Bitcoin falls after reaching all-time high due to massive sales

Bitcoin (COIN:BTCUSD) experienced a 7% drop shortly after

hitting a new all-time high of $69,208, with intense selling on

cryptocurrency exchanges preventing gains beyond the milestone.

Large sell orders on Binance, including over 300 BTC at $69,000 and

500 BTC at $70,000, created significant price resistance, resulting

in a rapid depreciation to $64,530 at the time of writing.

MicroStrategy announces debt issuance to expand Bitcoin reserves

MicroStrategy (NASDAQ:MSTR) plans to raise $600 million by

selling convertible debt in a private offering to finance the

purchase of more bitcoins. Under the leadership of Michael Saylor,

the company has consistently increased its bitcoin holdings since

2020, currently owning 193,000 coins valued at over $13 billion.

The proceeds from the sale will also be allocated to general

corporate purposes, capitalizing on the recent surge in its stock

value. MSTR shares, which rose 24% on Monday, recorded a Tuesday

drop of over 16% in response to the announcement and the Bitcoin

price retracement.

Deutsche Boerse launches crypto trading platform for institutions

Deutsche Boerse (TG:DB1), the primary operator of the German

stock exchange, announced the launch of a crypto trading platform

called DBDX for institutional investors. The platform, which

provides a regulated environment for trading, settlement, and

custody of crypto assets, will begin with request-for-quote-based

trading, expanding to multilateral operations. In partnership with

Crypto Finance, which recently received German regulatory licenses,

Deutsche Boerse aims to ensure a reliable and regulated market for

digital assets in Europe.

Osprey Bitcoin Trust explores sale or merger with ETF

The Osprey Bitcoin Trust (USOTC:OBTC), known for aggressively

competing with Grayscale’s ETF (AMEX:GBTC), is now exploring

strategic alternatives such as selling itself or merging with a

Bitcoin ETF. This fund, whose shares are trading at a discount to

its actual BTC value, is also considering other options. If these

attempts fail, the company plans to wind down its operations and

liquidate its assets within six months.

BlackRock aims to incorporate Bitcoin ETFs in new opportunity fund

BlackRock (NYSE:BLK), an investment giant, proposed to the SEC

the inclusion of Bitcoin ETFs in its new Strategic Income

Opportunities Fund. The company intends to add shares of ETPs

mirroring the performance of Bitcoin (COIN:BTCUSD), including those

sponsored by BlackRock affiliates. With the recent approval of

Bitcoin ETFs by the SEC, BlackRock also considers investing in

Bitcoin futures, warning about inherent risks such as volatility

and the possibility of substantial losses.

VanEck aims for significant expansion in crypto assets in Europe

VanEck, with 69 years of experience in asset management and

issuer of the Bitcoin ETF (AMEX:HODL), is optimistic about the

growth of cryptographic products in its European division,

currently representing 10% of its assets under management. Martijn

Rozemuller, CEO of VanEck Europe, foresees a future where

cryptographic and conventional assets are more evenly balanced in

the company’s portfolio, potentially achieving a 50/50 split. With

a history of investment innovation, VanEck seeks to become a leader

in crypto and blockchain offerings, despite competition in the

sector.

OrdiZK suspected of scam after $1.4 million diversion

OrdiZK, a project aimed at connecting the Bitcoin, Ethereum, and

Solana blockchains, is accused of executing a Rug Pull scam,

disappearing with over $1.4 million. CertiK, a blockchain security

company, reports that OrdiZK developers withdrew the funds and shut

down their website and social media profiles. The OZK token

collapsed, losing nearly all its value after developers

suspiciously sold their tokens and withdrew Ether.

Fantom Foundation seeks asset recovery after $200 million exploit

The Fantom Foundation (COIN:FTMUSD), responsible for the Fantom

blockchain, is in the process of recovering assets after a $200

million exploit on the Multichain protocol. Following a favorable

ruling in Singapore, the foundation seeks to liquidate Multichain,

similar to bankruptcy in the American model, to distribute the

recovered assets. The action aims to facilitate claims from all

affected users, although the foundation cannot legally act on

behalf of users, legal precedent is expected to aid in individual

claims.

Montenegro overturns extradition decision of Do Kwon to the US

The Montenegro Court of Appeals overturned the extradition of Do

Kwon, co-founder of Terraform Labs, to the United States, accepting

the defense’s arguments about flaws in the previous judicial

process. The case will be reconsidered at a lower instance,

following Kwon’s successive appeals against extradition, both to

the US and South Korea, amidst accusations related to the collapse

of the Terra ecosystem.

Binance ceases operations with Nigerian Naira in response to

regulatory challenges

Cryptocurrency exchange Binance announced the discontinuation of

services related to the Nigerian Naira (FX:NGNUSD), including

transactions, deposits, and others, in a phased exit. Users have

until March 8 to withdraw their funds in NGN, after which they will

be converted to USDT. The decision follows tensions with Nigerian

authorities, accusing Binance of influencing exchange rates and

facing possible government sanctions.

BRICS plans blockchain payment system to strengthen monetary

independence

The BRICS consortium, formed by Brazil, Russia, India, China,

and South Africa, is developing an innovative payment system using

blockchain and other digital technologies. According to TASS

agency, the initiative aims to create a payment platform that is

efficient, cost-effective, and depoliticized, aiming for

independence from conventional systems and reducing dependence on

the dollar. This move is part of the group’s ongoing efforts to

expand its influence in the global monetary system and promote

de-dollarization.

Argo Blockchain sells property to offset debt and restructure

operations

Argo Blockchain (NASDAQ:ARBK), a Bitcoin mining company, sold

one of its properties in Quebec for $6.1 million to reduce its

financial obligations in response to a decrease in BTC production.

Of the total proceeds, $4 million were used to pay off part of the

debt with Galaxy Digital, reducing the debt to around $14 million.

The operation also involved the transfer of mining equipment to

another location in Quebec and the liquidation of older

machines.

Temporary 50% price drop of Shiba Inu on Coinbase surprises the

market

Shiba Inu experienced a sudden 50% drop on Coinbase, a major

American exchange, before recovering its value, highlighting an

atypical market fluctuation. This decline was isolated to Coinbase

during a broader market sell-off, led by Bitcoin, and was not

reflected on other major exchanges. The anomaly was attributed to a

sell order that overwhelmed available liquidity. Despite the

incident, SHIB (COIN:SHIBUSD) records an 8.3% drop in value over

the past 24 hours.

DWF Labs to invest $10 million in TokenFi to boost AI-driven

products

DWF Labs commits to acquire $10 million worth of TokenFi

(COIN:TOKENUSD) tokens over two years to support the development of

innovative products. The purchase, made from TokenFi’s treasury,

will finance new solutions integrating artificial intelligence,

including an AI generative system for NFTs and a smart contract

auditing tool. The news boosted the value of TOKEN, reaching a new

peak, while inspiring optimism for future growth in the crypto

market focusing on tokenization and AI.

Baanx raises $20 million in funding for global expansion

Baanx, a British cryptocurrency payment company recognized by

the FCA, raised $20 million in its first major funding round, with

contributions from names like Ledger and Tezos Foundation. With the

total funds surpassing $30 million, Baanx plans to expand its

innovative crypto payment services to the US and Latin America,

promoting a new era of cryptographic transactions with full

autonomy for users.

Utila raises $11.5 million in investment round for crypto security

Israeli company Utila, specializing in cryptographic wallets for

institutions, raised $11.5 million in initial funding from major

investors such as NFX and Wing Venture Capital. The investment

round, which involved several companies and angel investors, comes

at a time of renewed interest in the cryptocurrency market. Utila

aims to enhance security in digital asset management, using

advanced technology to prevent single points of failure.

Institutional investors plan to increase cryptocurrency

investments, survey reveals

A study by Nickel Digital indicates that the majority of

institutional investors and wealth managers intend to increase

their investments in cryptocurrencies over the next year, motivated

by a more positive outlook for the sector and recent market

performance. About 74% of participants with digital assets in their

portfolios plan to raise their allocations, driven by the approval

of bitcoin ETFs and long-term optimism, with 92% viewing the sector

as attractive over five years. Sovereign and pension funds are

among the most inclined to increase their investments in digital

assets.

Animoca Brands Japan and KDDI partnership to advance Web3 with

Mocaverse and αU

Animoca Brands Japan and KDDI join forces to promote the

adoption of Web3, utilizing Animoca’s Mocaverse and the αU

platform. This collaboration aims to integrate Moca ID with the αU

wallet to facilitate access to Web3 content, including games and

entertainment, within the Mocaverse ecosystem. The goal is to

create immersive and interoperable experiences for global users in

the Web3 gaming and entertainment universe, marking a significant

step in merging digital and physical culture.

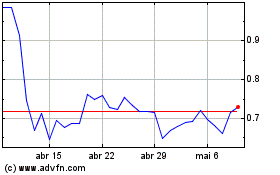

Fantom Token (COIN:FTMUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Fantom Token (COIN:FTMUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024