Crypto market volatility causes $138 million liquidation in 24

hours

The crypto market starts the week with significant losses,

highlighted by the sharp falls of Solana (COIN:SOLUSD), Ripple

(COIN:XRPUSD), and Cardano (COIN:ADAUSD). Bitcoin (COIN:BTCUSD),

having lost the crucial support level of $41,000, affected other

cryptocurrencies, resulting in over $138 million in liquidations,

mainly of long positions, in the last 24 hours.

The selling pressure on Bitcoin is partly attributed to the

sales of Grayscale’s GBTC ETF (AMEX:GBTC), while other Bitcoin

ETFs, such as those from BlackRock (NASDAQ:IBIT) and Fidelity

(AMEX:FBTC), show buying signals with net inflows of over $1

billion. The new Bitcoin ETFs, dubbed the “Newborn Nine,” have

accumulated 95,000 BTC, reaching nearly $4 billion in assets under

management (AUM).

Despite Bitcoin’s volatility, the positive performance of these

ETFs suggests a preference of investors for regulated products, in

contrast to the outflows from the Grayscale Bitcoin Trust.

Following the conversion of its Grayscale Bitcoin Trust (GBTC) into

an ETF, Grayscale Investments sold Bitcoin, sparking debates about

its future price impact. The sale occurred due to investors

migrating to ETFs with lower fees and withdrawals by some

investors. Experts are divided: while Chris J. Terry predicts

stability or a fall in Bitcoin’s price, Mike Novogratz of Galaxy

Digital expects stabilization in six months, with flows into other

Bitcoin funds.

Hong Kong prepares to launch first spot crypto ETFs in 2024

Gary Tiu of OSL anticipates that Hong Kong may launch its first

spot crypto ETFs by mid-this year, with five to ten companies

considering such a launch. Discussions include concerns about fees

and integration with traditional financial institutions. HashKey

and Venture Smart Financial Holdings also plan similar launches.

Hong Kong regulators have revised policies to facilitate spot

crypto ETFs, focusing on investor protection and the use of

licensed platforms.

Terraform Labs declares bankruptcy following devaluation of

stablecoin USTC

Terraform Labs, creator of the stablecoin USTC, filed for

Chapter 11 bankruptcy in Delaware amid legal disputes, including

actions by the SEC. The company maintains the ability to meet

financial commitments and has assets and liabilities between $100

and $500 million. With cofounders and major entities among the

creditors, CEO Chris Amani sees the bankruptcy as a measure to

resolve legal issues and focus on ecosystem development. Terra

tokens, including USTC (COIN:USTCUSD) and LUNC (COIN:LUNCUSD),

experienced significant declines.

B. Riley under investigation in the US for dealings with Brian Kahn

The investment bank B. Riley (NASDAQ:RILY) is being investigated

for its relations with Brian Kahn, a suspect in a criminal case of

the US Department of Justice. The firm denies knowledge of the

SEC’s investigation but promises full cooperation. B. Riley has

invested in the Bitcoin mining sector, including deals with Iris

Energy (NASDAQ:IREN) and Core Scientific (USOTC:CORZQ). A Bloomberg

report suggests close ties between B. Riley and Kahn, citing

Nomura’s involvement in financing Kahn’s acquisition, but clarifies

that Nomura is not a target of the investigation.

Binance Labs persists with 25 new investments in 2023 despite

regulatory challenges

In 2023, Binance Labs, the venture capital arm of Binance, made

25 new investments, focusing on DeFi, Web3 games, and

infrastructure, despite challenges in the crypto market and loss of

confidence in centralized entities. It invested in Radiant Capital,

allocated $5 million in CRV for integration with the BNB Chain, $10

million in the Helio Protocol, $15 million in Xterioled, and in

GOMBLE. It also invested in the Arkham Token. Despite a fine of

$4.3 billion and leadership changes, Binance Labs continues to

expand its investments.

Speculative surge in Dogecoin and Floki due to adoption

expectations in X

Dogecoin (COIN:DOGEUSD) and Floki (COIN:FLOKIUST) recorded an

increase of up to 12% before retracting, driven by speculation of

adoption in the social app X. The trading volume of these tokens

grew 200% over the weekend, and the futures contracts rose to a

cumulative value of $430 million. Speculation revolves around the

use of DOGE for payments and advertising in X, similar to Tesla’s

payment initiatives with DOGE. There is no official confirmation

yet on the adoption of DOGE as a payment option in X.

Ondo Finance expands to Asia-Pacific, broadening the market for

tokenized securities

Ondo Finance, a leading company in tokenized securities, has

opened its first office in the Asia-Pacific region. Holding 40% of

the global market, Ondo offers tokenized products like OUSG, OMMF,

and USDY, providing exposure to US financial assets. Nathan Allman,

CEO of Ondo, highlights the growth of the crypto community in

Asia-Pacific and the appreciation for high-quality US assets.

Ashwin Khosa, formerly of Tether and Bitfinex, has been appointed

vice president of business development in the region.

MetaMask and Consensys Stake launch Ethereum staking service for

users

MetaMask, a renowned crypto wallet, is collaborating with

Consensys Stake to enable users to stake 32 eth, about $80,000, to

run validator nodes on the Ethereum network, now based on post-‘The

Merge’ proof of stake. The partnership does not require pooling or

specific hardware/software, and Consensys Staking already operates

about 4% of the total eth staked. MetaMask promises about 4% annual

yield, with a 10% fee, and offers pooled staking options with Lido

and RocketPool.

Increase in trading of Trump collections and DeSantis support for

crypto

The trading volume of Trump Series 1 increased by 248%, reaching

$90,000, while his other collections suffered declines. The minimum

price of these collections fell by 4%. Meanwhile, DeSantis

suspended his candidacy, supporting Trump, citing the preference of

Republican voters. He defends Bitcoin’s (COIN:BTCUSD) rights and

opposes Central Bank Digital Currency (CBDC).

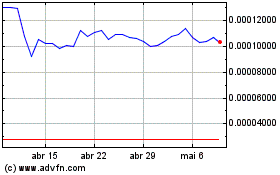

Terra Luna Classic (COIN:LUNCUSD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Terra Luna Classic (COIN:LUNCUSD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025