Honeywell (NASDAQ:HON) – Honeywell plans to

spin off its advanced materials division, which could be worth over

$10 billion as an independent company. CEO Vimal Kapur is focusing

on aviation, automation, and energy, according to WSJ. The advanced

materials division serves sectors like retail, pharmaceuticals,

buildings, and manufacturing, with $3.65 billion in sales last

year. Honeywell shares rose 2.8% in premarket trading after closing

down 0.2% on Monday.

Foxconn (USOTC:FXCOF) – Foxconn is building the

largest manufacturing unit to produce Nvidia’s GB200 chip due to

massive demand for Nvidia’s Blackwell platform, according to

Reuters. Nvidia shares rose 1.4% in premarket trading after closing

up 2.2% on Monday.

Alibaba (NYSE:BABA), NIO

(NYSE:NIO), Bilibili (NASDAQ:BILI) – Shares of

U.S.-listed Chinese companies fell sharply in premarket trading on

Tuesday. Bilibili shares dropped 15.3%, NIO 11.1%, and Alibaba

8.1%, as Beijing disappointed investors by not announcing new

economic stimulus.

Alphabet (NASDAQ:GOOGL) – A U.S. judge ordered

Google to change its practices on Android apps, offering more

payment options and downloads from competitor sources. The ruling,

aimed at increasing competition in the Play Store, prohibits

exclusive payment deals and agreements with manufacturers. Google

plans to appeal, claiming the measure harms consumers and

developers. Additionally, Google is partnering with utilities to

explore nuclear energy for its data centers, citing rising demand

from AI. Shares rose 0.3% in premarket trading after closing down

2.4% on Monday.

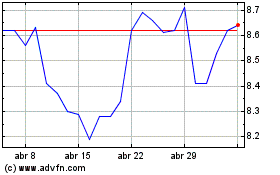

Vodafone (NASDAQ:VOD) – Vodafone signed a

10-year deal worth over $1 billion with Google to bring generative

AI devices to customers in Europe and Africa. The partnership will

expand access to 5G Pixel smartphones and offer Google One AI

Premium subscriptions in select countries by 2025. Shares rose 0.3%

on Monday.

Apple (NASDAQ:AAPL) – Apple shares closed down

2.3% on Monday after a Jefferies analyst warned that investor

expectations for the new iPhones are exaggerated. Edison Lee noted

that the lack of significant new features and limited AI coverage

may disappoint growth forecasts. He rated the stock as “Hold” due

to high valuation. Additionally, Dan Rosckes, head of global supply

chain procurement, is retiring after 24 years at the company, with

David Tom, his longtime deputy, succeeding him. Rosckes played a

key role in sourcing components and negotiating with suppliers,

crucial to Apple’s success. Shares rose 0.2% in premarket

trading.

Super Micro Computer (NASDAQ:SMCI) – Super

Micro Computer announced yesterday that it is shipping more than

100,000 GPUs per quarter and launched a new liquid cooling product

line. Demand for hardware for generative AI is driving its growth,

with the company expecting a significant market value increase.

Shares rose 2.5% in premarket trading after closing up 15.8% on

Monday.

Meta Platforms (NASDAQ:META) – The Appeals

Centre Europe, supported by Meta Platforms Oversight Board, was

certified to handle user disputes in the EU regarding policy

violations on platforms like Facebook, TikTok, and YouTube. The

body will review cases within 90 days and charge social media

companies, aiming to ensure fairness and impartiality in decisions.

Shares were flat in premarket trading after closing down 1.9% on

Monday.

Match Group (NASDAQ:MTCH) – Match Group

announced that Steven Bailey will become the new CFO next year,

replacing Gary Swidler, who will remain as president. Bailey, with

the company since 2012, takes over amid investor pressure to

improve growth following declines in Tinder’s paying users and

delays in new features.

Netflix (NASDAQ:NFLX) – As Netflix’s earnings

report approaches, two analysts expressed different views,

according to MarketWatch. Kannan Venkateshwar of Barclays became

bearish, warning that Netflix may struggle to maintain double-digit

revenue growth, while Matt Farrell of Piper Sandler was optimistic,

predicting the company still has growth opportunities. Shares

closed down 2.5% on Monday.

Trump Media & Technology Group (NASDAQ:DJT)

– Trump Media shares closed up 11.5% on Monday after Elon Musk

appeared alongside Donald Trump at a rally. Musk praised Trump

during the event, highlighting freedom of speech and the former

president’s positive impact. Additionally, Kinhbac City partnered

with the Trump Organization on a $1.5 billion project in Hung Yen,

Vietnam, including golf courses, hotels, and a residential complex.

The agreement was signed during the Vietnamese president’s visit to

the U.S. Trump Organization focuses on hotels and resorts. DJT

shares rose 3.5% in premarket trading.

Amazon (NASDAQ:AMZN) – Amazon shares dropped

3.1% on Monday, following a downgrade from Wells Fargo, which

expressed concerns about margins next year. Analyst Ken Gawrelski

downgraded the stock to “equal weight” and cut the price target

from $225 to $183. Additionally, the U.S. Federal Trade

Commission’s case against Amazon for allegedly suppressing

competition in online retail will proceed, despite some claims

being dismissed by state attorneys general in New Jersey and

Pennsylvania. The FTC accuses Amazon of anticompetitive practices,

while the company argues it has not harmed consumers. Shares rose

0.4% in premarket trading.

Cognizant Technology Solutions (NASDAQ:CTSH) –

Cognizant was found to have discriminated against non-Indian

workers and must pay punitive damages to affected employees,

according to a U.S. jury ruling. The company plans to appeal and

defends its equal employment opportunity policy.

Lululemon Athletica (NASDAQ:LULU) – Chip

Wilson’s $60 million mansion, founder of Lululemon, became a symbol

of political polarization in Canada’s provincial elections.

Recently, the property was vandalized with criticisms of Premier

David Eby, reflecting the growing rivalry between his party and

conservatives. Tensions are rising as the October 19 elections

approach. Shares fell 1.4% in premarket trading after closing up

0.8% on Monday.

Duckhorn Portfolio (NYSE:NAPA) – Butterfly

Equity agreed to buy Duckhorn Portfolio, a luxury wine brand, for

$1.95 billion. The $11.10 per share offer represents a 65.3%

premium. Duckhorn will remain private and headquartered in St.

Helena. Shares closed up 103% on Monday after the announcement.

PepsiCo (NASDAQ:PEP) – PepsiCo is set to report

its quarterly results, with analysts surveyed by FactSet expecting

earnings per share of $2.29 and sales of $23.9 billion. BofA

lowered its price target for the stock to $185 due to weak demand

in its snack and beverage segments. The market is focused on how

the company will address these challenges. Shares rose 0.02% in

premarket trading after closing down 0.45% on Monday.

Barnes Group (NYSE:B), Apollo Global

Management (NYSE:APO) – Barnes Group shares closed up 2.7%

on Monday after Apollo Global Management announced its $3.6 billion

acquisition. Shareholders will receive $47.50 per share, a 22%

premium. The deal is expected to close in early 2025, and Barnes

will go private.

Boeing (NYSE:BA) – Boeing and its largest union

continue negotiations to end the 25-day strike of 33,000 workers on

the U.S. West Coast. The union is seeking a 40% wage increase and

the restoration of pensions. Boeing offered a 30% increase, which

the union rejected. Shares fell 0.1% in premarket trading after

closing up 0.6% on Monday.

Uber (NYSE:UBER), Lyft

(NASDAQ:LYFT) – The U.S. Supreme Court rejected an appeal from Uber

and Lyft regarding lawsuits in California, allowing the state to

pursue allegations that drivers were misclassified as independent

contractors. The companies argued private arbitration agreements

should prevent such lawsuits, but the court declined to hear the

case. Uber shares fell 0.1% in premarket trading, while Lyft shares

rose 0.3%.

Mobileye Global (NASDAQ:MBLY) – Mobileye Global

shares have dropped 70% this year, impacted by inventory overhangs

among customers and challenges in China. JPMorgan analyst Samik

Chatterjee downgraded the company, predicting a further 22% drop

and highlighting lost market share to competitors. He projects

modest volumes for Mobileye’s SuperVision system, limiting future

growth. Shares fell 1.0% in premarket trading after closing down

4.6% on Monday.

General Motors (NYSE:GM) – GM announced Monday

that it has resumed production at its Texas and Michigan assembly

plants following a temporary halt caused by Hurricane Helene’s

impact on suppliers. Production at Flint Assembly and Arlington

Assembly was suspended on Thursday and Friday but has since

restarted. Additionally, GM is shifting its approach to EV

batteries, abandoning the Ultium brand. Under Kurt Kelty’s

leadership, the automaker plans to diversify cell chemistry and

formats to reduce costs and better meet the needs of different

models. Kelty is expected to address the topic during today’s

investor day presentation. Shares fell 0.3% in premarket trading

after closing up 0.7% on Monday.

Stellantis (NYSE:STLA) – S&P Global revised

Stellantis’ debt outlook from “stable” to “negative” after the

company slashed its 2024 financial forecasts, projecting negative

free cash flow between $5.5 billion and $11 billion. U.S. inventory

management issues and labor disputes are worsening the situation,

negatively impacting the stock. Shares fell 0.1% in premarket

trading after closing up 0.2% on Monday.

Lucid Group (NASDAQ:LCID) – Lucid Group

exceeded delivery expectations for the third quarter, delivering

2,781 vehicles, surpassing the forecast of 2,242. Demand was driven

by discounts and cheaper financing options, despite overall

weakness in the EV market. Shares rose 2.4% on Monday.

Rivian Automotive (NASDAQ:RIVN) – Rivian

Automotive lowered its 2024 production targets last Friday due to

supply chain issues. According to Bloomberg, a communication

failure with supplier Essex Furukawa led to a shortage of copper

windings, essential for its electric motors. Shares fell 1.1% in

premarket trading after closing up 0.5% on Monday.

Fisker (USOTC:FSRNQ) – The U.S. Department of

Justice stated Fisker’s plan to shift recall costs to customers is

illegal. Fisker, which filed for bankruptcy in June, must repair

defective vehicles at no charge, and reimbursing customers for paid

repairs also violates vehicle safety regulations.

BP Plc (NYSE:BP) – BP abandoned its goal to cut

oil and gas production by 2030, prioritizing new investments in the

Middle East and the Gulf of Mexico. According to Reuters, CEO

Murray Auchincloss adjusted the strategy to focus on faster

returns, facing investor pressure and declining stock prices.

Shares fell 1.8% in premarket trading after closing up 0.8% on

Monday.

Chevron (NYSE:CVX) – Chevron is selling its

Athabasca oil sands and Duvernay shale assets to Canadian Natural

Resources for $6.5 billion. The deal, expected to close by December

6, is part of Chevron’s plan to raise $10 billion to $15 billion by

2028, focusing on regions like U.S. shale. Canadian Natural expects

to add 122,500 barrels of oil equivalent per day with the

acquisition. Shares fell 1.1% in premarket trading after closing up

0.3% on Monday.

Equinor (NYSE:EQNR) – Norway’s Equinor acquired

a 9.8% stake in Danish offshore wind developer Orsted, valued at

around $2.5 billion, to expand its renewable energy portfolio.

Despite challenges in the wind sector, Equinor views this as a

long-term investment. Shares fell 2.4% in premarket trading after

closing down 3.0% on Monday.

Generac (NYSE:GNRC) – Generac shares jumped

8.5% on Monday, with hurricane activity increasing, particularly as

Milton approaches Florida. Demand for generators rises during

storms, but Wall Street analysts remain cautious. Generac has

growth potential, but the lasting impact of storms is uncertain for

driving future profits. Shares rose 0.5% in premarket trading.

Goldman Sachs (NYSE:GS) – According to

regulatory filings, Goldman Sachs holds derivatives in UniCredit,

equivalent to a 6.7% stake, mainly through swap contracts, futures,

and call options. If exercised, Goldman would become one of

UniCredit’s major investors.

Bank of America (NYSE:BAC), Berkshire

Hathaway (NYSE:BRK.B) – Warren Buffett’s Berkshire

Hathaway raised over $10 billion by reducing its stake in Bank of

America in its 14th round of sales. Recently, the company sold $383

million in shares, maintaining a 10.1% stake worth around $31.4

billion. Shares fell 0.1% in premarket trading after closing down

0.4% on Monday.

Walgreens Boots Alliance (NASDAQ:WBA) –

Walgreens appointed Jason Stenta, a former Optum executive, as its

chief commercial officer. He will lead growth strategy and B2B

health services development, as well as improve partnerships with

insurers and health providers. The appointment comes amid the

closure of underperforming stores due to weak consumer spending.

Shares fell 0.2% in premarket trading after closing up 1.7% on

Monday.

KinderCare, Moove,

UpStream Bio, Ceribell – This

week, the U.S. IPO market expects to see nine offerings raising

about $1.4 billion, led by KinderCare Learning and Moove

Lubricants. KinderCare aims to raise $600 million, while Moove

plans to raise $400 million, both on the New York Stock Exchange.

Additionally, UpStream Bio Inc. aims to raise $200 million under

the ticker “UPB” on Nasdaq. Ceribell, which filed for Nasdaq

listing under the symbol “CBLL,” seeks $100.5 million.

Rivus Pharmaceuticals – The pharmaceutical

company focused on obesity treatments is evaluating an initial

public offering in the U.S. for 2024, aiming to raise over $250

million. Backed by RA Capital Management, the company seeks to

capitalize on the recent momentum in the biopharma sector,

especially after a strong month for IPOs.

Vodafone (NASDAQ:VOD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Vodafone (NASDAQ:VOD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024