U.S. Index Futures Mixed in Pre-Market Tuesday, Oil Dip

07 Maio 2024 - 8:47AM

IH Market News

U.S. index futures signal a mixed opening this Tuesday in

pre-market trading, reflecting investors’ caution as they assess

the latest quarterly results.

At 6:44 AM, the futures of the Dow Jones Industrial Average

(DOWI:DJI) were up 66 points, or 0.17%. S&P 500 futures

advanced 0.05%, and Nasdaq-100 futures fell -0.14%. The yield on

10-year Treasury notes was at 4.461%.

In the commodities market, West Texas Intermediate crude for

June fell 0.38% to $78.18 per barrel. Brent crude for July dropped

0.40%, close to $83.00 per barrel. Iron ore traded on the Dalian

exchange fell 0.06% to $125.07 per metric ton.

On the economic agenda this Tuesday, the market will be

attentive at 11:30 AM to a speech by Neel Kashkari, President of

the Minneapolis Fed. At 3:00 PM, consumer credit data for March

will be released. Finally, at 4:30 PM, the API will announce weekly

oil inventories.

European markets are trending higher today, driven by a set of

positive earnings reports and encouraging retail sector data.

Notably, UBS (NYSE:UBS) surprised by reversing previous losses and

reporting a quarterly net profit, causing its shares to jump 9% in

morning trading. Concurrently, retail sales in the eurozone showed

an increase of 0.8% in March, in line with analysts’

expectations.

Stock markets in Asia and the Pacific closed predominantly

higher on Tuesday, following Wall Street’s advances. The

expectation that the Federal Reserve may cut interest rates in

September, amid signs of a slowdown in the U.S. job market,

motivated investors. Japan’s Nikkei rose 1.57%, South Korea’s Kospi

was up 2.16%, Australia’s ASX 200 also performed robustly, rising

1.44%, and China’s Shanghai SE recorded an increase of 0.22%.

Meanwhile, Hong Kong’s Hang Seng showed a slight retraction of

-0.53%.

On Monday, U.S. stock markets witnessed a significant rise,

extending the positive rally from the previous week and marking the

highest closing levels in nearly a month for the major indexes. The

Dow Jones advanced 0.46%, while the S&P 500 and Nasdaq gained

1.03% and 1.19%, respectively. This movement was partly motivated

by more dovish comments from Federal Reserve Chairman Jerome Powell

and by an employment report that came in below expectations,

reducing concerns about an imminent increase in interest rates. The

prospect of an interest rate cut by September seems increasingly

likely for investors, with estimates pointing to a probability of

83.5%.

On the quarterly earnings front, results are scheduled to be

presented before the market opens from Walt Disney

(NYSE:DIS), Ferrari (NYSE:RACE),

Nikola (NASDAQ:NKLA), BP plc

(NYSE:BP), Celsius Holdings (NASDAQ:CELH),

Datadog (NASDAQ:DDOG), Crocs

(NASDAQ:CROX), Rockwell Automation (NYSE:ROK),

Builders FirstSource (NYSE:BLDR),

Jumia (NYSE:JMIA), among others.

After the close, earnings numbers from Arista

Networks (NYSE:ANET), Wynn Resorts

(NASDAQ:WYNN), Upstart (NASDAQ:UPST),

Rivian Automotive (NASDAQ:RIVN),

Lyft (NASDAQ:LYFT), Occidental

Petroleum (NYSE:OXY), Twilio (NYSE:TWLO),

Coupang (NYSE:CPNG), Confluent

(NASDAQ:CFLT), Toast (NYSE:TOST), and more are

expected.

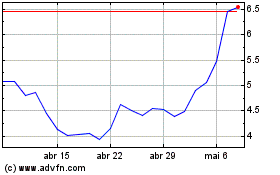

Jumia Technologies (NYSE:JMIA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Jumia Technologies (NYSE:JMIA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025