Nike (NYSE:NKE) – Nike shares fell 14.04% in

pre-market trading. Nike exceeded fourth-quarter fiscal earnings

estimates with adjusted earnings of $1.01 per share, but sales of

$12.6 billion fell short of expectations. Annual revenue of $51.4

billion also missed the $51.6 billion target, despite adjusted

earnings of $3.95 per share surpassing forecasts of $3.70 per

share. Nike predicted a surprising revenue decline for fiscal 2025,

expecting a mid-single-digit percentage drop, against analysts’

expected increase of 0.91%. This is due to weakened demand for its

sneakers, as it loses market share to newer brands like On and

Hoka. Nike said it cut overstocked brands and invested in better

running shoes, and plans new versions of the Air Max line. For the

next quarter, Nike expects a revenue drop of about 10%. Due to

Nike’s unexpected fiscal 2025 revenue drop prediction, shares of JD

Sports and Puma fell significantly, while Adidas shares saw a brief

increase followed by a drop. Analysts expect Adidas to gain market

share as Nike recalibrates its business until at least spring

2025.

Nokia (NYSE:NOK), Infinera

Corporation (NASDAQ:INFN) – Nokia will acquire Infinera

for an enterprise value of $2.3 billion to expand its optical

networks business, especially in the North American market. The

price of $6.65 per share represents a 26.4% premium over Infinera’s

closing price. Nokia will pay at least 70% in cash. Nokia shares

rose 1.3% in pre-market trading, while Infinera shares jumped

18.4%.

Verizon Communications (NYSE:VZ),

AT&T (NYSE:T), T-Mobile

(NASDAQ:TMUS) – Major US telecom providers stated on Thursday that

some of their international traveling users are facing connectivity

issues due to an incident with a partner network provider. Verizon,

AT&T, and T-Mobile are working to resolve the issue but have

not detailed the extent or the responsible partner.

Super Micro Computer (NASDAQ:SMCI) – Super

Micro Computer may replace Walgreens in the Nasdaq 100 index due to

its rising market value. Walgreens faces increasing challenges,

having been excluded from the Dow Jones Industrial Average in

February and is now at risk of being removed from the Nasdaq 100

index. Its stock fell to its lowest level since 1997 after

announcing the closure of thousands of pharmacies and cutting

financial forecasts for the current fiscal year. Shares rose 0.4%

in pre-market trading.

Walgreens Boots Alliance (NASDAQ:WBA) – On

Thursday, Walgreens shares plunged 22% after reporting

third-quarter fiscal net income of $344 million, or 40 cents per

share, with adjusted earnings of 63 cents, below the expected 68

cents. Total sales were $36.351 billion, surpassing last year’s

$35.415 billion. The company adjusted its adjusted earnings

forecast for the fiscal year to $2.80 to $2.95 per share.

Additionally, Walgreens announced the closure of 650 to 700 stores

in the US and up to 650 Boots stores in the UK due to weak sales.

The company expects pre-tax costs between $3.8 billion and $4.1

billion and halved the dividend. Shares fell 0.6% in pre-market

trading.

Accolade (NASDAQ:ACCD) – Accolade exceeded

first-quarter expectations by reporting a loss per share of -35

cents, above analysts’ estimate of -48 cents. The company also

posted revenue of $110.47 million, 5.02% higher than the $105.19

million forecast. However, Accolade issued projections for the

fiscal second quarter and the year below analysts’ expectations.

The company expects revenue between $104 million and $106 million

for the second quarter and an adjusted EBITDA loss between $8

million and $10 million, higher than the projected loss of $5.9

million. Shares of the health technology company plummeted 26.3% in

pre-market trading.

Biogen (NASDAQ:BIIB) – Eisai and Biogen

launched their Alzheimer’s treatment, Leqembi, in China, following

launches in the United States and Japan. The drug, which removes a

toxic protein called beta-amyloid from the brain, is the first

proven to alter the course of the fatal disease. The initial cost

will be $345.04 (2,508 yuan) per 200 mg vial.

Novo Nordisk A/S (NYSE:NVO) – Novo Nordisk will

limit initial sales of its obesity treatment Wegovy in China while

managing access to the drug for the world’s largest obese

population. The company faces the challenge of meeting pent-up

demand, taking advantage of a temporary edge over its competitor,

Eli Lilly. Shares fell 0.7% in pre-market trading.

Illumina (NASDAQ:ILMN), Grail

(NASDAQ:GRAL) – Illumina announced on Thursday that it will record

a $1.47 billion goodwill impairment charge in the second quarter

related to Grail, a recently spun-off cancer diagnostics company.

Goodwill impairment reflects the perceived loss in value of an

acquired business. Additionally, it expects an additional charge of

approximately $420 million for Grail’s in-process research and

development asset.

Microsoft (NASDAQ:MSFT) – Russian hackers who

breached Microsoft’s systems and spied on employee inboxes earlier

this year also stole emails from its customers, the tech giant

revealed on Thursday. The disclosure highlights the extent of the

breach and increases regulatory pressure on Microsoft’s system

security against foreign threats. Shares rose 0.33% in pre-market

trading.

OpenAI – Time magazine and OpenAI have signed a

multi-year content agreement, allowing the creator of ChatGPT to

access Time’s news archive. The AI will cite and link to sources on

Time.com in user responses. Financial terms were not disclosed.

Meta Platforms (NASDAQ:META) – Meta, the owner

of Facebook, is considering blocking news content in Australia if

the government requires payment of licensing fees. Mia Garlick,

regional policy director, said all options are being considered,

including preventing Australians from sharing news on the platform

to avoid such fees. Additionally, a US appeals court on Thursday

revived a class-action lawsuit by a software engineer against Meta

Platforms, alleging the company refused to hire him, preferring

foreign workers paid lower wages, potentially setting a precedent

against discrimination of American citizens. Shares rose 0.6% in

pre-market trading.

Amazon (NASDAQ:AMZN) – Amazon plans to launch

its first space internet satellites in the fourth quarter of this

year, with Project Kuiper customer trials slated for 2025 and

limited commercial service also in 2025. The goal is to compete

with Elon Musk’s Starlink network, with a constellation of over

3,000 satellites. Shares rose 0.4% in pre-market trading.

Uber Technologies (NYSE:UBER),

Lyft (NASDAQ:LYFT) – Uber and Lyft agreed to adopt

a minimum payment standard of $32.50 per hour for drivers in

Massachusetts and pay $175 million to settle a lawsuit brought by

the state’s attorney general. The agreement includes paid leave,

accident insurance, and health stipends, reflecting a balance

between flexibility and benefits. Additionally, Uber is offering up

to $1,000 in credits for certain travelers in the US and Canada who

opt not to use their personal cars for five weeks. Instead, they

must use public transportation, car-sharing, or other alternative

transport options to reduce carbon emissions and promote

sustainable practices. Uber shares rose 0.3% in pre-market trading,

while Lyft shares were stable.

Tesla (NASDAQ:TSLA) – Tesla claims Elon Musk

won the legal dispute over his $56 billion pay package because

shareholders approved the compensation, despite a judge nullifying

it earlier this year. The company argues that the shareholder vote,

which ratified the 2018 package, should influence the final

judgment. According to the J.D. Power Initial Quality Study for the

2024 model year, Tesla no longer stands out in quality among

electric vehicles due to questionable design changes, such as the

removal of turn signal stalks, which frustrated owners and reduced

their scores in a key quality survey. Shares rose 0.5% in

pre-market trading.

Rivian Automotive (NASDAQ:RIVN) – Rivian plans

to reduce material costs in its electric SUVs and pickups by 20% by

the end of 2024, focusing on electronics and process simplification

to achieve profitability. The partnership with Volkswagen should

help reduce operational expenses and launch new affordable models.

Shares fell 0.8% in pre-market trading.

Fisker (NYSE:FSR) – Hope is dwindling for

owners of Fisker Inc.’s electric SUVs as the company faces

bankruptcy. Customers report increasing difficulties in getting

technical support for their problematic vehicles. According to

Bloomberg, an owner in Cincinnati has accumulated a dozen

unresolved service calls, while another in Colorado can’t find a

local shop to repair a crack in his vehicle’s sunroof.

Nikola (NASDAQ:NKLA), Walmart

(NYSE:WMT) – Nikola delivered its first hydrogen-electric

semi-truck to Walmart Canada, making it the first major retailer in

the country to add this vehicle to its fleet. The initiative is

part of Walmart’s efforts to achieve zero emissions by 2040. Nikola

shares rose 3.7% in pre-market trading, while Walmart shares rose

0.3%.

Target (NYSE:TGT) – Target is taking a tougher

approach to combat store theft, lowering the minimum value

threshold for theft intervention from $100 to $50. This change is

part of efforts to control inventory losses impacting its profit

margins. The new directive is expected to be implemented this

summer.

Boeing (NYSE:BA) – Despite Boeing’s financial

and production challenges following an incident in January,

workers’ willingness to strike for better working conditions will

not change, according to the local union president. Workers,

represented by the IAM, seek better retirement benefits and wage

increases above 40% over three to four years after years of

stagnant wages. Additionally, the National Transportation Safety

Board (NTSB) warned Boeing that it could lose its status as part of

the incident investigation after violating rules by disclosing

non-public information to the press and speculating on possible

causes.

Lockheed Martin (NYSE:LMT),

Boeing (NYSE:BA) – The joint venture between

Boeing and Lockheed Martin will replace Sierra Space’s Dream Chaser

aircraft with a mass simulator on its Vulcan rocket certification

flight in September, announced Tory Bruno, CEO of United Launch

Alliance. This flight is essential to qualify the Vulcan for US

national security missions.

Banks – Major US banks have sufficient capital

to withstand a severe economic downturn, according to the Federal

Reserve’s annual stress test results. While they may face

significant losses in risky business areas this year, the CET1

ratio shows robustness, with minimums above regulatory

requirements. Additionally, ten major banks agreed to pay $46

million to settle an antitrust lawsuit accusing them of

manipulating the interest rate swaps market. Investors claimed the

banks profited from bid/ask spreads, harming competitors and

investors. The banks include Bank of America

(NYSE:BAC), Goldman Sachs (NYSE:GS),

JPMorgan Chase (NYSE:JPM),

Barclays (NYSE:BCS), BNP Paribas

(EU:BNP), Citigroup (NYSE:C), Deutsche

Bank (NYSE:DB), Morgan Stanley (NYSE:MS),

NatWest (NYSE:NWG), and UBS

(NYSE:UBS).

New York Community Bancorp (NYSE:NYCB) – NYCB

announced a one-for-three reverse stock split, effective mid-July,

aiming to raise the stock price after a 71% drop since January due

to unexpected losses and dividend cuts. The measure aims to attract

more institutional and retail investors.

UBS Group AG (NYSE:UBS) – UBS is restructuring

its wealth management sector in the US, hiring Michael Camacho, a

former JPMorgan Chase executive, to lead the unit. Additionally,

UBS is creating a new division, Global Wealth Management Solutions,

focused on offering various products and services to its advisors

and clients. Camacho, who assumes the role on September 16,

replaces Jason Chandler, who will take on a new role in the

company.

Block (NYSE:SQ) – Block Inc.’s investment in

Bitcoin allows the company to explore a “potentially

transformative” technology, according to CFO and COO Amrita Ahuja.

The Bitcoin bet is seen as a long-term commitment, with the company

investing 10% of gross profit from Bitcoin products monthly. Ahuja

emphasizes that Bitcoin could change the reality of underserved

consumers, who typically pay high fees to move money.

Webtoon Entertainment (NASDAQ:WBTN) – Online

comics platform Webtoon Entertainment saw its shares rise up to

14.3% above the initial price on its Nasdaq debut, reaching a

market value of $2.71 billion. Founded as a side project in 2005 by

Junkoo Kim, the company plans to use the $315 million raised in the

IPO to expand its presence in North America. Shares jumped 11.17%

in pre-market trading.

Chewy (NYSE:CHWY) – Keith Gill, known as

Roaring Kitty, posted an image of a dog on his social network X on

Thursday, generating 2.5 million views and speculation about its

meaning, possibly related to Chewy Inc. The trading volume of the

pet products company’s shares was well above the 65-day average,

with shares rising quickly on Thursday but closing the day down

0.3%. Chewy shares fell 0.17% in pre-market trading.

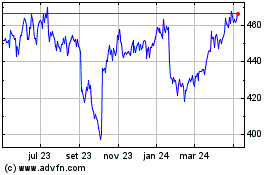

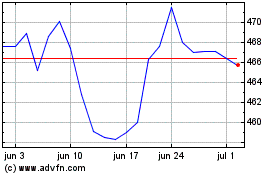

Lockheed Martin (NYSE:LMT)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Lockheed Martin (NYSE:LMT)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024