Ford Motor (NYSE:F) – The global automaker

reported adjusted earnings per share of $0.47 in the second

quarter, below the $0.67 expected, impacted by ongoing warranty

issues. Revenue increased 6.2% to $47.8 billion, exceeding

expectations. Warranty costs rose by $800 million due to quality

problems, affecting financial performance. EBIT profit forecast for

2024 remains between $10 billion and $12 billion. Shares fell 12.7%

pre-market.

Stellantis (NYSE:STLA) – In the first half,

Stellantis saw a 48% drop in profits, with net income of $6.12

billion (€5.65 billion), below the forecast of €6.25 billion.

Revenue fell 14% to €85.02 billion, also below estimates. Adjusted

operating profit dropped 40% to €8.46 billion, and cash flow was

negative at €392 million. The company announced the reintroduction

of old models and possible price cuts to combat declining sales and

operational challenges. Shares fell 6.4% pre-market.

Viking Therapeutics (NASDAQ:VKTX) – The drug

development company reported a quarterly loss of $0.20 per share,

better than the estimate of $0.27. The net loss was $22.3 million,

compared to $19.2 million in the previous year, due to higher

R&D expenses. Viking Therapeutics’ R&D expenses in the

second quarter were $23.8 million, a significant increase from

$13.9 million in the same period in 2023. Revenue was boosted by

interest gains. Besides the results, Viking Therapeutics announced

it would advance its experimental obesity treatment, VK2735, to a

phase 3 trial. An oral version of the drug will begin phase 2

trials in the fourth quarter. Shares rose 20.2% pre-market.

Unilever Plc (NYSE:UL) – In the second quarter,

Unilever’s sales increased by 3.9%, below the expected 4.3%. Global

economic pressure impacted results, and the company faces

challenges in recovery under Hein Schumacher’s leadership. Unilever

maintains its growth targets of 3% to 5% for the year and expects

an operating margin of at least 18%. The company is restructuring,

including possible unit sales and a reduction of 7,500 jobs. Shares

rose 5.3% pre-market.

International Business Machines (NYSE:IBM) –

The tech and IT services company reported an adjusted profit of

$2.43 per share and revenue of $15.77 billion in the second

quarter, beating LSEG forecasts of $2.20 per share and $15.62

billion in revenue. AI services bookings increased significantly,

reaching over $2 billion since mid-2023, double the previous

quarter. About 75% of these bookings are for consulting services,

with the rest for software. IBM expects slightly higher free cash

flow for the year. Shares rose 3.7% pre-market.

STMicroelectronics NV (NYSE:STM) – In the

second quarter, STMicroelectronics reported sales of $3.23 billion,

a 25% drop from the previous year, in line with the forecast of

$3.2 billion. The company reduced its annual revenue projection to

$13.2-13.7 billion, down from the previous forecast of $14-15

billion, due to low automotive demand and excess inventory. Shares

fell 10.4% pre-market.

Chipotle Mexican Grill (NYSE:CMG) – The Mexican

food restaurant chain exceeded earnings and revenue expectations in

the second quarter due to higher restaurant traffic and price

increases offsetting some costs. Chipotle reported adjusted

earnings of 34 cents per share and revenue up 18.2% to $2.97

billion, beating LSEG forecasts of 32 cents per share and $2.94

billion in revenue. Net income of $455.7 million was above the

$341.8 million of the same quarter last year. Same-store sales

increased 11.1%, beating StreetAccount estimates of 9.2%.

Restaurant traffic rose 8.7% despite recent social media criticism

over smaller portions. Shares rose 3.8% pre-market.

ServiceNow (NYSE:NOW) – The enterprise software

and services company reported adjusted earnings of $3.13 per share

and revenue of $2.62 billion in the second quarter, beating LSEG

forecasts of $2.84 per share and $2.61 billion in revenue.

Lloyds Banking Group (NYSE:LYG) – In the second

quarter, Lloyds Banking Group reported pre-tax profit of £1.74

billion, beating estimates. The loan loss provision was only £44

million, well below the £323 million average expected by analysts.

The net interest margin fell to 2.93%, in line with expectations.

Shares fell 0.3% pre-market.

Align Technology (NASDAQ:ALGN) – The Invisalign

dental aligners company expects a decline in Clear Aligner volume

and Systems and Services revenue due to seasonality in the third

quarter, in addition to second-quarter revenue missing estimates.

Adjusted earnings were $2.41 per share, and revenue was $1.03

billion, while LSEG expected $2.30 per share and $1.04 billion in

revenue.

KLA Corporation (NASDAQ:KLAC) – The

semiconductor equipment manufacturer reported adjusted earnings of

$6.60 per share, beating LSEG expectations of $6.15 per share.

Revenue was $2.57 billion, above the forecast of $2.52 billion. KLA

Corp impressed with its financial forecast for the first quarter,

predicting revenues of $2.75 billion against analysts’ estimate of

$2.62 billion. The company also projected adjusted earnings per

share (EPS) of $7, surpassing the $6.50 forecast. Shares fell 2.1%

pre-market.

Molina Healthcare (NYSE:MOH) – The managed

healthcare company reported a strong second quarter in 2024, with

adjusted earnings per share of $5.86, above the expected $5.65.

Revenue reached $9.88 billion, surpassing the forecast of $9.76

billion. Premium revenue increased 17% year over year to $9.4

billion. Molina also issued an adjusted earnings outlook of at

least $23.50 per share for the year, above FactSet’s estimates of

$23.09.

O’Reilly Automotive (NASDAQ:ORLY) – The auto

parts retailer reported earnings of $10.55 per share and revenue of

$4.27 billion, below FactSet forecasts of $10.98 per share and

$4.32 billion in revenue. For fiscal 2024, O’Reilly expects

earnings per share between $40.75 and $41.25, below analysts’

consensus of $41.86. The company expects revenue between $16.60

billion and $16.90 billion, against analysts’ estimate of $16.88

billion.

Ameriprise Financial (NYSE:AMP) – In the second

quarter, the asset management and financial advisory firm saw a 9%

increase in adjusted profit, reaching $882 million or $8.53 per

share, surpassing the $807 million or $7.44 per share profit of the

previous year. Revenue of $4.22 billion was slightly below

estimates of $4.24 billion. The company manages $1.43 trillion in

assets, 12% more than last year.

Raymond James (NYSE:RJF) – In the third

quarter, Raymond James reported adjusted earnings per share of

$2.39, beating estimates of $2.31. Excluding one-time costs,

earnings were $2.31. Revenue of $3.23 billion met expectations.

Assets under management reached $1.48 trillion, up 15% year over

year.

United Rentals (NYSE:URI) – In the second

quarter, the industrial equipment rental company saw a 7.6%

increase in profit, reaching $636 million or $9.54 per share,

compared to $591 million or $8.58 per share last year. Revenue grew

to nearly $3.8 billion, surpassing the $3.5 billion of the previous

year.

SK Hynix (KOSPI:000660) – South Korea’s SK

Hynix reported an operating profit of 5.47 trillion won

(approximately $3.96 billion) for the April to June quarter,

marking the highest since the third quarter of 2018. This result

represents a significant turnaround from the 2.9 trillion won loss

of the previous year. The company’s revenue also jumped 125%,

reaching a record 16.4 trillion won, driven by increasing demand

for high-bandwidth memory chips used in AI.

Vodafone (NASDAQ:VOD) – In the first fiscal

quarter, Vodafone had service revenue of $9.6 billion, a 5.4%

increase, surpassing the estimate of $8.1 billion. Growth in

Africa, up 10% to $1.5 billion, offset a 1.5% decline in Germany.

Vodafone maintained its profit and free cash flow targets. CEO

Margherita Della Valle is focused on transforming the company,

including sales of operations and cutting 11,000 jobs. Vodafone

expects adjusted profits of about $11.92 billion and free cash flow

of at least $2.6 billion by March 2025. Shares fell 2.0%

pre-market.

Edwards Lifesciences (NYSE:EW) – The heart

valve systems manufacturer reported second-quarter earnings of

$366.3 million, or $0.70 per share adjusted, one cent above LSEG

estimates. Revenue was $1.39 billion, below the estimate of $1.65

billion. For the next quarter, the company projects revenue between

$1.56 billion and $1.64 billion, while analysts forecast $1.62

billion. Shares fell 22.1% pre-market.

AstraZeneca (NASDAQ:AZN) – AstraZeneca saw its

second-quarter 2024 revenue increase by 13%, reaching $12.94

billion. In the first half, revenue rose 15% to $25.62 billion.

Oncology sector sales grew 19% at constant exchange rates to $5.33

billion, representing 41% of global sales. Earnings per share of

$1.24 increased by 5.98% in the second quarter compared to the

previous year. The company updated its forecasts for fiscal 2024,

reflecting strong demand and growth. Shares fell 4.7%

pre-market.

Sanofi (NASDAQ:SNY) – In the second quarter,

Sanofi had an operating profit of $3.05 billion, above the estimate

of $2.24 billion. Global sales rose 10.2%, with Dupixent sales

increasing by 29.2%. The company expects 2024 earnings per share to

align with 2023, rather than a decline. Shares rose 2.2%

pre-market.

Teradyne (NASDAQ:TER) – The testing and

robotics technology company reported earnings per share of $1.14

and revenue of $730 million in the second quarter, beating the

profit estimate of 77 cents per share. For the third quarter,

profit guidance of 62 to 82 cents per share was below analysts’

expectation of 84 cents. Shares fell 6.7% pre-market.

Posco Holdings (NYSE:PKX) – In the second

quarter, the world’s third-largest steel producer had a net profit

of 546 billion won (about $394.7 million), a 30% drop from last

year but exceeded the estimate of 379.27 billion won. Revenue fell

8% to 18.51 trillion won, and operating profit dropped 43% to 752

billion won. Steel demand remains weak, and China’s steel

production affects the market.

TotalEnergies (NYSE:TTE) – In the second

quarter, TotalEnergies had an adjusted net profit of $4.7 billion,

a 9% drop from the previous quarter and 15% for the semester.

Adjusted EBITDA was $11.1 billion, down 4% for the quarter and 11%

for the semester. Cash flow from operations of $7.8 billion fell 5%

for the quarter and 12% for the semester.

Whirlpool (NYSE:WHR) – Whirlpool lowered its

profit forecast to $12 per share, down from the previous $13 to $15

and the expected $12.56. Annual revenue remains at $16.9 billion.

The company also expects to generate $500 million in free cash flow

this year, down from the previously projected $650 million. Revenue

fell 5.7% in North America due to low demand for large

appliances.

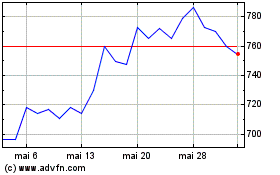

KLA (NASDAQ:KLAC)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

KLA (NASDAQ:KLAC)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024