Microsoft (NASDAQ:MSFT),

Vodafone (NASDAQ:VOD) – Microsoft announced a new

stock buyback program of up to $60 billion and a 10% increase in

its quarterly dividend to $0.83. The company plans to hold its

annual shareholders’ meeting on December 10. Additionally,

Microsoft revealed that Vodafone signed a significant contract to

use 68,000 licenses for Copilot AI assistants in Office after tests

showed a time-saving of three hours per worker weekly. Microsoft

also introduced new AI tools for Excel, Outlook, and Teams aimed at

enhancing business productivity. Microsoft shares rose 1.9% in

pre-market trading after closing up 0.2% on Monday.

Intel (NASDAQ:INTC) – Intel signed a deal with

Amazon’s cloud services division to produce custom AI chips. CEO

Pat Gelsinger highlighted cost-cutting efforts and restructuring

its foundry operations to increase competitiveness after a

disappointing quarterly report. Additionally, Intel’s construction

projects in Poland and Germany will be delayed by around two years,

although German Chancellor Olaf Scholz assured that Intel remains

committed to building factories in eastern Germany. Intel has

already qualified for up to $3 billion from the US CHIPS and

Science Act program. Shares climbed 6.9% in pre-market trading

after closing up 6.4% on Monday.

Amazon (NASDAQ:AMZN) – Amazon CEO Andy Jassy

announced changes to improve efficiency, such as eliminating

management layers and requiring employees to return to the office

five days a week starting in January. The move aims to reduce

bureaucracy that hinders quick decision-making. Jassy also plans to

increase the proportion of individual contributors by 15% by March

2025 and set up a direct line for reporting inefficient processes.

Separately, hundreds of Amazon delivery drivers joined the

International Brotherhood of Teamsters, demanding better wages and

working conditions. They are calling for Amazon to recognize their

union. Amazon shares rose 0.5% in pre-market trading after closing

down 0.9% on Monday.

Micron Technology (NASDAQ:MU) – Micron

Technology shares fell 4.43% on Monday, signaling a bearish chart

pattern for the first time in over two years, suggesting potential

accelerated losses. Morgan Stanley expressed pessimism about the

memory chip sector, predicting a nearly 30% contraction in

valuations as investors worry about a possible profit peak. Shares

rose 1.1% in pre-market trading.

Apple (NASDAQ:AAPL) – Apple shares closed down

2.78% on Monday after analysts noted that delivery times for the

new iPhone 16 Pro indicate weaker-than-expected demand. The average

shipping time is shorter compared to previous models, raising

concerns about the lack of AI features in the release. Pre-order

sales also saw significant drops. Shares rose 0.2% in pre-market

trading.

Affirm Holdings (NASDAQ:AFRM) – Affirm

announced on Monday that its “buy now, pay later” payment options

are now available to Apple Pay users on iPhones and iPads. This

integration offers flexibility and security, allowing users to

select customized payment plans. Shares rose 0.5% in pre-market

trading after closing up 0.1% on Monday.

Dell Technologies (NYSE:DELL), Super

Micro Computer (NASDAQ:SMCI) – Dell received an Outperform

rating and a $135 price target from Mizuho. Mizuho also initiated

coverage of Super Micro Computer with a Neutral rating and a $450

price target. SMCI shares rose 0.5% in pre-market trading, while

Dell shares rose 1.7%.

Alphabet (NASDAQ:GOOGL) – Google reinforced its

commitment to hardware, highlighting Pixel devices as showcases for

Android. Despite this, sales have never rivaled the iPhone or

Galaxy. The company’s AI advantage, exemplified in its Gemini AI

suite, is a new bet for differentiation. The Pixel 9 and other

devices offer software and hardware integration, but practical

limitations remain, such as commands that Google Assistant fails to

execute properly, according to Bloomberg. Nevertheless, the new

Pixels continue to exemplify the best Android experience with sleek

designs and advanced camera functionality. Shares rose 0.5% in

pre-market trading after closing up 0.4% on Monday.

Meta Platforms (NASDAQ:META) –

EssilorLuxottica, maker of Ray-Ban and Oakley eyewear, announced on

Tuesday the extension of its partnership with Meta Platforms to

develop smart glasses for the next decade. In other news, Meta

announced a ban on RT and other Russian state media, citing

deceptive online influence tactics. The ban will be implemented

across all Meta platforms in the coming days. Meta shares rose 0.2%

in pre-market trading after closing up 1.7% on Monday.

Udemy (NASDAQ:UDMY) – Udemy announced a new

round of layoffs as part of its recovery plan, expected to be

completed by March. About half of the 280 affected employees will

be rehired, mainly in lower-cost regions. The company estimates

charges between $16 million and $19 million, recognized from 2024

to 2025. In February 2023, Udemy had already cut 10% of its

workforce, ending 2023 with 1,443 employees.

Flutter Entertainment (NYSE:FLUT) – Flutter

Entertainment agreed to acquire Playtech’s gaming division,

Snaitech, for $2.6 billion, aiming to expand its presence in the

Italian market. The deal is expected to close in the second quarter

of 2025. With this acquisition, Flutter will control around 30% of

the Italian betting market. Shares rose 0.4% in pre-market trading

after closing up 1.3% on Monday.

DraftKings (NASDAQ:DKNG) – The Major League

Baseball Players Association sued DraftKings and Bet365, alleging

unauthorized use of athletes’ images in marketing campaigns,

violating Pennsylvania law. The union seeks damages and a cease in

image usage, as well as the return of profits.

Tapestry (NYSE:TPR), Capri

Holdings (NYSE:CPRI) – Designer Michael Kors explained in

court that the luxury handbag market is highly competitive and

diverse, with new brands rapidly gaining popularity thanks to

social media and influencers. Kors testified that the competition

in the handbag market is so intense that he only discovered the

Aupen brand after seeing Taylor Swift with one of their bags. Kors

noted how social media has made it easier to launch new brands and

pointed out that celebrities like Swift and Beyoncé are not paid

for such promotions. His testimony came during a hearing about the

$8.5 billion merger between Tapestry and Capri Holdings, which

faces regulatory opposition for potentially reducing competition in

the “accessible luxury” handbag market.

Starbucks (NASDAQ:SBUX) – Michael Conway, CEO

of Starbucks North America, announced his retirement after 11 years

with the company. The change comes as new CEO Brian Niccol

implements a recovery plan and will not fill Conway’s position.

Sarah Trilling, head of retail operations, will report directly to

Niccol. Conway will serve as a consultant until the end of 2024.

Shares rose 0.2% in pre-market trading after closing down 2.3% on

Monday.

Chipotle (NYSE:CMG) – Chipotle is testing a

bowl-making machine and an avocado-processing robot at some

California locations. The technology aims to improve efficiency as

the chain seeks to maintain quality customer service. Broader

implementation will depend on feedback received. Chipotle also

mentioned that the automation is not related to the state’s wage

increase. Shares rose 0.03% in pre-market trading after closing up

2.7% on Monday.

Walmart (NYSE:WMT) – The Walton family, heirs

to Walmart, reached significant wealth milestones, with Jim and Rob

Walton each surpassing $100 billion in net worth, while Alice

Walton is close to that figure. Walmart shares have been boosted in

2024 by increased online sales, reflecting growing demand for

groceries and consumer products. Shares rose 0.1% in pre-market

trading after closing down 0.05% on Monday.

Target (NYSE:TGT) – Target announced plans to

hire about 100,000 seasonal workers for the holiday season,

maintaining the same level as in the past three years. Despite

projected retail sales growth at the slowest pace in six years, the

company will focus on offering affordable products to attract

inflation-conscious consumers.

Sprouts Farmers Market (NASDAQ:SFM) – Evercore

ISI believes Sprouts Farmers Market’s positive trajectory will

continue after its shares more than doubled in value this year,

driven by growing consumer interest in healthy eating. Following an

“outperform” rating upgrade, the stock hit a record high, with a

new $120 price target indicating more upside potential. Shares

closed up 4.4% on Monday.

Chewy (NYSE:CHWY) – Chewy shares closed up 2.2%

on Monday, completing a seven-day winning streak after influential

trader Keith Gill, known as Roaring Kitty, made an enigmatic post

featuring a dog image. This marks the longest winning streak since

June 2019, with the stock closing at $32.67.

Tupperware Brands (NYSE:TUP) – Tupperware

Brands is preparing to file for bankruptcy this week after years of

failed attempts to revitalize the company in a declining market.

The company, which faces over $700 million in debt, violated loan

terms and hired financial advisors. Tupperware has struggled in

recent years, including closing its only US factory and laying off

employees. The brand, known for its storage products, began selling

its items in 1946. Shares closed down 57.5% on Monday.

Boeing (NYSE:BA) – According to Reuters, Boeing

could lose more than $100 million in daily revenue until it reaches

an agreement with its striking union, representing over 30,000

workers. The strike, the first since 2008, could cost Boeing up to

$3 billion, putting pressure on its already strained finances.

Boeing has frozen hiring and is considering temporary layoffs to

cut costs. Additionally, FAA chief Mike Whitaker will testify on

September 24 about Boeing’s quality improvement plan, following the

plan’s submission in May. Senator Blumenthal emphasized the need to

explain FAA oversight and Boeing’s safety culture. Whitaker also

prohibited Boeing from increasing production until issues are

resolved. Boeing faces growing scrutiny from Congress, especially

after a 737 MAX incident. Shares rose 0.3% in pre-market trading

after closing down 0.8% on Monday.

Embraer (NYSE:ERJ) – Boeing will pay Embraer

$150 million after backing out of merger talks in 2020, concluding

a long arbitration process. Embraer’s US-listed shares closed down

4.1% on Monday as the amount was considered below market

expectations. Nevertheless, the stock remains up 120% for the year.

The dispute arose after Boeing accused Embraer of not meeting

conditions for the $4.2 billion deal.

Ryanair Holdings (NASDAQ:RYAAY) – Ryanair

estimates that a Boeing strike will delay its aircraft deliveries

by six weeks, pushing jets from the first half of 2025 to the end

of the year. CEO Michael O’Leary mentioned that up to 10 deliveries

could be affected, impacting the carrier’s target of transporting

200 million passengers. Shares rose 0.8% in pre-market trading

after closing up 0.2% on Monday.

Stellantis (NYSE:STLA) – The United Auto

Workers (UAW) union accused Stellantis of unfair labor practices

for not providing information about its product plans and

attempting to move Dodge Durango production out of the US. UAW

president Shawn Fain criticized the company’s management and

highlighted delays in investments. Shares rose 0.9% in pre-market

trading after closing up 0.8% on Monday.

Tesla (NASDAQ:TSLA) – Tesla shares closed down

1.52% on Monday, ending a five-day winning streak, as the S&P

500 and Dow Jones rose. The weakness was attributed to a general

decline in tech stocks, despite Tesla’s announcement of producing

its 100 millionth 4680 battery cell. Investors are looking ahead to

the company’s RobotaxiDay on October 10 and the Federal Reserve’s

interest rate decision, which could affect vehicle financing.

Shares rose 0.6% in pre-market trading.

Mobileye Global (NASDAQ:MBLY) – Mobileye shares

rose 4.2% in pre-market trading after closing up 4.7% on Monday,

following reports that the Israeli driver-assistance technology

company was not mentioned in Intel’s new “transformation” phase.

Bloomberg recently reported that Intel is evaluating its 88% stake

in Mobileye amid a restructuring of its chip division.

Exxon Mobil (NYSE:XOM),

Chevron (NYSE:CVX) – Oil companies like Exxon

Mobil and Chevron won an appeal from consumers accusing them of

conspiring with Donald Trump, Russia, and Saudi Arabia to reduce

production and raise prices. The US Ninth Circuit Court of Appeals

ruled that the case involved political questions and found no

evidence of antitrust violations. Exxon shares rose 0.2% in

pre-market trading, while Chevron shares rose 0.3%.

BP Plc (NYSE:BP) – BP Plc plans to sell its US

onshore wind energy operation, refocusing on its core business and

reducing exposure to renewables. The company will also sell part of

its stake in a pipeline to Apollo Global Management for $1 billion,

facing financial challenges. BP, which committed to increasing

dividends and share buybacks, is now seeking to simplify its

portfolio and prioritize its solar arm, Lightsource BP. Shares rose

0.3% in pre-market trading after closing up 1.4% on Monday.

Petrobras (NYSE:PBR) – Petrobras’ five-year

business plan, set for release in November, will include realistic

investments and may raise the debt ceiling to $65 billion,

providing more financial flexibility. The company focuses on

expanding oil and gas reserves. Recently, it sold $1 billion in

bonds, with strong demand from international markets. Shares rose

0.1% in pre-market trading after closing up 1.7% on Monday.

Equinor (NYSE:EQNR) – Equinor plans to begin

production at the Johan Castberg oil field in the Barents Sea later

this year after anchoring a production ship on-site. The field has

recoverable resources of 450 to 650 million barrels of oil

equivalent and is expected to operate for 30 years. Equinor holds

50% of the field, while Var Energi owns 30% and Petoro 20%. Shares

fell 0.1% in pre-market trading after closing up 0.4% on

Monday.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway could reach up to $300 billion in cash by the end of

September, driven by stock sales and solid profits, despite a weak

buyback quarter. The current cash balance of $277 billion

represents over 25% of its market value, while stock buybacks have

been drastically reduced. Shares rose 0.3% in pre-market trading

after closing up 0.9% on Monday.

Bank of America (NYSE:BAC) – Bank of America

hired Johnbull Okpara, former chief accounting officer at

Citigroup, as its new head of accounting. Okpara, who will assume

the role in December, will work with Rudolf Bless through 2025. He

brings over 30 years of experience in governance and financial

management, having also worked at Morgan Stanley and American

Express. The bank also appointed Jim Rourke and Michael Liu as

co-leaders of the “Private Client Partnership Development”

initiative, aimed at increasing connectivity between its investment

banking and wealth management units. They will be responsible for

maximizing opportunities in Global Corporate & Investment

Banking, Merrill Wealth Management, and Private Bank. Shares rose

0.3% in pre-market trading after closing up 1.2% on Monday.

Charles Schwab (NYSE:SCHW) – Charles Schwab

shares closed up 2.53% on Monday after the company reported a

significant increase of $32.8 billion in new net assets in August,

despite a decline in bank deposits. Schwab faces challenges with

cash sorting, but analysts believe the situation may improve as

interest rates ease.

UBS Group AG (NYSE:UBS) – A Swissmem survey of

231 companies in August 2024 revealed that nearly 25% of Swiss

industrial companies are dissatisfied with UBS services,

particularly in lending, since its acquisition of Credit Suisse in

2023, reflecting concerns about the bank’s dominance. While UBS

reiterated its commitment to the market, only 2% said banking

services had improved, while 74% reported dissatisfaction with

lending terms. Shares rose 0.5% in pre-market trading after closing

up 0.7% on Monday.

Citigroup (NYSE:C) – Citigroup appointed Tim

Ryan, head of technology, to work with Anand Selva on addressing

data management issues. Ashutosh Nawani, head of risk management,

will also join the team. The bank faces pressure to improve after

being fined $136 million for insufficient progress. Shares closed

up 1.3% on Monday.

Barclays (NYSE:BCS) – Barclays hired Morgan

Stanley veteran Rob Patterson to lead investment banking coverage

in data and information. Patterson will report to Kristin Roth

DeClark as Barclays continues to expand its technology and M&A

team. In another development, Barclays’ Skylar Montgomery Koning

believes stronger sales will shift expectations of rate cuts,

boosting the dollar. Montgomery stated that the dollar is set to

recover as traders overestimate Federal Reserve rate cuts and

underestimate an upcoming retail sales report. Shares rose 1.9% in

pre-market trading after closing up 0.9% on Monday.

Blackstone (NYSE:BX),

Smartsheet (NYSE:SMAR) – Vista Equity Partners and

Blackstone are in advanced talks to acquire Smartsheet, valuing the

company at around $8 billion, with a bid of roughly $56 per share,

according to Reuters. If successful, the deal will be one of the

largest transactions of the year, driven by expectations of Federal

Reserve rate cuts. Blackstone shares closed up 2.2% on Monday,

while Smartsheet rose 0.9%.

Apollo Global Management (NYSE:APO) – Apollo

Global Management’s Scott Kleinman warned that investors are

overestimating Federal Reserve rate cuts over the next 12 months.

He believes rate cuts will only happen if there is a recession, and

that wage and housing inflation will limit reductions, with markets

not yet reflecting this scenario.

Rappi – Colombian startup Rappi, backed by

SoftBank, could launch an initial public offering on the New York

Stock Exchange within 12 months, according to co-founder Simon

Borrero. He emphasized that the company is profitable and will take

a patient approach in choosing the right time for the IPO. Rappi

operates in nine Latin American countries and offers delivery and

digital banking services.

BKV Corp. – BKV, a natural gas production unit

of Thailand’s Banpu Pcl, seeks to raise up to $315 million in an

initial public offering in the US, offering 15 million shares

priced between $19 and $21 each. Founded in 2015, the company

operates in the Barnett Shale and Northeast Marcellus formations.

Banpu, which owns 93% of BKV, will continue to control the majority

of voting shares.

Shein – Chinese online clothing company Shein

faces challenges in going public in the US, with members of

Congress calling on the SEC to block its listing due to concerns

over sustainability, labor practices, and ties to China. The Biden

administration’s recent proposal to limit tariff benefits for

Chinese companies further complicates Shein’s IPO ambitions and

underscores the growing skepticism of doing business with China in

the current political climate.

Guardian Pharmacy Services – Guardian Pharmacy

Services announced a valuation of up to $973.5 million for its

initial public offering in the US, planning to list on the New York

Stock Exchange as “GRDN.” The pharmaceutical services company aims

to raise up to $108 million by selling 6.75 million shares priced

between $14 and $16 each.

Johnson & Johnson (NYSE:JNJ) – An Oregon

judge overturned a $260 million verdict against Johnson &

Johnson in a mesothelioma case linked to the use of talc. Judge

Katharine von ter Stegge granted the company’s request for a new

trial, while the plaintiff, Kyung Lee, plans to appeal. J&J

faces over 62,000 asbestos-related claims tied to its products.

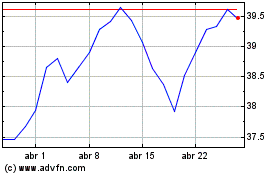

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

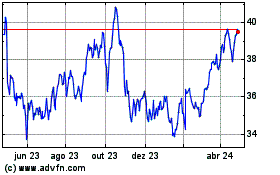

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024