Nvidia (NASDAQ:NVDA) – According to Reuters,

design flaws could delay the launch of Nvidia’s new AI chips by up

to three months, affecting customers like Meta, Google, and

Microsoft. The Blackwell series, succeeding the Grace Hopper

Superchip, faces production issues, impacting orders from these

major companies. Shares fell 7% pre-market.

Kellanova (NYSE:K) – Mars, the maker of

M&M’s and Snickers, is considering acquiring Kellanova, the

producer of snacks like Cheez-It and Pringles, with a market value

of $27 billion. This potential deal, one of the largest in the

sector, might face regulatory challenges and test the interest of

other buyers, while Kellanova continues to trade below some

competitors. Shares rose 6.7% pre-market.

Berkshire Hathaway (NYSE:BRK.B) – Warren

Buffett increased Berkshire Hathaway’s cash reserves to $276.9

billion in June, up from $189 billion the previous quarter. The

company sold $75.5 billion in stocks, including around 505 million

Apple shares. Despite a record operating profit of $11.6 billion in

Q2 (up 15%), Berkshire bought only $345 million of its own shares,

less than the $2.57 billion the previous quarter. Net profit fell

15%, totaling $30.34 billion. According to Buffett, the sale of

nearly half of Berkshire’s Apple stake does not indicate a lack of

confidence in the tech giant but rather a risk management strategy.

Buffett adjusted his Apple position to reduce concentration and

balance the portfolio. Apple remains Berkshire’s largest position,

and the decision reflects caution regarding the stake size rather

than doubt about the company’s future. Buffett believes the market

is overestimating the impact of AI innovation, but the company

still has significant potential. BRK.B shares are down -3.8%

pre-market.

Apple (NASDAQ:AAPL) – Apple Intelligence, shown

to developers, still does not match the expected enthusiasm. Apple

delayed its introduction to October and did not include all

features in the initial release. The company is also reorganizing

its design leadership and expects revenue growth despite weakness

in China. The iPhone 16 will launch in September, while Apple

Intelligence will be integrated later. In Thailand, Apple pulled an

ad after criticism that the film, depicting Bangkok and Rayong,

misrepresented the country as underdeveloped. Lawmakers and

citizens protested, and the Thai government was concerned about the

country’s tourism image. Apple apologized, stating it did not

intend to offend. Apple shares are down -6.5% pre-market.

Intel (NASDAQ:INTC) – Intel will face a

contraction period, including layoffs and dividend suspension,

following negative financial reports. Shares fell 26% on Friday due

to margin declines and cost-cutting needs. The company’s future

focus is on new products like Lunar Lake and Gaudi 3, essential for

regaining competitiveness. In contrast, Qualcomm and Arm posted

positive results, excelling in revenue and licensing growth,

respectively. Shares fell 3.6% pre-market.

CrowdStrike (NASDAQ:CRWD), Delta Air

Lines (NYSE:DAL) – Alphabet’s CapitalG fund reduced its

stake in CrowdStrike from 855,789 to 427,895 shares by June 30.

This occurred before a global disruption in July caused by a

CrowdStrike software update, affecting various sectors and

resulting in a 35% drop in the company’s stock value. In other

related news, CrowdStrike denies responsibility for Delta Air

Lines’ flight disruptions in July, suggesting minimal contractual

liability. Delta claims a $500 million loss and is considering

suing the cybersecurity firm. CrowdStrike said it offered help

immediately after the incident, but Delta did not respond.

CrowdStrike shares fell 4.1% pre-market. Delta shares fell

3.5%.

Alphabet (NASDAQ:GOOGL) – Character.AI, an AI

chatbot platform, announced a deal with Google to license its

language technology, reflecting the trend of large companies

acquiring AI startups. Cofounder Noam Shazeer and others are

returning to Google, where they previously worked. The startup will

receive additional funding, but the amount has not been disclosed

yet. Shares fell 4.5% pre-market.

Dun & Bradstreet (NYSE:DNB), Cannae

Holdings (NYSE:CNNE) – Dun & Bradstreet is considering

a sale, working with Bank of America to explore potential buyer

interest, including private equity. Cannae Holdings, the largest

shareholder, might include its stake in the deal. Dun &

Bradstreet shares fell 2.2% pre-market.

23andMe (NASDAQ:ME) – 23andMe rejected CEO Anne

Wojcicki’s acquisition offer, considering it too low. She had

proposed buying all remaining shares at $0.40 each. The company is

now seeking other options to maximize shareholder value and has

given Wojcicki and investors more time to submit a revised

proposal.

Meta Platforms (NASDAQ:META) – Meta is offering

millions to celebrities like Judi Dench and Awkwafina to use their

voices in AI projects. The company aims to create tools for its

Connect 2024 event. Negotiations face challenges due to

disagreements over voice usage terms, with Hollywood concerns about

AI’s impact. Meta shares fell 5.6% pre-market.

Warner Bros. Discovery (NASDAQ:WBD) – Warner

Bros. Discovery gained more streaming subscribers during the first

four days of the Paris Olympics than throughout the Tokyo Games.

Viewership exceeded Tokyo’s after two days, boosted by the European

time zone and outdoor studios in Paris. Shares fell 4.1%

pre-market.

Uber Technologies (NYSE:UBER) – Tony West,

Uber’s chief legal officer and brother-in-law of Vice President

Kamala Harris, is taking a leave to help with Harris’s presidential

campaign. West will leave Uber on August 17 to support the campaign

as a volunteer, with no formal role or pay, and plans to return

after the campaign. Uber shares fell 5% pre-market.

Tesla (NASDAQ:TSLA) – Elon Musk’s Neuralink

successfully implanted its device in a second patient, enabling

them to control digital devices with their thoughts. The device,

designed to help people with spinal cord injuries, already allowed

the first patient to perform digital activities. Musk noted that

the second implant is functioning well, with more tests planned.

Tesla shares fell 5.3% pre-market.

JPMorgan Chase (NYSE:JPM) – JPMorgan is

considering suing the Consumer Financial Protection Bureau (CFPB)

over investigations into Zelle. The bank claims it already

reimburses unauthorized transactions and wants to prevent the CFPB

from imposing new rules requiring refunds for fraud where customers

were deceived. Zelle, a peer-to-peer payment app, allows quick

money transfers between bank accounts, widely used since its 2017

launch. Shares fell 3.6% pre-market.

Citigroup (NYSE:C) – Don Plaus, who recently

joined Citi to lead the wealth management division, is leaving

after just four months. His departure raises questions about the

new leadership’s efforts to revitalize the bank’s $540 billion

wealth management sector. Shares fell 6.1% pre-market.

Lloyds Banking Group (NYSE:LYG) – Lloyds

Banking Group appointed Rohit Dhawan as director of artificial

intelligence and advanced analytics. He will integrate AI into the

bank’s operational and customer processes. Dhawan, former head of

data strategy and AI for AWS in Asia-Pacific, will help accelerate

digitization and improve services like support and fraud detection.

Shares fell 4.9% pre-market.

Coinbase (NASDAQ:COIN) – Brian Armstrong, CEO

of the cryptocurrency exchange Coinbase, stated that any future

U.S. government will be “constructive” towards cryptocurrencies.

Despite intense SEC scrutiny, the sector has gained significant

support, reflected in political campaigns and candidate promises,

which could influence crypto asset legislation. Although many at

the Bitcoin Conference 2024 in Nashville were excited about Trump,

there’s notable division within the crypto community. Some believe

his political ideas oppose Bitcoin’s ethos, which aims to be

decentralized and government-independent. Trump’s popularity among

Bitcoin enthusiasts may be more a response to current regulation

than genuine support for cryptocurrency concepts. Coinbase shares

fell 12.9% pre-market, while Bitcoin dropped -8.5% in the past 24

hours.

Eli Lilly (NYSE:LLY) – Eli Lilly’s Mounjaro and

Zepbound medications, used for diabetes and weight loss, are listed

as available on the Food and Drug Administration (FDA) website.

However, the regulator has not removed the drugs from its shortage

list, while Lilly invests in expanding production to meet high

demand. Shares fell 4.1% pre-market.

Petrobras (NYSE:PBR), Galp

Energia (EU:GALP) – Petrobras plans to include a partner

in its proposal to acquire a 40% stake in Galp Energia’s Mopane

block in Namibia. The decision to seek a partner aims to reduce

risks, while Petrobras attempts to increase its reserves amid

environmental challenges in Brazil. The offer should not impact the

company’s dividends. Shares fell 1.7% pre-market.

United Parcel Service (NYSE:UPS) – UPS

announced significant increases in year-end surcharges due to fewer

operational days and higher delivery costs. The decision aims to

offset revenue declines caused by slower deliveries from low-cost

retailers. Experts fear this could drive customers away and reduce

demand. Shares fell 0.9% pre-market.

Five Below (NASDAQ:FIVE) – Five Below will

grant $1.5 million retention bonuses to four executives following

CEO Joel Anderson’s departure in July, which caused shares to drop

16%. The bonuses include $300,000 in cash and $1.2 million in

stock. The company also named Kenneth Bull as interim CEO, eligible

for a $2 million bonus. Five Below shares have dropped 68% this

year. Shares fell 1.5% pre-market.

McDonald’s (NYSE:MCD) – After earnings fell

short of expectations, McDonald’s might adopt the “McSmart” model

seen in Australia, Germany, and France, offering affordable meals.

The platform has performed well abroad, suggesting a similar

version in the U.S. could attract value-seeking consumers. Experts

believe this change might be necessary due to the declining

popularity of the “1, 2, 3 Dollar” menu. Shares fell 1.7%

pre-market.

Walmart (NYSE:WMT) – Walmart’s “everyday low

price” promise will be tested in its quarterly results after Amazon

reported consumers are bargain hunting and predicted a weak

quarter. Despite the pressure to keep prices low, Walmart may

benefit due to its scale and focus on essential products. Shares

fell 2.2% pre-market.

Amazon (NASDAQ:AMZN) – Jeff Bezos, founder of

Amazon, established an automated stock sale plan with a price limit

of $200. Sales began in July but halted when shares fell below this

value. Currently, with shares at $167.90, future sales under the

plan may be delayed. Shares closed down -8.8% on Friday and fell

2.4% pre-market.

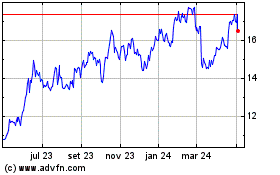

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025