Pfizer (NYSE:PFE) – Activist investor Starboard

Value acquired about $1 billion in Pfizer shares, seeking changes

to improve performance. Former CEO Ian Read and former CFO Frank

D’Amelio showed interest in supporting Starboard, according to

Reuters. Pfizer is facing a significant decline in COVID-19 vaccine

and drug sales, leading to a stock drop. Shares rose 2.2%

pre-market after closing up 0.9% on Friday.

Rio Tinto (NYSE:RIO), Arcadium

Lithium (NYSE:ALTM) – It was confirmed on Monday that Rio

Tinto is negotiating the purchase of lithium producer Arcadium

Lithium, estimated between $4 billion and $6 billion. The

acquisition would strengthen Rio’s position as one of the largest

lithium producers, essential for electric vehicle batteries.

Falling lithium prices made Arcadium an attractive target. Shares

fell 0.6% pre-market after closing down 0.2% on Friday.

Novo Nordisk (NYSE:NVO) – Danish pharmaceutical

company Novo Nordisk announced a $158.2 million (864 million reais)

investment to renovate its factory in Montes Claros, Brazil. This

facility is responsible for a quarter of global insulin production

and will implement sustainable projects. The announcement was made

during a meeting between President Lula and Queen Mary of Denmark.

Shares rose 1.0% pre-market.

BP (NYSE:BP) – BP abandoned its goal of cutting

oil and gas production by 40% by 2030, adjusting its strategy to

focus on short-term returns and increased investment in projects in

the Middle East and the Gulf of Mexico. The company still aims for

net-zero emissions by 2050 but prioritizes more profitable oil and

gas assets. Shares rose 0.2% pre-market after closing up 1.3% on

Friday.

Shell (NYSE:SHEL) – Shell’s refining profit

margins fell 30% in Q3, reaching $5.5 per barrel due to declining

global demand and new refineries. The company also expects lower

earnings on October 31 due to petrochemical trading. However,

increased liquefied natural gas (LNG) and oil production offset

some losses. Shares rose 0.4% pre-market after closing up 0.1% on

Friday.

Samsung Electronics (USOTC:SSNHZ) – Samsung

Electronics is expected to report a more than fourfold increase in

quarterly profits, reaching $7.67 billion (10.33 trillion won),

driven by improved chip demand. However, its recovery is slowing

due to a delayed response to the AI chip market and increased

competition from rivals like SK Hynix and Micron.

Foxconn (USOTC:FXCOF) – Foxconn reported its

highest quarterly revenue, driven by strong demand for AI servers,

reaching $57.3 billion (T$1.85 trillion), a 20.2% increase

year-over-year. The revenue boost came from AI server demand, with

strong growth in its cloud and network division. Despite quarterly

growth in consumer electronics, annual performance remained

flat.

Micron Technology (NASDAQ:MU) – Micron

Technology CEO Sanjay Mehrotra plans to sell up to $20 million in

company shares starting November 7. The sale will occur through a

trading plan under Rule 10b5-1, which automates transactions based

on pre-established conditions like price and volume. Shares fell

0.4% pre-market after closing up 0.4% on Friday.

Alphabet (NASDAQ:GOOGL) – Google is testing

checkmarks next to some companies in its search results to help

users identify trusted sources and avoid fraudulent sites. This

feature is aimed at protecting brands and offering accurate

information. The feature is still in the experimental phase and is

not widely available. Shares fell 0.5% pre-market after closing up

0.7% on Friday.

Meta Platforms (NASDAQ:META) – Meta Platforms

launched Movie Gen, a new AI tool that creates or edits videos

based on text prompts. The feature is currently available to some

employees and partners to increase engagement across the company’s

platforms. Meta is also testing a new “Local” tab on Facebook,

showing users content based on location, such as neighborhood

activities and items for sale. Additionally, Meta is developing an

“Explore” tab and a full-screen video section to attract younger

users. Shares fell 0.3% pre-market after closing up 2.3% on

Friday.

OpenAI – OpenAI is now worth more than 87% of

S&P 500 companies, becoming one of the most valuable private

companies after raising $6.6 billion, reaching a valuation of $157

billion. Despite projecting $11.6 billion in revenue by 2025, the

company expects $5 billion in losses this year. Investors see

future potential, but Wall Street remains skeptical due to strong

competition from companies like Google and Meta.

Trump Media & Technology (NASDAQ:DJT) –

Trump Media & Technology, owner of Truth Social, saw its stock

rise 2% on Friday after announcing the departure of COO Andrew

Northwall on September 28. The company did not disclose the reason

for his departure and plans to redistribute his duties internally.

Shares, down 72% from their March peak, rose 2.7% pre-market.

Palantir Technologies (NYSE:PLTR) – Palantir

Technologies shares rose 2% on Friday, reaching a new high of

$40.01, following a 4.7% gain on Thursday. Recently, Chairman Peter

Thiel sold more than 12.4 million shares for $457.4 million.

Although shares are up 130% this year, some analysts are cautious

due to high valuations and elevated multiples. Shares fell 0.4%

pre-market.

Boeing (NYSE:BA) – Boeing will resume contract

negotiations with its largest union, IAM, on October 7, aiming to

resolve a strike involving around 33,000 workers. The company

prioritizes an agreement due to rising debt and financial pressure,

while seeking a 30% wage increase over four years. Additionally,

Italian prosecutors charged seven people and two subcontractors

with fraud and safety violations following an investigation into

defective parts supplied to Boeing. The investigations revealed

that the subcontractors used unsuitable materials, compromising

aircraft safety. Boeing and Leonardo cooperated with the

investigation, which identified over 5,000 non-compliant

components. Shares fell 0.6% pre-market after closing up 3.0% on

Friday.

General Motors (NYSE:GM) – General Motors

temporarily suspended truck and SUV production at its Flint,

Michigan, and Arlington, Texas, plants due to supplier disruptions

caused by Hurricane Helene. The automaker is working with suppliers

to resume operations quickly, minimizing impacts on its plants.

Shares fell 0.1% pre-market after closing up 1.6% on Friday.

Stellantis (NYSE:STLA) – Stellantis sued the

United Auto Workers (UAW) union for threatening a strike, alleging

contract violations due to delays in planned investments. The

automaker seeks compensation for financial losses and argues that

investments depend on market conditions, while UAW claims the

company backed out of agreed commitments. Shares fell 1.3%

pre-market after closing up 1.8% on Friday.

Tesla (NASDAQ:TSLA) – Tesla’s Robotaxi Day is

scheduled for Thursday, representing a crucial opportunity for the

company to reinforce its leadership in automotive innovation.

Shares rose 0.3% pre-market after closing up 3.9% on Friday.

Rivian Automotive (NASDAQ:RIVN) – Rivian

lowered its annual production forecast due to parts shortages and

weak demand for electric vehicles. The company now expects to

produce between 47,000 and 49,000 vehicles, down from the previous

forecast of 57,000, facing challenges in deliveries and costs.

Rivian delivered 10,018 vehicles in Q3, missing analysts’ estimates

of 12,078. The company reaffirmed its annual delivery forecast

between 50,500 and 52,000 vehicles, while market expectations were

53,491. Additionally, Rivian applied for a federal loan to build

its electric vehicle factory in Georgia, according to a U.S.

Department of Energy document. While the loan amount and terms were

not disclosed, the factory will begin partial operations in Q3

2027. Shares fell 0.6% pre-market after closing down 3.2% on

Friday.

Wynn Resorts (NASDAQ:WYNN) – Wynn Resorts

obtained the first commercial gaming license in the UAE, granted by

the General Gaming Regulatory Authority. The company is developing

a luxury resort on Wynn Al Marjan Island in Ras Al Khaimah, in

partnership with Marjan and RAK Hospitality Holding. This decision

follows legal reforms allowing gambling in the region. Shares rose

3.4% pre-market after closing up 2.3% on Friday.

Vista Outdoor (NYSE:VSTO) – Vista Outdoor Inc.

agreed to sell its ammunition and outdoor gear divisions for

approximately $3.4 billion. The outdoor gear unit, Revelyst, will

be sold to Strategic Value Partners for $1.13 billion, while the

ammunition business, Kinetic Group, will be acquired by

Czechoslovak Group for $2.23 billion. Shares rose 6.8% pre-market

after closing up 1.1% on Friday.

McDonald’s (NYSE:MCD) – McDonald’s will launch

the Chicken Big Mac in the U.S. on October 10, replacing beef

patties with fried chicken in the classic Big Mac. The launch is

part of the expansion of its chicken offerings, including McNuggets

and McCrispy, aiming to boost sales in a challenging year.

Goldman Sachs (NYSE:GS) – Goldman Sachs

economists reported that the likelihood of a U.S. recession next

year fell back to 15%, following a strong September jobs report.

The 254,000 job increase and the unemployment rate falling to 4.1%

supported expectations of moderate interest rate cuts by the

Federal Reserve. Additionally, Goldman Sachs upgraded its

recommendation for Chinese stocks to overweight, highlighting the

positive impact of Beijing’s recent stimulus package. Analysts

predict indices could rise 15%-20% if policy measures are

implemented, though they caution about potential challenges, such

as weaker fiscal stimulus and global risks. Shares fell 0.2%

pre-market after closing up 1.9% on Friday.

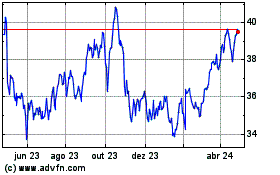

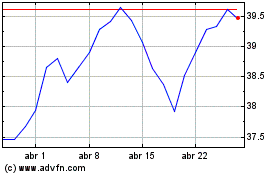

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BP (NYSE:BP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024