on

EuroDNS, leading to consideration of a switch to a more secure

domain registrar and abandonment of the .fi TLD. Balancer has

advised other platforms to consider similar changes to prevent

future security breaches.

Whale loses millions and scams multiply

A cryptographic “whale” suffered a sophisticated phishing

attack, losing around $4.46 million in Tether

(COIN:USDTUSD). The transfer occurred from the Kraken exchange

wallet to an address identified as fraudulent by Blockchain

security company PeckShield. This is not an isolated case,

with Scam Sniffer highlighting an alarming total of US$337 million

diverted in scams, affecting more than 21,953 people. Experts

warn of the need for robust security measures and skepticism

towards unsolicited offers.

Advancement in Web3 games: Proof of Play raises US$ 33 Million

Proof of Play, led by Farmville mastermind Amitt Mahajan, has

raised $33 million in funding to develop Web3 games. This

venture also involves Twitch co-founder Emmett Shear as an

advisor. The initiative included investments from industry

icons such as Chris Dixon and Naval Ravikant, as well as renowned

companies such as Zynga and Firebase. The objective is to

overcome barriers in Web3 games, with the Pirate Nation game

already in beta, promising an immersive and innovative experience

without the need for prior knowledge in blockchain.

Significant devaluation: Most NFTs lose value on the market

A recent report revealed that 95% of top NFTs have experienced a

decline in value, with many now worth next to nothing. This

study, highlighted by Rolling Stone on September 20, was carried

out by dappGambl, analyzing 73,257 NFT collections. The

research indicated that 69,795 of these collections would not be

able to raise a dollar in the current market, being considered

“completely worthless” and held by around 23 million

investors. This discovery provoked varied reactions in the

digital asset space, with many investors expressing concerns and

disappointment at this marked devaluation.

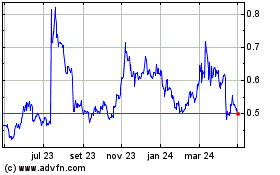

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024