Lido expands connection with BNB Chain

On August 9, Lido DAO (COIN:LDOUSD) approved the integration of

Axelar and Wormhole to connect Lido Staked ETH (stETH) to the BNB

Chain. This bridge will enable $23 billion in total value locked to

interact with the BNB Chain. It marks Lido’s first connection with

a layer-1 blockchain outside Ethereum, expanding its impact in

liquid staking and DeFi. Lido, with 28.2% of the Ether staking

market, has solidified its leadership in DeFi, reaching one million

validators and significantly contributing to the sector’s total

value locked.

Golem rises 34% in the last 7 days

Golem (COIN:GLMUSD) recently faced volatility, leading to mixed

investor sentiment and a decrease in the number of network

addresses. However, large investors, known as “whales,” have shown

optimism by accumulating nearly 11 million GLM in recent days. The

token’s price has risen by 34.16% over the past week, currently

priced at $0.315130. If the price surpasses the $0.47 resistance, a

significant increase is expected. However, if it fails to break

this barrier, GLM may face additional resistance and remain below

$0.40 for a longer period.

SUI rises 80% in one week

The cryptocurrency of Sui Network (COIN:SUIUSD) recorded a

remarkable 79.68% price increase in the last week and an 18% rise

in the last 24 hours, reaching $1.03. The intraday high reached

$1.12. Daily trading volume surged, while technical indicators like

MACD show strength in the upward trend. Potential profit-taking

could lead to a price pullback to $0.46.

Aptos unlocks 11.31 million APT tokens

On August 12, Aptos (COIN:APTUSD) unlocked 11.31 million tokens,

increasing the circulating supply to 471.14 million. Aptos, a

Layer-1 blockchain focused on security and performance, has faced

criticism for its venture capital-influenced tokenomics. The unlock

will benefit community members, contributors, and investors. The

token reached an intraday high of $6.85, currently priced at $6.40,

gaining 11.7% in the last 24 hours. Over the past 7 days, it has

risen by 19.96%.

Aleph Zero launches new layer 2 for Ethereum

Aleph Zero (COIN:AZEROUST) launched its Ethereum-compatible

layer 2 solution, using its WASM-based layer 1 and zkOS for

enhanced privacy and efficiency. The new Ethereum Virtual Machine

(EVM) layer will reduce block times to 250 milliseconds. Developed

with Gelato and Arbitrum Orbit, the new network promises fast

transactions and support for Ethereum applications, while the AZERO

token will continue to power gas transactions.

Marathon Digital seeks to raise $250 million for Bitcoin expansion

Marathon Digital Holdings (NASDAQ:MARA) aims to raise $250

million through a private convertible note offering to expand its

Bitcoin reserves. The company, which holds over 20,000 Bitcoins,

produced 579 Bitcoins in July and purchased $100 million in Bitcoin

earlier this month. This move follows the strategy of companies

like MicroStrategy (NASDAQ:MSTR), which accumulate Bitcoin as

corporate assets.

Argo Blockchain repays $35 million loan to Galaxy Digital

Bitcoin miner Argo Blockchain (NASDAQ:ARKB) has completed the

repayment of a $35 million loan obtained from Galaxy Digital in

2022. This repayment, considered a “significant milestone,” was

made without affecting the company’s hash rate, essential for

Bitcoin mining. In December 2022, Argo avoided bankruptcy through

this loan and the sale of its Helios facility.

Bitcoin mining revenue hits annual low

On August 11, daily revenue for Bitcoin miners fell to $2.54

million, marking a new annual low. After the April halving, which

cut rewards from 6.25 BTC to 3.125 BTC, daily earnings fell below

$3 million for the first time in May.

Bitcoin drops after weekend sell-off

On Monday, Bitcoin’s (COIN:BTCUSD) price fell 0.3% to $58,542

after a weekend sell-off. Despite some recovery late last week,

market sentiment remains fragile, with investors concerned about

upcoming U.S. inflation data due on Wednesday. A holiday in Japan

also reduced trading volume, and a strong dollar weighed on risk

assets. Analysts suggest a possible correction below $55,000 before

any recovery. An important trendline is around $63,000. Recovery

above this level could propel Bitcoin to new highs, with a

potential six-figure rally. However, a high CPI reading could

intensify corrections.

$89 million outflows from U.S. Bitcoin ETFs

On August 9, U.S. Bitcoin ETFs faced net outflows of $89.7

million, according to data from Farside Investors. While

BlackRock’s (NASDAQ:IBIT) and Grayscale Bitcoin Mini Trust ETFs

(AMEX:BTC) saw inflows of $9.6 million and $15.6 million,

respectively, Grayscale Bitcoin Trust (AMEX:GBTC), Fidelity

(AMEX:FBTC), and Bitwise (AMEX:BITB) ETFs saw withdrawals of $77

million, $19.8 million, and $18.1 million. By February 15, ETFs

accounted for approximately 75% of new Bitcoin investments,

contributing to the asset’s appreciation above $50,000.

Tether responds to Celsius litigation with extortion allegations

Tether (COIN:USDTUSD) contested a lawsuit filed by bankrupt

Celsius, demanding the return of about $3.3 billion in Bitcoin.

Celsius alleges that Tether sold Bitcoin at low prices and

committed fraud by preferentially securing payment. Celsius also

seeks $100 million in damages for breach of contract. Tether

responds that it followed the contract correctly and considers the

lawsuit baseless, emphasizing that its funds are secure and that

the case will be vigorously defended.

Brazil approves first Solana ETF, but skepticism remains in the

U.S.

Brazil’s Securities and Exchange Commission (CVM) approved the

first Solana spot ETF, to be offered by QR and managed by Vortx.

The fund will use the CME CF Solana Dollar Reference Rate to

determine Solana’s price in dollars. While the ETF is in the

pre-operational stage, its final approval depends on B3. The launch

is expected within the next 90 days.

U.S. financial experts are skeptical of a Solana spot ETF due to

the high daily issuance of SOL tokens (COIN:SOLUSD), totaling

162,503 SOL per day, valued at around $25 million. Critics fear

that this excessive supply could destabilize SOL’s price, and the

absence of a similar ETF in the U.S. may limit institutional

interest.

KfW and Boerse Stuttgart Digital announce partnership for digital

bonds

Germany’s leading development bank, KfW, has partnered with

Boerse Stuttgart Digital (BSD) to issue blockchain-based digital

bonds. The issuance, scheduled for the coming weeks, will be

conducted under Germany’s electronic securities law. BSD will

handle the security of cryptocurrency wallets and private keys. The

offering is part of the European Central Bank’s tests for

blockchain transactions.

El Salvador receives record $1.6 billion investment for port

modernization

El Salvador’s President Nayib Bukele announced a historic $1.6

billion investment from Yilport Holdings to modernize the Acajutla

and La Unión ports. Yilport, in partnership with CEPA, will upgrade

the infrastructure and expand the ports’ capacity. The project is

part of the government’s third phase of economic development, aimed

at boosting trade and creating jobs. The upgrade of La Unión port

aligns with plans for the proposed Bitcoin City.

Tornado Cash developer seeks funds for appeal in the Netherlands

Alexey Pertsev, sentenced to five years in prison for his

developments in the Tornado Cash protocol (COIN:TORNUSD), is

seeking to raise between $750,000 and $1 million for his legal

defense. On August 10, he launched a public campaign on Juicebox to

raise Ether. The crypto community has already donated 15.35 ETH and

over $40,000 for his cause, highlighting support for privacy and

open-source code.

Binance challenges: blockages in Venezuela and health crisis of

detained executive

Tigran Gambaryan, a Binance executive detained in Nigeria, is

facing a severe deterioration in his health, requiring urgent

surgeries for a herniated disc and tonsils. His wife, Yuki, has

appealed to the Nigerian government to release or allow proper

treatment, highlighting that his condition could cause permanent

damage. Gambaryan, confined to a wheelchair, has also suffered from

malaria and severe infections.

In Venezuela, Binance users are facing difficulties accessing

the platform due to blockages imposed by the state-owned operator

CANTV, which is blocking the Amazon CloudFront service. Binance has

reported that it is monitoring the situation and assured the

security of users’ funds. The blockage comes after President

Nicolás Maduro announced the suspension of access to X for 10 days,

citing efforts to combat violence plans.

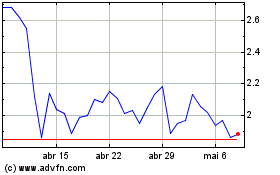

Lido DAO Token (COIN:LDOUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Lido DAO Token (COIN:LDOUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025