US Index Futures Fall Amid Tech Giant Earnings, Oil Prices Rise

24 Julho 2024 - 6:55AM

IH Market News

U.S. index futures fell in pre-market trading on Wednesday,

impacted by recent financial results from tech giants

Tesla and Alphabet. Investors are

watching for potential Federal Reserve interest rate changes and

market recovery, focusing on upcoming earnings from companies like

AT&T, General Dynamics,

Ford, and IBM.

At 4:55 AM, Dow Jones futures (DOWI:DJI) dropped 180 points, or

0.44%. S&P 500 futures lost 0.65%, and Nasdaq-100 futures fell

0.90%. The 10-year Treasury yield was at 4.236%.

In commodities, West Texas Intermediate crude for September rose

0.58% to $77.41 per barrel. Brent crude for September climbed 0.60%

to around $81.50 per barrel. Oil prices increased after three

consecutive declines, driven by reduced U.S. oil inventories and

Canadian wildfires affecting supply.

On Wednesday’s economic calendar, S&P Global will release

preliminary July PMI readings for manufacturing and services at

9:45 AM. At 10 AM, the U.S. Commerce Department will report June

new home sales. Additionally, at 10:30 AM, the U.S. Department of

Energy (DoE) will present updated oil inventory data through last

Friday.

Asia-Pacific markets showed negative performances. Japan’s

Nikkei 225 fell 1.11% to close at 39,154.85. Hong Kong’s Hang Seng

dropped 0.94% to 17,304.46. China’s Shanghai Composite declined

0.46% to 2,901.95. South Korea’s Kospi decreased 0.56% to 2,758.71,

while Australia’s S&P/ASX 200 remained nearly flat with a

slight 0.09% dip to 7,963.70.

Japan saw solid growth with the July composite PMI at 52.6, up

from June’s 49.7. In Australia, private sector activity slowed with

the composite PMI dropping to 50.2, according to Juno Bank. Among

individual stocks, China’s Li Auto fell 4%, while

Nio and Xpeng lost over 5%.

Taiwan’s Foxconn announced a $138 million

investment in China. South Korea’s Samsung

Electronics (KOSPI:005930) dropped 2.26% due to a worker

strike.

European markets are down, pressured by household goods and tech

sectors. Investors await financial results from major companies and

economic data from the UK and Eurozone flash PMIs, as well as

German consumer confidence. Eurozone business activity growth

stalled this month, with the composite PMI falling to 50.1 due to a

manufacturing recession. Recovery expectations decreased,

reflecting continued slowdown.

Among individual stocks, BNP Paribas (EU:BNP)

exceeded expectations with a 21% net profit increase, reaching

$3.69 billion, driven by higher equity sales. However, an 11% drop

in net interest income and weak domestic retail performance led to

a 2.7% decline in its shares.

LVMH (EU:MC) shares fell around 5% after

second-quarter sales growth missed expectations, increasing only 1%

to $22.76 billion. The slowdown affected other luxury stocks, like

Hermes (EU:RMS) and Kering

(EU:KER). Bloomberg reports that LVMH’s Tag Heuer is in talks to

become the new official timekeeper of Formula 1, replacing Rolex.

This significant sponsorship could strengthen LVMH’s presence in

the luxury watch market.

U.S. stocks closed slightly lower on Tuesday, reflecting

traders’ hesitation ahead of upcoming financial releases and

inflation data due on Friday, which could influence future Federal

Reserve decisions. The Dow Jones fell 0.14%, the S&P 500

dropped 0.16%, and the Nasdaq decreased 0.06%. Recent volatility

has created market uncertainty, with investors awaiting reports

from Alphabet (NASDAQ:GOOGL) and

Tesla (NASDAQ:TSLA) after the close.

Wednesday’s pre-market earnings reports include

AT&T (NYSE:T), Thermo

Fisher (NYSE:TMO), GE

Vernova (NYSE:GEV), General

Dynamics (NYSE:GD), Vertiv

Holdings (NYSE:VRT), Lamb

Weston (NYSE:LW), Amphenol (NYSE:APH), NextEra

Energy (NYSE:NEE), Tenet

Health (NYSE:THC), Lennox

International (NYSE:LII), and more.

Post-market numbers are expected from Ford

Motor (NYSE:F), IBM (NYSE:IBM), Chipotle

Mexican

Grill (NYSE:CMG), ServiceNow (NYSE:NOW), Newmont (NYSE:NEM), Whirlpool (NYSE:WHR), KLA

Corporation (NASDAQ:KLAC), Celestica (NYSE:CLS), Las

Vegas Sands (NYSE:LVS), Viking

Therapeutics (NASDAQ:VKTX), and others.

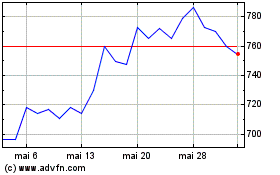

KLA (NASDAQ:KLAC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

KLA (NASDAQ:KLAC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024