Market contrast: Bitcoin rises while ETFs fall

In the last 24 hours, Bitcoin (COIN:BTCUSD) experienced a modest

increase, surpassing $43,000, while exchange-traded funds (ETFs)

showed a contrasting trend. Notably, ETFs from BlackRock

(NASDAQ:IBIT) and Van Eck (AMEX:HODL) suffered losses, each

dropping by 1.1% during this period. This decline is part of a

broader downward trend since their launch, with both ETFs recording

a decline of over 10%. Other cryptocurrencies and related assets,

such as MicroStrategy (NASDAQ:MSTR), are also experiencing

pullbacks, highlighting the market’s volatility.

Despite a surge on Tuesday, Bitcoin has been under significant

downward pressure since the introduction of spot ETFs in the US.

After reaching a peak of $49,102 on Thursday, Bitcoin’s value

dropped by more than 8%. This decline is mainly attributed to

traders taking profits on long positions established prior to the

ETF launch. The Cumulative Volume Delta (CVD) indicator shows that

Binance traders led this selling wave, with the CVD, which measures

the net difference between buying and selling volumes, indicating

strong selling pressure on Binance. Analyst Fernando Pereira from

Bitget predicts that Bitcoin could retreat further in the coming

weeks: “After falling 15% from the high on the 11th, Bitcoin

still has room to drop. I foresee a pullback to approximately

$36,000 in the coming weeks.”

CUP vs. Wright: A crucial judgment in Bitcoin’s history

The trial of the Crypto Open Patent Alliance (COPA) against

Craig Wright, set to begin on February 5th, represents a pivotal

moment for Bitcoin (COIN:BTCUSD). It challenges Wright’s claims of

being Satoshi Nakamoto. The case symbolizes the struggle between

the open-source ethos of the Bitcoin community and Wright’s

potentially restrictive claims. With major industry players’

support, COPA confronts Wright, accused of presenting dubious

evidence. The trial aims not only to clarify Nakamoto’s true

identity but also to define the future of Bitcoin’s development and

governance.

TrueUSD volatility and challenges: Drop in parity and reduced

supply

The TrueUSD stablecoin has seen significant instability, falling

below $1 and not regaining parity to date. Currently, TrueUSD

(COIN:TUSDUSD) has dropped to $0.986300. A massive sell-off of TUSD

was evident, with data from Binance showing an imbalance between

sales and purchases, leading to a substantial deficit. Factors like

TUSD’s absence from Binance’s launch pools and an imbalance in

TUSD’s Curve pool, which favored other stablecoins, contributed to

this volatility. Additionally, Whale Alert reported the burning of

millions of TUSD tokens. There were concerns about warranty

reporting, though attestation later normalized. The total supply of

TUSD saw a sharp decline, reaching its lowest point since June

2023.

SEC postpones judgment against Terraform Labs and Do Kwon

The SEC has delayed the trial against Terraform Labs and its

co-founder, Do Kwon, to April 15th. This postponement comes at

Kwon’s request, who agreed to extradition from Montenegro and is

expected to arrive in the US in March. The trial was originally

scheduled for January 29th. The delay aims to ensure Kwon’s

participation, who is currently serving a sentence for passport

fraud. The SEC opposes separate trials for Terraform Labs and Kwon,

arguing that the cases are nearly identical.

Tether responds to UN allegations about illegal use of USDT

Tether (COIN:USDTUSD) has refuted allegations in a UN report

regarding the illicit use of its USDT tokens. Tether emphasized its

intense regulatory monitoring, claiming it surpasses traditional

banking systems, with oversight from agencies like the DOJ, FBI,

and USSS. Tether representatives stated that the public blockchains

used make Tether tokens an unfavorable option for illegal

activities, contrasting with the UN report’s claims of USDT usage

in fraud. Tether advises the UN to deepen its understanding of

blockchain technology and expresses its willingness to collaborate

in combating financial crime.

Circle CEO predicts approval of US stablecoin laws in 2024

According to CNBC, Jeremy Allaire, CEO of Circle (COIN:USDCUSD),

expressed optimism at the World Economic Forum in Davos about the

likely passage of stablecoin laws in the US by 2024. He believes

that global regulatory progress increases the chances of the US

regulating stablecoins, supported by various government sectors.

Allaire also mentioned the positive impact of recent spot bitcoin

ETFs on USDC usage. Meanwhile, Circle is preparing for an initial

public offering (IPO), despite a drop in USDC’s market share last

year, marked by a temporary decoupling from the dollar following an

issue with Silicon Valley Bank.

Manta Pacific surpasses Base as the 4th largest scaling solution

Manta Pacific, layer 2 of the Manta Network, has overtaken

Coinbase to become the fourth-largest scaling solution, with a TVL

of $845 million. The TVL (Total Value Locked) metric is crucial for

evaluating DeFi protocols, indicating user popularity and trust.

Manta Pacific’s growth has been driven by its paradigm bridging

program and the adoption of zero-knowledge cryptocurrencies, making

it stand out in the DeFi competition.

Coinbase Prime records record activity increase following launch of

Bitcoin ETFs

Coinbase Prime, aimed at institutional and high-net-worth

investors, saw a surge in trading activity following the launch of

US Bitcoin ETFs. An analysis showed that the platform’s hot wallet

recorded significant movements, with inflows and outflows of $5.7

billion in the last week, surpassing Binance. Despite Binance’s

dominant track record, Coinbase Prime demonstrated a notable

increase in large transactions, indicating a profound impact of

ETFs on the Bitcoin market.

OKX expands globally with virtual asset services license in Dubai

OKX secured a virtual asset service provider license in Dubai

through its subsidiary, OKX Middle East Fintech FZE. This step is

part of the company’s global expansion, awaiting license activation

after meeting certain conditions and requirements. The license will

allow OKX Middle East to offer a broader range of regulated virtual

asset services, strengthening its presence in the growing Web3 and

crypto region of MENA.

Binance starts operations in Thailand after partnership with Gulf

Innova

The joint venture between Binance and Gulf Innova, Binance

Thailand, announced the start of its crypto exchange operations.

After a year of detailed planning and collaboration with Thai

regulators, the platform offers digital asset exchange services,

including pairs with Thai baht and integration with local banks.

Overseen by Thailand’s SEC, Binance Thailand represents a strategic

step in financial inclusion and advancing the global digital

financial landscape.

Fantom reduces staking requirement by 90% to strengthen network

security

Fantom (COIN:FTMUSD) announced a 90% reduction in the

requirements to run an auto-staking node, lowering it to 50,000

FTM. This change aims to increase network security by facilitating

the participation of more validators. Unlike Ethereum, each

validator on Fantom processes transactions independently, improving

network distribution and security. Despite the change, FTM prices

remained stable in the market at 0.415820.

Chainlink and Circle collaborate to expand USDC use across multiple

blockchains

Chainlink (COIN:LINKUSD) integrated Circle’s CCTP protocol

(COIN:USDCUSD) into its CCIP system, aiming to facilitate the

secure movement of USDC stablecoin across various blockchains. This

collaboration promises to expand the use of stablecoins in payments

and DeFi. While Chainlink’s CCIP allows the transfer of data and

assets between blockchains, Circle’s CCTP enables native USDC

transfers, burning, and minting the currency on supported networks.

The integration of these technologies marks a significant

advancement in the interoperability and application of

stablecoins.

Solana Mobile prepares to launch second smartphone with encryption

Solana Mobile is planning to launch a second smartphone,

following the unexpected success of its first crypto-focused

device, Saga. The new model will retain similar features, such as

an integrated crypto wallet and a decentralized application store,

but will be offered at a more affordable price and with different

hardware. The launch seeks to meet growing demand in the secondary

market, where the Saga has achieved high prices due to its limited

supply.

HashKey Group approaches $100 million fundraising goal

HashKey Group, operator of a cryptocurrency exchange in Hong

Kong, announced that it is close to reaching its fundraising goal

of $100 million. The funding round, initiated after obtaining a

license for retail crypto trading, boosted the company’s valuation

to $1.2 billion, achieving unicorn status. HashKey did not disclose

the round’s investors, highlighting a challenging period for the

cryptocurrency sector.

Digital Infrastructure raises $11.5 million in Series A for DIMO

Network

Digital Infrastructure Inc, focused on decentralized physical

infrastructure networks, raised $11.5 million in a Series A round

led by CoinFund. The round saw participation from investors

including Slow Ventures, ConsenSys Mesh, and others, bringing the

total funding to $22 million. The startup develops the DIMO

network, a decentralized automotive data protocol, and the DIMO

Mobile app, allowing drivers to collect data from their cars and

earn rewards in DIMO tokens (COIN:DIMOUSD). With more than 36,000

connected cars, representing over $1 billion in assets, the company

anticipates an increase in utility and tools for developers.

Animoca Brands launches Anichess, a Web3 chess game in partnership

with Chess.com

Animoca Brands, a Hong Kong-based Web3 investor, has launched

the first phase of Anichess, a decentralized chess game developed

in collaboration with Chess.com and supported by champion Magnus

Charlsen. This initial phase features solo gameplay, with plans to

add player-versus-player modes later this quarter. Anichess offers

daily chess puzzles where players can earn in-game resources and

unlock new challenges. Animoca Brands highlights that Anichess

innovates by combining traditional chess strategy with fantastic

elements and Web3 functionalities. The project, which raised $1.5

million in June 2023, merges classic strategy and modern

technology.

Vivek Ramaswamy ends presidential campaign in support of Trump

Vivek Ramaswamy, known for his pro-crypto stance, announced the

suspension of his presidential campaign to support Donald Trump. In

a statement via social media, Ramaswamy expressed his commitment to

ensuring Trump’s election. Despite Trump’s previously anti-crypto

rhetoric, he has recently become involved in NFT projects.

Ramaswamy stood out during his campaign for criticizing the SEC’s

regulatory approach and proposing crypto-friendly policies aimed at

greater economic freedom and protecting developers’ rights.

European Banking Authority establishes anti-money laundering

guidelines for crypto assets

The European Banking Authority (EBA) has issued new guidelines

for crypto companies to comply with anti-money laundering and

counter-terrorism financing regulations. The guidelines, which

expand existing measures to include the crypto-asset sector, aim to

harmonize the practices of crypto-asset service providers (CASP)

across the EU. The EBA warns of increased risks due to the speed of

transactions and features that can conceal user identities,

requiring CASPs to implement effective mitigation measures.

Furthermore, the new guidelines also apply to financial

institutions that interact with crypto assets, reinforcing the EU’s

integrated approach to combating financial crime. The guidelines

will take effect on December 30th, in line with the Markets in

Cryptoassets (MiCA) legislation.

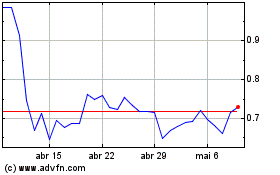

Fantom Token (COIN:FTMUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Fantom Token (COIN:FTMUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024