Intel (NASDAQ:INTC), Apollo Global

Management (NYSE:APO), Qualcomm

(NASDAQ:QCOM) – Apollo Global Management has reportedly offered up

to $5 billion to invest in Intel, according to Bloomberg. The

negotiations are in the early stages and could change or fall

apart. In addition, Qualcomm is in preliminary talks to acquire

Intel, aiming to reshape the chip sector, but faces significant

challenges, with CEO Cristiano Amon evaluating deal options. The

proposals come amid Intel’s stock losing almost 60% of its value.

According to some experts like Hendi Susanto of Gabelli Funds,

acquiring Intel would be financially risky for Qualcomm and

wouldn’t resolve its reliance on Taiwan Semiconductor, possibly

affecting its margins. In pre-market trading, Intel shares rose

1.9%, while Qualcomm shares dropped 0.2%.

TSMC (NYSE:TSM), Samsung

Electronics (USOTC:SSNHZ) – TSMC and Samsung are

discussing chip projects in the UAE, funded by Mubadala, with

potential investments exceeding $100 billion. TSMC stated no

confirmed plans, while Samsung considers new operations, according

to the WSJ. TSMC shares fell 0.2% in pre-market trading, after

closing 1.2% lower on Friday.

ASML (NASDAQ:ASML) – Morgan Stanley lowered its

earnings estimates for ASML, following similar cuts by UBS and

Deutsche Bank, due to weakness in the memory chip market and

concerns about demand from Intel and Chinese manufacturers.

However, Morgan Stanley expects strong performance in 2025, driven

by demand for advanced AI-related technologies. ASML shares closed

down 4% on Friday but rose 0.1% in pre-market trading Monday.

Constellation Energy (NASDAQ:CEG),

Microsoft (NASDAQ:MSFT) – Constellation Energy and

Microsoft have signed an agreement to revitalize the Three Mile

Island nuclear plant, marking a potential historic restart,

according to Reuters. The plant, which was decommissioned in 2019,

will supply 835 megawatts of electricity, helping meet Microsoft’s

growing data center demands for 20 years. Constellation plans to

spend about $1.6 billion on the plant, expected to be operational

by 2028. The deal still requires regulatory approvals.

Constellation Energy shares rose 0.8% in pre-market trading, after

closing 22.3% higher on Friday.

Meta Platforms (NASDAQ:META) – A Kenyan court

ruled that Meta, Facebook’s parent company, can be sued over the

firing of content moderators after unionization attempts. The

ruling reaffirms a previous decision on layoffs and poor working

conditions, potentially impacting Meta’s global operations with

moderators. In other news, the family of billionaire Eduardo

Saverin, Facebook’s co-founder, donated about $15.5 million to the

Singapore American School, marking the largest donation in the

institution’s history. Superintendent Tom Boasberg noted the gift

would have a “transformative” impact, supporting infrastructure and

educational programs for current and future students. Shares rose

0.6% in pre-market trading, after closing 0.4% higher on

Friday.

Fox Corp. (NASDAQ:FOX) – Fox may avoid a

shareholder vote on a proposal requiring differentiated labels for

its news and opinion programs, according to the U.S. Securities and

Exchange Commission. The decision is a win for the company ahead of

its annual meeting and reflects concerns about misinformation in

news coverage.

News Corp (NASDAQ:NWS) – REA Group, controlled

by News Corp, made a third bid to acquire British company

Rightmove, valuing the brokerage at approximately $8.1 billion. The

new proposal offers 770 pence per share, a 9.2% increase over the

previous offer. Rightmove will consider the bid, but it has already

rejected two others, claiming they undervalue its worth and

potential.

Trump Media & Technology Group (NASDAQ:DJT)

– Shares of Trump Media & Technology Group fell 7.8% on Friday,

hitting a new low of $13.50 after the end of a privileged sales

lockup. The company, which operates the Truth Social app and is 57%

owned by Donald Trump, saw its market capitalization drop to $2.71

billion. Shares rose 1.5% in pre-market trading.

Amazon (NASDAQ:AMZN), Nokia

(NYSE:NOK) – Nokia announced that a Munich Regional Court ruled

Nokia can block Amazon from selling certain Fire TV Stick products

in Germany, accusing Amazon of using Nokia’s patented video

technologies without a license. Amazon contested the decision,

stating the situation will be resolved soon and expressed

dissatisfaction with Nokia’s demands. Both companies are engaged in

patent litigation.

Zoom Video Communications (NASDAQ:ZM) – Zoom

decided to reduce stock compensation for its employees. CEO Eric

Yuan stated that stock dilution has become unsustainable and that

the company will adjust its compensation policy, offering more cash

bonuses and reducing stock grants. Shares rose 0.5% in pre-market

trading, after closing 0.9% higher on Friday.

MicroStrategy (NASDAQ:MSTR) – MicroStrategy

raised $1.01 billion by selling convertible senior notes to acquire

more Bitcoin and redeem higher-yielding bonds. The company used

$458 million to purchase Bitcoin, increasing its total holdings to

about 252,220 units, solidifying its position as the largest

corporate holder of the cryptocurrency. Shares rose 2.3% in

pre-market trading, after closing 0.1% higher on Friday.

Citigroup (NYSE:C) – Citigroup’s plan to expand

in China faces delays due to a $136 million fine imposed by the

Federal Reserve over data management issues. The bank has yet to

receive Fed approval, necessary for obtaining the Chinese license,

but remains in talks to establish its business in the country.

Wells Fargo (NYSE:WFC), Tempur

Sealy (NYSE:TPX) – A Wells Fargo-led consortium launched a

$1.6 billion loan to finance Tempur Sealy International’s

acquisition of Mattress Firm. The FTC seeks to block the deal,

claiming it could harm competition and raise prices. The loan is

one of the largest since 2021, according to Bloomberg.

HSBC (NYSE:HSBC) – HSBC is selling its private

banking operations in Germany to BNP Paribas. The deal, involving

120 employees, will close in the second half of 2025, pending

approvals. HSBC aims to streamline its operations, while BNP

Paribas will strengthen its position in the German market with over

€40 billion in assets. Shares rose 0.5% in pre-market trading,

after closing 1.2% lower on Friday.

Tesla (NASDAQ:TSLA) – Elon Musk announced on X

that SpaceX plans to launch five uncrewed Starship missions to Mars

in the next two years. The success of these missions will determine

the timeline for crewed missions in four years. If failures occur,

the schedule may be delayed by another two years, depending on the

challenges faced. Shares rose 1.0% in pre-market trading, after

closing 2.3% lower on Friday.

General Motors (NYSE:GM) – General Motors will

lay off 1,695 workers at its Fairfax, Kansas plant in two phases by

January 2024. According to Reuters, the first phase will take place

on November 18 and the second on January 12. GM will invest $390

million to produce the Chevrolet Bolt EV, with production resuming

in 2025, resulting in temporary layoffs. In Ontario, Canada, CAMI

plant workers approved a two-year contract with GM, with 95.7%

voting in favor. The deal includes an immediate 10% wage increase,

followed by 2% in September 2025 and 3% in July 2026, along with a

20.25% wage increase for skilled workers. Shares fell 0.4% in

pre-market trading, after closing 0.5% higher on Friday.

Stellantis (NYSE:STLA),

Ferrari (NYSE:RACE) – An Italian judge seized

about $84 million from five people, including John Elkann, in a tax

fraud investigation. Prosecutors allege that Elkann and his

siblings failed to pay taxes on their grandmother Marella

Caracciolo’s inheritance, claiming she resided in Italy, not

Switzerland. The Elkanns’ lawyers argue the seizure does not

indicate guilt, reiterating that their grandmother always lived in

Switzerland.

Boeing (NYSE:BA) – Last Friday, Boeing began

temporary layoffs for thousands of employees in Washington and

Oregon after more than 32,000 workers went on strike, halting

production of the 737 MAX and other jets. Union negotiations are

stalled, and the company is preparing for a possible extended

strike, with workers demanding a 40% wage increase. Additionally,

Boeing announced the immediate departure of Ted Colbert, head of

its space and defense unit, temporarily replaced by Steve Parker.

The new CEO, Kelly Ortberg, highlights the need to restore customer

trust following several setbacks, including issues with the

Starliner capsule and the 737 MAX. Shares rose 0.6% in pre-market

trading, after closing 0.8% lower on Friday.

Alaska Airlines (NYSE:ALK) – Alaska Airlines

reported an IT failure that caused delays and led to a two-hour

stop order on arrivals in Seattle. The airline clarified that the

issue was caused by a certificate and not a cyberattack. Some

residual impacts are still expected.

American Airlines (NASDAQ:AAL) – American

Airlines requested the U.S. Department of Transportation to delay

the resumption of two daily flights to China, citing low travel

demand between the two countries. The airline currently operates

one daily flight between Dallas and Shanghai, but demand has not

yet returned to pre-pandemic levels. Shares fell 0.2% in pre-market

trading, after closing 0.9% lower on Friday.

Southwest Airlines (NYSE:LUV) – Southwest

Airlines is considering changes in routes and schedules to boost

revenue, as well as offering assigned seats. The airline announced

it will take difficult steps to restore profitability and meet

demands from activist investor Elliott Investment Management.

Rio Tinto (NYSE:RIO) – Dominic Barton, chairman

of Rio Tinto, stated in an interview with Bloomberg TV that the

mining industry needs to ramp up exploration to meet growing demand

for critical metals like copper for the energy transition. He

emphasized that mergers and acquisitions will not solve the supply

gap and that the company is focused on exploration investments.

Shares fell 0.3% in pre-market trading, after closing 2.5% lower on

Friday.

Nike (NYSE:NKE) – New Nike CEO Elliott Hill is

expected to reverse the direct-to-consumer strategy of former

president John Donahoe, prioritizing relationships with retailers

and boosting sales. Nike shares closed 6.8% higher on Friday after

his appointment, as the company faces strong competition and seeks

to regain market share. During Donahoe’s tenure, he received nearly

$104 million in salary and benefits at Nike, while the company lost

about $40 billion in market value. Donahoe still holds more than

1.5 million stock options that could generate returns if the stock

price recovers. Hill will receive an annual package worth about $20

million. Shares fell 0.4% in pre-market trading.

AstraZeneca (NASDAQ:AZN) – AstraZeneca

announced that its experimental cancer drug, datopotamab deruxtecan

(Dato-DXD), did not improve survival in breast cancer patients

compared to chemotherapy. The company noted that the use of other

effective therapies after disease progression may have influenced

the results. Shares fell 1.4% in pre-market trading, after closing

0.7% lower on Friday.

Grifols (NASDAQ:GRFS) – Grifols accelerated the

reduction of executive powers from Thomas Glanzmann, who will now

only chair the board, aiming to improve corporate governance. The

change, anticipated for 2025, is part of a restructuring following

criticism from Gotham City Research and comes amid acquisition

talks for the company. Shares fell 2.0% in pre-market trading,

after closing 1.4% lower on Friday.

Cardinal Health (NYSE:CAH) – Cardinal Health

announced the acquisition of Integrated Oncology Network for $1.12

billion, expanding its presence in cancer treatment. The

transaction will allow its Navista unit to access more than 100

healthcare providers across 10 states, strengthening community

oncology services. The company expects a positive earnings impact

within 12 months of the deal’s close.

Johnson & Johnson (NYSE:JNJ) – A Johnson

& Johnson subsidiary filed for bankruptcy for the third time,

seeking a $10 billion settlement to resolve thousands of lawsuits

alleging its talc products cause cancer. Despite 83% of claimants

supporting the deal, J&J faces legal resistance and criticism

for manipulating the bankruptcy system.

Novo Nordisk (NYSE:NVO) – Novo Nordisk shares

closed down 5.5% on Friday after disappointing results from a trial

of its obesity pill, monlunabant, which showed only 6.5% weight

loss over 16 weeks, compared to the 15% expected. The company plans

to initiate a phase 2b trial to further explore dosage and safety.

Shares fell 0.8% in pre-market trading.

Sanofi (NASDAQ:SNY) – Sanofi announced that its

multiple sclerosis drug, tolebrutinib, reduced the progression of a

progressive form of the disease by 31%. The pharmaceutical company

plans to seek approval later this year, following a setback in

trials for the recurring form of the disease. Sanofi is looking to

diversify its options in MS treatment after losing the Aubagio

patent. Sanofi also announced that the Food and Drug Administration

(FDA) approved Sarclisa as a first-line combination treatment for

multiple myeloma in newly diagnosed patients who are ineligible for

stem cell transplant. This is Sarclisa’s third U.S. approval and

the first for newly diagnosed patients, based on data from the

IMROZ study.

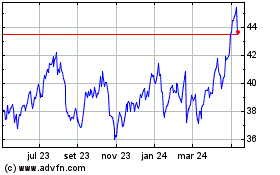

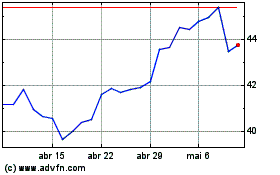

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

HSBC (NYSE:HSBC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024