Fluctuations in the US bitcoin ETF market and the importance of the

$60,000 mark for bitcoin

Bitcoin (COIN:BTCUSD) registered a 2.9% decline in the last 24

hours, hitting $60,200 amid a broad market downturn. Selling

pressure may increase due to the imminent asset distributions by

the bankrupt exchange Mt. Gox, scheduled for release this week.

According to QCP Capital, “this potential dump of up to 140,000 BTC

may continue to pressure the market, especially due to uncertainty

about the exact release timeline.”

On July 2, US bitcoin exchange-traded funds marked a return to

negative flows after five days of gains, with a total net outflow

of $13.62 million. Grayscale’s ETF (AMEX:GBTC) led the losses with

$32.38 million in outflows, while BlackRock’s ETF (NASDAQ:IBIT) and

Fidelity’s ETF (AMEX:FBTC) saw inflows of $14.12 million and $5.42

million, respectively. Despite these movements, the trading volume

of the funds was lower than in March, when it reached up to ten

billion dollars daily.

Traders often consider round numbers as significant support or

resistance levels, and in the case of Bitcoin, the $60,000 mark

stands out. This level is crucial because it coincides with the

average entry price of bitcoin ETFs, which could trigger

liquidations if retested. With over $14 billion in net inflows

since the debut of these ETFs, a retest of this price could

significantly influence the market, especially in contexts of

volatility and strategic investor adjustments.

Bittensor suspends activities after $8 million cryptocurrency theft

Bittensor, a decentralized machine learning network based on

blockchain, halted its network operations on July 3 to contain a

significant theft after discovering that at least $8 million in

digital assets were stolen. The shutdown was an emergency measure

to prevent further losses, putting the network into a safety mode

that allows block production but prevents transactions. The

investigation is ongoing, and it is believed that the theft was

caused by a private key leak.

Consensys acquires Wallet Guard to enhance MetaMask security

Consensys has purchased Wallet Guard, a security tool, to

enhance protection in the MetaMask digital wallet against theft and

fraud. The integration will expand MetaMask’s security

capabilities, allowing better defense against scams and malware

through advanced threat detection technologies. This initiative

aims to increase security for Web3 users, especially in a context

of growing risks of hacks and cryptocurrency fraud.

Sydney Sweeney’s X account hacked to promote cryptocurrency scheme

Actress Sydney Sweeney’s X account was compromised and used to

promote a pump-and-dump scheme involving a cryptocurrency token

called SWEENEY. Deleted posts from the account boosted the token,

which moved over $10 million within two hours of its launch. The

token’s value plummeted by nearly 90% in one hour but saw a partial

recovery. This is the second time Sweeney’s account has been used

for a fraudulent cryptocurrency promotion.

Marathon Digital maintains bitcoin reserves

Marathon Digital Holdings (NASDAQ:MARA), the world’s largest

bitcoin miner, did not sell any bitcoin last month despite the

prolonged market downturn. The company held 18,536 bitcoins, valued

at over $1.1 billion in June. While Marathon plans to sell some of

its reserves in the future to finance operations and treasury

management, it remains committed to increasing its holdings by

buying more bitcoins in the market and exploring other

opportunities to boost its bitcoin yield.

CleanSpark increases bitcoin production and exceeds hashrate target

CleanSpark (NASDAQ:CLSK), an American bitcoin mining company,

increased its bitcoin production by 6.7% in June, exceeding its

mid-year hashrate target with 20.4 exahashes per second (EH/s). The

company retained most of the 445 bitcoins mined during the month,

raising its total to 6,591 BTC. After installing new miners at its

Georgia facilities, CleanSpark became the third-largest bitcoin

miner, aiming to reach 50 EH/s as its next goal.

Growth in staked Ethereum on Lido despite regulatory challenges

Despite the US SEC classifying staking programs as securities,

Lido (COIN:LDOUSD) recorded an increase of 95,616 ETH staked

between June 24 and July 1, raising its assets to $33.48 billion.

Lido outperformed other platforms in Ethereum (COIN:ETHUSD)

deposits and saw a significant increase in activity on Layer 2

networks. Additionally, Lido is promoting decentralization with the

launch of a Community Staking Module, facilitating permissionless

entry for node operators and encouraging greater individual

participation in the protocol.

Bybit expands Web3 ecosystem with new chain integrations

Bybit, a leading Web3 platform, announced the integration of

three new chains — SUI (COIN:SUIUSD), ZKLink, and Scroll

(COIN:SCRLUSD) — into its ecosystem. With these additions, Bybit

users can switch between various chains within the Bybit Wallet

extension, enabling access to a wider range of DeFi services and

applications. The Bybit Wallet continues to support popular wallets

with seed phrases, allowing for a smooth and convenient transition

to these new chains.

T-Mobile Deutsche Telekom and Subsquid partner to power

decentralized data lake

T-Mobile Deutsche Telekom MMS has partnered with Subsquid, a

decentralized data platform, to operate dedicated worker nodes in

Subsquid’s data lake. The collaboration aims to enhance security

and efficiency in blockchain data retrieval and delivery. Worker

nodes process queries and extract necessary information from the

data lake for users. The partnership aligns with Deutsche Telekom’s

strategy to support decentralized and innovative business

models.

KuCoin introduces 7.5% tax for Nigerian users

Starting July 8, global cryptocurrency exchange KuCoin will

implement a 7.5% value-added tax (VAT) on transaction fees for

users in Nigeria. This measure affects only transaction fees, not

the total traded value. Despite KuCoin being among the platforms

banned by the Nigerian government, the new policy raises questions

about transparency and tax implementation, especially with the

Central Bank of Nigeria’s restrictions on crypto-to-fiat

conversions.

Bitget seeks licensing in India to improve compliance and services

Bitget, a leading cryptocurrency exchange, is in talks with

India’s Financial Intelligence Unit to obtain registration as a

Virtual Asset Service Provider (VASP). This registration will allow

Bitget to operate in accordance with local laws, improving tax

compliance and operational transparency. In addition to

facilitating community engagement and educational campaigns, the

registration will also help in consumer protection and dispute

resolution.

CoinDCX acquires BitOasis and expands presence in the Middle East

and North Africa

Indian cryptocurrency exchange CoinDCX has acquired BitOasis, a

Dubai-based trading platform, without disclosing financial details

of the transaction. This move marks CoinDCX’s entry into the Middle

East and North Africa (MENA) market and is part of BitOasis’s

efforts to expand its regional presence. Recently, BitOasis also

obtained licenses to operate in Bahrain and remains licensed in the

United Arab Emirates.

Uniswap sets volume record amid DeFi growth

Uniswap, a leading decentralized exchange (DEX) for

cryptocurrencies, achieved a record swap volume, solidifying its

crucial position in the decentralized finance (DeFi) sector. This

milestone highlights the increasing adoption of DEXs as more

flexible and decentralized trading alternatives. In June, the

number of swappers on Uniswap reached an unprecedented peak,

reflecting the growing demand for decentralized liquidity and the

platform’s continued innovation, particularly in Layer 2 solutions

that promise faster transactions and lower costs.

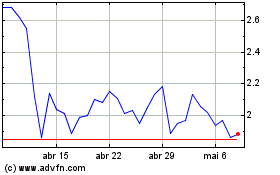

Lido DAO Token (COIN:LDOUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Lido DAO Token (COIN:LDOUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025