U.S. index futures rose in premarket trading on Tuesday,

suggesting a rebound after earlier declines caused by rising bond

yields and oil prices. Investors await key economic data this week

amid statements from Federal Reserve leaders.

At 5:48 AM ET, Dow Jones (DOWI:DJI) futures rose 62 points or

0.15%. S&P 500 futures gained 0.37%, and Nasdaq-100 futures

advanced 0.42%. The 10-year Treasury yield was at 4.016%.

In commodities, West Texas Intermediate crude for November fell

1.91% to $75.67 per barrel, while Brent for December dropped 1.84%

to $79.44 per barrel.

Oil prices fell as traders took profits despite a recent rally

driven by fears of a regional war in the Middle East. The previous

rally was fueled by concerns about oil supply disruptions due to

escalating conflict.

The National Development Commission remains confident in its

annual goals despite concerns about reduced demand in China. In the

U.S., Hurricane Milton shut down a platform in the Gulf of Mexico,

and investors await oil inventory data, expecting a 1.9 million

barrel increase by October 4.

Iron ore and base metal prices fell after a briefing by China’s

National Development and Reform Commission offered no new promises

of economic stimulus. Investors had hoped for more measures after a

holiday, but disappointment led to sell-offs, reflecting concerns

over the economic recovery.

On today’s U.S. economic agenda, at 3 AM ET, Fed Governor

Adriana Kugler spoke in Europe, emphasizing that the U.S. central

bank must remain focused on reducing inflation to 2% while avoiding

an economic slowdown. She supports further rate cuts if inflation

continues to improve.

The NFIB’s September optimism index will be released at 6 AM ET,

with a forecast of 91.6. The U.S. trade deficit for August will be

announced at 8:30 AM ET, with expectations of -$70.8 billion. At

12:45 PM ET, Atlanta Fed President Raphael Bostic speaks, followed

by Federal Reserve Vice Chair Philip Jefferson at 7:30 PM ET.

Asia-Pacific markets closed mostly lower. Mainland China stocks

returned from a holiday with a strong initial rally, driven by

expectations of economic stimulus, but lost momentum. The lack of

concrete details from Beijing disappointed investors. China’s CSI

300 closed up 5.93%, while the Hang Seng dropped 9% in the final

hour of trading, reflecting profit-taking and a lack of new

stimulus measures.

Japan’s Nikkei 225 fell 1%, with the Topix declining 1.47%.

South Korea’s Kospi dropped 0.61%, while the Kosdaq lost 0.35%.

Australia’s S&P/ASX 200 fell 0.35%.

Zheng Shanjie, president of China’s National Development and

Reform Commission, stated that the country would accelerate the

issuance of special bonds to support regional economies and

announce a 100 billion yuan investment plan. However, without

significant new stimulus, investors were disappointed, affecting

the Chinese market.

In the U.S., investors directed $5.2 billion into China-focused

ETFs during the country’s Golden Week holiday, spurred by Beijing’s

stimulus packages, such as interest rate cuts and bank liquidity.

The weekly inflow surpassed the average outflow of $83 million in

2024, generating optimism about economic recovery.

China’s recent actions to revitalize the real estate market

resulted in an immediate increase in sales and buyer interest

during the holiday. However, the sustainability of this recovery

remains uncertain. Showroom visitors increased by 50% compared to

last year, but developer stocks fell due to the lack of new

measures in economic planning.

According to a Reuters poll, South Korea’s central bank is

expected to cut its interest rate by 25 basis points to 3.25% on

Friday, as inflation dropped to 1.6%. Economists predict this will

be the only rate cut of the year, as the bank remains concerned

about rising debt and financial stability in the housing

market.

In Japan, inflation-adjusted wages fell 0.6% in August, while

household spending also decreased by 1.9%. Base pay rose 3.0%

compared to August 2023, and bonus payments increased by 2.7%.

Saudi Arabia’s sovereign wealth fund sold its stake in

Nintendo, reducing it from 8.58% to 7.54%, despite

an executive previously suggesting the possibility of increasing

investment. The sale occurred between August 21 and October 1, as

the government seeks to diversify its economy by investing in

gaming companies.

Hyundai Motor India’s IPO will open for

subscriptions on October 14, with a price range of 1,865 to 1,960

rupees per share, valuing the company at up to $19 billion. This $3

billion IPO marks Hyundai’s first listing outside South Korea and

the first automaker to go public in India in two decades.

European markets are trading lower on Tuesday, with investors

concerned about the impact of Middle Eastern conflict on oil

prices, supply chains, and the global economy. Markets will also be

watching for statements from European Central Bank and Federal

Reserve officials and the release of Germany’s industrial

production data for August.

The UK may ease market access for specialized trading houses

without retail deposits, according to the head of the Financial

Conduct Authority. The regulator seeks to promote wholesale trading

and increase liquidity while simplifying the fundraising process

for listed companies.

Mining and domestic goods sectors are among the most affected,

while luxury stocks also fell due to uncertainty over Chinese

demand.

Among individual stocks, Vistry Group Plc

(LSE:VTY) faces its biggest drop in eight years after announcing

that its adjusted profit would be £80 million lower than expected.

The company identified cost underestimation in one of its divisions

and launched an independent review, with shares down about 29%.

Shares of European distilleries fell after China announced

anti-dumping tariffs on EU cognac, heightening trade tensions.

Remy Cointreau (EU:RCO) dropped up to 8.6%,

Pernod Ricard (EU:RI) 4.3%, and

LVMH (EU:MC) as much as 4.8%. The decision follows

EU tariffs on Chinese electric vehicles.

Shares of Siemens (TG:SIE) fell around 1.6%

after announcing the acquisition of Denmark-based Danfoss Fire

Safety to expand its sustainable portfolio. The subsidiary will

integrate into Siemens’ smart infrastructure division. The company

will continue to operate independently, with the transaction

expected to close by the end of 2024.

On Monday, U.S. markets closed lower, impacted by geopolitical

uncertainty in the Middle East. The Dow lost 0.94%, the S&P 500

fell 0.56%, and the Nasdaq dropped 1.18%. The dollar hit a

seven-week high against the yen, driven by strong U.S. job data,

which reinforced economic resilience but reduced expectations for

aggressive Federal Reserve rate cuts. Consumer credit in August

rose less than expected, increasing by $8.9 billion, below the

forecast of $12 billion.

John Williams, president of the New York Federal Reserve, stated

that reducing rates “over time” would be appropriate following the

half-point cut in September, noting that current monetary policy is

well-calibrated.

Alberto Musalem, president of the St. Louis Federal Reserve,

also supports gradual rate cuts, emphasizing the need for caution

to avoid excess in easing. He expects inflation to return to 2%

soon and considers the labor market consistent with a strong

economy.

Quarterly reports from

PepsiCo (NASDAQ:PEP)

and Accolade (NASDAQ:ACCD) are expected

before the market opens.

After the close, Saratoga Investment

Corp (NYSE:SAR) will release its numbers.

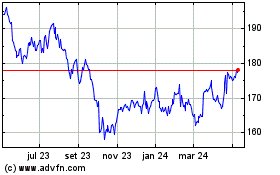

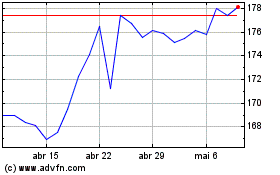

PepsiCo (NASDAQ:PEP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

PepsiCo (NASDAQ:PEP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024