U.S. Stocks Move Mostly Higher, Largely Offset Monday’s Sell-Off

09 Agosto 2024 - 5:44PM

IH Market News

Following the rally seen during Thursday’s session, stocks

turned in a relatively lackluster performance during trading on

Friday but managed to end the day mostly higher.

The major averages finished the session off their highs of the

day but still in positive territory. The Dow edged up 51.05 points

or 0.1 percent to 39,497.54, the Nasdaq climbed 85.28 points or 0.5

percent to 16,745.30 and the S&P 500 (SPI:SP500) rose 24.85

points or 0.5 percent to 5,344.16.

The higher close on Wall Street came as stocks continued to

recover from recent selling sparked by concerns about the outlook

for the U.S. economy.

With the upward move seen over the course of the session, the

Nasdaq and the S&P 500 largely offset the steep losses posted

on Monday, closing only slightly lower for the week.

For the week, the S&P 500 edged down by less than a tenth of

a percent and the Nasdaq dipped by 0.2 percent, while narrower Dow

slid by 0.6 percent.

The major averages still remain well off their recent highs

after also moving sharply lower last Thursday and Friday.

Traders may have been reluctant to make more significant moves

amid a lack of major U.S. economic on the day ahead of the release

of several key reports next week.

Key inflation data is likely to be in the spotlight next week,

although reports on retail sales and industrial production may also

drive trading amid recent concerns about the outlook for the

economy.

Among individual stocks, shares of Expedia (NASDAQ:EXPE) moved

sharply higher after the travel technology company reported better

than expected second quarter results.

Cloud computing company Akamai Technologies (NASDAQ:AKAM) also

saw significant strength after reporting second quarter results

that beat estimates and raising its full-year guidance.

On the other hand, shares of e.l.f. Beauty (NYSE:ELF) came under

pressure even though the company reported better than expected

fiscal first quarter results.

Sector News

Pharmaceutical stocks showed a strong move to the upside on the

day, driving the NYSE Arca Pharmaceutical Index up by 1.8

percent.

Notable strength was also visible among gold stocks, as

reflected by the 1.1 percent gain posted by the NYSE Arca Gold Bugs

Index. The strength in the sector came amid a modest increase by

the price of the precious metal.

Software and brokerage stocks also saw some strength, while most

of the other major sectors ended the day showing only modest

moves.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly higher during trading on Friday. Japan’s Nikkei

225 Index climbed by 0.6 percent, while Hong Kong’s Hang Seng Index

shot up by 1.2 percent.

The major European markets also moved to the upside on the day.

While the German DAX Index edged up by 0.2 percent, the U.K.’s FTSE

100 Index and the French CAC 40 Index both rose by 0.3 percent.

In the bond market, treasuries regained ground after trending

lower over the past few sessions. As a result, the yield on the

benchmark ten-year note, which moves opposite of its price, slid

5.5 basis points to 3.942 percent.

Looking Ahead

While reaction to the U.S. economic data is likely to drive

trading next week, traders are also likely to keep an eye on the

latest corporate earnings news, including results from Walmart

(NYSE:WMT) and Home Depot (NYSE:HD).

SOURCE: RTTNEWS

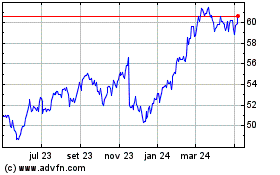

Walmart (NYSE:WMT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

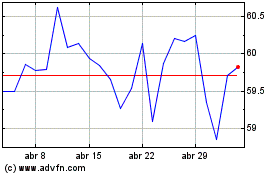

Walmart (NYSE:WMT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025