Big Lots (NYSE:BIG) – Big Lots is considering

filing for bankruptcy protection soon, according to Bloomberg. The

company is seeking investors to avoid Chapter 11, with its stock

falling 27% last week and nearly 88% this year. Big Lots is facing

financial difficulties due to declining sales and high interest

rates. The stock fell 26.9% in pre-market trading after closing

down 5.8% on Wednesday.

DraftKings (NASDAQ:DKNG) – DraftKings acquired

Simplebet, a company that offers real-time betting during sports

events. The acquisition aims to simplify betting for customers by

integrating Simplebet’s technology into their systems. The purchase

amount was not disclosed. Simplebet is known for providing betting

data for leagues such as the NFL and NBA. The stock rose 0.3% in

pre-market trading after closing down 2.8% on Wednesday.

Berkshire Hathaway (NYSE:BRK.A) – Berkshire

Hathaway’s market value surpassed $1 trillion for the first time,

reflecting investor confidence in the conglomerate Warren Buffett

has built over nearly six decades. The company now joins other U.S.

tech giants with similar valuations. Class A shares have risen 28%

this year.

Apple (NASDAQ:AAPL) – Luca Maestri is retiring

as Apple’s CFO, a position he has held since 2014. During his

tenure, he boosted capital returns, paying $134 billion in

dividends and buying back $600 billion in shares. Kevan Parekh will

take over, and analysts expect continuity in strategy. The stock

rose 0.8% in pre-market trading after closing down 0.7% on

Wednesday.

Alphabet (NASDAQ:GOOGL) – Google updated its

Gemini AI model to generate images of people after a pause due to

historical inaccuracies. The new feature will be available to paid

subscribers, starting in English. The enhanced tool, based on the

Imagen 3 model, will avoid creating images of specific individuals

or graphic content. Additionally, Google may build a large data

center in Vietnam near Ho Chi Minh City, marking the first

significant investment by a major U.S. tech company in the country.

This center, planned for 2027, aims to meet the growing demand for

cloud services and support the local digital economy. On another

front, YouTube promised to limit minors’ access to videos about DIY

weapons, but a report shows they can still easily find and watch

such content. This comes despite previous promises to restrict

access and update policies after criticism and pressure from

authorities about the impact of these videos. The stock rose 0.3%

in pre-market trading after closing down 1.1% on Wednesday.

Yelp (NYSE:YELP) – Yelp sued Google, alleging

that the company uses its search monopoly to dominate the local

search and advertising market. Yelp seeks to prevent Google from

prioritizing its services over competitors, citing a recent

antitrust ruling that confirmed Google’s monopolistic

practices.

Intel (NASDAQ:INTC) – Senator Rick Scott

questioned Intel about its plans to cut over 15,000 jobs despite

receiving nearly $20 billion in U.S. subsidies for chip production.

He requested clarification on how these cuts align with promises of

job creation and protection of public investments. The stock rose

0.3% in pre-market trading after closing down 2.3% on

Wednesday.

OpenAI – OpenAI is in talks to raise billions

of dollars in a new funding round, potentially reaching a valuation

of over $100 billion. The round is expected to be led by Thrive

Capital, with an investment of about $1 billion, and will also

include participation from Microsoft.

Super Micro Computer (NASDAQ:SMCI) – The delay

in a $10,000 payment by Super Micro Computer caused a loss of over

$800 million in Chairman Charles Liang’s net worth. The stock

dropped 19% after the company postponed its annual financial

disclosures and faced allegations of accounting irregularities.

Liang, whose fortune fell from $9 billion to $3.5 billion since

March, saw a 62% reduction in his wealth. The stock fell 5.3% in

pre-market trading after closing down 19% on Wednesday.

Reddit (NYSE:RDDT) – Reddit announced that an

update caused an outage affecting thousands of users, but the issue

has now been fixed. The company stated it had resolved the flaw and

restored platform stability. Downdetector recorded over 152,000

problem reports in the U.S. The stock remains stable in pre-market

trading after closing down 4.9% on Wednesday.

Meta Platforms (NASDAQ:META) – Meta is

developing the “Puffin,” a lighter mixed-reality device than

current Quest headsets. It is expected to be released in 2027 and

will allow interaction through gestures and eye movements, without

handheld controllers. Puffin aims to offer a more attractive

alternative for consumers by combining augmented and virtual

reality. In Brazil, Meta faces a fine of up to $3.62 million after

losing a lawsuit filed by the Havan network. Havan accused Meta of

allowing fraudulent ads that used its name and image without

authorization. The court ruling requires Meta to block such ads

within 48 hours or face additional fines. The stock rose 0.3% in

pre-market trading after closing down 0.5% on Wednesday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media shares fell 4.2% on Wednesday, dropping below $20 for

the first time since its merger with Digital World Acquisition

Corp. The stock, which reached $29 in August, has been declining

since then, reflecting a significant loss from the recent peak. The

stock fell 0.7% in pre-market trading.

Walt Disney (NYSE:DIS) – ESPN renewed its

contract with the United States Tennis Association to broadcast the

US Open until 2037. The new deal, which starts in 2026, covers the

U.S., Latin America, and the Caribbean and includes additional

streaming rights. It is the network’s longest tennis contract, with

financial terms undisclosed. Additionally, ESPN is exploring the

use of artificial intelligence to personalize “SportsCenter” on

Disney’s new standalone app, expected in 2025. AI will assist in

personalization, clip generation, and narration, and ESPN also

plans to include betting and fantasy sports in the app. The company

recently launched ESPN Bet and a “Where to Watch” feature to find

sports broadcasts. In India, Disney and Reliance Industries

received approval for an $8.5 billion merger of media assets after

resolving regulatory concerns about cricket broadcasting rights

control. The deal will create India’s largest media

conglomerate.

Amazon (NASDAQ:AMZN) – Amazon received

permission to acquire a 500-square-meter plot of land in New

Zealand for its Project Kuiper, which aims to provide satellite

internet. The land will be used to install telecommunications

equipment, with the goal of launching its satellites by the end of

2024 and starting tests in 2025. The stock rose 0.6% in pre-market

trading after closing down 1.3% on Wednesday.

Tesla (NASDAQ:TSLA) – Ahead of a 100% tariff on

Chinese electric vehicles by Canada starting October 1st, Tesla

requested a reduced fee from the Canadian government, similar to

that of the European Union. JD Power adjusted its forecast for EV

market share in the U.S. in 2024 to 9% due to increasing

competition and slow adoption but expects it to reach 36% by 2030.

Additionally, Supreme Court Justice Alexandre de Moraes gave Elon

Musk 24 hours to appoint a legal representative for the X platform

in Brazil or face suspension. On Wednesday, SpaceX’s Falcon 9

failed to land after launching Starlink satellites, resulting in a

violent crash into the ocean; the FAA has demanded an

investigation, which could affect future launches. Additionally,

Starlink launched services in Botswana after obtaining a two-year

license from local regulators. Finally, xAI, a startup founded by

Musk, is under criticism for using gas turbines in its Memphis data

center without proper permits. The stock fell 0.04% in pre-market

trading after closing down 1.7% on Wednesday.

Ford Motor (NYSE:F) – Ford announced changes to

its diversity, equity, and inclusion (DEI) program, including

withdrawing from the rankings of an LGBTQ advocacy group. CEO Jim

Farley stated that the company is adjusting its policies due to a

changing external and legal environment and to focus on supporting

employees and customers.

Toyota Motor (NYSE:TM) – Toyota reported a 0.7%

growth in global sales in July, driven by demand in Europe and

Japan, after five months of decline. However, recalls in the U.S.

and production issues in Japan due to the typhoon could negatively

impact future results.

Fisker (NYSE:FSR) – The U.S. National Highway

Traffic Safety Administration closed investigations into Fisker’s

Ocean SUVs after the company issued recalls for door and brake

issues. The failures were corrected by recalls and software

updates, resolving safety concerns.

Polestar Automotive (NASDAQ:PSNY) – Polestar

named Michael Lohscheller as the new CEO to address losses and

operational challenges. Lohscheller, former CEO of Opel, VinFast,

and Nikola, will replace Thomas Ingenlath starting October 1st.

Polestar faces challenges with delayed launches and strong

competition in China. The stock rose 0.5% in pre-market trading

after closing down 16.4% on Wednesday.

AeroVironment (NASDAQ:AVAV) – AeroVironment

shares surged on Wednesday after the U.S. Army awarded a record

$990 million contract for its SwitchBlade technology. The contract

will guarantee about $50 million in quarterly revenue through 2029,

exceeding Wall Street expectations and boosting the stock. The

stock remains stable in pre-market trading after closing up 9.1% on

Wednesday.

United Airlines (NASDAQ:UAL) – United Airlines

flight attendants approved a strike authorization with 99.99% of

the vote in favor. This is the first such vote since 2005. They are

seeking wage increases, better ground pay, and improved working

conditions. The strike will not occur immediately; permission from

the National Mediation Board is required after a “cooling-off”

period.

ONEOK (NYSE:OKE) – ONEOK announced the

acquisition of GIP assets for $5.9 billion, including stakes in

EnLink Midstream and Medallion Midstream, to expand its presence in

the Permian Basin and other regions. These deals are expected to

immediately boost earnings and cash flow, generating synergies of

$250 million to $450 million over the next three years. The company

secured up to $6 billion in financing commitments from JPMorgan

Chase and Goldman Sachs, with completion expected in early Q4.

Petrobras (NYSE:PBR) – Petrobras plans to

reduce natural gas reinjection in response to the decree allowing

the ANP regulator to set reinjection limits. The company’s

president, Magda Chambriard, said that due to limited

infrastructure and platform design, Petrobras will adjust its

operations and explore new platforms to optimize gas transport.

Ecopetrol SA (NYSE:EC), Occidental

Petroleum (NYSE:OXY) – Two Ecopetrol board members, Juan

José Echavarría and Luis Alberto Zuleta, resigned after the company

canceled the $3.6 billion purchase of Occidental Petroleum assets.

They claimed the decision, influenced by opposition from Colombian

President Gustavo Petro, would compromise the company’s finances

and growth strategy.

US Steel (NYSE:X) – Nippon Steel plans to

invest an additional $1.3 billion in US Steel as part of the

pending acquisition. This amount complements the $1.4 billion

investment already promised by 2026. The funds will be primarily

directed to modernizing and expanding US Steel’s facilities. The

deal is expected to close in H2 2024. The stock rose 1.6% in

pre-market trading after closing down 1.6% on Wednesday.

Raymond James Financial (NYSE:RJF) – Raymond

James Financial is advancing in the municipal bond market, reaching

seventh place this year. The St. Petersburg-based firm increased

its positions after the exit of major banks and a wave of hiring.

Municipal debt issuance is up 37% this year, and Raymond James has

already replaced Citigroup in major deals.

Franklin Resources (NYSE:BEN) – Franklin

Resources CEO Jenny Johnson realized the risks of celebrity fund

managers after the acquisition of Legg Mason. Now, the company

faces a crisis with the SEC investigation into Ken Leech of Wamco,

involving allegations of unfair business practices. The situation

has caused a decline in shares and investor withdrawals.

BlackRock (NYSE:BLK) – BlackRock initiated an

auction for the German startup SellerX after failing to approve a

loan. The auction, scheduled for September 17th in Berlin, seeks to

resolve SellerX’s financial crisis, which is struggling due to the

post-pandemic slowdown in e-commerce. The debt value and impact on

investors are in dispute.

Deutsche Bank AG (NYSE:DB) – Deutsche Bank will

lead a $4.325 billion bond issuance and loan to finance Apollo

Global Management’s purchase of Everi Holdings, which also includes

acquiring International Game Technology operations. The financing

will help complete the planned merger, with the possibility of

launches until September 2025.

HSBC Holdings (NYSE:HSBC) – Nuno Matos, head of

HSBC’s wealth unit, is leaving the bank after losing the CEO

position. He will be replaced by Barry O’Byrne and will remain as

an advisor until 2024 before leaving HSBC in 2025. Matos’s

departure follows Georges Elhedery’s promotion to CEO and other

changes in the bank’s top management. The stock fell 0.1% in

pre-market trading after closing down 0.5% on Wednesday.

Just Eat Takeaway (LSE:JET), JPMorgan

Chase (NYSE:JPM) – Just Eat Takeaway CEO Jitse Groen

humorously reacted to JPMorgan’s suggestion of a possible merger

with Delivery Hero and iFood to create a new giant called

JustiFoodHero. He commented on X, mentioning that the name would

need adjustments, with a laughing emoji.

Dick’s Sporting Goods (NYSE:DKS) – Dick’s

Sporting Goods revealed on Wednesday that an unauthorized third

party accessed its systems and confidential data. The company has

engaged cybersecurity experts and notified federal authorities.

There is no information yet on impacts on business operations.

Foot Locker (NYSE:FL) – Foot Locker will move

its headquarters from New York to St. Petersburg, Florida, by the

end of 2025, aiming to reduce costs and expand locally. The city,

which once housed Champs, offers benefits such as lower living

costs and tax incentives. The move is expected to create 175 new

jobs, totaling 330 in Florida. The stock remains stable in

pre-market trading after closing down 10.2% on Wednesday.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle

Mexican Grill appointed Adam Rymer as the new CFO starting October

1st. Rymer, with 15 years at the company, was vice president of

finance. Jack Hartung will indefinitely assume the role of

president and chief strategy officer to support interim CEO Scott

Boatwright.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – On Wednesday, the U.S. Federal Trade Commission

highlighted labor disputes in the Kroger-Albertsons merger case

following strikes in Oregon. Kroger’s lead negotiator, Jon

McPherson, and union leader Daniel Clay testified, discussing wages

and labor competition. The merger faces resistance from unions

concerned about the impact on working conditions.

Wynn Resorts (NASDAQ:WYNN) – Wynn Resorts, in

partnership with Related Cos. and Oxford Properties Group, unveiled

a $12 billion casino-resort project at Hudson Yards, New York. The

plan includes a 1,500-room hotel, restaurants, spa, public art,

1,500 residences, a school, and a park. The project will create

35,000 construction jobs and 5,000 permanent jobs. Wynn is

competing for one of three new casino licenses for the New York

metropolitan area.

Kenvue (NYSE:KVUE) – The manufacturer of

Tylenol, Kenvue, won a lawsuit filed by consumers who claimed that

the “rapid release” gel capsules did not relieve pain faster than

cheaper tablets. Federal Judge Andrew Carter ruled that the company

followed FDA regulations, dismissing the consumers’ allegations of

misleading labeling.

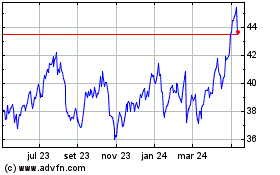

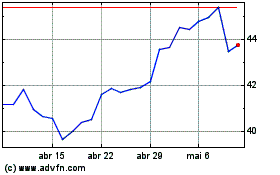

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024