Apple (NASDAQ:AAPL) – iPhone 16 sales in China

grew 20% in the first three weeks compared to its 2023 predecessor,

driven by demand for Pro and Pro Max models, which increased 44%.

Despite strong competition from Huawei and others, initial sales

show signs of success. On another front, Donald Trump claimed to

have received a call from Apple CEO Tim Cook about fines imposed by

the European Union. Apple was fined $15 billion, plus an antitrust

fine of $2 billion. Trump assured Cook that if elected, he would

protect American companies from such penalties. Shares rose 0.9% in

pre-market trading.

Sobr Safe (NASDAQ:SOBR) – Sobr Safe withdrew a

public offering of units. The alcohol detection company decided not

to proceed with the offering, which involved common stock and

warrants, without disclosing values. Shares surged 108.8% in

pre-market trading after closing 0.4% higher on Thursday.

ASML (NASDAQ:ASML) – Samsung delayed ASML

equipment deliveries to its $17 billion Texas factory due to a lack

of key customers. The $200 million EUV machines were initially

scheduled for delivery this year but were postponed. Production,

originally planned for 2024, may now begin in 2026. ASML shares

rose 2.5% in pre-market trading.

Nvidia (NASDAQ:NVDA), Taiwan

Semiconductor Manufacturing Co. (NYSE:TSM) – Nvidia shares

hit an intraday record following TSMC’s optimistic sales forecast,

boosting investor confidence in demand for AI chips. TSMC shares

rose 9.8% on Thursday, while Nvidia gained 0.9%, reflecting growing

optimism in the chip sector. Nvidia shares were up 1.2% pre-market,

while TSMC shares fell 1.0%.

Intel (NASDAQ:INTC) – Intel is seeking to sell

a minority stake in its Altera unit, valued at around $17 billion,

to raise funds. After market losses and a stock price decline, the

company is considering private investor proposals, shifting from a

previously planned 2026 IPO. Shares rose 0.5% in pre-market trading

after closing 0.6% higher on Thursday.

Vistra Corp. (NYSE:VST) – JPMorgan analyst

Jeremy Tonet recommends buying Vistra shares, highlighting its

exposure to ERCOT, natural gas generation, and nuclear option.

Despite a 317% rise over the past 12 months, Tonet forecasts an

additional 31% increase, citing potential nuclear contracts as a

positive catalyst. Shares rose 1.8% in pre-market trading after

closing down 6.2% on Thursday.

Alphabet (NASDAQ:GOOGL) – Google will transfer

its Gemini app team to its AI lab, DeepMind, to streamline its

structure and accelerate generative AI development. Sundar Pichai

stated this will improve feedback and new model implementation.

Demis Hassabis, DeepMind’s CEO, will lead the team. Additionally,

Google appointed Nick Fox as its new head of research, ads, and

commerce division, replacing Prabhakar Raghavan, who will take the

role of chief technologist. The move is aimed at adapting to the

rapid evolution of AI. Shares rose 0.3% in pre-market trading after

closing down 1.4% on Thursday.

Amazon (NASDAQ:AMZN) – Amazon executive Matt

Garman defended the company’s five-day-a-week in-office policy,

stating that employees who disagree should find other jobs. He

emphasized that innovation is more effective in person, and the

current three-day policy has not met the company’s goals.

Additionally, AWS expects Nvidia’s new Blackwell chips to be ready

by early 2025, following a production delay. Nvidia had promised

availability by the end of 2024, but manufacturing adjustments

postponed the plan. AWS will receive the first major shipments next

year. Shares rose 0.2% in pre-market trading after closing 0.3%

higher on Thursday.

Walt Disney (NYSE:DIS) – The FCC proposed

fining ESPN $147,000 for misusing emergency alert tones in

promotions for the 2023-2024 NBA season. The FCC prohibits using

these tones outside of official alerts to avoid confusion. ESPN has

been fined in 2015 and 2021 for similar violations. Disney shares

rose 0.2% in pre-market trading after closing down 0.2% on

Thursday.

BP Plc (NYSE:BP) – BP is considering selling a

minority stake in its offshore wind energy business to reduce its

renewable energy investments. Under pressure from shareholders, CEO

Murray Auchincloss is focusing on high-margin businesses. BP

continues to develop large wind projects but has revised its

expansion plans. Shares rose 1.2% in pre-market trading after

closing 1.3% higher on Thursday.

Archer-Daniels-Midland (NYSE:ADM) –

Archer-Daniels-Midland was accused of intentionally neglecting the

maintenance of safety systems at its grain plant, contributing to a

2023 explosion that severely injured a worker. According to

Reuters, the incident is part of a series of safety problems at

ADM’s facilities in Decatur, Illinois. Shares rose 0.3% in

pre-market trading after closing 0.6% higher on Thursday.

Deere and Co (NYSE:DE) – The U.S. Federal Trade

Commission (FTC) is investigating Deere for potential restrictions

in its equipment repair policies, which may violate the “right to

repair,” Reuters reports. The investigation, launched in September

2021, is evaluating whether Deere unfairly prevented customers from

repairing their own products. The company is cooperating with the

FTC and already faces lawsuits from farmers over these practices.

Deere also signed an agreement last year allowing farmers to repair

their equipment at independent shops. Shares were flat in

pre-market trading after closing down 1.0% on Thursday.

SolarWinds (NYSE:SWI) – SolarWinds plans to

open an office in Riyadh, Saudi Arabia, in 2025 due to rapid

business growth in the Middle East. Since 2022, sales in the region

have grown in double digits. The company is considering relocating

its headquarters from Cork, Ireland, to Dubai, reflecting its focus

on the region.

General Motors (NYSE:GM) – GM plans to expand

its investments in lithium and other essential minerals for

electric vehicles in the U.S. after increasing its stake in a

Nevada mine to nearly $1 billion. The automaker formed a joint

venture with Lithium Americas to develop the Thacker Pass mine,

extending its access to lithium for 20 years. Shares rose 0.2% in

pre-market trading after closing 0.8% higher on Thursday.

CSX Corp. (NASDAQ:CSX) – CSX received a

subpoena from the SEC related to previously disclosed accounting

errors and certain non-financial performance metrics. The company,

which corrected these errors in August, is cooperating with the

investigation. While the errors were not material to previous

periods, they could have impacted 2024 results if repeated. Shares

fell 6.7% on Thursday.

Boeing (NYSE:BA) – Boeing requested to sell up

to $25 billion in shares and bonds, but it is awaiting SEC

approval, which may take days or weeks. Issues related to aircraft

safety disclosures could be delaying the process. Boeing seeks to

raise funds to bolster its cash position after burning $8 billion

this year.

Catalent (NYSE:CTLT), Novo

Nordisk (NYSE:NVO) – U.S. consumer groups and labor unions

urged the FTC to block Novo Holdings’ acquisition of Catalent,

citing concerns about competition in weight loss drugs and gene

therapies. The $16.5 billion deal could hinder the development of

competitors like Amgen and Pfizer.

Supernus Pharmaceuticals (NASDAQ:SUPN) –

Supernus Pharmaceuticals released results from a Phase 2a study of

an antidepressant therapy, showing effective reduction in

depression symptoms.

Goldman Sachs (NYSE:GS),

Blackstone (NYSE:BX) – Goldman Sachs and

Blackstone sold $475 million in loans to private funds backed by

securities. These loans allow funds to delay liquidity requests

from investors. Blackstone bought the riskiest part, and Goldman

seeks to expand this practice, benefiting from low credit risk

involved. The strategy reflects a growing partnership between banks

and private lenders to optimize balance sheets and minimize

exposure to risk capital under Basel III rules.

New York Community Bancorp (NYSE:NYCB) –

Flagstar Bank, a unit of New York Community Bancorp, plans to lay

off about 1,900 employees. Around 700 cuts have already occurred,

with another 1,200 following the sale of the mortgage servicing

unit to Mr. Cooper for $1.4 billion, expected in Q4 2024.

Berkshire Hathaway (NYSE:BRK.A), Bank

of America (NYSE:BAC) – Berkshire Hathaway sold more Bank

of America shares, unloading 8.7 million shares for $370 million on

October 15. The previous week, it sold 9.5 million shares for

$382.4 million, continuing to reduce its stake below 10%.

Home Bancorp (NASDAQ:HBCP) – The Home Bancorp

board increased the quarterly dividend from $0.25 to $0.26 per

share, raising the annual payout to $1.04 per share. The dividend

will be paid on November 8, with a yield of 2.3%, based on a $45.00

share price.

Nomura Holdings (NYSE:NMR) – Major Japanese

financial institutions temporarily suspended trading with Nomura

Holdings following a market manipulation scandal. At least 10

companies, including insurers and banks, halted activities until

the brokerage implements corrective measures. Nomura faces a

temporary loss of clients and declining shares, worsening its

recent crisis.

Pony AI – Chinese autonomous driving company

Pony AI, backed by Toyota, filed for an initial public offering

(IPO) in the U.S. The company’s revenue nearly doubled to $24.7

million in H1 2024, but it still posted a $51.3 million loss. Pony

AI operates a fleet of 250 robotaxis with 33.5 million kilometers

of autonomous driving.

Assai (NYSE:ASAI) – Brazilian retailer Assai

revised its 2025 store opening forecast, now planning around 10 new

stores, half its previous target. The company, which seeks to

reduce its leverage after accelerated expansion, expects to resume

growth in 2026 with 20 new stores.

PepsiCo (NASDAQ:PEP),

Coca-Cola (NYSE:KO) – Pepsi and Coca-Cola bottlers

in the West Bank face shortages of cans and sugar due to the

closure of the Allenby Bridge. Pepsi’s production fell by 35%, and

its factory operates with only one shift per day. Coca-Cola also

faces shortages of essential supplies.

Tyson Foods (NYSE:TSN) – Tyson Foods heir John

R. Tyson was fined for DUI in June, paying $960 in fines and

serving 32 hours of community service. His 90-day jail sentence was

suspended. Tyson was suspended as CFO after the incident and later

replaced by Curt Calaway. He remains on medical leave.

PPG Industries (NYSE:PPG) – PPG Industries

announced it will lay off 1,800 employees in the U.S. and Europe

and close plants as part of a cost-cutting program. The company

will also sell its architectural coatings business for $550 million

and expects to save around $175 million annually from these

changes.

Earnings

Netflix (NASDAQ:NFLX) – The global streaming

and content production company beat Q3 expectations with earnings

per share (EPS) of $5.40, surpassing the $5.12 forecast. Net income

for the period was $2.36 billion. Revenue reached $9.83 billion,

adding 5.1 million subscribers, totaling 282.7 million. Netflix

exceeded analysts’ revenue estimates of $9.77 billion and 282.15

million paid subscribers. The Q4 forecast is $10.13 billion in

revenue and $4.23 EPS. Netflix expects advertising to drive growth

through 2026. Shares rose 5.7% in pre-market trading after closing

down 2.0% on Thursday.

Intuitive Surgical (NASDAQ:ISRG) – The advanced

surgical robotics and medical solutions company beat Q3

expectations with adjusted earnings per share of $1.84, above the

forecast of $1.64. Revenue rose 17% to $2.04 billion, surpassing

the $2.01 billion projection. The number of procedures using the Da

Vinci robot grew 18%, driving sales of disposable instruments.

Shares rose 6.3% in pre-market trading after closing down 0.6% on

Thursday.

WD-40 (NASDAQ:WDFC) – The maintenance and

lubrication products manufacturer beat Q4 2024 expectations with

earnings per share of $1.23 and revenue of $156 million, above the

$149.19 million estimates. The gross margin rose to 54.1%, and net

income was $16.8 million. The company projects growth between 6%

and 11% in 2025.

Crown Holdings (NYSE:CCK) – The metal beverage

and product packaging company reported a Q3 loss of $1.47 per

share, or $175 million, due to pension settlement charges. Adjusted

earnings were $1.99, beating estimates of $1.81. Revenue rose 0.2%

to $3.07 billion, slightly above the $3.06 billion expected. The

company forecasts full-year adjusted earnings between $6.25 and

$6.35.

First National Bank (NYSE:FNB) – The

traditional and corporate banking services provider reported net

income of $110.1 million in Q3 2024, down from $145.28 million the

previous year. Earnings per share were $0.30, compared to $0.40

last year. Net interest income fell to $323.33 million, down from

$326.58 million the previous year.

OceanFirst Bank (NASDAQ:OCFC) – The regional

community banking services provider reported net income of $25.12

million in Q3 2024, up from $20.67 million the previous year.

Earnings per share rose to $0.42, beating the previous year’s

$0.33. Net interest income was $82.22 million, down from $91

million last year.

Bank OZK (NASDAQ:OZK) – The regional

diversified financial services bank reported record net income of

$177.1 million in Q3 2024, a 4.4% increase from the previous year.

Diluted earnings per share rose to $1.55, 4% higher than the prior

year. Net revenue before provisions reached $282.6 million, up 7%.

Loans and deposits grew 15.3% and 19.6%, respectively.

Alpine Income Property Trust (NYSE:PINE) – The

commercial real estate investment trust (REIT) reported Q3 2024

revenue of $13.48 million, beating estimates of $12.03 million. Net

income was $3.35 million, reversing a loss from the prior year.

Diluted earnings per share were $0.21, while funds from operations

(FFO) increased 14%, reaching $6.69 million.

Marten Transport (NASDAQ:MRTN) – The

refrigerated goods transportation company reported net income of

$3.8 million in Q3 2024, a significant drop from $13.6 million the

previous year. Earnings per share were $0.05, down from $0.17 last

year. Total operating revenue was $237.4 million, below estimates

of $243.89 million.

Metropolitan Commercial Bank (NYSE:MCB) – The

commercial banking services provider reported a net interest margin

of 3.62% in Q3 2024, an increase of 18 basis points. Diluted

earnings per share were $1.08, down from $1.50 in the previous

quarter. Loans totaled $5.9 billion, with deposits of $6.3 billion.

The bank maintains strong liquidity with $3.1 billion available.

The quarter included $12.6 million in pre-tax expenses related to

regulatory reserves and digital transformation initiatives.

MGP Ingredients (NASDAQ:MGPI) – The distilled

beverages and food ingredients producer forecast a 24% drop in Q3

sales to $161.5 million, below estimates of $186.5 million.

Adjusted earnings per share are expected to be $1.29, lower than

the $1.44 expected. The company also lowered its full-year revenue

and earnings forecast. Full results are scheduled for release on

October 31.

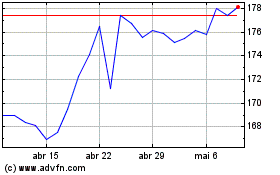

PepsiCo (NASDAQ:PEP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

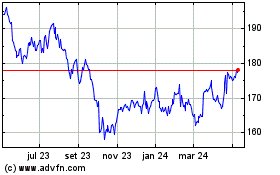

PepsiCo (NASDAQ:PEP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024