Ericsson (NASDAQ:ERIC) – Ericsson reported

better-than-expected profits, driven by a rebound in 5G equipment

demand in North America. Net sales fell 4% to $5.92 billion but

surpassed forecasts, with U.S. sales jumping over 50%. Europe and

Latin America remained stable, while other markets faced

challenges. Adjusted profits were 7.33 billion crowns, exceeding

estimates and last year’s 3.9 billion, buoyed by an AT&T

contract. The adjusted operating margin was 11.9%, above

expectations. Shares rose 6.9% pre-market after closing up 0.4% on

Monday.

Alphabet (NASDAQ:GOOGL) – Google has signed a

deal with Kairos Power to purchase electricity from small modular

reactors (SMRs) to meet growing demand for AI-related power. The

first reactor is expected to be operational by 2030, with more

deployments by 2035. Google will buy 500 megawatts of power from

six to seven reactors. Shares remained steady in pre-market trading

after closing up 1.1% on Monday.

Microsoft (NASDAQ:MSFT) – Sebastien Bubeck,

Microsoft’s vice president of AI research, is leaving to join

OpenAI, maker of ChatGPT. While his new role is unspecified,

Microsoft expects to continue collaborating with him.

Nvidia (NASDAQ:NVDA) – The Biden administration

is considering restricting the sale of advanced AI chips from

Nvidia and other American firms, with restrictions based on

countries. This move aims to protect national security,

particularly in Gulf nations investing in AI data centers.

Discussions are in early stages. Nvidia’s director, Mark Stevens,

recently sold 155,000 shares for $20.5 million, bringing his total

2024 sales to over 4 million shares, totaling $425.5 million. Other

executives use automated trading plans, but Stevens has not adopted

such plans for his sales. Nvidia shares closed up 2.4% on Monday,

driven by strong demand for AI chips, bringing the company close to

surpassing Apple as the world’s most valuable. Pre-market shares

fell 1.8%.

International Business Machines (NYSE:IBM) –

IBM is investigating its head of China, Chen Xudong, after an

anonymous letter accused him of misconduct, including accepting

gifts from partners and leaking confidential information. The

company confirmed the letter’s existence and is conducting an

investigation.

SoFi Technologies (NASDAQ:SOFI) – SoFi

Technologies’ shares surged 11.4% on Monday, boosted by a $2

billion lending platform deal with Fortress Investment Group. The

deal strengthens confidence in SoFi’s lending model, alleviating

market concerns about credit underwriting. Shares have risen 34% in

three months. Pre-market shares fell 0.2%.

Meta Platforms (NASDAQ:META) – Meta Platforms’

Facebook and Instagram were largely restored after an outage that

affected thousands of U.S. users on Monday. At its peak, there were

over 12,000 reports of issues with Facebook and 5,000 with

Instagram. Shares rose 0.1% pre-market after closing up 0.1% on

Monday.

Adobe (NASDAQ:ADBE) – Adobe launched new AI

tools for creating and editing videos, integrating them into its

Premiere software. These generative AI features allow users to

extend video clips and create videos from text and images. Adobe is

marketing its models as “commercially safe,” using carefully

selected training data. Adobe CEO Shantanu Narayen noted that the

new tool would have a different price due to the higher production

cost of videos. With the rise in video creation, distinct pricing

models will be implemented, as Adobe currently does not charge for

AI features beyond its standard subscription. Shares rose 0.2%

pre-market after closing up 2.9% on Monday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media & Technology Group’s shares closed up 18.5% on

Monday, fueled by increasing chances of Donald Trump’s victory in

the upcoming November presidential election. The rise followed the

announcement of a Fox News interview with Kamala Harris. Trump

Media shares climbed 53% last week, recovering from previous

losses. Pre-market shares rose 10.6%.

Frontier Communications (NASDAQ:FYBR),

Verizon (NYSE:VZ) – Some Frontier Communications

shareholders, including Glendon Capital and Cerberus Capital, are

unhappy with Verizon’s $38.50 per share offer to acquire the

company, considering it too low. Glendon, holding nearly 10% of

Frontier, plans to vote against the $9.6 billion deal set for

decision on November 13. Verizon shares rose 0.4% pre-market after

closing up 0.4% on Monday.

Warner Bros. Discovery (NASDAQ:WBA) – Warner

will launch its Max streaming service in new Asian markets like

Hong Kong and Thailand starting November 19. While Amazon and

Disney are cutting back investments in the region, Warner will

bring popular franchises such as Harry Potter and the DC Universe.

Max will offer subscription options for mobile and TV. Shares fell

0.3% pre-market after closing up 0.3% on Monday.

Stellantis (NYSE:STLA) – Stellantis NV is

requiring employees to return to the office three days a week after

a profit warning triggered management changes. The company, which

previously allowed 70% remote work, is redesigning spaces to

accommodate employees. Stellantis CEO Carlos Tavares attributed

U.S. issues to a risky marketing strategy and promised to resolve

inventory issues by the end of 2024, but faces investor pressure

and stiff competition. Additionally, Chairman John Elkann said

Stellantis is not pursuing mergers or acquisitions, despite rumors

of a possible Renault merger. Elkann emphasized that Stellantis is

focused on its business, not distractions from consolidations, as

it already has competitive size. Pre-market shares fell 1.5% after

closing up 1.8% on Monday.

Tesla (NASDAQ:TSLA) – The German union IG

Metall accused Tesla of using “aggressive tactics” against workers

trying to unionize, following the dismissal of a workers’ council

representative. The union said the Gruenheide plant is threatening

other members with dismissal to intimidate IG Metall workers.

Additionally, Tesla used human remote control for some Optimus

robot functions during the “We, Robot” event to generate investor

excitement. While appearing autonomous, some participants noticed

this assistance. CEO Elon Musk stated that Optimus, with domestic

capabilities, could become a major product. Pre-market shares fell

1.1% after closing up 0.6% on Monday.

Southwest Airlines (NYSE:LUV) – Elliott

Investment Management is calling for a special Southwest Airlines

shareholder meeting to vote on new directors to guide the company’s

strategy. Elliott, holding 10% of shares, wants to replace eight

directors, including CEO Bob Jordan, aiming to improve Southwest’s

financial performance, whose stock has dropped 42% in five years.

Pre-market shares rose 0.4% after closing down 0.8% on Monday.

Azul SA (NYSE:AZUL) – Azul is seeking to raise

capital after an agreement with aircraft lessors reduced its debt

by R$3 billion in exchange for 100 million new preferred shares.

However, the company still needs new financing to strengthen its

liquidity, a crucial step to avoid future financial troubles.

Boeing (NYSE:BA) – Acting U.S. Labor Secretary

Julie Su traveled to Seattle to mediate Boeing machinists’ strike,

now in its fifth week. The strike prompted Boeing to announce

17,000 job cuts and $5 billion in charges, worsening the company’s

crisis. The engineers’ union stated Boeing would issue 60-day

layoff notices in November for employees to be terminated in

January. Pre-market shares remained steady after closing down 1.3%

on Monday.

Phillips 66 (NYSE:PSX) – Phillips 66 will sell

its 49% stake in Coop Mineraloel AG for $1.24 billion to its Swiss

partner. The transaction is part of the company’s plan to divest $3

billion in non-core assets by 2024. The sale will be completed in

Q1 2025.

Petrobras (NYSE:PBR), Vale

(NYSE:VALE) – Petrobras is negotiating a partnership with Vale to

reduce carbon emissions by supplying marine fuel and diesel with

renewable content. As two major Latin American players, they aim to

decarbonize operations. Petrobras already offers fuels with up to

24% renewable content and targets net-zero emissions by 2050.

Petrobras also focuses on maximizing oil extraction from existing

fields to prevent production decline in the 2030s. Its next

strategic plan, to be released in November, will prioritize

revitalizing old fields and new platforms while seeking approval

for Equatorial Margin drilling. Pre-market shares of Petrobras fell

1.2%, while Vale shares dropped 2%.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens Boots Alliance will report earnings today, but no major

changes are expected for its stock, which has fallen 66% this year.

The company is expected to report fiscal Q4 earnings of 36 cents

per share, down from 67 cents in the same quarter last year, on

sales of $35.8 billion, up from $35.4 billion. Investors await the

company’s plans to reverse its fortunes. Pre-market shares fell

0.6% after closing down 2.3% on Monday.

Vanda Pharmaceuticals (NASDAQ:VNDA) – Vanda

Pharmaceuticals rejected a second acquisition offer from Cycle

Pharmaceuticals, which valued the company at $8 per share. The

offer represented an 80% premium after Vanda shares dropped 4.5%

due to an FDA drug rejection. Pre-market shares fell 1.7% after

closing up 8.3% on Monday.

Coty (NYSE:COTY) – Coty, owner of CoverGirl,

reduced its Q1 sales growth forecast to 4%-5%, down from 6%, due to

a slowdown in the U.S., Australia, and China. The company expects

some sales acceleration in H2 and is cutting costs. Pre-market

shares fell 2% after closing down 0.4% on Monday.

Citigroup (NYSE:C) – According to Reuters,

Citigroup faces difficulties training staff in risk and compliance

roles, delaying the resolution of regulatory issues. A lack of

qualified personnel and training tools worsens the situation, even

after billions spent on improvements. Recent layoffs have further

complicated regulatory efforts. Pre-market shares rose 0.3% after

closing up 0.4% on Monday.

HSBC Holdings (NYSE:HSBC) – HSBC is reviewing

expenses and operational controls at its China-based digital wealth

unit, Pinnacle, due to excessive costs. The review could lead to

layoffs and includes an investigation into inflated supplier

expenses. The bank seeks to control costs, as unit revenue lags

behind expenses, marking a potential setback. Pre-market shares

fell 1.3%.

Bank of America (NYSE:BAC) – A Bank of America

survey showed investor optimism reaching its highest level since

June 2020, driven by Federal Reserve rate cuts and expectations of

Chinese stimulus. Stock allocations increased, while cash and bonds

decreased. U.S. trade policy is expected to be the primary impact

of the upcoming election. Pre-market shares rose 0.6% after closing

down 0.1% on Monday.

UBS Group AG (NYSE:UBS) – Swiss regulator Finma

stated UBS must review its emergency plan to ensure safe resolution

during crises, considering its integration of Credit Suisse. The

bank’s current restructuring strategy needs adjustments, focusing

on liquidity and refinancing the Swiss entity due to increased

capital requirements. Pre-market shares fell 1% after closing up

0.5% on Monday.

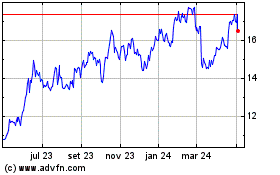

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025